With the net flow of investor capital remaining firmly positive for the year, and slightly positive in April, 2018 would appear to be a pretty good year for the industry, on the surface. However, there is increasing evidence of dissatisfaction with near-term results that is manifesting in fund flow data.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

While this is a cause for concern in certain segments, it also a positive theme for the industry. The strong should survive and prosper for the greater long-term health of the pack, and this appears to be exactly what is happening in 2018.

Highlights

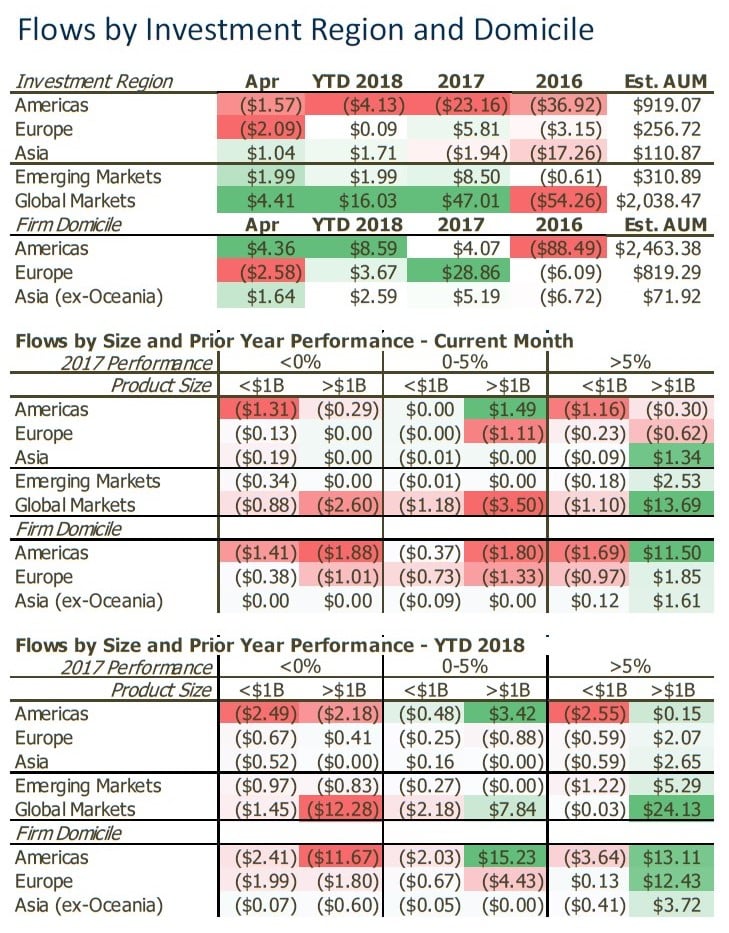

- Investor flows were near flat, but positive in April. Allocations were estimated at $1.78 billion during the month, and $13.67 billion for the year.

- Managed futures funds faced broad redemption pressure, though the magnitude of outflows abated.

- Macro fund flows returned to positive, though the minority of funds benefited.

- A desire for credit exposure within EM provided the universe with net inflows in April.

Managed Futures & Event Driven Weigh on Net HF Flows

Investor flows accounted for a net inflow of an estimated $1.78 billion into hedge funds in April. For the year, investors have allocated an estimated net $13.67 billion into the industry.

Key Points

- Despite net inflows, redemptions were very widespread in March. Nearly 63% of reporting managers faced some level of net outflow in April, the most elevated level seen since October 2016.

- Despite broad redemption pressures, not a lot of funds lost a lot of assets. The reason flows were net positive in April, despite the breadth of redemptions, was that from those who faced redemptions there was not a large proportion which lost a significant level of their assets. Fewer than 20% of managers lost greater than 2% of their AUM from outflows in April, which is below the eighteen month average.

- The majority of hedge funds have faced redemptions in 2018. On the surface, with $13.67 billion of net inflows this year, it would appear to be a good year for the industry. However, only 47% of reporting managers are seeing net new money coming in.

- Managed futures managers continued to face the consequences of performance declines. Nearly 80% of managed futures funds had net outflows in April. Redemptions in April were the second consecutive month of outflows following some of the strategies largest losses on record in February. If we’re looking for a positive side to this scenario, redemptions in April were lower than in March, and funds posted mostly positive performance in April.

- Allocations to macro strategies resumed in April, despite presence of redemptions. Macro hedge funds began 2018 how they began 2017, with a surge of investor interest. While there were some very targeted redemption pressures in March, positive investor flow returned in April. The primary beneficiaries continue to be the largest managers in the space, while many others faced outflows. 55% of reporting macro funds had net outflows in April, an uptick from levels in prior months.

- Net inflows to credit strategies resumed in April, though redemptions also ticked up. The elevated redemptions seen in March for credit strategies were concentrated within a few managers. April’s flows were somewhat of a mirror image. Similar to macro strategies, 55% of credit funds faced redemptions in April, but overall, new allocations outpaced redemptions. Desire for exposure to EM credit was one notable positive influence on flows.

- Event driven strategies continue to face redemption pressure. Despite some notable names in the event driven space underperforming in recent months, the majority of outflows in April were from smaller (<$1b) managers with performance issues in 2018. Managers with the ten largest redemptions in April have returned an average of -1.1% in 2018.

Allocations Return to Emerging Markets in April, to the Benefit of Few

Key Points

- Nearly 65% of emerging market funds faced net outflows in April. EM fund flows were positive in April, but a relatively low proportion of managers benefitted in the process. Despite the targeted allocations during the month, still greater than 50% of managers have inflows for the year. Given the rising level of losses coming from the group, this remaining theme of broad positivity may slip away soon.

- Fixed income exposure supported EM inflows in April. The five largest new allocations to emerging market strategies in April all went to fixed income/credit focused funds. With those removed, estimated net flows for the month would have been negative. While broad EM credit is of interest, there appears to be a meaningful level of interest in China.

- You can’t blame managed futures strategies on European fund outflows in April. There was actually a diverse set of funds located in Europe that faced redemption pressures in April, and it seems like performance is a key issue. Of the five with the largest outflows, none were managed futures strategies, but four of them have posted losses in 2018, with an average return near -3%.

Article by eVestment