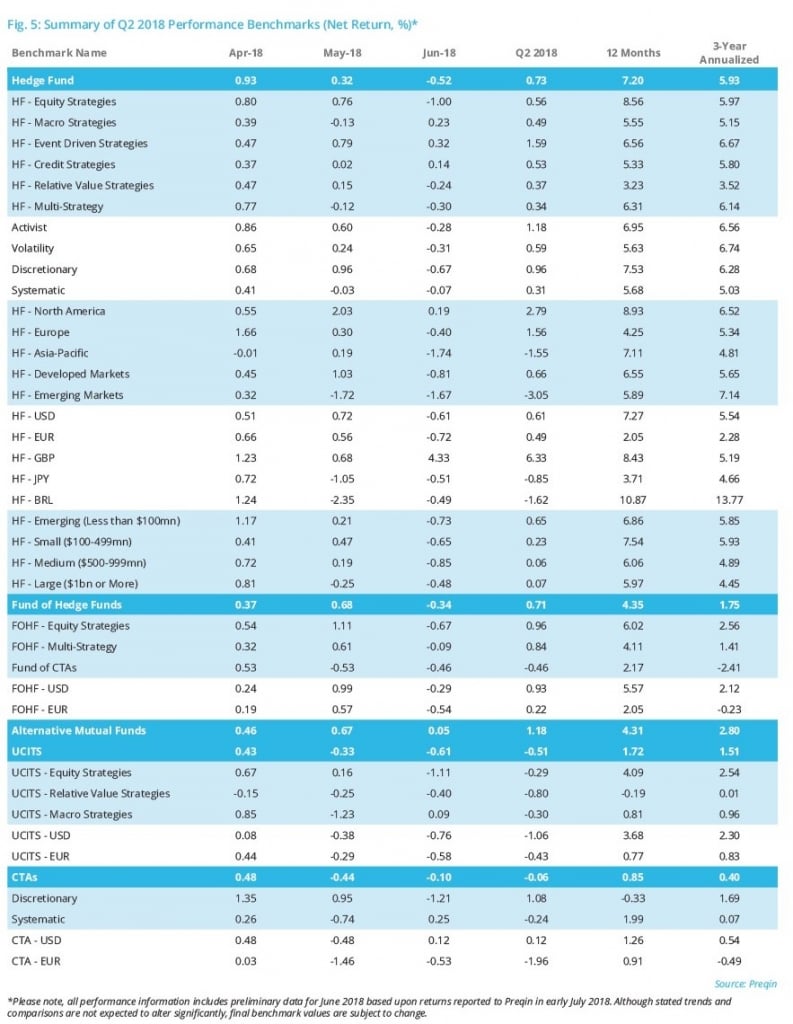

Hedge fund performance has dominated the narrative around the asset class for a number of years and 2018 appears no different. Following the four-year high in annual returns at the end of 2017, investor sentiment with respect to hedge funds seems to be improving. However, relatively poor performance in Q2 2018 compared to Q2 2017 has seen the 12-month return of hedge funds erode. The Preqin All-Strategies Hedge Fund benchmark over 12 months was at 7.20% at the end of Q2 2018, lower than the 8.02% reported at the end of Q1.

Q2 hedge fund letters, conference, scoops etc

Following poor performance in March, the second quarter started well for hedge funds with a return of 0.93% in April. This strong start to the quarter was matched with a disappointing end, with losses of 0.52% reported in June.

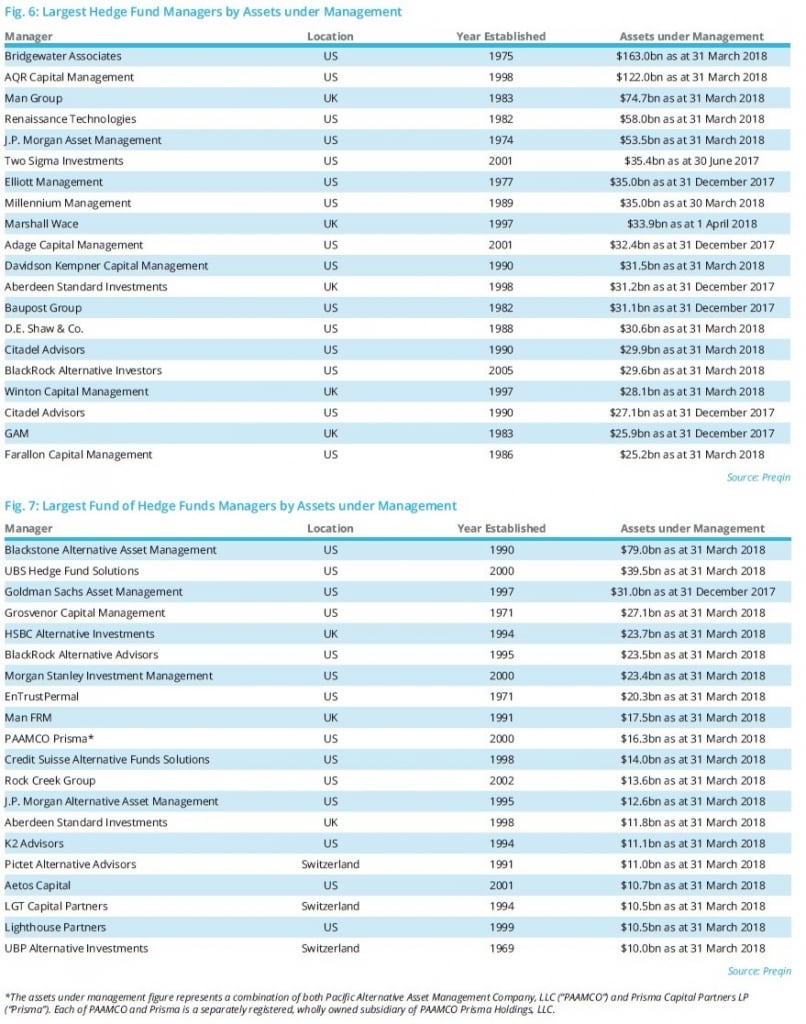

Perhaps due to the continued rise in global equity market volatility and growing concerns around a market correction, we have seen a drop in the number of managers targeting equity strategies in Q2 2018. Multi-strategy funds, however, have become increasingly prominent, despite the fact that only CTAs reported worse returns in Q2.

There has been a trend reversal in the emerging markets hedge fund space over 2018. After being among the top performing benchmarks in 2017, emerging markets-focused hedge funds are in the red for the year with losses of 1.44% YTD. Funds focusing on emerging markets reported losses of 3.05% in Q2 2018 alone, perhaps explaining why there were no new funds launched during the second quarter with a focus on these regions, and may set the tone for manager activity in emerging markets going forward.

We hope you find this report useful and welcome any feedback you may have. For more information, please visit www.preqin.com or contact [email protected].

Performance Update

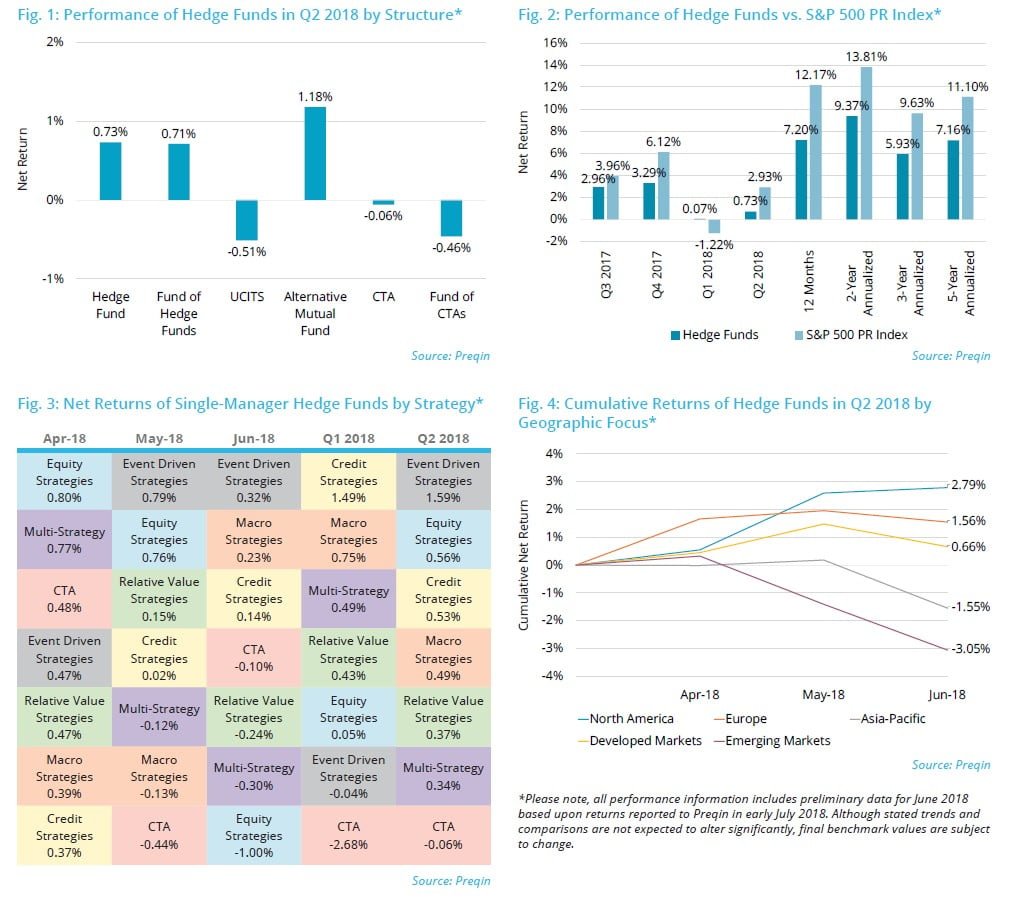

Following a challenging start to 2018, hedge fund performance, on the whole, has gained momentum during Q2 2018. The Preqin All-Strategies Hedge Fund benchmark returned 0.73% over the second quarter, an improvement on the 0.07% returned in Q1 (Fig. 1). Alternative mutual funds outperformed all other fund types for the quarter (+1.18%), which marks a considerable turnaround since the beginning of 2018 when they returned -0.81%.

Equity strategies were the worst performers in June (-1.00%), despite having the best returns in April and the second best in May, highlighting volatility in broader equity markets. CTAs were the only top-level strategy to suffer losses over the quarter, albeit to a lesser extent than in Q1.

Hedge funds with a focus on North America reported the highest returns (+2.79%) in the quarter (Fig. 4). Hedge funds focusing on emerging markets reported negative returns for the quarter, a significant turnaround from Q1, when funds in the region displayed the highest returns. The strong performance towards the end of 2017 and early 2018 appears to be waning in emerging markets, highlighting volatility associated with funds based in the region.

Performance Benchmarks

Largest Fund Managers

Fund Launches

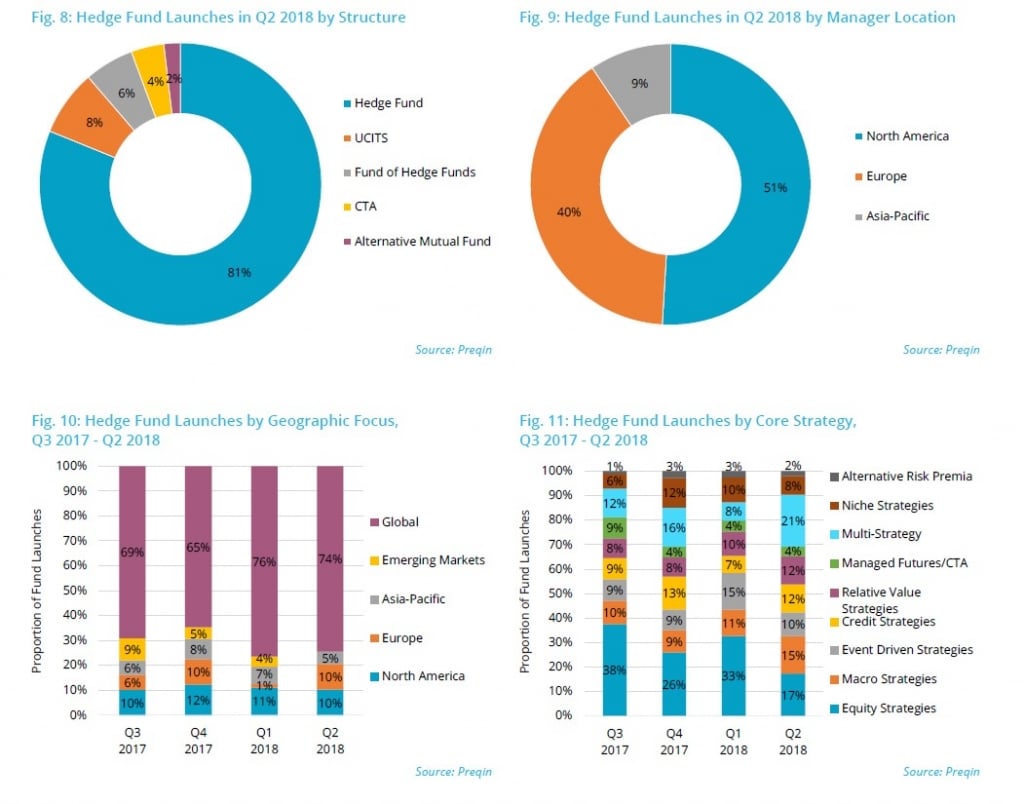

Fifty-three hedge funds were launched in Q2 2018, a decline from 74 launches in Q1 2018. Single-manager hedge funds accounted for 81% of launches, down 8% when compared with Q1 2018 (Fig. 8). However, UCITS’ share of fund launches (8%) has doubled since the previous quarter, while the percentage (6%) of CTA launches has increased six-fold. One in every four UCITS funds launched in Q2 is managed by a North America-based fund manager, a growing trend for the European fund structure.

Although North America-based hedge funds continue to dominate launch activity in Q2 (51%, Fig. 9), the share of fund launches within the region has decreased significantly from the previous quarter. The majority of newly launched funds in Q2 focused their investments globally (74%, Fig. 10).

The proportion (21%) of fund launches represented by multistrategy funds has almost tripled since the previous quarter (Fig. 11); among these is ExodusPoint Capital Management’s ExodusPoint Master Fund, an $8bn multi-strategy fund founded by Millennium Management’s former executive Michel Gelband in May 2018. Meanwhile, the proportion of hedge funds launched in Q2 2018 employing an equity strategy has fallen to 17%, almost half the levels seen in Q1. A challenging fundraising environment for equity strategies has been prevalent for the past couple of years: according to Preqin data, investors withdrew a net $24bn from the strategy across 2017, and a net $50bn in 2016.

Fund Searches

There were 191 new hedge fund searches added to Preqin’s online platform in Q2 2018. North America-based investors accounted for the largest proportion (44%) of fund searches issued, followed by Europe with 32% (Fig. 12).

Long/short equity remains the most commonly targeted strategy, as sought by 30% of investors that issued mandates in Q2 (Fig. 13). Macro and long/short credit strategies represent 19% and 15% of mandates respectively, making these strategies the second and third most attractive among investors.

Ninety-four percent of investors plan to access the hedge fund asset class through commingled vehicles, while managed accounts (15%) and UCITS (13%) are also commonly sought fund structures (Fig. 14).

Fund of hedge funds managers represent the majority (55%) of investors that have issued fund searches in Q2 2018 (Fig. 15). Private wealth firms round out the most prominent investor types, with wealth managers and family offices combining to account for 19% of hedge fund searches issued.

aa

Read the full article here by Preqin