On Wednesday, the CFO of biotech firm HCW Biologics Inc (NASDAQ:HCWB), Rebecca Byam, disclosed in a US Securities and Exchange Commission filing that she purchased 66,452 shares at an average price of $2.42 a share for a total slightly above $160,000.

HCW Biologics is a company that is focused on discovering and developing novel immunotherapies to lengthen health span by disrupting the link between chronic, low-grade inflammation, and age-related diseases. These diseases include cancer, cardiovascular diseases, diabetes, neurodegenerative diseases, and autoimmune diseases.

Q1 2022 hedge fund letters, conferences and more

The insider purchase and previous accumulation trends have driven the Fintel officer accumulation score higher to 96.75. This places HCWB in 2nd place out of 11,702 analyzed companies. In addition to this score, has an insider accumulation score of 93.37.

HCWB has a total of 10 insiders that own 15.7 million or about 44% of the total float. CEO Hing Wong owns 15.3 million shares of this figure and continues accumulating holdings with the most recent purchase on the 13th of June.

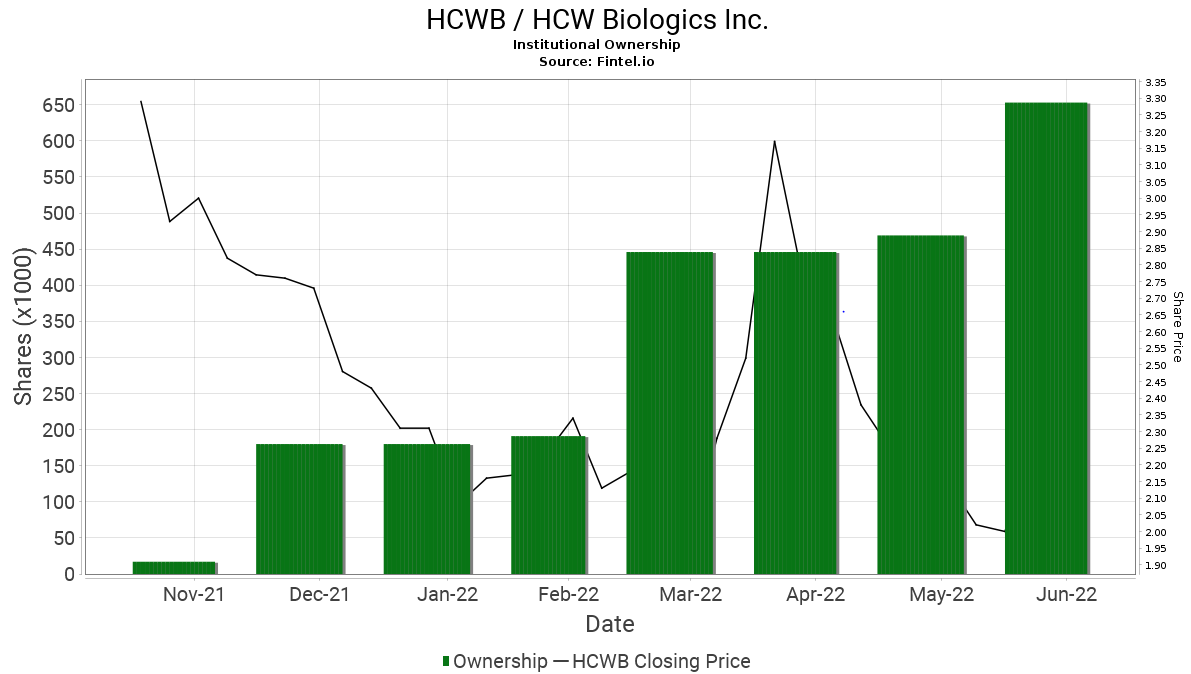

Institutional ownership in the company remains low with 24 firms that have filed 13D/G or 13F forms with the SEC and own about 654,000 shares or 1.8% of the total listed float. The table provided below illustrates the growing level of institutional ownership since listing, which contributes to a score of 77.11. This score above 50 places HCWB in the top 10% of 26,057 screened companies and confirms that institutions have been growing position sizes.

HCWB was listed on the Nasdaq in July 2021 at $8 per share. Since listing, shares have lost 70% of their value, currently trading below $2.50.

HCWB’s stock bottomed out at a 12 month low point of $1.89 and has since formed buying support with a short rally in April that faded and now a second rally that began in June.

The most recent rally has been supported by insider purchases that have likely given added confidence to traders and investors.

The most recent result for the first quarter was released in May and highlighted $3.1 million in revenue generation that were derived from the sale of clinical development material to the firms licensee, Wugen.

The net loss narrowed to $2.05 million from $3.3 million in the prior year, assisted by the revenue generated and lower research and development expenses.

The company ended the quarter with liquidity that management expects will provide a cash runway through to the end of 2023. This included $18.1 million in cash, $17 million in short-term investments and long-term investments totaling $9.8 million.

HCWB highlighted the preclinical data for HCW9218 that Wong presented at the “Conference on Cell and Experimental Biology,” stating:

“The Company believes these results demonstrate the potential of HCW9218 to fundamentally change the treatment of a broad range of diseases and conditions associated with aging, even aging itself, by enhancing health span that has been diminished with aging”

In a broker report from Maxim Group, analyst Michael Okunewitch highlighted that HCWB has advanced its first program into the clinic and expects a study in pancreatic cancer to follow shortly despite current market conditions y. Maxim Group believes HCW is well positioned to advance its pipeline in aging-related diseases. The group reiterated their ‘buy’ rating and target of $4 on the stock.

Another report from EF Hutton analyst Constantine Davides viewed the Phase 1 clinical trial to evaluate HCW9218 as a solid sign that the program is progressing. They hope to see a similar update for the HCWB-sponsored Phase 1B/2 study for pancreatic cancer. EF Hutton remain buyers of the stock with a bullish $10 price target that is based on peak potential sales.

On average, HCWB holds a consensus ‘buy’ rating and an average target price of $7 across the two institutions that cover the stock.

Article by Ben Ward, Fintel