Management last week declared a 7.1% increase in the quarterly HVT stock dividend rate to be paid in June

On the landscape of dividend capture strategies, where investors seek to seize fleeting profits from dividend payments, one intriguing candidate has emerged from the depths of the stock market. Haverty Furniture Companies, Inc. (NYSE:HVT), a stalwart in the furniture industry, recently announced a 7.1% increase in its quarterly dividend, signaling a potential opportunity for astute dividend hunters.

The company operates 123 showrooms under the “Havertys” brand in 16 states in the South and Midwest. Its founding dates to 1885. The HVT stock price is down 1.1% over the last 12 months.

The next dividend itself is set to be paid on June 21, to stockholders that are on the record as of June 6. This timeline creates a narrow window of opportunity for dividend capture enthusiasts to position themselves strategically in HVT stock.

The strategies’ allure lies in the promise of extracting quick gains from dividend payments, a siren song that beckons those with a hunger for immediate rewards.

Best Capture Candidates

Fintel’s Dividend Capture Strategy model provides a real-time look at upcoming payouts and provides a handy list of the best capture candidates.

The concept is deceptively simple: investors position themselves to capture dividends by purchasing a stock just before the ex-dividend date, allowing them to collect the dividend and then swiftly selling the stock shortly after.

The goal is to profit from the dividend payout while avoiding the long-term commitment to the underlying asset. It is, in essence, a game of timing, where fortunes can be made or lost with the precision of a maestro’s baton.

In the case of Atlanta, Georgia-based Haverty Furniture, the stock is a regular dividend payer that has rewarded investors with income every year since 1935.

The most recent dividend adjustment will see the furniture fim increase its quarterly dividend by two pennies, to 30 cents per share, giving thahe stock an annualized dividend yield of 4.53%, well above the S&P 500 index average 1.66% for quarter ended March 31.

Recovery Days

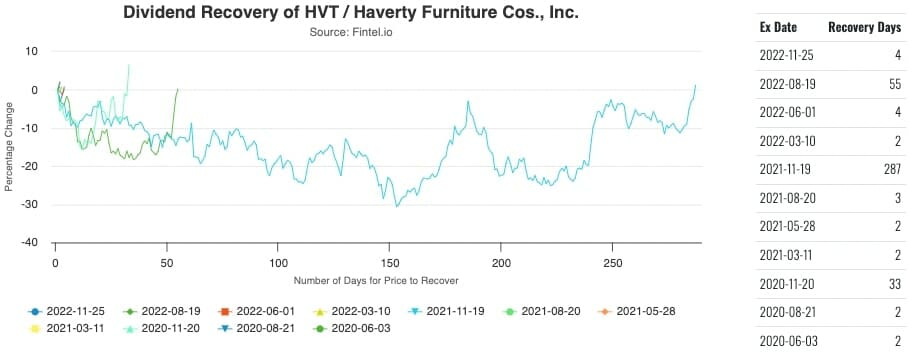

The dividend analysis page for HVT stock highlights an average of 36 “recovery days,” that is until the share price has risen above after the amount paid.

The chart and table below show how many days it took for the share price to recover after each of the quarterly dividends since mid-2020. We can see that the data is skewed by a few outliers and that three quarters of the time, the stock has recovered the price within four trading days, making it a solid candidate for the strategy.

The stock also features quite highly on Fintel’s dividend screener and leaderboard in 175th ranking with a score of 90.69.

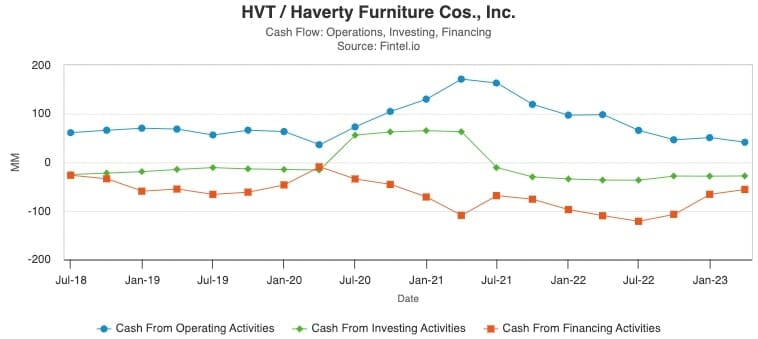

This score is based on the stock having a cash-from-operations payout ratio of 0.83 and has exhibited robust growth in the dividend rate over the last three years.

The payout ratio has risen in recent quarters as the cash flow generation from operations has decreased from recent highs achieved during the pandemic. While declining cash flows are concerning, the reduction of cash flows from debt (financing) has also decreased during the same period.

The cash flow analysis has been illustrated in the chart below from the financial metrics and ratios page for HVT.

The company’s first-quarter results for 2023 in early May revealed a decline in EPS to $0.74 per share from $1.11 last year. Consolidated sales experienced a 5.9% dip to $224.8 million, while comparable-store sales saw a 6.7% decline. Despite these challenges, Haverty still reported an increase in its gross profit margin slightly to 59.1% from the previous year’s 59.0%.

In the face of shifting consumer spending patterns and persistent inflationary pressures, Haverty chairman and CEO, Clarence H. Smith, acknowledged the headwinds the company encountered during the quarter. Notably, he highlighted a reduction in traffic and written business, which reflected the transition from the explosive pace witnessed during the pandemic to a more measured growth trajectory.

Income Absent Commitment

By purchasing the stock just before the ex-dividend date and promptly selling it afterward, investors can potentially capture the dividend while avoiding a long-term commitment to the company.

However, as with any endeavor, risks abound in the realm of dividend capture. Markets are known for their fickleness, and a strategy built on fleeting gains can be a precarious foundation. Price fluctuations, unpredictable market conditions, and transaction costs all conspire to test the mettle of even the most seasoned investor. The quest for easy profits can quickly transform into a disheartening ordeal if caution is not exercised.

Yet, for those who can master this delicate dance, the rewards can be sweet. Dividend capture strategies can provide a steady stream of income, a consistent drumbeat of profits that can outperform traditional buy-and-hold approaches. By skillfully moving in and out of positions at precisely the right moment, investors can compound their gains, creating a symphony of wealth that resonates throughout their portfolio.

The post Haverty Furniture’s Recent Dividend Hike Makes It a Perfect Dividend Capture Stock appeared first on Fintel.