What’s New In Activism – Groupon Settles

Groupon Inc (NASDAQ:GRPN) reached a settlement with one of its largest shareholders, handing out two board seats to Pale Fire Capital.

Dusan Senkypl, a partner at Czech-based investment firm Pale Fire, a Czech Republic-based investment firm, was appointed to Groupon’s board after the company’s June 15 annual meeting. Jan Barta, another partner at the activist firm, will join as a board observer initially and then as a director by November 30. As a result of the new additions, Groupon will increase the size of the board to nine members.

Q1 2022 hedge fund letters, conferences and more

Groupon has seen several activists on its share register in recent years. Turkish investment firm RPD Fund Management invested in May 2022 and U.S.-based Prescience Point Capital has been bullish on Groupon.

The company was profiled in November 2018 as a potential activist target on Insightia's Vulnerability module. Read that report for free here.

Activism chart of the week

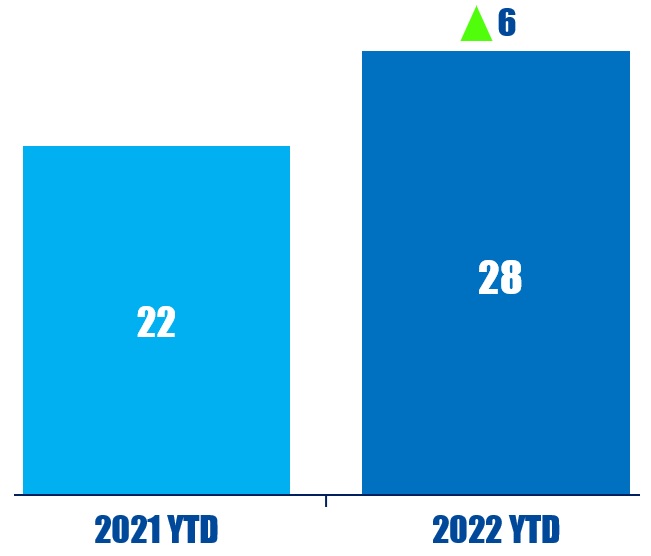

So far this year (as of June 16, 2022), 28 U.S.-based companies have been publicly subjected to activist demands by non-U.S.-based investors. That is compared to 22 in the same period last year.

Source: Insightia | Activism

What’s New In Proxy Voting - Oil Backlash Against ESG Investors

West Virginia State Treasurer Riley Moore has warned six financial institutions they may be ineligible for contracts for state banking services over ESG-based "boycotts" of the fossil fuel industry.

Moore announced that he had sent notices to BlackRock, JP Morgan Chase, Wells Fargo, Morgan Stanley, U.S. Bancorp, and Goldman Sachs on June 10, warning they could be placed on the state's restricted financial institution list for appearing to be "engaged in boycotts of fossil fuel companies."

"Earlier this year our Office proposed Senate Bill 262 to push back against unfair discrimination against our coal, oil, and natural gas industries by the financial sector as part of the so-called ESG investing movement," Moore said in a press release. "We've now demonstrated we are serious about enforcing this law."

Senate Bill 262, which was passed by the state Senate in January, authorizes the Treasurer's Office to create a restricted financial institution list consisting of companies that have publicly stated they will refuse, terminate, or limit doing business with coal, oil, or natural gas companies "without a reasonable business purpose."

Voting chart of the week

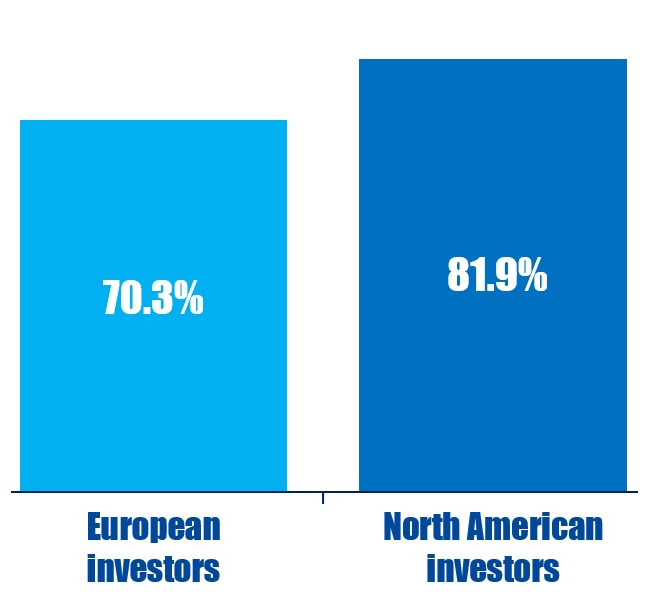

In the year to June 31, 2021, North American investors supported management remuneration proposals 81.9% of the time on average, globally. This is compared to European investors who voted in favor only 70.3% of the time.

Source: Insightia | Voting

What’s New In Activist Shorts - Culper Research v Piedmont Lithium

Culper Research shorted pre-production lithium miner Piedmont Lithium (NASDAQ:PLL)'s stock last week, calling it a "U.S. flag waving stock promotion."

In a June 14 short report, Culper said Piedmont "has little hope of ever producing battery-grade lithium" from its North Carolina mine, due to "overwhelming local pushback and management ineptitude."

The short seller accused the company of inflating the mine's capabilities, described Piedmont's claim that it has "the best lithium asset on the planet" as nothing short of "laughable." Culper also claimed Piedmont underestimates its costs by over $300 million, "hence contributing to an artificially high NPV [net present value]."

Culper also alleged that former insiders have been linked to mining ventures which collapsed.

Shorts chart of the week

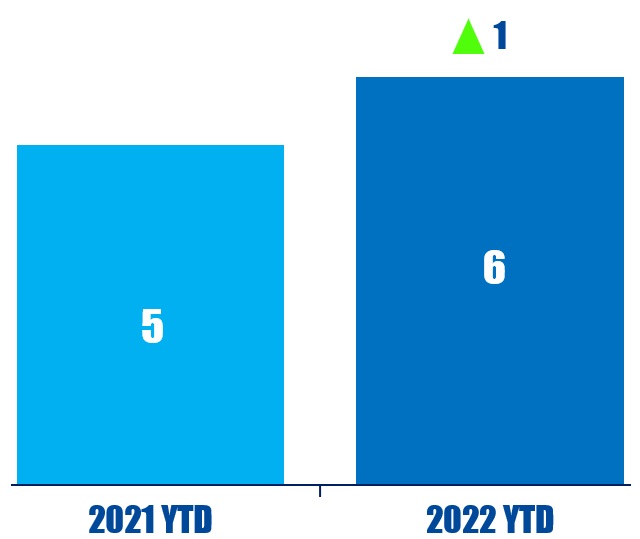

So far this year (as of June 17, 2022), six Canada-based companies have been publicly subjected to an activist short campaign. That is up from five in the same period last year.

Source: Insightia | Shorts

Quote Of The Week

This week's quote comes from Hindenburg Research in a June 16 short report on India-focused fintech Ebix. Read our reporting here.

“The ocean of 1-star reviews cite complaints such as money being fraudulently stolen from users, terrible customer service, and the app not working.” – Hindenburg Research