This report provides an overview of the global crypto hedge fund landscape and offer insights into both quantitative elements (such as liquidity terms, trading of cryptocurrencies, and performance) and qualitative aspects, such as best practice with respect to custody and governance.

Q1 2021 hedge fund letters, conferences and more

By sharing these insights with the broader crypto industry, PwC’s goal is to encourage the adoption of sound practices by market participants as the ecosystem matures.

For this 3 rd annual edition, PwC have partnered with the Alternative Investment Management Association (AIMA) to also survey some of the non crypto focused hedge funds (referred to as ‘traditional’ hedge funds in this report). The data on these traditional hedge funds is provided in the second part of this report.

Strategy insights

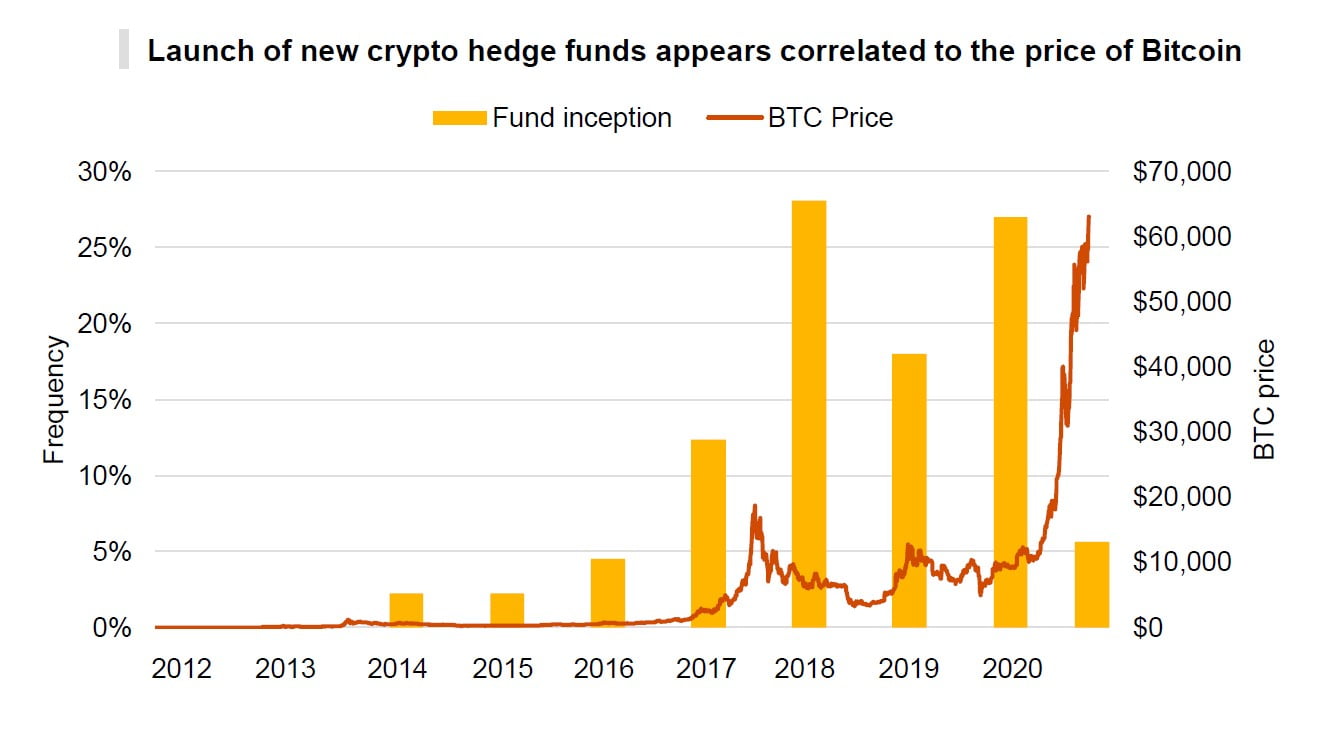

Our research this year shows that there are between 150 and 200 active crypto hedge funds currently. Our survey results suggest that four in every five of these were launched between 2017 and 2020 (81%).

As shown by the graph above, the launch of actively managed crypto funds is highly correlated with the price of Bitcoin (BTC). The price spike in 2018 appears to have been a catalyst for further crypto funds to launch, while the decrease in 2018 led to fewer funds being launched in 2019. 18% of the survey respondents were launched in 2020, when prices were rising again.

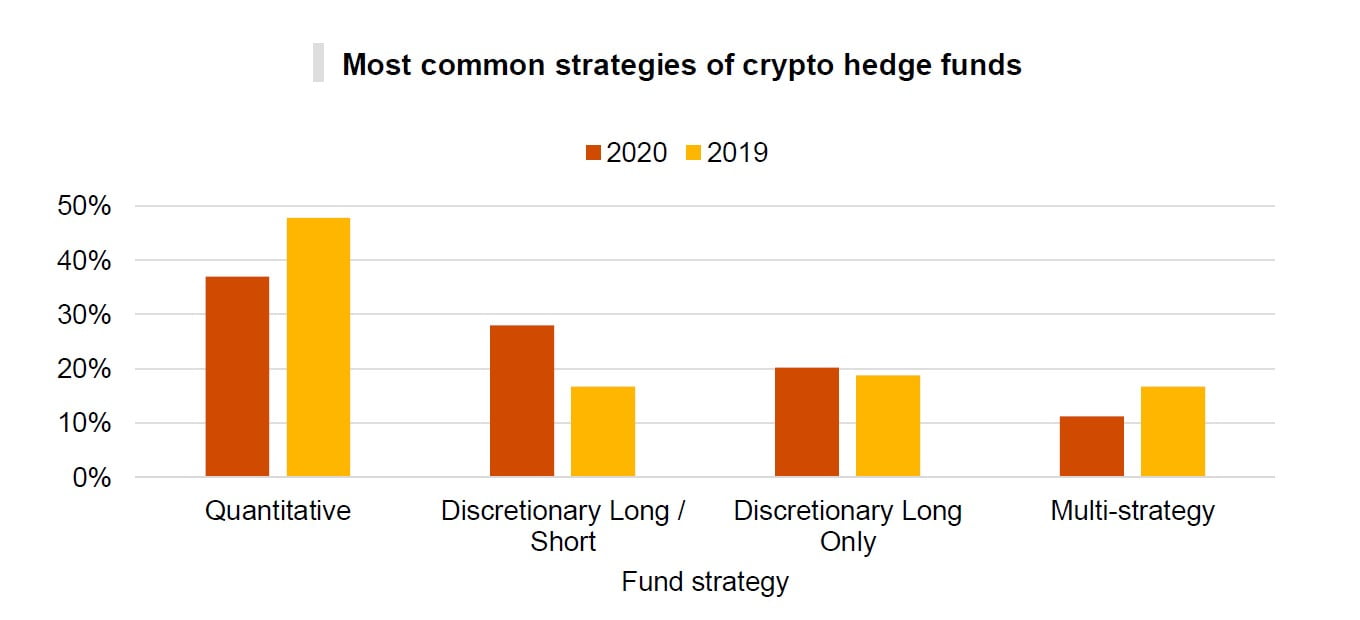

We have classified crypto hedge funds according to four broad fund strategies:

- Discretionary Long Only: Funds which are long only and whose investors have a longer investment horizon. These funds tend to invest in early stage token/coin projects, and they also buy and hold more liquid cryptocurrencies. These funds tend to have the longest lock up periods for investors.

- Discretionary Long/Short: Funds which cover a broad range of strategies including: long/short, relative value, event driven, technical analysis and some strategies which are crypto specific, such as mining. Discretionary funds often have hybrid strategies which can include investing in early stage projects. They tend to have a similar lock up period to the Discretionary long only group.

- Quantitative: Funds taking a quantitative approach to the market in either a directional or a market neutral manner. Indicative strategies include: market making, arbitrage and low latency trading. Liquidity is key for these strategies and restricts these funds to only trading more liquid cryptocurrencies. As a result, these funds typically have the shortest lock up periods for investors.

- Multi strategy: Funds adopting a combination of the above strategies. For instance, within the limitations set in the prospectus of a particular fund, traders may manage discretionary long/short and quantitative sub accounts.

Assuming our dataset is representative of the total crypto hedge fund universe, we conclude that quantitative funds are the most common among crypto hedge funds, making up for just over a third of all currently active crypto funds.

The next two larger categories are discretionary long/short (28%) and discretionary long only (20%), with multi strategy funds making up a much smaller proportion, at 11%.

Market analysis

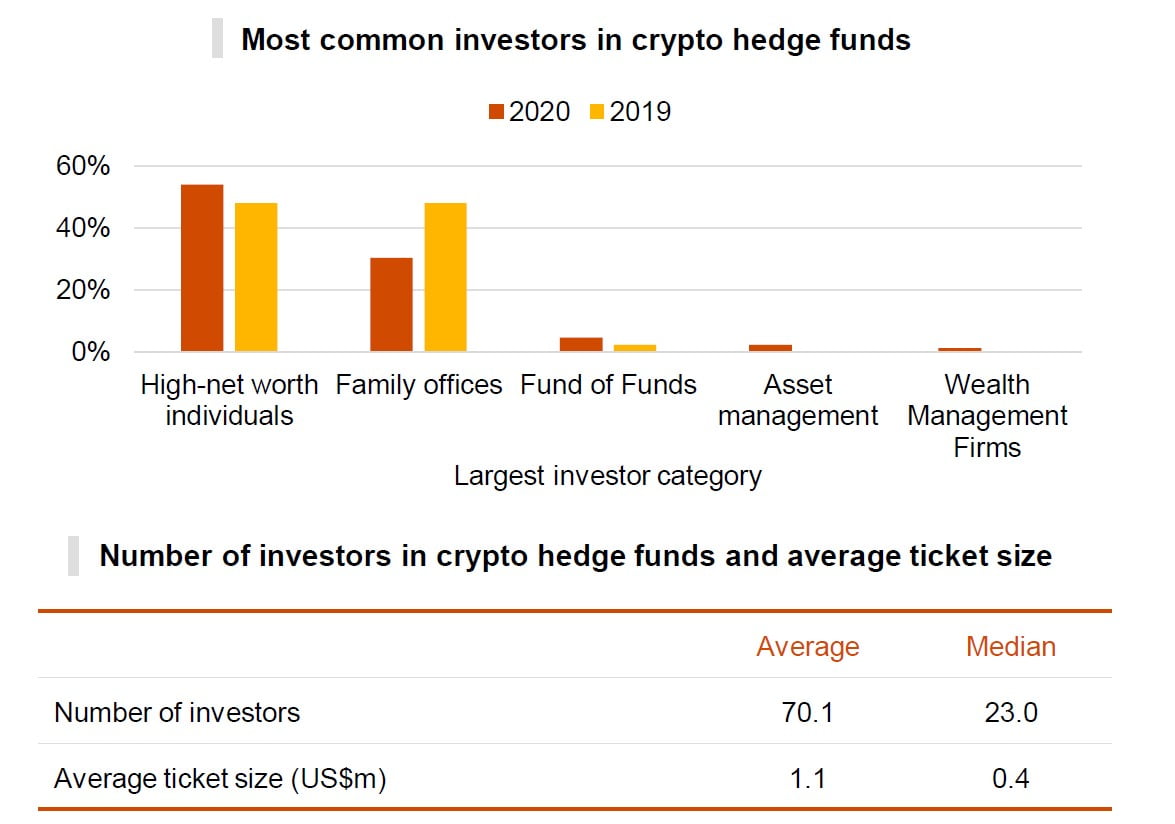

Looking at the market for crypto hedge funds, we identified High net worth individuals ‘HNWIs as the most common investor type in crypto hedge funds, with more than half of funds mentioning them as the most common investor type. Family offices come second (30%) and funds of funds, a distant third (4%). Although institutions have been aggressively ploughing into cryptocurrency markets, they are not yet prevalent investors in crypto hedge funds, with only one fund in our sample mentioning them as their main investor type and the top spots still dominated by HNWIs and family offices. Going forward, it is expected that this mix in the investor base while gradually change with the increased levels of interest from institutional investors.

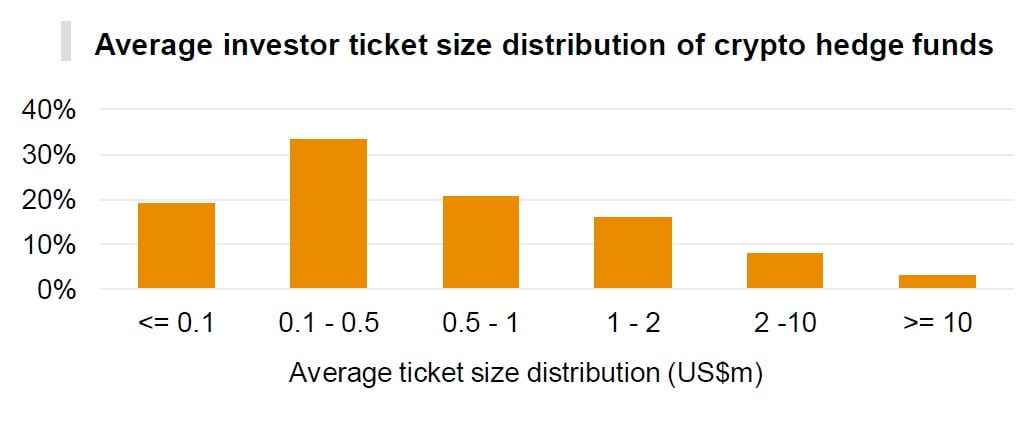

The median number of investors in funds is 23 and the average is 70.1, while the median ticket size is US$0.4 million and the average is US$1.1 million. The graph below shows the distribution of the average ticket size and suggests that half of funds have tickets below US$0.5 million.

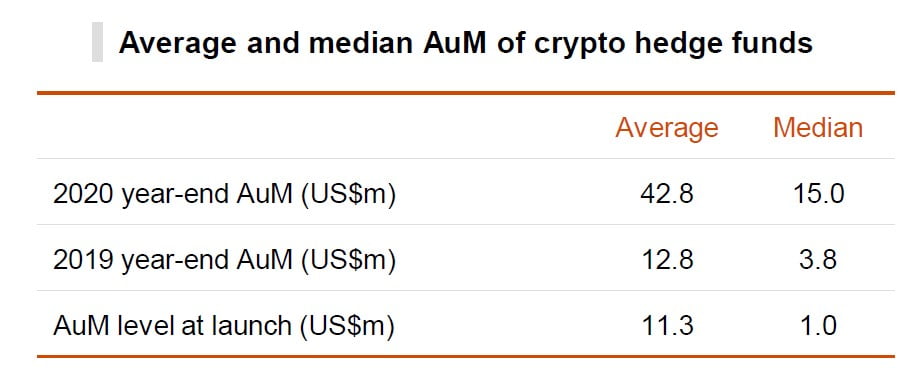

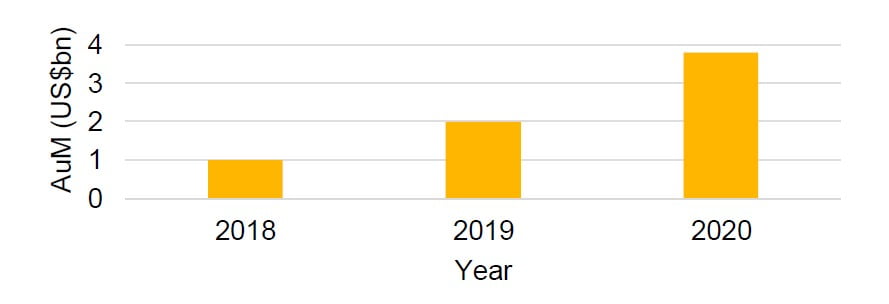

Assets under management

We estimate that the total AuM of crypto hedge funds globally increased to over US$3.8 billion in 2020, just over US$2 billion in the previous year. This data is based on the AuM responses given to us by the surveyed fund managers with certain adjustments due to some funds having not disclosed their total AuM

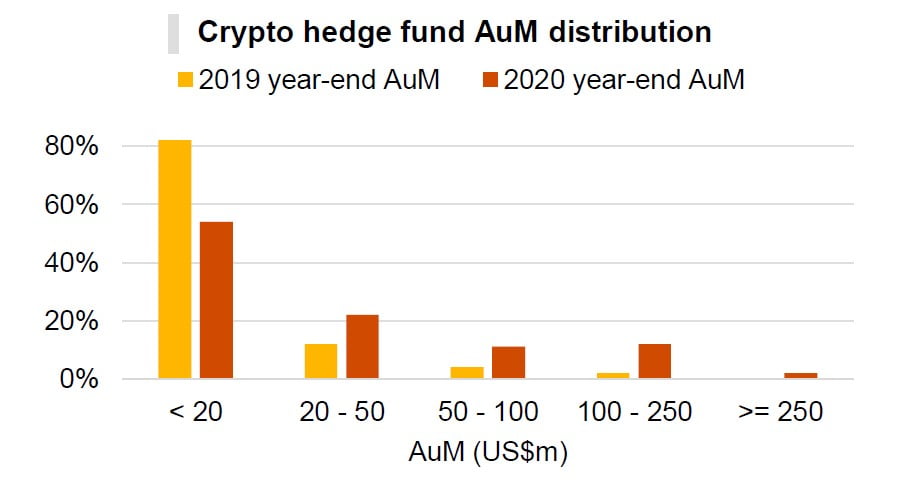

The graph below shows the distribution of AuM held by individual crypto hedge funds. Although there are many smaller funds, assets are still highly concentrated among the largest hedge funds. Our survey showed that the top 10 largest crypto hedge funds control 63% of total AuM

Also, the effect of the 2020 crypto bull market is clearly visible in the data above, with the number of funds with smaller AuMs being considerably lower in 2019 than in 2020, while, at the other end of the spectrum, the number of funds managing larger amounts of assets is considerably higher in 2020.

Read the full report here by PwC