Still captain sensible – a deep dive into the FTSE 100 weighting

Q1 2021 hedge fund letters, conferences and more

| FTSE 100 arrival? | FTSE 100 departure? |

| Royal Mail PLC (LON:RMG) | Renishaw plc (LON:RSW) |

| FTSE 250 arrivals? | FTSE 250 departures? |

| Harbour Energy PLC (LON:HBR) | Provident Financial plc (LON:PFG) |

| Auction Technology Group PLC (LON:ATG) | Foresight Solar Fund Ltd (LON:FSFL) |

| Moonpig Group PLC (LON:MOON) | Sabre Insurance Group PLC (LON:SBRE) |

| Trustpilot Group PLC (LON:TRST) | Capita PLC (LON:CPI) |

| Darktrace PLC (LON:DARK) | Wickes Group PLC (LON:WIX) |

| Tyman PLC (LON:TYMN) | JLEN Environmental Assets Group Ltd (LON:JLEN) |

“The FTSE reshuffle won’t see the topflight move much with only Royal Mail likely to be delivered a coveted FTSE 100 seat. But there is some significant movement on the lower deck with changes to the FTSE 250. The new arrivals are likely to include newcomers like Moonpig, Auction Technology Group, DarkTrace and Trust Pilot, which have all flown onto the London market in recent months, while Premier Oil’s transformation into Harbour Energy could see it make the mid cap list. Shuffling down a grade could be, Provident Financial Group, Capita, Foresight Solar Fund and Sabre Insurance Group as industry trends weigh on their respective sectors. There could well be some late moves to the line-up, as the reshuffle will be worked out on market values at the close on 1st; and announced on 2nd June. They will become effective on 21st June.

-

Table of Contents Show

FTSE 100 - Moving up?

Royal Mail - prime contender for promotion to the FTSE 100

Royal Mail has opened a bulging sack of profits for the year, showing its success in capitalising on the e-commerce boom. This is likely to deliver it a coveted spot back in the blue-chip index, which would be a red-letter day for the company when the reshuffle is announced. This postman has rung twice, not just with a sharp increase in parcel volumes at Royal Mail, but also with its international business GLS, which is enjoying runaway success. Royal Mail is targeting 12% annual revenue growth over the next five years for GLS with only modest capital expenditure. Momentum revved up as the group increased its capacity for parcel deliveries, but the group’s UK operations still creak under high demand and significantly more capital expenditure will be needed after years of underfunding.

ITV - outside contender to inch back up to the topflight

ITV lost its lustre as the pandemic caused production problems for its pipeline of shows and it grappled with rapid belt tightening of advertising budgets. The Love Island broadcaster’s revenue plunged after the hit show was cancelled and episodes of popular soaps were scaled back. But marketing spend is ramping up once again as vaccine roll outs fuel confidence among brands. There is also hope of a rebound in fortunes for its Studios business, where it produces content for others, especially with the streaming wars seeing little sign of de-escalating. This part of the business is key to ITV’s turnaround, to help the company reduce the reliance on the fickle world of advertising. It is still slow progress, but investors have glimpsed the flicker of better times ahead and it has the potential to clamber back up to the topflight if momentum continues.

-

FTSE 100 - moving down?

Renishaw - set for demotion from the FTSE 100

Renishaw, known for its precision engineering, narrowly made it into the top-flight. It was boosted into position by announcing its sale with impeccable timing for the last reshuffle. But the blue-chip status hasn’t helped find a buyer and the company’s high price tag and strings attached to the deal seemed to have put off potential suitors from clinching a deal. Founders Sir David McMurtry and John Deer who are selling their combined 53% holding set up the company almost five decades ago and have seen it flourish into a global player. They indicated their focus will be on finding a new owner who fits their vision for the company while respecting its culture, heritage and commitment to the communities in which it operates. It has manufacturing bases not just in Gloucestershire, where the company is headquartered, but also in Cardiff and York as well as plants in Ireland, India, Germany and the USA. It’s share price has been on the slide as the hunt for a new owner continues, and it’s fall back into the FTSE 250 league looks highly likely.

-

FTSE 250 Moving up?

Harbour Energy - contender to jump into the FTSE 250

Harbour Energy looks set to jump upstream into the FTSE 250, as demand for oil and gas recovers and more countries ease out of pandemic restrictions. Harbour Energy is the reincarnation of Premier Oil formed via a reverse takeover by newly listed Chrysaor, which gave Premier a nifty solution to its debt issues. It won’t be plain sailing for the group though, with concerns about fresh Covid strains likely to weigh on the oil price. It offers some green credentials, by being a key player in the Acorn project, a carbon capture and hydrogen venture alongside Shell and Storegga. But with ESG concerns of increasing interest to investors, future guidance on its renewable strategy will be watched with interest.

ATG - Auction Technology Group - contender for the FTSE 250

When the hammer goes down on the reshuffle, Auction Technology Group is highly likely to enter the FTSE 250 fray. The Antiques Trade Gazette owner is an expert in online auctions and figures in its first results after listing in February show that remote bidding is here to stay. Even though plenty of auction houses have reopened in the US, a major market for the company, bids are staying firmly online which bodes well for the prospects for the group. Revenues for the half year were up 48% to 34.5% million. Plenty of people have had time during the pandemic to dig around for potential treasure squired away in attics, which may also provide a mini tailwind for the group over the months to come.

DarkTrace - to secure FTSE 250 position after successful IPO

Cyber security firm, DarkTrace is highly likely to creep into the FTSE 250 following its successful IPO which saw shares soar 40% on listing. It raised £143.3 million which will be used to further develop its AI technologies which detect and counter cyber threats. Founded by US and UK intelligence agents in 2013, it uses machine learning, to scan regular business operations and detect tiny irregularities, which can be the canaries in the coalmine of cyber-attacks. The global shift to digital which has accelerated during the pandemic, should open up new opportunities and markets for DarkTrace as firms scale up their operations to meet demand, whilst trying to ensure their systems stay secure.

Moonpig - set to fly into the FTSE 250

E-card retailer Moonpig’s is set to fly into the FTSE 250, after snuffling out a hefty valuation at its IPO launch. Although its shares have had a bit of a wobble, they have risen sharply in recent days and the company boasts a £1.59 billion price tag. By positioning itself as a digital sales platform, using data to predict consumer preferences, Moonpig has succeeded in positioning itself as a big e-commerce player, rather than an online card retailer. The company has been living high on the hog during the pandemic as demand for cards and personalised gifts ordered online soared. But easing pandemic restrictions mean consumers are now free to browse real rather than virtual racks of cards once more, and its flying sales risk coming down to earth with a bit of a bump. Plenty of other retailers are sniffing out the truffles in the e-card market with Card Factory, Funky Pigeon and start up Papier eager to steal more market share.

Trust Pilot - FTSE 250 contender after listing in London

The consumer reviews operator Trust Pilot has capitalised on the accelerated shift to digital during the pandemic and launched on the London market as part of the IPO gold rush. After a bit of a volatile start to trading, its shares have broadly risen over the past month, giving it a market capitalisation of £1.22 billion, as investors assess not just its value as a reviews site but also the vast amount of data it holds on consumer behaviour. It offers consumers the chance to voice their opinions about sites and sellers, offering crucial information to shoppers testing out e-commerce traders for the first time. The data it is able to mine on customer experience is Trust Pilot’s currency and it sells a subscription model to companies allowing them to not only use positive reviews for marketing but providing information to help them improve their service. However, the company is still loss making and its profit prospects will depend on the company winning more paid subscribers. With the e-commerce boom likely to continue there is significant potential for growth. However, there is competition in this space not least from the big retail platforms, like Amazon, hosting the digital shops of small retailers, who run their own review systems. Trust Pilot’s future prospects will depend very much on how the e-commerce ecosystem evolves.

Tyman - set to be promoted to the FTSE 250

Door and window manufacturer Tyman has seen its share price rise sharply after it benefited from robust demand for repairs, renovations and new build homes in its key markets. There is of course a risk that demand for new panes will wane, as the home renovation craze cools. However, the housing market in the US and the UK doesn’t show signs of stalling any time soon, with remote working having sparked interest in moving to bigger properties or more rural locations. In the US it could also benefit from Biden’s infrastructure spending boost. Higher commodity costs though, could cause the price it pays for components for its engineered parts to rise, and there is a risk that could eat into margins.

-

FTSE 250 - Moving down?

Sabre Insurance Group - likely to be demoted from the FTSE 250

Sabre Insurance Group is likely to drop down a gear from the FTSE 250 as it faces increasing competition in the UK car insurance market. Business went into the slow lane last year with gross written premium taking a knock, due to effects of the pandemic with pre-tax profit falling by 13% to £49.1 million. Revenues were hit by fewer people learning to drive and buying new cars. However, with fewer vehicles on the road, there were fewer claims, a situation likely to go into reverse as the network gets busier again. The company forecast that Recent lower premium volume will likely be headwind for sales during 2021.

After the demerger from Travis Perkins in the FTSE 250, Wickes is now a standalone entity and will enter the FTSE All Share index. So, it’s not a demotion and in fact Wickes has been firing on all cylinders, with a like for like 5% rise in sales last year. It capitalised on the trend for pandemic home improvements with DIY purchases particularly buoyant, rising by almost 20%. The appetite for DIY may wane a little as furloughed workers return to the busy world of work, but with demand for long term solutions to working from home set ups, sales should stay brisk.

Capita - set for demotion from FTSE 250

The outsourcing firm took a big hit during the pandemic, with its transactional business, like Capita Travel and Events particularly badly affected. Last year adjusted pre-tax profit fell to £65.2m from £197.7m in 2019. So, a big restructure is now on the cards, and a sale of assets, to try and limit further losses as its divisions attempt a recovery. It’s likely it’ll be nursing its divisions back to health out of the FTSE 250, given the recent slide in its share price.’

Provident Financial - doorstep lending woes could see it ejected from FTSE 250

The fortunes of Provident Financial Group have been seriously on the slide, and the company has now called time on its doorstep lending business. It’s all part of its attempt to climb out of a financial black hole, after being forced to pay compensation for mis-selling its products. Thousands of complaints were upheld against the company, and the bill to compensate customers was already set at £50 million. The business has been targeted by claims management companies, sniffing out the opportunity to make money after the financial ombudsman service upheld a high number of complaints. In many ways, by setting up the compensation scheme, Provident had been trying to shut the stable door, after the horse had already bolted. With such a big bill to foot, and customers more wary of signing up to high-cost credit, the doorstep lending business clearly looks largely unprofitable going forward. Shifting its business model away from riskier high interest loans towards a mid-cost credit model now looks like the direction of travel for the company. It’s highly likely that it will try and make that slow but difficult pivot from outside of the mid cap league, given the fresh downwards trajectory of its share price.

Foresight solar fund - could lose its FTSE 250 lustre

The Jersey based investment company; Foresight Solar Fund has lost some of its shine amid a change in the direction of its diversified portfolio. It’s won shareholder approval to focus on battery storage alongside its ground based solar plants. As part of the plan it ploughed £12.7 million into a 50% equity stake in a 50MW UK grid battery project, using existing revolving credit facilities. It is likely to take time for the strategy to bear fruit but upgraded battery storage facilities are seen as crucial for the long-term success of renewable energy projects. But there are still concerns over the aging UK power network and when it can be sufficiently upgraded to meet the requirements of a rapid roll out of green power.

4imprint Group - set to avoid demotion from FTSE 250

It’s been a tough year for 4imprint Group as demand plummeted for its promotional products during the pandemic. With advertising and marketing spend tightened, orders plunged, and profits fell 93% for the full year. But recovery is now on the cards for the group, with momentum building rapidly as the economy has opened up again. Order intake in April was just above 80% of 2019 levels. That’s led to a sharp rebound in the share print, which is now very likely to see it avoid relegation, despite being in the drop zone a week ago.

Still captain sensible - a deep dive into the FTSE 100 weighting

The FTSE reshuffle will give an insight into the companies riding high after an exceptionally challenging year, and those whose fortunes are less bright. But beyond the shifting fortunes of individual companies, the changes are likely to highlight the UK market is still captain sensible.

Sophie Lund-Yates, equity analyst, Hargreaves Lansdown comments:

“Like most things, the FTSE100 changes as it ages. But where does it stand today compared to decades gone by? More importantly, what does this teach us about the UK’s investment appetite, and what could the future of the index look like?

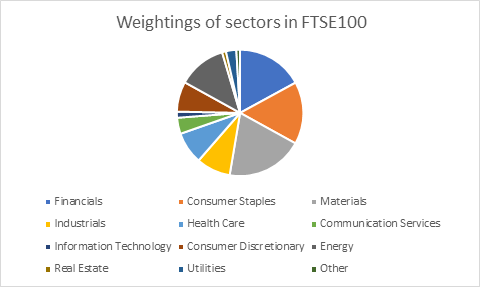

Source: Refinitiv Eikon, data correct as at 11/5/2021

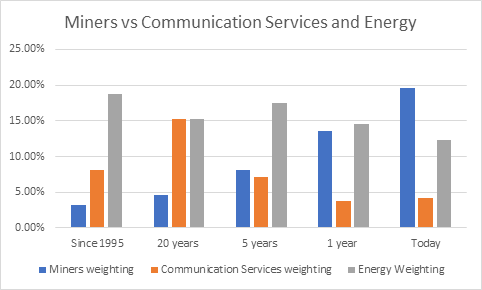

The FTSE100’s biggest constituent is materials. Most of this sector is made up of miners. Giant Rio Tinto used to be the sole miner, but that list has swelled to include the likes of Anglo American, BHP, Fresnillo, Glencore and others.

Today the sector makes up 19.6%, by weight, of the FTSE100. This has risen from just 3.2% since 1995 and 4.6% twenty years ago.

But why do miners make up such a huge chunk of the index now?

Firstly, the London Stock Exchange became home to some mining giants over the years, boosting the sector’s footprint. Plus, the global need for raw materials is pretty reliable. It’s not like iron ore’s a fad that will go out of fashion—it’s a necessary building material and has been for decades. There have been cyclical highs and lows over the years (mining stocks tend to do well when the economy’s doing well, and less good when times are tough), but overall, these companies have only grown because ultimately, the world still needs copper and iron ore, lots of it.

More recently, they’ve been buoyed by soaring commodity prices and a weaker US dollar too.

The UK lives off the day-to-day stuff

The next biggest sector is financials. Banks and insurers make up 17.1% of the FTSE100’s weight, which is up over 5% compared to 1995, but pretty much unchanged from five years ago.

The sector has been battered and bruised because of the pandemic, but that doesn’t stop it playing a huge part in the UK markets. An interesting thing to keep in mind is that with a market cap of a whopping £92.8bn, HSBC is the biggest bank by market cap. That means it plays a substantial role in moving the UK’s most famous index, but its fortunes are decidedly international, with about 65% of pre-tax profit coming from Asia.

Source: Refinitiv Eikon, data correct as at 11/05/2021

Both the materials and financial sectors are hardly exciting. But they are reliable to some degree: demand for these products aren’t going to evaporate. Money and metals make the world go round. They’re how we build skyscrapers. They’re how we pay for those skyscrapers. One thing’s clear, while the pandemic has been a serious shock to the financial system, the status quo is very much intact.

This in itself is where unmasking the changing face of the FTSE is interesting. It proves the UK’s steadfast penchant for all things useful. Exciting tech stocks, banks are not.

So what’s losing weight?

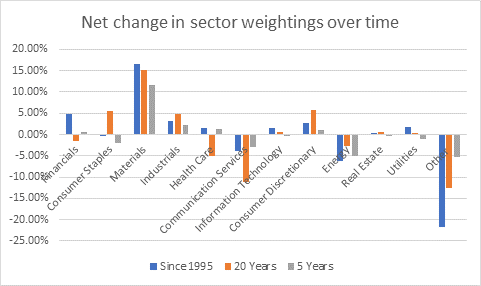

While the big picture might look similar, the FTSE100 is far from immune to change. Changing trends will cause this famous index to shapeshift, and after doing some digging, the results are quite stark.

Source: Refinitv Eikon, data correct as at 11/5/2021

26 years ago, communication services accounted for 8.1% of the FTSE 100, it’s now just 4.1%.

There are two sides to this shift. The first is the shrinking fortunes of BT and Vodafone. An uber competitive environment for each of them, has played a huge role in their smaller statures. In the case of Vodafone, huge chunks of the business have been sold too. Back in 2014 Verizon paid $130bn for a substantial piece of Vodafone’s indirect holding in Verizon Wireless.

The other important thing to notice is the communication sector includes traditional media companies. ITV and WPP are the two that spring to mind. There’s a structural decline happening in traditional media, and these two are rocks of this struggling industry.

The oil majors are also shrinking in size. The energy sector makes up just 12.4% of the index. Twenty years ago this was 15.2%. The share price performance of giants BP and Shell is very closely linked to the oil price, and this has fallen almost 13% in the last ten years. It’s also worth considering increasing ESG awareness and the role this plays on the size of the oil majors. More on that later.

What about the pandemic?

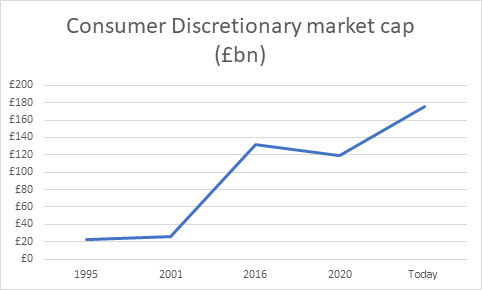

Because weightings give more precedence to bigger companies, they can hide other interesting trends.

Something that really stands out is the huge increase in the market capitalisation of consumer discretionary stocks over the last year. We usually wouldn’t look back at something with a one year view – that’s pretty short-term. But we aren’t in usual times.

Source: Refinitiv Eikon, data correct as at 11/5/2021

The pandemic’s added about £56bn, which is around a 47% increase, onto the market cap of this sector in the last year. It includes retailers B&M bargains and Ocado, luxury retail and housebuilders. You’d usually expect spending to have fallen off a cliff in times of such great economic volatility. But consumers have clearly continued to splurge in certain areas. That has a lot to do with the seismic shifts in where money’s being spent.

On one hand, people conscious about money in these tough times are likely to have transferred to discount retailers. The other side of the coin is that some of the nation has spoiled itself. We went all out for Christmas and Easter to try and make the best of a bad situation. Higher-end Ocado benefited from this mindset, and the huge shift to online groceries during lockdown.

Finally, given the boutique is a huge part of the luxury apparel appeal, it’s been surprising to see the luxury sector hold up so well. People have continued to clamour for the latest insta-worthy look, even if that meant using a website instead.

Where next for the FTSE?

Looking ahead, energy is likely to be the sector that changes the most. As giants BP and Shell pivot towards renewable energy, one of two things is going to happen. Their transformations could be successful, and they will become much less reliant on the oil price, giving the businesses room to expand perhaps more quickly. This wouldn’t be a given though – oil prices could rise in the future if demand remains high but supply becomes constrained.

The other risk is that transformations could fail, meaning the groups are over-exposed to high carbon fossil fuels as the world transitions to green solutions. They’d then ultimately shrink, making up a much smaller piece of the FTSE100. The colossal sums invested in green energy would also have been for nothing. It’s also important to remember that those choosing to sell down their oil and gas assets to focus on renewables, face huge execution risk. In both scenarios, performance on an operational level could suffer, sending shocks through the share price.

Either way, in the coming decades, the energy sector is going to be a very different beast to what we know today.

The same but different?

Miners are likely to remain heavyweights of the index. But this will be for new reasons – we’re likely to see growth because of accelerated ESG trends.

The electric vehicle revolution means the need for the likes of Anglo American’s platinum group metals, is expected to increase. And this is a growth opportunity on top of what should be steadily increasing demand for the raw materials needed for construction and industrial production all over the world.

Banks, for what they’re worth

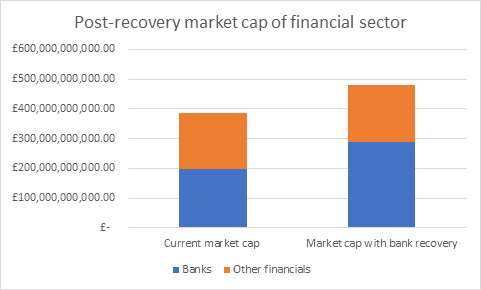

At the moment, the banks in the FTSE100 are trading on an average of 0.56 times the value of their assets. That’s about 46% lower than the ten year average. If these were to gain ground and trade back at 0.82 times book value, that would increase their weighting in the FTSE100 to around 13.0% (assuming the rest of the index carries on as-is).

Source: Refinitiv Eikon, data correct as at 11/5/2021

Whether or not this happens will depend largely on how the banks fare in a low interest rate environment. If rates stay on the ground, it will make turning a profit on loans a much more difficult task. Jitters around this, are a large reason why those share price valuations are currently so low.

More tech?

Today, the FTSE 100 is decidedly a little unexciting. Unlike the likes of NASDAQ, the London Stock Exchange’s biggest companies tend to be traditional profit and cash generative businesses.

Downing street would like this to change, and want to encourage more forward-thinking, high growth, tech names to London. That’s why Deliveroo’s flop was so disappointing – it could put tech names off choosing the LSE in the future. But London’s lack of tech presence stems far past one disappointing IPO. London’s investment appetite still appears conservative at its core, with little desire for loss-making start-ups. In our view, that’s unlikely to change for some time.

Our verdict

The FTSE100 has shape shifted over the years, but its core remains familiar. The UK’s reliance on materials and financials is unlikely to be shaken down anytime soon. The biggest risks and opportunities for investors looking to the future will involve understanding how the oil majors’ green plays pan out. And in the nearer term it will be worth keeping an eye on how consumer discretionary spending shapes up – we suspect this sector has been forever changed by the pandemic, and that kicks up some serious opportunities."

Article by Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown

About us

Over 1.6 million clients trust us with £132.9 billion (as at 30 April 2021), making us the UK’s largest digital wealth management service. More than 98% of client activity is done through our digital channels and over 600,000 access our mobile app each month.