Executive Summary

The image we received from reviewing Folli Follie’s financial statements and official declarations over the year is that of a rapidly-growing multinational fashion company led by double-digit growth in its key segment: Asia. Unfortunately, following an extensive investigative and due diligence work we find it impossible to reconcile that picture with our findings on the ground, which point to an unprofitable, struggling company with materially smaller, and rapidly decreasing revenue, network size and cash balances. The core of the issue seems to be concentrate in FF’s Asian and, particularly, Chinese subsidiaries. Our conclusions are well substantiated by the following points that will be reviewed in depth in this report:

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

A. The network of points of sale (POS) appears materially smaller than expected: We performed an extensive due diligence and checked each individual POS, often in multiples ways: contrary to the 630 POS mentioned in the 2016 annual report for the Folli Follie brand, we found evidence of only 289 operating POS. The majority of the remaining ones appear to have ceased operations.

B. Onsite checks: we personally visited several Folli Follie POS in key strategic locations (e.g. New York City and Tokyo, Japan) and can confirm that many critical assets that the company, still appearing on its website (e.g. FF Soho or FF Madison Avenue shops), are indeed closed. We also noticed how a number of POS, including in key locations, appear to be of negligible size (often just a small window) and in the process of liquidation.

C. Digital presence: we ran an audit on Folli Follie presence online, checking website traffic and popularity on social media and benchmarking it against FF competitors. Our findings suggest that FF digital presence, especially in Asia, may be indicative of a far smaller company.

D. Financial analysis: Folli Follie official figures indicate growing revenue and profit, but constantly negative free cash flow, the bulk of which is explained by large and increasing working capital in its Asian subsidiaries. The amount of account receivables and inventory of FF Asian subsidiaries seems clearly disproportionate compared to its peers.

E. Chinese subsidiaries: FF claims $1bn of revenue originating in Asia, of which China has presumably the lion’s share (70% of the Asian network would be located there). Surprisingly, we found that the only two mainland Chinese subsidiaries of FF, Fu Li Fu Lei and Binlianyun, generate only some $40m of revenue and together count only about 50 POS.

F. Concerns about auditors: after auditing their accounts for several years through Baker Tilly, a 2nd or 3rd-tier accounting firm, FF recently switched to “Ecovis” a relatively unknown firm. Moreover, the auditors of the entity consolidating FF sales in Asia, totaling approximately $1bn, appear to be an obscure firm with a staff of only two people. According to senior Chinese auditors from Big Four firms, this firm may well be inadequate for an audit of this scope ($1bn of sales; hundreds of POS in multiple countries).

I. Company Description

Folli-Follie Commercial Manufacturing and Technical SA operates in the fields of jewelry, department stores, and apparel in Greece and internationally. The Company has three main segments:

- Jewelry-Watches-Accessories: this is the core segment and in 2016 would have generated € 978m of revenue (73% of total).

- Over 90% of this revenue (€892m) originates in Asia (mostly China and Japan). Folli Follie Asia also generates 100% of the Group’s operating income.

- Department Stores: the operation of three “Attica” department stores in Athens, Greece - €181m (14% of total).

- Retail/wholesale: operations of a distribution network in Greece, Romania and Bulgaria - €178m (13% of total).

As management frequently boasts, it is clear from the figures above that Asian sales constitute the dominant part of FF’s activity. This report will present strong evidence that FF’s Asian business, far from growing rapidly, may instead be dramatically shrinking and may be substantially smaller than perceived by the market. Because this is such a large part of Folli Follie overall turnover, we are deeply concerned that the financial statements may be incompatible with the facts that we have seen on the ground.

II. Historical Background

The company was established in 1986 in Greece by Dimitris Koutsolioutsos. The first shop was in the commercial district of Athens. Folli Follie started by manufacturing jewelry and in 1994 launched their first watch line. In the mid 1990s the company started expanding aggressively in Asia, first in Japan and later in China and elsewhere.

At first business was good: Folli Follie products where esthetically pleasing, creative and affordable. Folli Follie enjoyed significant success in Japan, where the brand was extremely popular around 15 years ago. However, in 2008 the Japan business started a slow decline and that does not seem to have changed. The decline was offset until recently by strong growth in China, fueled by the initial popularity of the brand and by the growth in the number of points of sale. However, starting 4/5 years ago, growth peaked in China as well and the brand has been in retreat ever since, with both the number of sales outlet as well as comparable sales decreasing dramatically6.

Links of London, a British jewelry brand acquired by Folli Follie in 2006, and Attica, a department store with its main outlet in Athens, are non-core businesses accounting for a smaller proportion of sales and possibly unprofitable.

The steady “growth” of Folli Follie’s revenue, has in the last few years generated negative cash, to the extent that FF in 2017 issued a €300m bond repayable in 2021, in addition to another €150m bond issued in 2014.

The company claims rapid growth, investment and expansion. This report will instead suggest a dramatically different picture: a rapidly-shrinking, far smaller company heading toward financial uncertainty.

III. What the Company claims about itself

The extensive evidence we collected and examined suggests that Folli Follie business may be in a precarious situation. This view clearly is in conflict with the image that management tries to portray of a rapidly growing company with a bright future. In order to understand these disturbing inconsistencies, it is important to first look at the official figures, which we view with great skepticism:

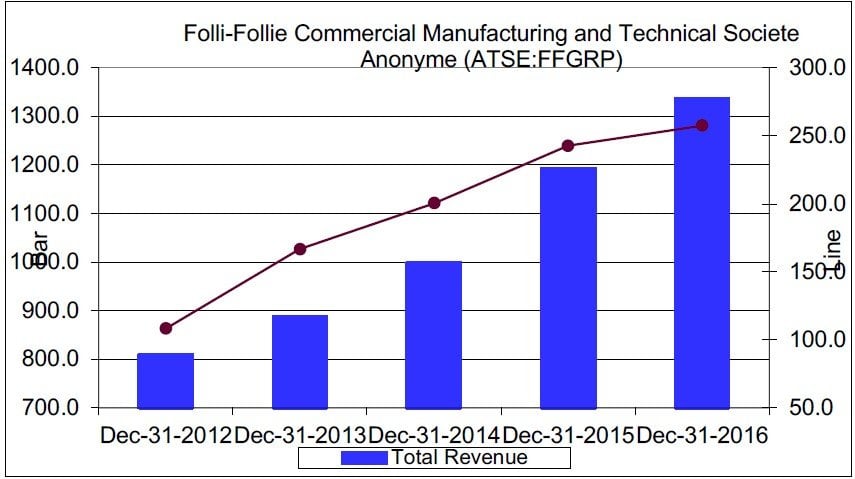

a) Fast Growth in Revenue and Net Profit7:

For the year 2016, Folli Follie claimed total revenue of €1.3b and operating income of €257m, with a healthy 20% operating margin. From 2010, revenue has been growing at 11% per year on average; operating income growth averaged almost 20% per year.

b) Large and Growing Network of points of sale (POS): the 2016 Annual Report claims 930 points of sales8

(up from 5689 in 2012, implying 362 new POS).

c) Growth of the Jewelry-Accessories segment: from €642m (2013) to €977m (2016) (see table below).

Tables implying growth of Jewelry-Accessories segment of 52% in three years (2013-2016)10.

2016 CEO Annual Letter claiming announcing fast growth.

IV. The Real Picture (according to Quintessential)

Months of painstaking due diligence suggest a radically different picture of Folli Follie than what could be inferred from FF official reporting. We came across convincing evidence suggesting an unprofitable, rapidly shrinking business, with decreasing revenue and negative cash flows. We estimate that the real revenue of the Jewelry-Watches-Accessories segment may be only a fraction of the reported revenue.

We also have a radically different view concerning the size of the Folli Follie network and the number of POS: according to our due diligence, FF-branded points-of-sale may be less than 300 (vs. 630 claimed by the company) with a large number of POS being little more than a small window and selling a few thousand Euros per year. Besides a rapidly shrinking network, same-store-sales in Asia, unlike what the management claims during the conference calls, seem to have been decreasing steadily over a number of years.

What is going on? In our opinion, and based on the extensive evidence we gathered, after the initial success in Asia, particularly in China and Japan, the situation slowly, but steadily went downhill. At first comparable store sales started to drop i.e. each individual store was selling less and less. In Japan, this led to a steady closing of shops that gradually became unprofitable (in Japan there are no franchisees). In China, the company tried to counter this trend by opening new points of sales with new franchisees: this worked for a while, as overall sales increased due to additional shops despite decreasing comp sales. However, soon enough franchisees started closing shops due to disappointments with the achieved levels of sales.

Until about 2013, business was decent in China, the network peaking around 200 POS, half company-owned and half franchisees. At the time, sales were increasing around 10% per year, but driven by new outlets as comp sales were already decreasing. From 2014 onwards, the pace of deterioration accelerated such that a leading Folli Follie figure (the Managing Director for China) left the company for a competitor (Montblanc). Apparently, sales quickly fell further after that.

According to our estimates11, FF sales in China may be as little as $40m in 2016 and may have decreased further in 2017.

During the last few years FF appears to have closed most of its Chinese network and 30% of its Japanese one, with more POS planning to shut down soon. We have identified the following reasons for FF catastrophic deterioration in Asia:

- Sub-optimal management practices: Folli Follie is a family-owned, family-managed business. Most strategic decisions, down to the location of some of the individual stores, are taken directly from Dimitris Koutsolioutsos and there seems to be a lack of organized processes for activities such as merchandising, for example. There have reportedly there have been disagreements between Mr. Koutsolioutsos and his son, who allegedly would be interested in getting rid of the FF brand altogether.

- Competition: when FF first opened in Asia (15 years ago in Japan and later on in China) they found a “greenfield” location and basically had all the market by themselves. The Chinese consumer was far less sophisticated than it is today and eagerly bought FF products that were perceived as quality western luxury goods. Now, however, companies such as Coach, Kate Spade, Furla, Pandora and Swarovsky started entering the market with arguably far greater resources and better management practices than FF. For example, space productivity (i.e. sales per sqm) for FF was only about 50% of Swarovsky or Michael Kors12.

- Products: In many cases, the FF lines of products received mixed receptions from consumers. For example, the “KK” product line (designed by the founder’s wife, now in her ‘70s) was perceived as “old school” by clients, especially considering that FF seeks to position itself as a “young” brand. There were also concerns about product quality.

- Key personnel leaving: as the situation deteriorated, key talent left the company (for ex. the China Managing Director who left for Montblanc). According to our field checks, the departing managing director has been left without a replacement for years. A similar situation seems to have occurred in Japan, with a number of key personnel leaving in frustration.

Given the above, it appears that the entire Asian business, such a dominant part of the Group may be in shambles. Therefore, we are skeptical about FF’s financial statements that claim sales for the Jewelry-Accessories segment increasing over 50% from 2013 to 2016, when Folli Follie shut down almost half of its Asian network while suffering decreasing comp sales.

Article by Quintessential Capital Management

See the full PDF below.