The Broad Market Index was down 1.27% last week and 52% of stocks out-performed the index. Corporate growth increased again in the recent period to an unprecedented high. We have never seen US corporations with sales growth of 25% before and now for two quarters. Add to that rising gross profit margins, lower SG&A costs and lower interest expenses and, on average, companies are growing like never before.

Inflation & Corporate Sales

Measured inflation increased again in February to 8% and that will contribute to the high sales growth rate. Inflation is also an increase in corporate costs. Energy and commodity costs are the most immediate. Companies that are producing commodities or can pass on rising costs as higher product prices, are achieving a rising gross profit margin.

Q4 2021 hedge fund letters, conferences and more

However, the frequency of improvement sales growth is falling. The proportion of companies achieving a rising sales growth rate is down to 60% from 83% at the peak six months ago. The virus-related recovery wave persists but the average sales growth has peaked, and frequency of improvement is down. The new uncertainty is related to how steeply sales growth will fall.

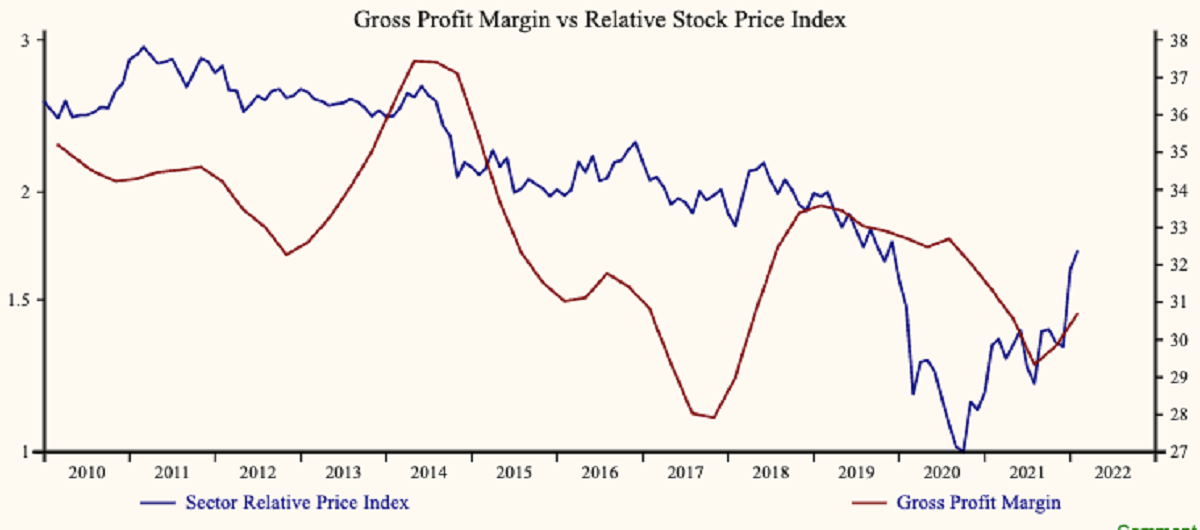

Margins Under Cost Pressure

Gross profit margins are up again in the recent period but the proportion of companies achieving an improvement fell to 42% of companies down from 62% six months ago. With sales growth high, Selling, General and Administrative (SG&A) expenses are easier to manage downward relative to sales. More companies are recording a falling gross profit margin but a rising operating profit margin.

This is a MoneyTree pot with a red top rim but a golden bottom rim. This is a poor-quality growth trend. If you see that among your portfolio companies then the stock should be sold.

The gap between inflation and the long-term bond yield has never been wider and must close. It will be challenging to manage assets through that transition. Lower inflation meanings lower corporate growth while higher bond yields mean lower asset values.

Energy Sector Is Key

To a greater degree, it all hangs on the energy sector. Last quarter we observed that capital expenditures among energy companies were falling with oil prices rising. This is very unusual since there are long lead times to bring new energy supply to market. We proposed that environmental concerns might permanently slow supply growth and prices would never fall again.

Well, that is out the window now. Environmental concerns are quickly taking a back seat to geopolitics and oil drilling is back. Capital expenditures-to-sales rose at energy companies in the most recent period after dropping for two years. Future supply growth is up and the likelihood that inflation can be moderated by lower oil prices has increased.

War Effect

War in Europe has brought back the boom and bust that characterized the entire history of the nation state and we are at the top of the boom. In an astonishing display of global cooperation and solidarity, central bankers coordinated a massive financial rescue effort since 2008. That is now in disarray. We have lost the persistent upward pressure on asset values from 30 years of low inflation and lower interest rates. It was a period when procrastination actually paid off.

Look For Accelerating Financial Attributes

We must ensure now that our portfolio of companies have the improving attributes that give us the best chance making money while asset values are broadly down.

The US federal reserve has shifted focus back to capital market stability and, at least for the duration, inflation will be ignored. It will be a challenge to maintain our accelerating company attributes (tall green MoneyTree in a fat golden pot) and it is important to sell stocks when companies cannot sustain their current acceleration.

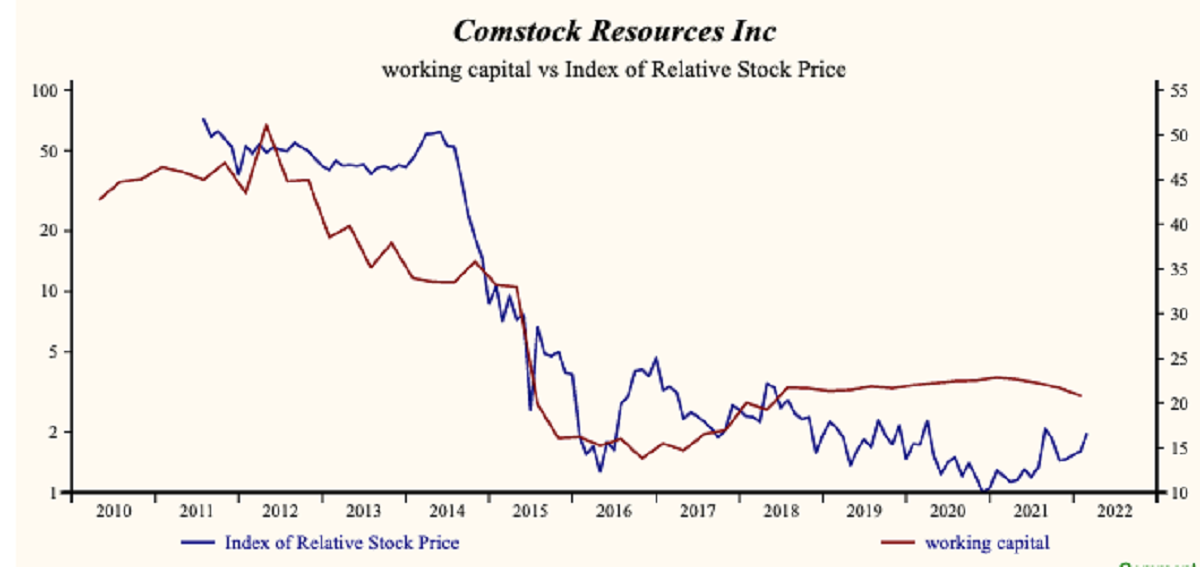

Comstock Resources Inc (NASDAQ:CRK) $9.530 BUY This Poor Company Getting Better

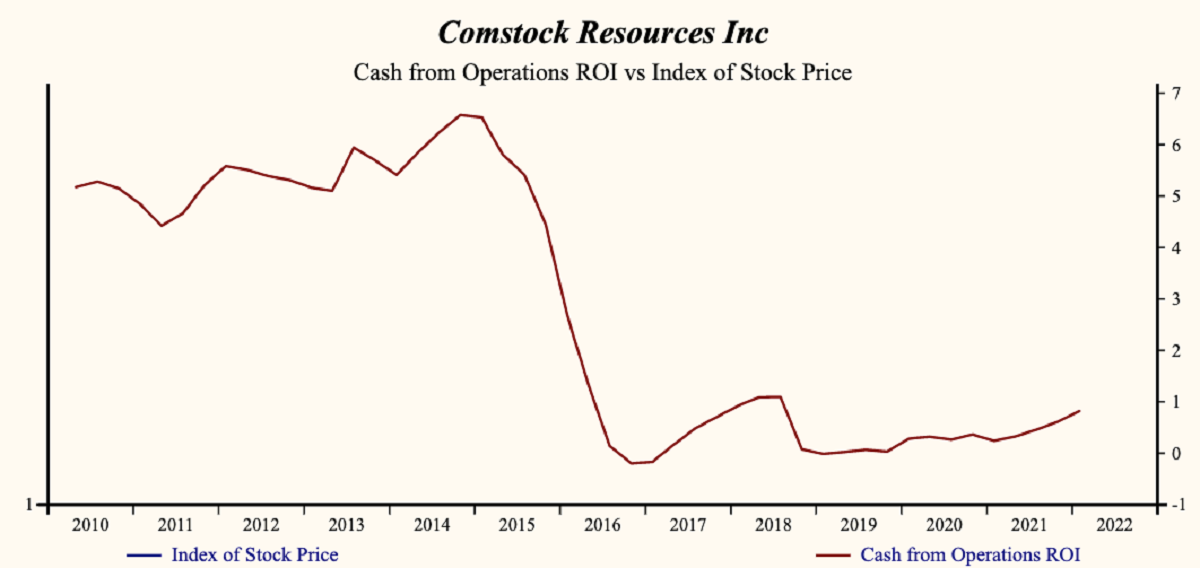

Comstock Resources Inc. has been an unprofitable company with chronically low cash return on total capital of 5.6% on average over the past 20 years. Over the long term, the shares of Comstock Resources Inc have declined by 59% relative to the broad market index.

The shares have been correlated with trends in Growth Factors. The dominant factor in the Growth group is Cash-Operating Activities ROI which has been 80% correlated with the share price with a one quarter lead.

More recently, the shares of Comstock Resources Inc have advanced by 85% since the December, 2020 low.

The shares are trading at upper-end of the volatility range in a 15-month rising relative share price trend. The recent weakness in the share price provides an excellent opportunity to buy an accelerating at a discount.

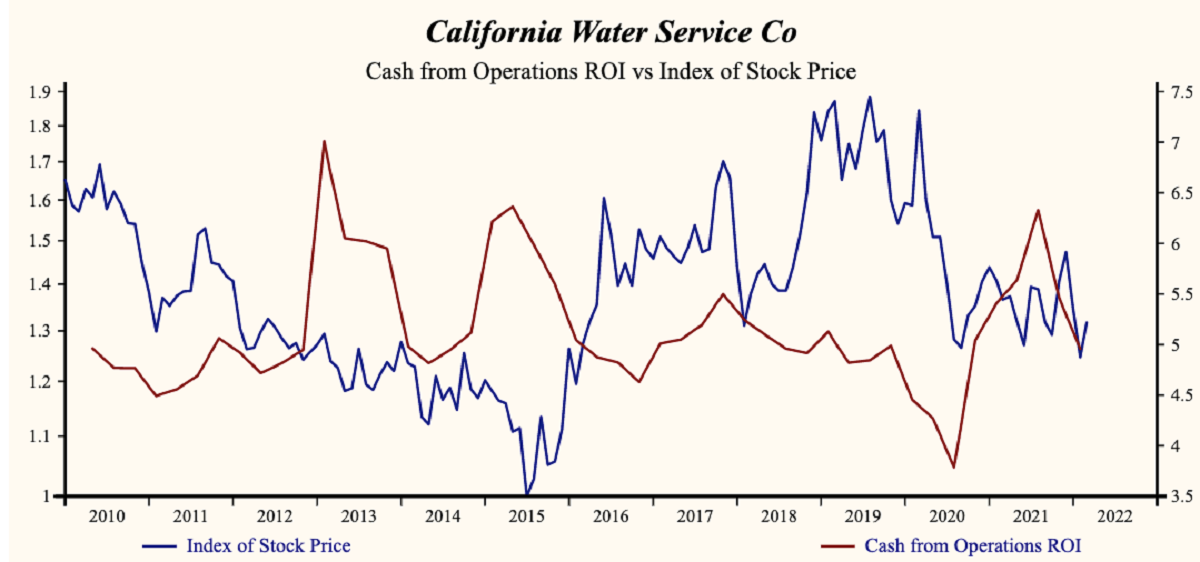

California Water Service Co (NYSE:CWT) $56.680 SELL This Poor Company Getting Better

California Water Service Co has been an unprofitable company with frequently low cash return on total capital of 5.3% on average over the past 20 years. Over the long term, the shares of California Water Service Co have declined by 30% relative to the broad market index.

The shares have been very highly correlated with trends in Growth Factors. The dominant factor in the Growth group is Net Shareholder Wealth which has been 98% correlated with the share price with a three-quarter lead.

More recently, the shares of California Water Service Co have advanced by 6% since the September, 2020 low.

The shares are trading at lower-end of the volatility range in an 18-month rising relative share price trend. The current depressed share price implies that there is likely to be a better future opportunity to sell the shares of this evidently decelerating company.