When it comes to smartphones, Singapore is ranked as one of the highest globally for smartphone penetration. Various mobile app continued to rise in popularity – with the usage and need of shopping online that have become ubiquitous.

We can’t deny how essential mobile phone to be used for almost every aspect of our lives. In fact, a report stated that Singaporeans downloaded 245.4 million apps in 2018 spending approximately US$399.3 million on apps alone.

[REITs]Q1 hedge fund letters, conference, scoops etc

Although mobile apps today play an important role, a number of Singaporeans still prefers to browse for product and conduct purchases on desktops. This was evident in our previous study on the State of E-commerce.

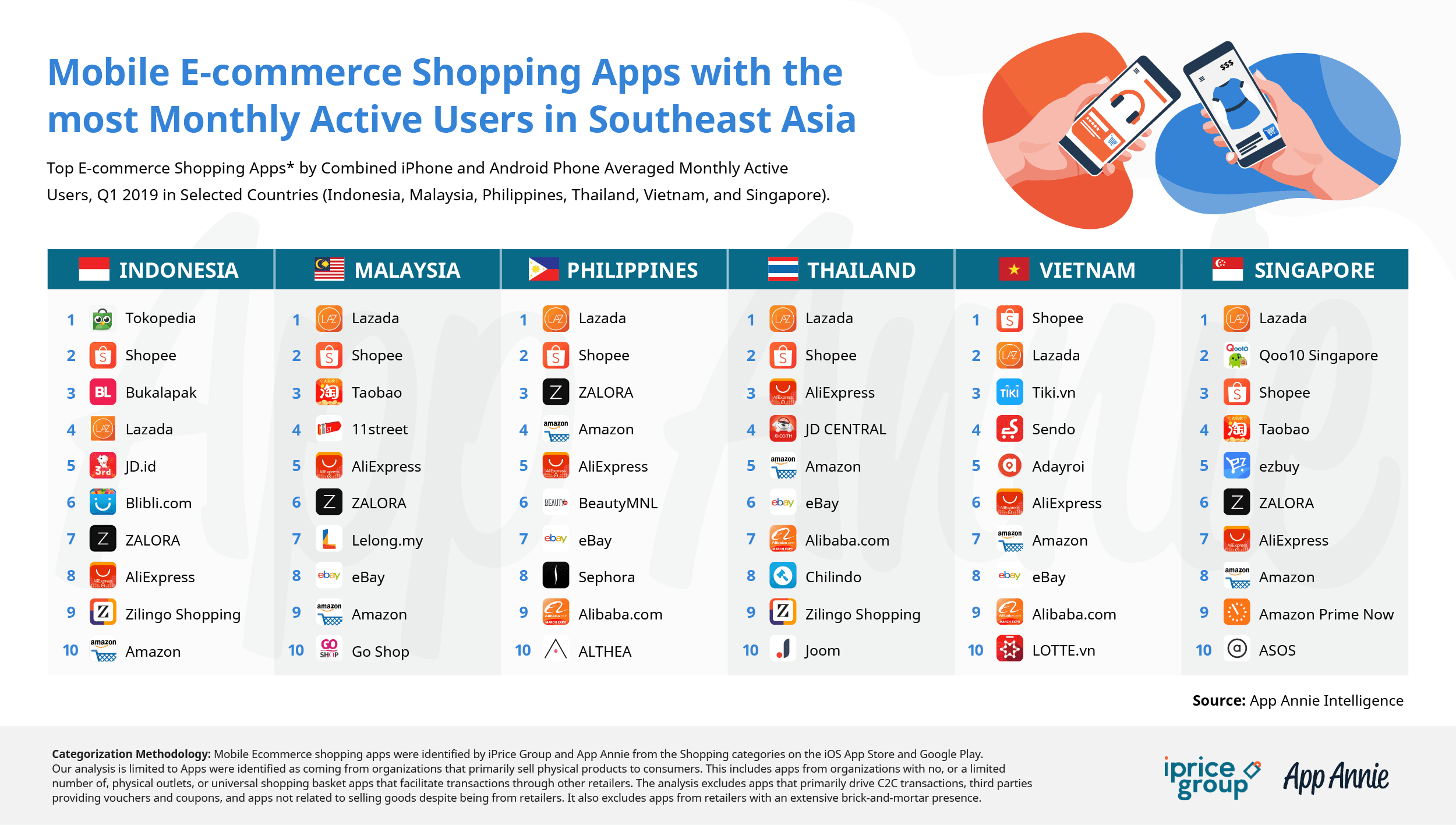

We conducted a study to portray who were the mobile e-commerce shopping apps with the highest monthly active users in Southeast Asia in Q1 2019 with the help of App Annie Intelligence. This data comprises combined iPhone and Android phone averaged monthly active users, Q1 2019 in selected countries – Singapore, Malaysia, Indonesia, Philippines, Thailand, and Vietnam.

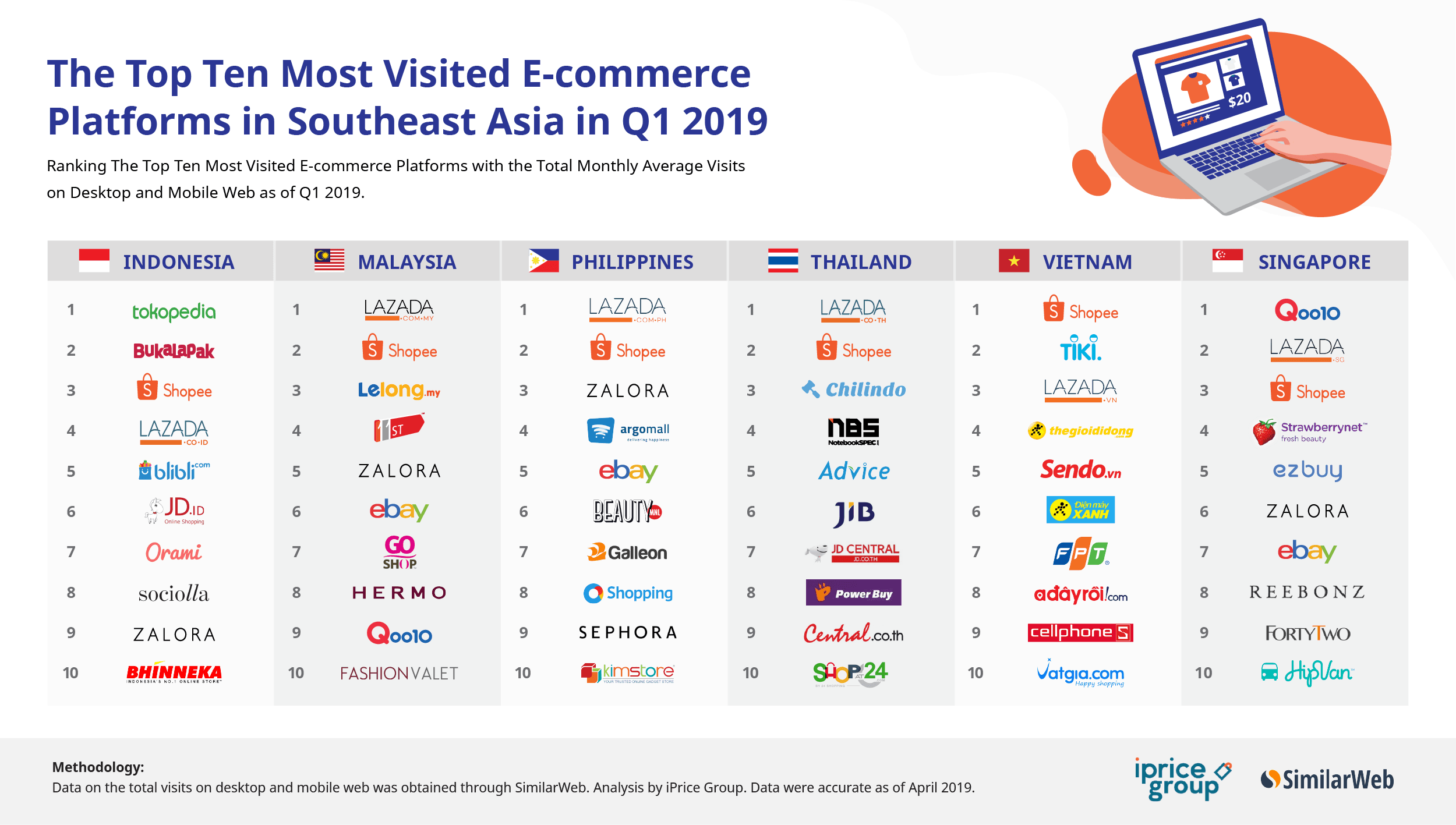

We also analysed the top most visited e-commerce platforms in Southeast Asia in Q1 2019 obtained through SimilarWeb. The companies selected for this study were amongst the top 50 most visited platforms – on desktop and mobile web – in Singapore.

Lazada, Qoo10, Shopee, & Taobao Were The Most Actively Used Apps

Lazada

Lazada juxtaposed its annual anniversary event to offer a varied range of products and prices that took place from 21 to 27 March 2019. The platform received a tremendous amount of traffic over week-long celebration that came to its peak with a 24-hour shopping extravaganza on 27th March.

Through the app itself, on average shoppers would log on as often as six times a day to play in-app games. On top of that, Lazada live streamed performances artistes on its app to attract consumers.

More importantly, Lazada has strengthened its position as a key e-commerce player in Singapore as Redmart was integrated into Lazada’s app and website on 15 March 2019. Customers now are able to browse to more than 400,000 retailers in Lazada’s ecosystem – within the same app as what users have been using and at redmart.lazada.sg.

Nonetheless, Lazada requires a series of app updates over the next few months as well as launching the Redmart features and functionalities which is hoped will be ready by end-June 2019. These include; order amend, delivery slot incentives, my list features, search functionality, delivery slot reservation, and order rescheduling.

Furthermore, Chinese New Year 2019 that fell on February 4th to 5th – coincides with the February new moon and the year of the pig – was celebrated by people in Southeast Asia countries as a time to honor deities and to be with family.

In conjunction with this Lunar New Year, Lazada Singapore celebrated its CNY campaign with huge promotions, such as 888 flash deals, up to 88%off, and up to $88 vouchers. It is a celebration sale period as consumers will actively go through the Internet and e-commerce to find what they need for the preparation of the occasion.

Qoo10

Qoo10 remains as a strong competitor in Singapore with the 2nd highest in monthly active users on its mobile app in Singapore in Q1 2019. The Singaporean-based e-commerce company in 2018 stated that the company will continue to focus its progress on the city-state and remains as a strong competitor in the mobile shopping app arena.

Among the possible drivers of its performance in Q1 2019 could be the introduction of its partnership with Grab Pay that provides consumers the option to pay later for rides, food delivery, and for shopping on Qoo10.

Ku Young Bae, the CEO of Qoo10 is optimistic of its company’s future as there is much room for improvements such as in its diverse product selection, more cross-border merchant sources, a predominantly domestic vendor base, self-owned cross-border shipping network, and price competitiveness to drive further growth in Singapore.

Shopee

Shopee – as the third most actively used app – is amongst the fastest growing e-commerce apps as compared to others in the list of the most active users in Singapore. Shopee was founded in 2015 where the trend in Southeast Asia had a tendency towards users were to purchase through their smartphones. Founded since 2015, the e-commerce company has considered itself as a mobile-first platform, prioritising its developments on the mobile app, which has made them amongst the most actively used apps in Singapore. In terms of its overall ranking, Shopee’s mobile app was ranked at 2nd place amongst other apps.

In its past months, prioritised a ‘hyper-localised’ user experience approach by having a different app for each country. This was part of their strategy to focus on taking a highly localised approach to each market. Sea – the parent company of Shopee – in March 2019 stated it aims to raise US$1.5B in an effort to drive further growth for Shopee. It also has become the most visited e-commerce platform (on desktop & mobile web) in Southeast Asia during the quarter, which garnered a total traffic increased by 5% from website and app combined as compared in Q4 2018 to 184.4 million visits.

Taobao

As the fourth most actively used app in Singapore in particular, TaoBao seemed to be performing well in countries where there were more consumers proficient in the Chinese language – Mandarin. As such, Taobao although usable in other countries in Southeast Asia, was most actively used in Singapore and Malaysia. Taobao was actively used in Singapore as most sellers would provide delivery services to Singapore as well as attractive deals and products that are sometimes not available in the country.

Beyond its ley mobile app, Taobao products are also available to Singaporeans via a Taobao agent or third-party platforms such as EZBuy, SGShop, Peeka, and Oops.

Nevertheless, if users are to prefer Lazada as their platform to shop through Taobao, it is still feasible to purchase the items from there as Lazada recently excelled cross-border business across Southeast Asia.

The Most Visited E-commerce Platforms on Desktop & Mobile Web in Singapore and Southeast Asia

Qoo10 remains as the most visited e-commerce platform in Singapore, garnering an average of 7.9 million visits on desktop and mobile web in Q1 2019. Subsequently, Lazada was the second most visited at 7.4 million visitors and Shopee at 2.5 million visitors in the same period.

Totalling the overall traffic garnered in Q1 2019 across Southeast Asia, Shopee is the most visited e-commerce platform in Southeast Asia (six countries – Indonesia, Malaysia, Philippines, Thailand, Vietnam, & Singapore) in Q1 2019 with a total average of 184.8 million visitors.

In terms of ranking, Lazada remains as the most visited platform (on desktop and mobile web) in Malaysia, Philippines, and Thailand. Overall, Lazada obtained 179.7 million visitors in Q1 2019 (six countries – Indonesia, Malaysia, Philippines, Thailand, Vietnam, & Singapore).

Please click on one of the links below to view the data in detail for each country. More findings in the overall Map of E-commerce Report for Q1 2019.

We are always happy to share our insights with our clients, the press, academia and more. Should you decide to utilise our data or visuals, please attribute us by including this sentence “From the Map of E-commerce, iPrice Group, April 2019” with a hyperlink to one of these URLs:

Singapore: https://iprice.sg/insights/mapofecommerce/

Indonesia: https://iprice.co.id/insights/mapofecommerce/en/

Vietnam: https://iprice.vn/insights/mapofecommerce/en/

Thailand: https://ipricethailand.com/insights/mapofecommerce/en/

Philippines: https://iprice.ph/insights/mapofecommerce/en/

Malaysia: https://iprice.my/insights/mapofecommerce/

Report Methodology for Vital Insights on Mobile E-commerce Shopping Apps in Southeast Asia in Q1 2019

App Annie Intelligence for iPhone and Android phone were derived from mobile usage data collected from a large sample of real-world users, combined with additional proprietary data sets. For the purposes of this report, an active user is defined as a device having one or more sessions with an app in the time period. A single person may be active on multiple devices in any time period and will therefore be counted as one user per device in the total active users. For example, when a user logs into the app, it would be counted as a session during a given month and counted as an active user.

Monthly Active Users (MAU) rankings in this report are based on unified apps made possible by App Annie’s exclusive DNA. In unified apps, similar versions of the same app with different names and on different platforms are unified. For example, ShopeeSG: Lowest Price Madness on iOS, and ShopeeSG: Men Sale for Android on Google Play are all aggregated and ranked as a single Shopee unified app.

Data in this report reflects App Annie’s current estimates and DNA relationships for all time periods as of the time of publication. This includes data restatements as App Annie is continuously refining its algorithms to provide its customers with the most accurate estimates possible. Historical data may also be restated from a prior publication, a standard practice for the industry. Certain trademarks and/or images used in this report may belong to third parties and are the property of their respective owners. App Annie claims no rights in such trademarks or images.

App Category and Top App Definitions

Mobile E-commerce apps were identified by iPrice Group and App Annie from the Shopping categories on the iOS App Store and Google Play. Our analysis is limited to Apps were identified as coming from organizations that primarily sell physical products to consumers. This includes apps from organizations with no, or a limited number of, physical outlets, or universal shopping basket apps that facilitate transactions through other retailers. The analysis excludes apps that primarily drive C2C transactions, third parties providing vouchers and coupons, and apps not related to selling goods despite being from retailers.

Report Methodology for Vital Findings on the Most Visited E-commerce Platforms in Southeast Asia in Q1 2019

All data on the total visits on desktop and mobile web in this study were taken from global traffic figures from the respective websites as of April 2019 from SimilarWeb. The following industries were not included in this list: e-ticketing, financial services, rental services, insurance, delivery service, food & beverage, meta-search, couponing, cashback websites and ecommerce who solely provides classified ads/P2P services.

To ascertain the most visited local and Southeast Asian-based e-commerce platforms on desktop and mobile web, international applications were not included in this category. Insights based on SimilarWeb data.

Report Methodology for Mobile E-commerce Shopping Apps Highest Overall Rank

Mobile shopping applications were ranked by averaging the rank of the selected applications between 1 January 2019 and 31 March 2019. To ascertain the top local and Southeast Asian-based mobile shopping applications, international applications were not included in this category. Data obtained from App Annie’s Rank History feature.

About App Annie

App Annie delivers the most trusted app market data and insights for your business to succeed in the global app economy. Over 1 million registered members rely on App Annie to better understand the app market, their businesses and the opportunities around them. The company is headquartered in San Francisco with 450 employees across 15 global offices. App Annie has received $157 million in financing, including from investors such as Sequoia Capital, Institutional Venture Partners, IDG Capital Partners, e.ventures, Greenspring Associates, and Greycroft Partners.

About iPrice Group

iPrice Group is a meta-search website operating in seven countries across South East Asia namely in; Malaysia, Singapore, Indonesia, Thailand, Philippines, Vietnam, and Hong Kong. Currently, iPrice compares and catalogs more than 500 million products and receives about 20 million monthly visits across the region. iPrice currently operates three business lines: price comparison for electronics and health & beauty; product discovery for fashion and home & living; and coupons across all verticals.

This is an insights article by iPrice Group.