DoubleLine Emerging Markets webcast slides for the month of February 2018, titled, “To Euphoria And Beyond.”

TAB I - To Euphoria and Beyond

International Fixed Income

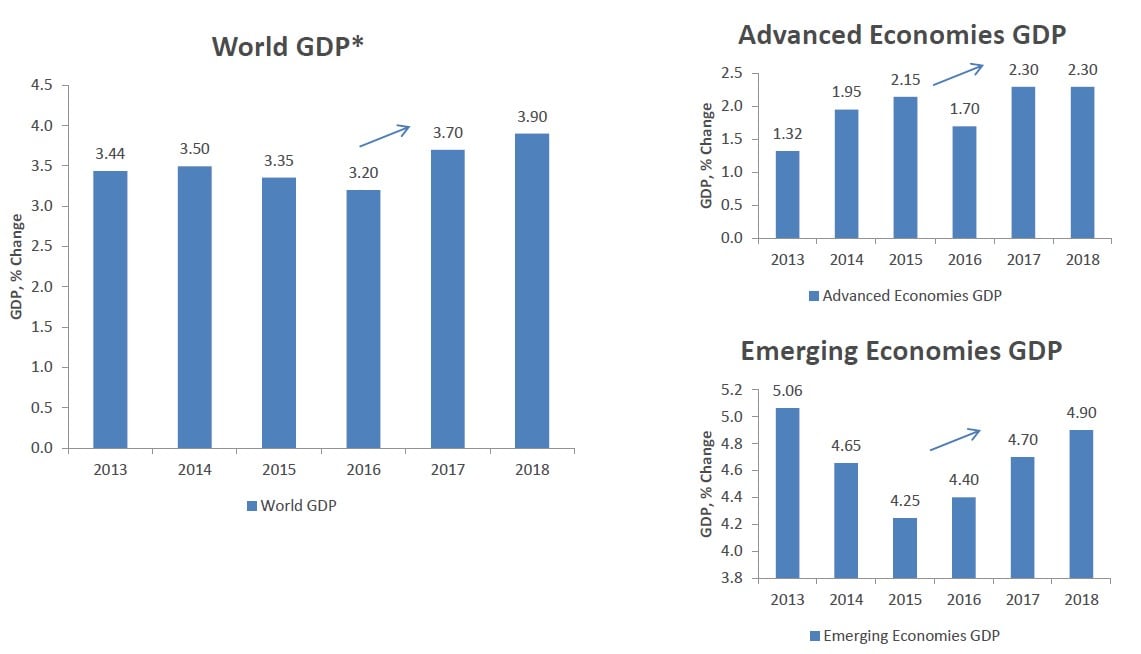

Synchronized Growth Pick up

Source: IMF World Economic Outlook, January 2018 Update.

* GDP: Gross Domestic Product

International Fixed Income

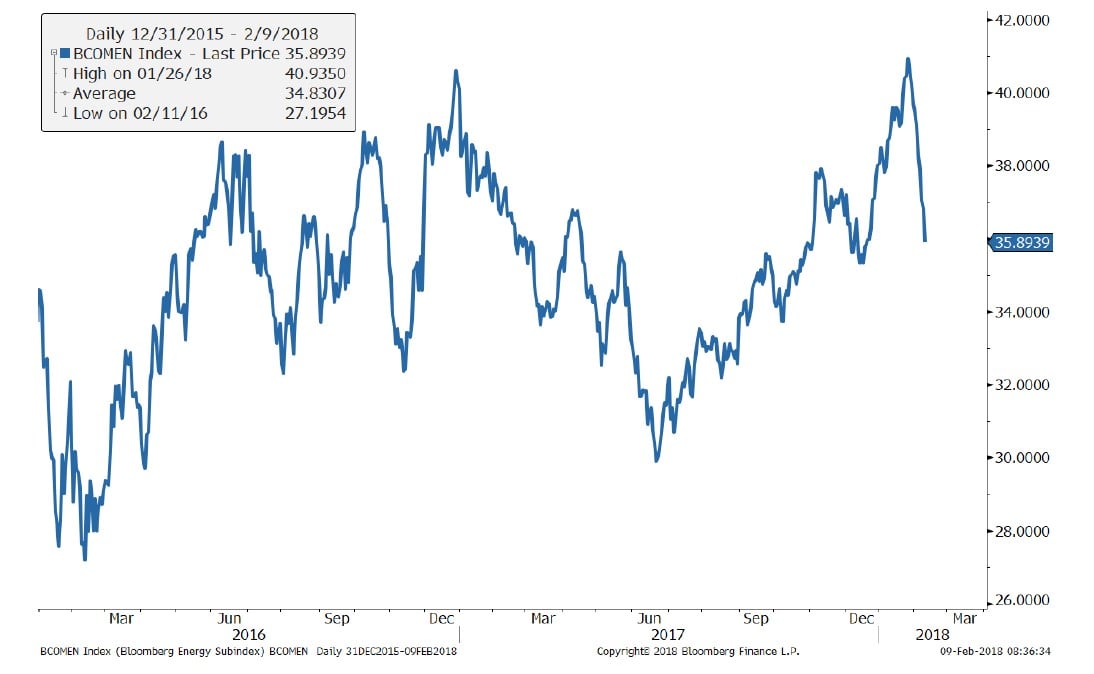

Bloomberg Energy Commodity Index

Source: DoubleLine, Bloomberg,

The Bloomberg Energy Commodity index is Formerly known as Dow Jones-UBS Energy Subindex(DJUBSEN), the index is a commodity group subindexof the Bloomberg CI. It is composed of futures contracts on crude oil, heating oil, unleaded gasoline and natural gas. It reflects the return of underlying commodity futures price movements only and is quoted in USD.

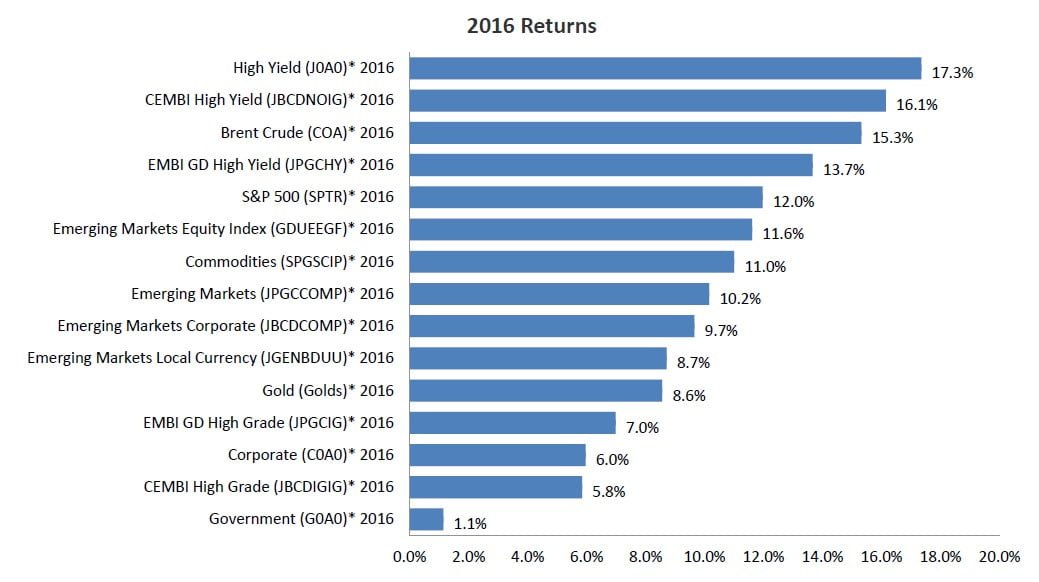

Performance

2016 Returns

Source: Bloomberg, Doubleline

YTD Returns from 12/31/2015 to 12/31/2016

*G0A0 = BofAMerrill Lynch U.S. Government Index, C0A0 = Merrill Lynch U.S. Corporate Bond Index, JGENBDUU = JP Morgan Emerging Markets Government Bond Index, J0A0 = Merrill Lynch U.S. Cash Pay High Yield Index, GDUEEGF = Morgan Stanley Capital International –Emerging Markets USD Index, SPGSCIP= Standard & Poor’s GSCI Excess Return Index

JBCDCOMP= JP Morgan Corporate Emerging Markets Bond Index Broad Diversified (JBCDNOIG and JBCDIGIG are sub-indices of JBCDCOMP),JPGCCOMP= JP Morgan Emerging Markets Bond Index Global Diversified (JPGCHY and JPGCIG are sub-indices of JPGCCOMP), SPX= S&P 500, Golds = Gold Spot price quoted as U.S. Dollars per Troy Ounce, Brent Crude (COA) = Brent Crude Future Actives Price. CEMBI High Grade refers to the JP Morgan CEMBI Broad Diversified Index.Please see appendix for definition.

Past performance is no guarantee of future results. An investment cannot be made directly in an index.

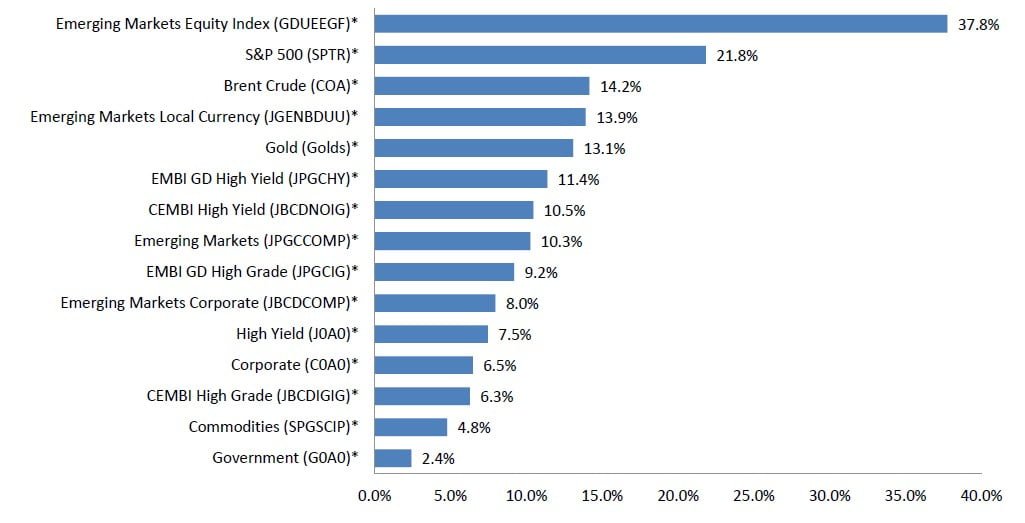

2017 Returns

Source: Bloomberg, Doubleline

YTD Returns from 12/31/2016 to 12/31/2017

*G0A0 = BofAMerrill Lynch U.S. Government Index, C0A0 = Merrill Lynch U.S. Corporate Bond Index, JGENBDUU = JP Morgan Emerging Markets Government Bond Index, J0A0 = Merrill Lynch U.S. Cash Pay High Yield Index, GDUEEGF = Morgan Stanley Capital International –Emerging Markets USD Index, SPGSCIP= Standard & Poor’s GSCI Excess Return Index JBCDCOMP= JP Morgan Corporate Emerging Markets Bond Index Broad Diversified (JBCDNOIG and JBCDIGIG are sub-indices of JBCDCOMP),JPGCCOMP= JP Morgan Emerging Markets Bond Index Global Diversified (JPGCHY and JPGCIG are sub-indices of JPGCCOMP), SPX= S&P 500, Golds = Gold Spot price quoted as U.S. Dollars per Troy Ounce, Brent Crude (COA) = Brent Crude Future Actives Price. CEMBI High Grade refers to the JP Morgan CEMBI Broad Diversified Index.Please see appendix for definition.

Past performance is no guarantee of future results. An investment cannot be made directly in an index.

International Fixed Income

Investor Equity Allocations

Source: Bank of America Global Investment Strategy, BAC Data

Date: 1-19-2018

GWIM: Global Wealth & Investment Management team at Bank of America

AUM: Assets Under Management

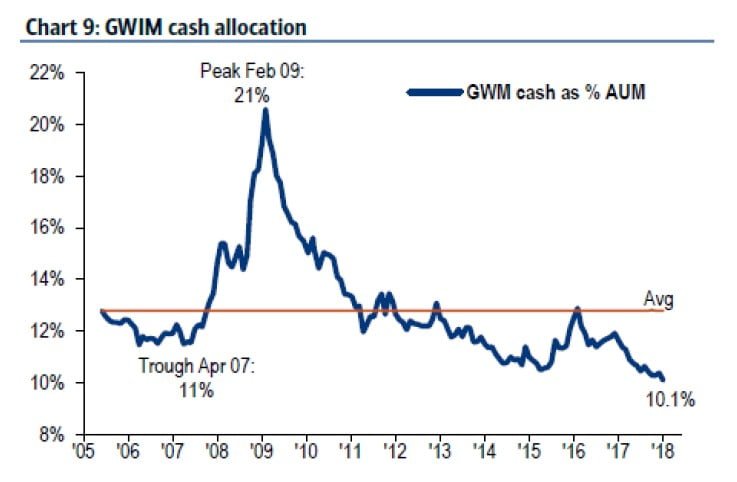

Investor Cash Holdings

Source: Bank of America Global Investment Strategy, BAC Data

Date: 1-19-2018

GWIM: Global Wealth & Investment Management team at Bank of America

AUM: Assets Under Management

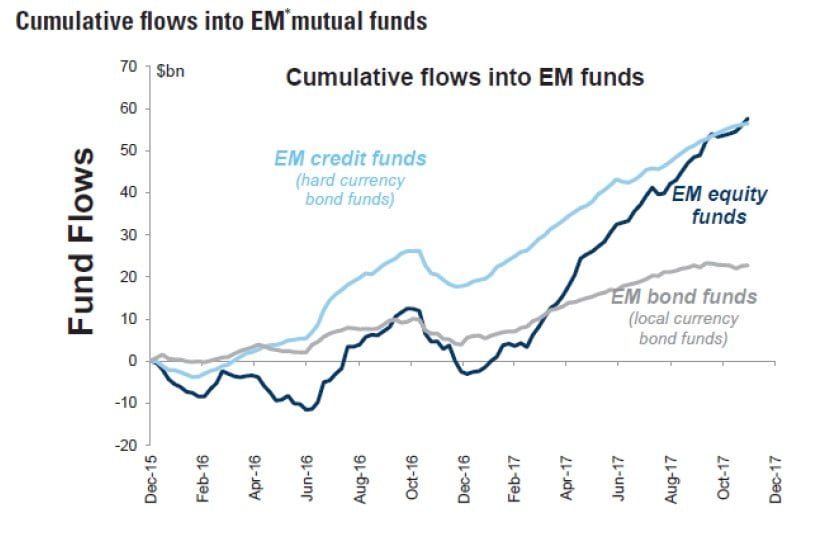

Emerging Market Flows

Source: Goldman Sachs, EPFR

“Reflation resurgence and the EM “melt-up” trade”, January 19, 2018

* EM: Emerging Markets

See the full PDF below.