Current levels of oil and petroleum products are high. Given that, what can explain such a surprising drop in US crude inventories?

Energy Market Updates

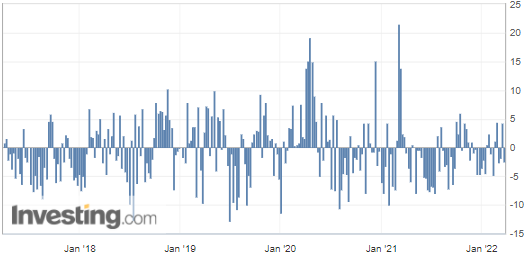

Commercial crude oil reserves in the United States fell much more than expected in the week ended March 18, according to figures released on Wednesday by the US Energy Information Administration (EIA).

US crude inventories have shrunk by more than 2.5 million barrels, which implies greater demand and is obviously another bullish factor for crude oil prices. Such a decline in inventories is particularly remarkable as the American strategic reserves have also recorded a significant drop. This is the 25th consecutive week of falling strategic reserves since the Biden administration started to make those adjustments in an attempt to relieve the market.

(Source: Investing.com)

WTI Crude Oil (CLK22) Futures (May contract, daily chart)

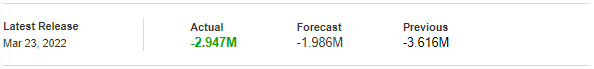

Furthermore, some additional figures extracted from the same EIA report were released and surprised the markets.

These are US Gasoline Reserves, which plunged by about 2.95 million barrels over a week, while the market was not even forecasting a two-million decline.

(Source: Investing.com)

Thus, US exports jumped by more than 30% compared to the previous week, not only due to large flows to Europe to replace Russian barrels, but also marked by a significant rebound in Asian demand.

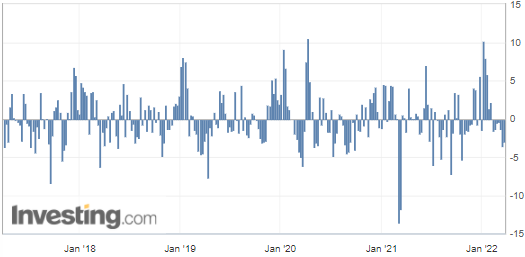

RBOB Gasoline (RBJ22) Futures (April contract, daily chart)

Beware that a NATO summit, a G7 summit, and a European Union summit are being held on Thursday, when the various countries could set a new round of sanctions against Moscow.

So, how will black gold progress from now on? Do you think that the on-going negotiations with Iran and Venezuela could flood the market with additional barrels? Let us know in the comments!

That’s all folks for today. Happy trading!

Like what you’ve read? Subscribe for our daily newsletter today, and you’ll get 7 days of FREE access to our premium daily Oil Trading Alerts as well as our other Alerts. Sign up for the free newsletter today!

Thank you.

Sebastien Bischeri

Oil & Gas Trading Strategist

The information above represents analyses and opinions of Sebastien Bischeri, & Sunshine Profits’ associates only. As such, it may prove wrong and be subject to change without notice. At the time of writing, we base our opinions and analyses on facts and data sourced from respective essays and their authors. Although formed on top of careful research and reputably accurate sources, Sebastien Bischeri and his associates cannot guarantee the reported data’s accuracy and thoroughness. The opinions published above neither recommend nor offer any securities transaction. Mr. Bischeri is not a Registered Securities Advisor. By reading Sebastien Bischeri’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Sebastien Bischeri, Sunshine Profits’ employees, affiliates as well as their family members may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.