What’s New In Activism – Trian Gets A Taste Of Its Own Medicine

Shareholders in Nelson Peltz’s U.K.-listed vehicle Trian Investors 1 voted out the fund’s chairman and installed a new director nominated by a group of investors led by Global Value Fund.

A proposal to remove Trian Investors 1 Chairman Chris Sherwell received 50.7% of the votes cast at an August 5 special meeting, according to a regulatory filing. Dissident nominee Robert Legget was elected to the fund’s board with the same number of votes, while four further activist proposals failed in a similarly tight ballot. A new chairman has not yet been named.

Q2 2022 hedge fund letters, conferences and more

Trian is not the first activist to get a taste of its own medicine. Listed vehicles managed by Pershing Square Capital Management and Third Point Partners have been criticized by their investors, as well as several smaller activists.

Activism chart of the week

So far this year (as of August 11, 2022), globally, 71 companies have been publicly subjected to activist demands pushing for, or opposing, M&A. That is down from 78 in the same period last year.

Source: Insightia | Activism

What’s New In Proxy Voting - Fossil Fuels In Australia

Market Forces has written to Commonwealth Bank (CBA), asking the ASX 200 financial institution to ensure that its financing will no longer be used for the purpose of new fossil fuel projects.

An August 10 press release from Market Forces cited concerns CBA is not taking sufficient action to reduce its exposure to fossil fuels.

"While the bank's new targets fall short of aligning to a 1.5-degree global warming limit, a more pressing concern is the bank's ongoing willingness to finance companies and projects expanding the scale of fossil fuels," Market Forces said.

To remedy these concerns, the environmental advocacy organization revealed its intention to submit a shareholder resolution at the bank's October 12 annual meeting.

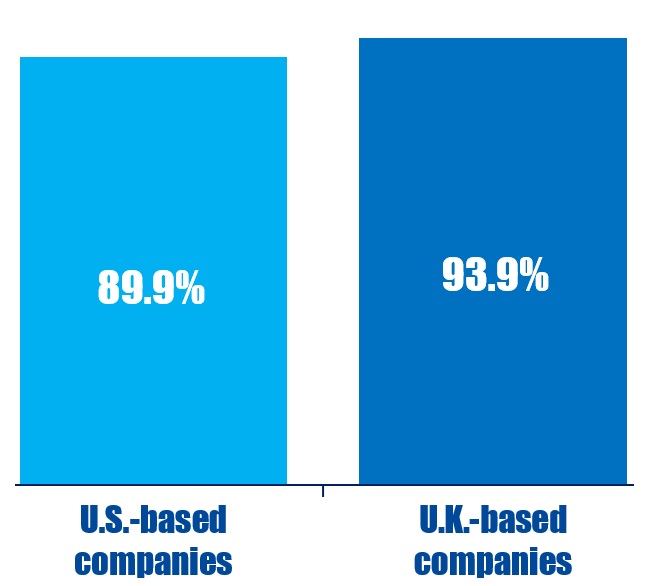

Voting chart of the week

So far this year (as of August 12, 2022), advisory pay votes at U.S. companies have received average support of 89.8%. This compares to 93.9% at U.K. companies.

Source: Insightia | Voting

What’s New In Activist Shorts - Court Rules Against FleetCor Technologies

A court in Atlanta ruled that short seller target FleetCor Technologies, Inc. (NYSE:FLT) and its CEO Ron Clarke knowingly deceived customers by falsely advertising rebates and concealing transaction fees.

The case was brought by the Federal Trade Commission (FTC) after Citron Research accused the company of predatory practices in 2019.

A federal judge in Atlanta ruled the company must end the practice but stopped short of allowing the FTC to sue for monetary relief. The Commission, however, will be able to seek damages in consumer cases under alternative proceedings. In an August 10 statement, FleetCor vowed to fight to overturn the ruling, saying it was "confident" it acted lawfully.

FleetCor advertised fuel cards to small business owners that it said offered savings and no fees. In reality, there were no rebates and the company was charging hidden fees, according to the FTC.

Shorts chart of the week

So far this year (as of August 12, 2022), 25 different activist short sellers have publicly subjected a company to an activist short campaign. That is down from 30 in the same period last year.

Source: Insightia | Activist Shorts

Quote Of The Week

This week's quote comes from Advocate Strategic Investments' Michael de Tocqueville as it took aim at embattled Australian wealth manager AMP. Read our coverage here.

“Recent asset sales and other so-called transformative simplification activities have done little to improve the company’s share price value in any meaningful way, while the company’s future strategy to grow shareholder value remains obscure, to say the least.” – Michael de Tocqueville