China is facing several economic problems right now. Will gold benefit from them?

The country was to become the biggest economic power that would dethrone the United States. Its pace of development was impressive and practically without precedent: in 1980-2010, the annualized rate of growth was an average of 10%.

Understandably, everyone trembled at the mere mention of the country’s name: China. Not anymore. China’s economy is clearly losing momentum.

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

China's Problem

In some senses, the slowdown is not surprising. The wealthier the country, the more challenging it is to develop very quickly. As China’s economy grew, the deceleration was only a matter of time, and right now, the country is still severely hit by the strict zero-COVID policy.

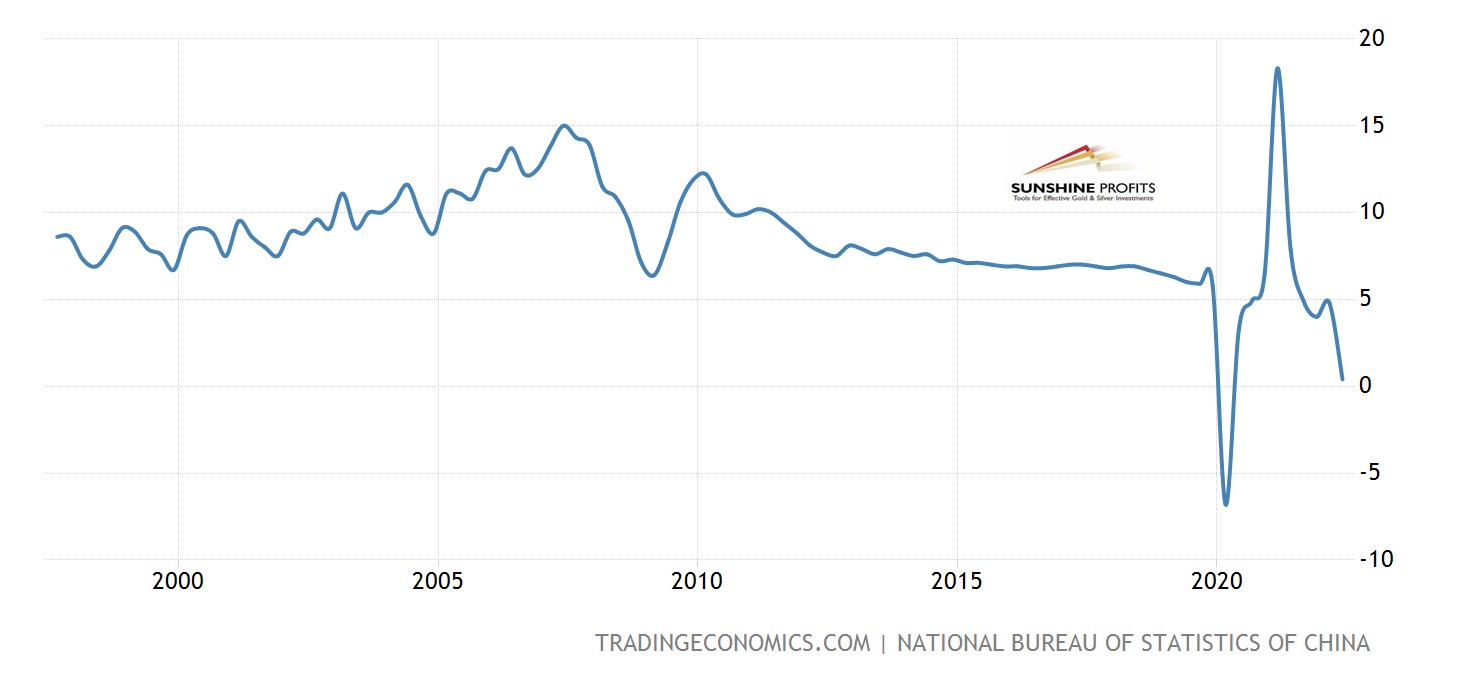

According to Nomura bank, about 12% of China’s GDP is affected by harsh lockdowns and other sanitary measures. As a consequence, it cut the forecast of the country’s economic growth in 2022 to just 2.7%. As the chart below shows, the GDP contracted 2.6% on a quarterly basis and rose just by 0.4% year-to-year in the second quarter of this year. Beijing, we have a problem!

However, the dark clouds go beyond the pandemic. Stephen Roach mentions three powerful forces at work here: a profound shift in the ideological underpinnings of Chinese governance towards less market-friendly and more nationalistic and statist ideology that focuses more on a muscular foreign policy than economic growth, a structural transformation of the economy toward more consumer and services-based, and payback for past excesses.

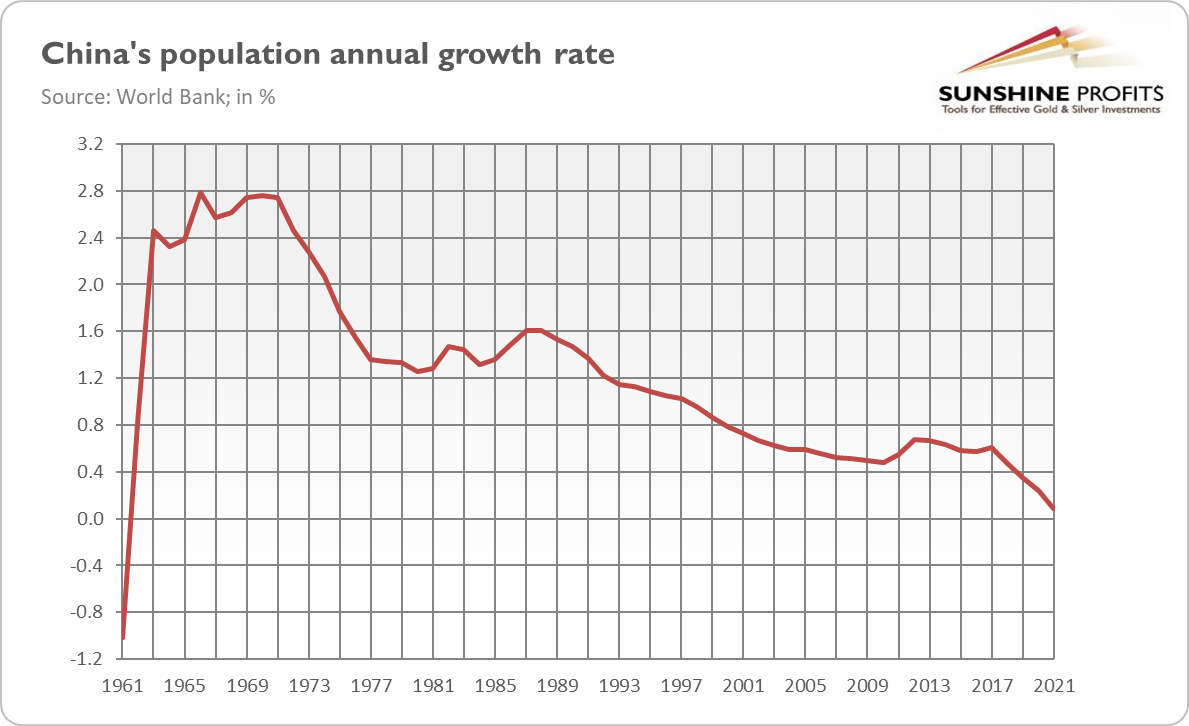

Other analysts add the issue of aging and population decline to this list. As the chart below shows, China’s population growth has been declining for decades – and this year it could actually shrink for the first time since the Great Famine of 1959-1961.

According to the Shanghai Academy of Social Sciences’ predictions, from 2022, the population of China will decline annually by 1.1%, shrinking from 1.4 billion to about 600 million in 2100, if the trend continues. It would imply a decreased workforce and a slower pace of economic growth.

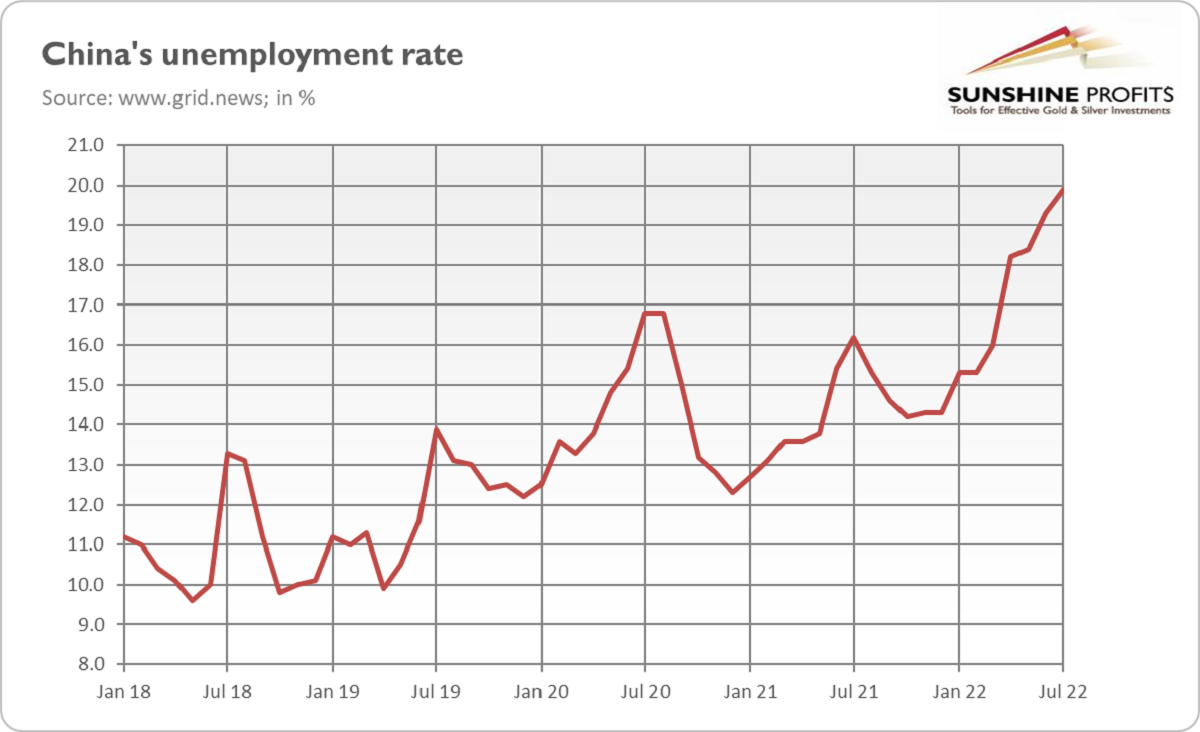

There is also a high rate of youth unemployment. In July, the unemployment rate among 16-24 year-olds hit an all-time high of 19.9%, as the chart below shows. Four years ago, when the data for the figure was finally made public, it was as low as 9.6%.

Don’t expect mass riots, but high unemployment among young people could add some tensions and complicate the socio-political situation in China.

Let’s focus on an inevitable bust that came after the boom of the hyper-growth era. The best known manifestation of such a painful but necessary readjustment is, of course, the deflating property bubble.

Paraphrasing Churchill’s famous phrase, never before have so many loans been taken by so many developers to build so many buildings in which so few people wanted to live!

As Peter Hannam from The Guardian notes, “while China’s economy is roughly three-quarters that of the US or Europe, property assets have ballooned to double the size of America’s and triple Europe’s,” leading to one of the greatest misallocation of resources in the world. Suffice it to say that property companies are demolishing entire cities of half-finished buildings. Goodbye, ghost towns!

Remember Evergrande, which defaulted on part of its debt? This infamous company is just the tip of the iceberg.

According to the S&P Global Ratings, 40% of developers are in “financial trouble,” and the situation may worsen further as some homeowners stop paying their mortgages in an untypical strike (the idea is simple: you stop construction, we stop paying mortgages). These boycotted loans could be worth as much as $300 billion.

Implications For Gold

What does China’s economic slowdown imply for the world’s economy and the gold market? Well, as China dominates global demand for many raw materials, its economic slowdown should take some pressure off commodity prices.

On the other hand, the series of lockdowns could prolong the supply-chain issues and, thus, a period of elevated inflation. This could be positive for gold prices, but as long as the Fed remains hawkish and determined to beat inflation, gold will struggle.

We can't rule out the possibility that the real estate crisis will lead to a wider financial crisis, though given the peculiarities of Chinese state capitalism, I expect more of a Japan-style period of stagnation (or relatively low growth) rather than an American-style outright economic crisis.

Gold could rally only if we see a contagion from China’s real estate to the US financial markets. Hence, gold bulls shouldn’t count on China’s economic problems – actually, the country’s slowdown could support the US dollar, putting gold prices under pressure. However, China’s economic slowdown would imply slower global growth, making the world more fragile and prone to recessions.

Last but not least, it could be that Xi Jinping decides to distract attention from economic problems and escalate conflict over Taiwan. In this scenario, gold could get support, although geopolitical tensions usually provide only a short-term boost.

Thank you for reading today’s free analysis. We hope you enjoyed it. If so, we would like to invite you to sign up for our free gold newsletter. Once you sign up, you’ll also get 7-day no-obligation trial of all our premium gold services, including our Gold & Silver Trading Alerts. Sign up today!

Arkadiusz Sieron, PhD

Sunshine Profits: Effective Investment through Diligence & Care.