Bonhoeffer Capital letter to partners for the third quarter ended September 30, 2018.

Keith Smith is a CFA charterholder and received his MBA from UCLA. He has held positions with Empire Valuation Consultants, PwC, Management Consulting & Research, and served as a captain in the U.S. Air Force. Keith most recently served as a managing director of a valuation rm, and his expertise includes technology firm valuation, corporate transactions, distressed loans, derivatives, and intangible assets. Warren Buffett and Benjamin Graham’s value-oriented approach of pursuing the “fty-cents on the dollar opportunities” underpins Keith’s investment strategy. The combination of his experience and track record led Keith to commit most of his investable net worth to the Bonhoeffer Fund model.

Q3 hedge fund letters, conference, scoops etc

Can you tell our readers a bit about your background and the Bonhoeffer Fund?

I grew up in Rochester, New York. I attended college at Union College and earned an electrical engineering degree. While at Union, I took as many finance courses as I could and read all of the classic valuation books while I was working as a summer intern at Cornell University. I began my work career as an Air Force officer developing satellites in Los Angeles, California. I left the Air Force six years later as the Cold War had been won and the Air Force was going through a reduction in force. Then I worked for a cost consulting firm while earning my MBA from UCLA. After graduating, I worked for Price Waterhouse in the Valuation Group in the Los Angeles office. This was an interesting time, as the dot coms were going public and we provided valuation services to many of these firms before they went IPO. In 2000, my family moved from Los Angeles to Rochester, New York, as I accepted a job with an independent valuation firm, Empire Valuation Consultants. At these valuation firms, I specialized in technology firm and asset valuation along with more broad based valuation of private businesses. I became a partner at Empire in 2008 and have recently left Empire to start my own fund with my joint venture partner, Willow Oak Asset Management. Over the past 15 years, I invested my retirement savings in various stocks and generated a decent track record. While investing my personal account, I focused on specific market segments (media/telecom, consumer products, financials and service firms) and specific types of securities (compound mispricings and public LBOs) in specific regions of the world (Anglo/Dutch influenced countries). My learning was accelerated by sharing ideas and receiving feedback from other investors at events around value investor annual meetings like Fairfax, Daily Journal and Berkshire and from website communities like the Corner of Berkshire and Fairfax.

The Bonhoeffer Fund was an outgrowth of my personal investing experience and includes investing in countries not easily available to US retail investors like South Korea, the Philippines and South Africa. We pursue opportunities in my circle of competence—like telecom/media and distribution businesses— in areas of the world that have rules that are understandable to a US-based investor. We have not invested in Russia or Turkey despite inexpensive valuations due to the rules being different than those in the US market. Our investable universe includes countries with a history of Anglo/Dutch rules and disclosures (like the UK, South Africa or the Philippines) or countries where they are heading in that direction (South Korea). All of our investments have one or more characteristics of compound mispricings, mischaracterized firms, public LBOs or hidden options. We also look for growth in the business over time and an inexpensive price. The price is calculated including the possible compound mispricing due to the securities’ characteristics independent of the business valuation.

You say there are three strategies (compound mispricings, mischaracterized firms and public LBOs) you employ to generate "higher expected returns in unusual places." Could you tell us some more about these strategies?

Sure. Compound mispricings are situations where there are mispricings in both the underlying firm and a security in the firm’s capital structure or a derivative security. These compound mispricings can be seen in nested discounts in derivative securities associated with either the firm directly or one of the firm’s securities. The key parameter with all of these discounts is to determine what a normal discount should be. There are some studies performed from around the world to provide some guidance here, as well as calculating economic discounts for expenses or rights associated with these securities Examples of places where compound mispricing can occur include non-voting preferred stocks in countries like South Korea, Germany and Italy, holding companies common in the Far East and Europe and derivatives such as warrants or LEAPs.

Mischaracterized firms are situations where a firm is transitioning from one industry to another or has one segment of the firm that is in higher-return industry than the other. Examples include some firms like car dealerships or tire companies that have some economics tied to overall OEM auto sales but have larger portions of their economic returns tied to more consistent returns from segments like service, finance and insurance for auto dealers and after-market sales for tires. These types of situations can also include good company/bad company situations where, with the right management team, the firms create two more valuable pieces ether via spin-off or sale.

Public LBOs are situation were leverage is used in a responsible fashion in publicly traded firms. This use is typically associated with recurring revenue which can provide safe collateral to borrow against. Dan Rasmussen has done a study on this and has found successful LBOs have been purchased historically at multiples of 6 to 8x EBITDA and have a 3 to 4x EBITDA of debt put on them. Many of the leaders profiled in the book The Outsiders (John Malone, Tom Murphy and Dick Smith) also used this model to enhance returns. With these valuation parameters and a growing business, rates of return in the low 20%s are easily obtainable. Examples of these situations can be seen in consolidating industries like local broadcast TV, radio and car dealerships. As a bonus for these consolidating industries, real cost synergies can be realized, providing more collateral for the loans.

The securities that Bonhoeffer holds have one or more the characteristics described above. We also like situations where there are a number of free options. When these can be found with entrepreneurial leaders who can exercise these options, you can have a very favorable risk/reward situation. An example here is telecom firms who have spectrum assets.

It would be great if you could provide an example of a ‘Public LBO’ style investment you’ve reviewed in the past, or currently own.

A public LBO we own is Teekay Offshore (Teekay). It is also a mischaracterized firm as the firm is being valued as though it is a Floating Production Storage and Offloading (FPSO) tanker leasing company versus a shuttle tanker/FPSO company. FPSO tanker leasing firms are being priced by the market today at 6x EBITDA, while shuttle tanker firms are being valued at 10x EBITDA. Currently, the EBITDA ratio is 40% shuttle, 60% FPSO/Floating Storage and Offloading (FSO). As a result of the Brookfield transaction, all new investment will be into the shuttle tanker segment versus the FPSO/FSO segment. This will increase the value of Teekay as the new dollars invested from the lowerreturning FPSO/FSO segment will be reinvested into the high-returning shuttle tanker segment.

For 2017, the shuttle tanker EBITDA/assets were 13.9%, while it was 11.1% for FPSO and 7.5% for FSO. The shuttle tanker segment also has more stable cash flows than the FPSO/FSO segment, has less competition (one major competitor in the shuttle tankers versus three independent providers along with the oil companies themselves for FPSO/FSO tankers) and is not as integrated with the offshore well equipment, as FPSO/FSOs are typically owned by the oil company.

Teekay was re-capitalized by Brookfield in 2017 via an LP/GP unit sale (in which Brookfield purchased 60% of the LP units) and a debt offering reducing debt from 7x EBITDA to a more manageable level of 4.5x EBITDA. Recently, Brookfield has taken control of the GP. Teekay has an aspect of good business/not so good business between its shuttle tanker and FPSO/FSO business. The 2018 data on cash flows is a little messy because there are temporary reductions in day rates for some of the FPSOs and there are assets that are not being used. Teekay currently sells for 6x EBITDA based upon EBITDA generated from less-than-fullyutilized ships and temporarily discounted lease rates. Other FPSO/FSO leasers sell at multiples of 6x EBITDA while shuttle tankers sell at 10x EBITDA. At the current cash flow mix, the blended ratio is about 8x EBITDA. Given Teekay’s leverage, if Teekay was valued at 8x EBITDA, the share price would increase by about 140%. Moving forward, Teekay should become more of a shuttle tanker company with its multiple increasing to the shuttle tanker multiple from the FPSO/FSO tanker leasing multiple.

Your current portfolio has some of the most attractive value metrics around and is currently majority invested in South Africa and South Korea. What do you like about these regions in particular?

Specifically, for South Korea you have the country’s governance improving rapidly. They have put executives in jail for corruption and firms have begun to take actions like share buybacks and increased dividends with excess cash. In addition, disclosure is very good in South Korea (on par with the US). These actions illustrate South Korea is increasingly embracing Anglo/Dutch rules-based capitalism (along with acceptance of the US-based culture of independence) versus the traditional relationship-based capitalism. This is in contrast to Japan and China where relationship-based is more important and other factors beyond shareholder value take precedence, like employment in Japan and government control in China.

South Africa is very interesting in that it has had a long history of capitalism reaching back to the 1600s with the arrival of the Dutch. You can see that today in the disclosure of many of the firms and shareholder-friendly actions like share buybacks and returns-driven divestitures. The issue with South Africa is the demands of the government dominated by the African National Congress (ANC). Recently, the head of the ANC and the President of South Africa has approved a change to the South African constitution which would remove the provision of restitution for the seizure of land. Although this is not good, it is not as bad is it appears given the context of multi-party and multi-state democratic rule versus autocratic rule in some other emerging-markets countries.

Could you give us an example of an idea you like in South Africa?

An example of an idea with many free options in South Africa is UEPS. UEPS provides transaction processing services to users in South Africa, Hong Kong, South Korea, India and Europe. It historically provided distribution of South African welfare benefits via a smart-card and biometric identification system it has developed. The contract with the South African government was completed in August 2018. The company will use its network technology it has developed for welfare benefit distribution to provide banking services to the underbanked in South Africa. Management expects the lost cash flow from the welfare benefit contract to be recovered by 2020 via its quickly growing banking and financial services network.

The firm also owns the third largest payment network in South Korea. Recently, regulation in South Korea has reduced the prices charged for network services for lower-priced items purchased. This will be a one-time hit to cash flows and revenue will increase as volume network increases from a lower base.

UEPS has recently made option-like investments in South Africa’s third-largest cell phone company (C-cell), an Indian digital wallet provider, a Hong Kong-based payment service provider, a European transaction processor and a cryptocurrency bank. These option-like investments generate very little cash flow today but have the ability to generate large amounts of cash flow if events associated

with investments play out.

UEPS currently sells at less than 1x EBITDA and earnings excluding cash and investing and 3.3x EBITDA and 7x earnings including cash and investments. The EBITDA and earnings numbers are based upon next year’s projected lower values associated with the loss of the welfare benefits contract. The average transaction processing firm sells at the mid-teens to low-twenties EBITDA multiple. So you are getting a cheap cash flowing business with a number of free options.

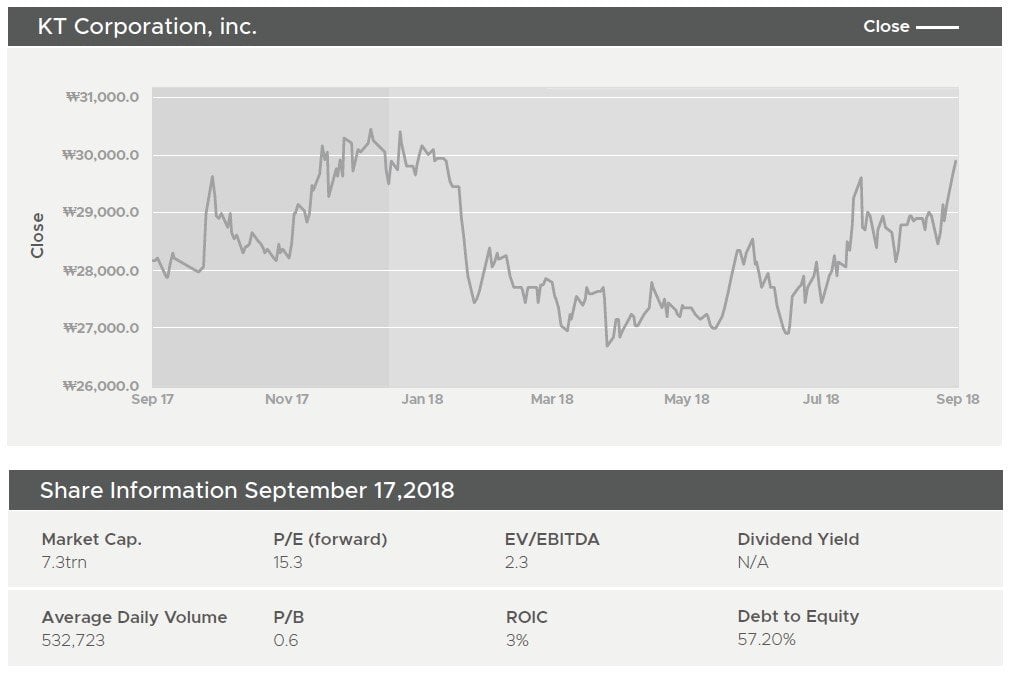

Bonhoeffer: Stock Idea One - KT CORPORATION

Your first pick is South Korean company KT Corp (030200). Can you start by giving us some background on this business?

KT Corp is Korea’s largest incumbent fixed-line telecommunications company. It is the second largest mobile telecommunications firm in Korea. KT Corp also owns excess real estate it is in the process of developing. KT Corp also owns a majority of the wireless infrastructure in Korea (90% of the transmitter locations and over 80% of the cable infrastructure) that will be shared for deployment of 5G equipment. KT Corp will receive compensation for the sharing of their infrastructure with other wireless carriers. KT also owns 50% of KT Skylife, Korea’s only satellite TV provider, BC Card, the largest payment card network in Korea with over 40 million cards and 2.6 million merchants, and various other firms in the entertainment content, call center, manpower supply, advertising and security monitoring business.

What first attracted you to the opportunity?

I liked the fact that when management had changed a few years ago, the operational performance of the firm improved; KT generated large amounts of free cash flow and invested in enabling technology joint ventures like internet of things, cloud computing, autonomous cars and smart cities that will drive data demand going forward. They also had a real estate portfolio that they were developing and various other businesses that provided optionality to the stock price. KT Corp’s free cash flow yield of 16% versus KT Corp’s bond yield of 3% is also appealing.

Which investment bucket does this fall into and why?

This is a compound mispricing and mischaracterized firm/country with embedded options. The compound mispricing is due to its holding company structure and discount from the sum of the parts, which is 73%. The expected discount based upon capitalizing management expenses is less than 1%. A typical discount for lack of control is about 15 to 20%. So you have a growing firm with a goodsized discount. KT Corp’s revenue has grown by low single digits with EBITDA growing by mid-single digits since the new CEO took over in 2014.

The mischaracterization is KT Corp is being priced as a declining revenue and cash flowing firm (i.e., below the price of declining legacy telcos in mature Asian markets). Mature Asian telecoms have an average EV/EBITDA of about 3.5x and KT Corp is selling for 1.5x EBITDA on a “look through” multiple basis. Over the short term, KT Corp should trade at the mature Asian telecom firms. KT Corp has all the pieces to be a quad play telecom firm (phone, internet, cable, wireless and content) so, over the long term, if revenue is generated from all of these segments, it should be priced as a quad play, which has multiples of about 10x EBITDA currently.

What do you think the market is missing?

In addition to the compound mispricing and mischaracterization described above, the market is missing KT Corp’s hidden assets. Some of these assets include excess real estate, KT Skylife (the Korean satellite TV operator), BC Card (Korea’s largest credit card network) and entertainment content firms. These assets have significant value (almost ₩23,178 per share, with a 30% hold co discount on investment assets). In addition, the improving capital allocation and governance should reduce the holding company discount over time.

You believe there’s hidden value in the firm’s real estate portfolio. How much could this asset potentially be worth?

Based upon comments from management the nonoperational real estate (not needed for operations) is ₩17,056 per share.

Is the firm working to unlock value here?

They are separating this unit and going forward with development of their projects. Management is expected to grow the value of this non-operational real estate by 6% per year over the next five years.

What about the media and broadband sections of the business? Where is the value here?

I think the core broadband connectivity business has value in addition to the content businesses. The core connectivity should be worth at least the 6 to 7x EBITDA like US-based non-declining telcos sell for and maybe 10x given the quad play assets KT Corp owns in Korea.

The business has struggled to grow over the past few years, what has been holding it back?

The business is a combination of a legacy phone business which is declining, a wireless business that has flat growth and broadband and content businesses which are growing. As the growing businesses represent larger and larger portions of total revenue, the growth rate should pick up. It is tough to use history as a guide due to the two underlying businesses’ revenue mixes changing over time.

What action is management taking to unlock value?

Historically, current management has implemented cost savings of ₩700 billion annually, sold capital-intensive car rental business and focused investments in growing areas such as cloud services and other broadband services such as IPTV and content. Recently, management has also repurchased shares.

Is there a catalyst you see on the horizon that could speed up the process of value realization?

5G rollout and the additional revenues that will be generated from leasing locations to other telecom firms and the removal of the cap on pay-TV ownership which will lead to consolidation.

What growth metrics are you keeping an eye on?

Growth in revenues, EBITDA and free cash flow as growing businesses overcome declines from declining businesses. Also the growth in broadband and IPTV subscribers versus the decline of legacy telecom and wireless subscribers.

How is management incentivized to achieve the best returns?

The CEO’s bonus compensation is based upon a growing EBITDA target and the KT Corp stock price growth in excess of the KOSPI. The CEO’s bonus in 2017 was 2x his salary of about $500,000.

In the bull case, how much do you think the stock could be worth?

The bull case here is with the telco asset trading at 8x EBITDA (a quad-play multiple) and other assets at fair value and a 20% holding company discount would be ₩108,000 per share.

And if the company fails to capitalize on growth opportunities, what’s the potential downside?

The downside would be the telco business at the multiples of other Asian telecos (3.5x EBITDA) times the current level of EBITDA and the discount at the holdco discount at 50% would result in value of ₩30,000.

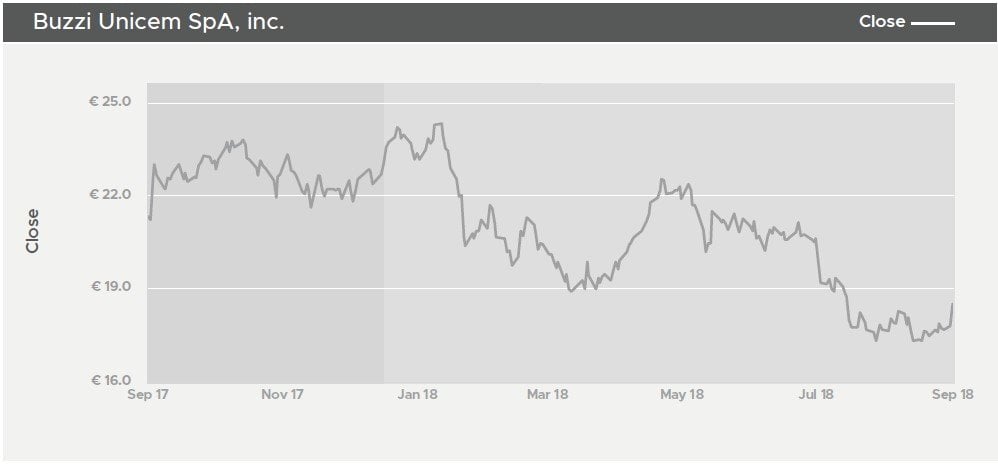

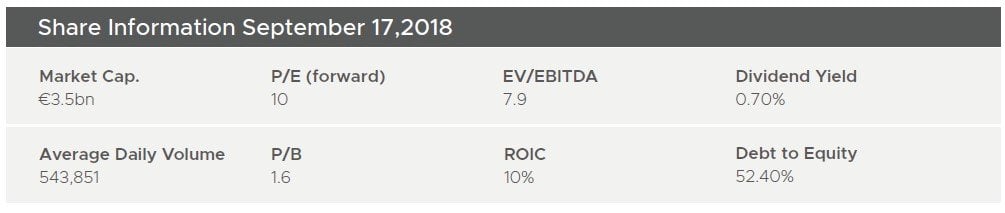

Bonhoeffer: Stock Idea Two - BUZZI UNICEM CORPORATION

The second pick is cement business Buzzi Unicem (BZU), listed in Italy. What first attracted you to this business?

Buzzi is a combination of a compound mispricing and a mischaracterized country situation. They also are growing (6% EBITDA growth over the past five years) and we are in the mid-portion of the building cycle (40% below the last cyclical peak in 2007) so we are not at a cyclical high. There is also consolidation in the cement business in many countries (including Italy) which improves economics for remaining firms. Buzzi saving shares’ free cash flow yield of 14% versus a bond yield of 1% is also appealing.

Bonhoeffer owns the savings shares of 0Buzzi Unicem. What’s the difference0 between this share class and the common?

The savings shares are non-voting common stock that have a higher dividend than the common shares. This is a historic structure similar to preferred shares in places like Germany and South Korea. These shares were issued to raise equity but not to dilute the voting control of the majority shareholder. There is a trend to consolidate share classes in Italy which improves governance. Before 2014, savings shares were converted at a discount to common shares. However, conversions since 2014 have been at parity to the common shares.

Why do you believe the savings shares are a better buy? – could you make the same trade with the common?

The savings shares currently trade at a discount of 40% to the common shares. The controlling family has a 59% stake in Buzzi, so shares of minority shareholders cannot win a vote against the controlling family. So if you buy the common 0or preferred, you are along for the ride. Given the historic trend of converting shares at parity, these shares should trade at a smaller discount to the common. In places with good governance (US and Norway/Sweden) and in US court cases, the voting/non-voting discount is typically 5 to 10%. So you are getting the Buzzi economics at a 35% discount to the common shares. The savings shares are also less liquid (€760,000 in average trading volume per day) versus the common shares (€18.3 million in average trading volume per day).

The common stock is currently trading at a multi-year low. What has gone wrong?

Buzzi’s change in price is in line with other multinational cement producers, such as Heidelberg and Cemex, over the past few years. Although Buzzi is headquartered and trades in Italy, almost none of its recent EBITDA is from Italy. Buzzi has its largest exposure to US and Mexico (80% of EBITDA) and Eastern Europe (20% of EBITDA) with its Western European operations having a breakeven EBITDA. Part of the reason for the decline is being an Italian company; however, very little of the current economics of Buzzi is tied to Italy. The situation in Italy is improving as consolidation is reducing the number of competitors in each regional market, and Buzzi expected to have an EBITDA profit in Italy in 2018.

Do you see these concerns having a longterm impact on the business?

Buzzi is in a cyclical business, but currently the cycles in Europe, North America and Mexico are at different phases, so this should smooth out cash flow generation in the current cycle. Also, a US infrastructure program and the pent-up demand for US housing should boost cement/aggregates demand in the US despite its current long-lasting

recovery.

What is the current valuation?

Buzzi savings shares currently sell at an EBITDA multiple of 2.9x and a free cash flow yield of 14%. The current average multiples of multinational integrated cement/aggregates companies is about 10x EBITDA. The upside to a 9x multiple is 162%.

Moving to the balance sheet, is there anything you think could hold the business back here?

Buzzi has debt but its EBITDA coverage ratio almost 11 times and the equity value of its publicly traded Mexican operations is more than the total amount of its debt. So debt is not a restriction on further investment or growth via acquisition.

Do you see any upcoming catalysts for the business?

None announced at present. However, one catalyst could be the conversion of savings to common shares or the improved economics of the Italian market due to consolidation. Other operational catalysts include a US infrastructure program and/or the pent-up demand for US housing. Also, if the market does not put a discount on Buzzi’s operations because it trades in Italy.

Is management incentivized to produce the best returns for investors?

The biggest incentive is the family’s 59% stake in Buzzi. Management compensation is modest at €400,000 for each co-CEO (family) and the CEO of Germany and the US (non-family) have higher compensation than the co-CEOs.

What’s your bull and bear thesis for the stock? Do you have a time horizon?

The bull thesis is that reduction of savings/common discount via a conversion on a 1:1 basis and the re-rating of the firm to a 9x multiple on current mid-cycle EBITDA would result in a share price of €27.77.

The bear thesis would be a deterioration of EBITDA which should be offset by either a savings share conversion or the market valuing the company on a look-through basis of where EBITDA is generated. So the downside should not be much lower than the current price of €10. The time horizon is difficult to quantify, but three to five years would be a reasonable timeframe for the thesis to play out.

Are you worried about the investment environment in Europe? Has that factored into your analysis? If not, why not?

The investment environment is already factored into the existing price via the lower price than justified by its location of EBITDA generation. If the market can look past the fact the firm is traded in Italy and generates no current EBITDA from Italy, then the price should rise.

Has the political change in Italy caused you to adjust your view of the company’s outlook?

The political change in Italy should have a small effect on Buzzi as almost 100% of its EBITDA is generated outside of Italy.

Any serious red flags that would cause you to sell if they emerged?

If management started to take larger-than-typical compensation and/or made an overpriced or nonsynergistic acquisition with a large amount of debt.