BNP Paribas survey shows ESG integration is maturing and institutional investors are at different stages of readiness for net zero

Q2 2021 hedge fund letters, conferences and more

A BNP Paribas survey of 356 asset owners, official institutions, and asset managers, shows that ESG integration is maturing, with a growing number of investors allocating more than 75% of their portfolio to ESG and know-how increasingly embedded throughout organisations. However, institutional investors are at different stages of readiness for net zero.

Growing ESG Integration

Key findings of the ESG Global Survey 2021 include:

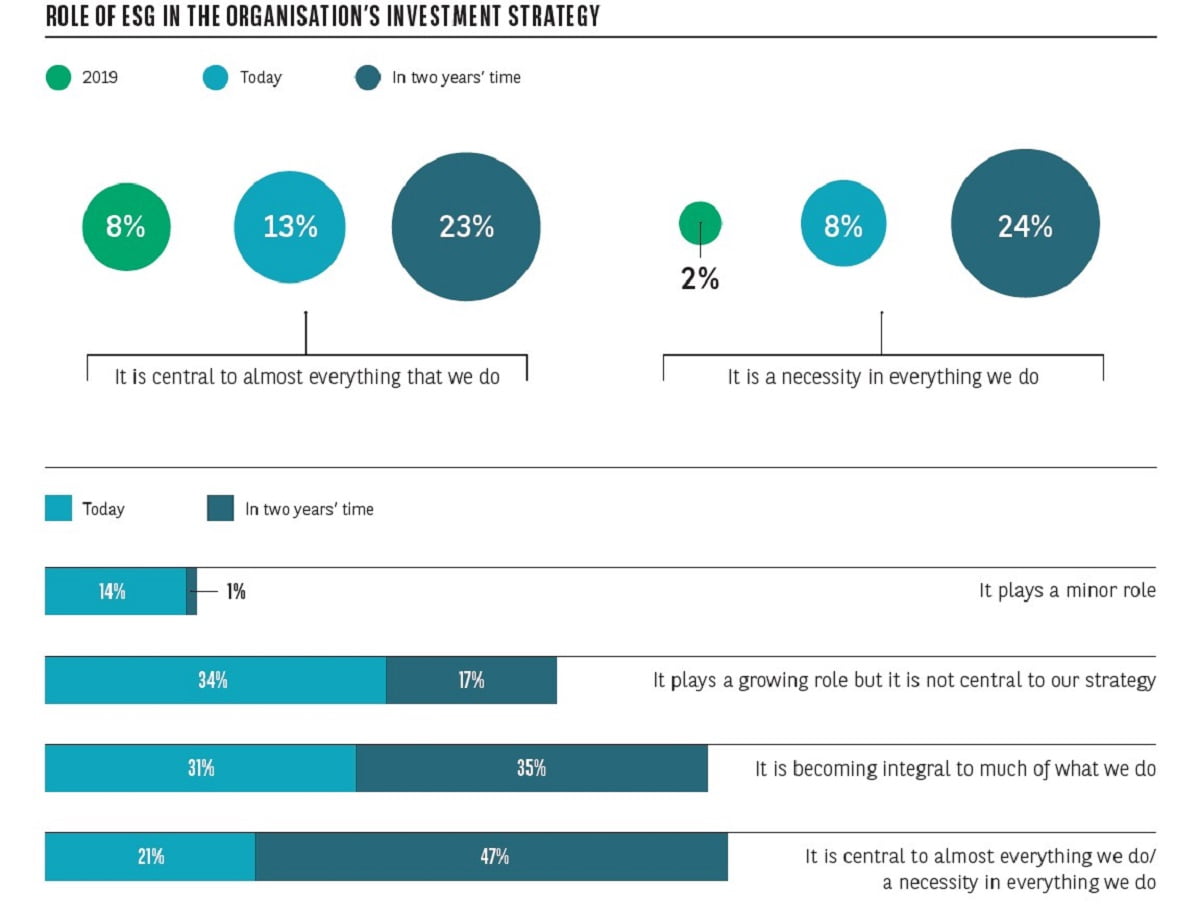

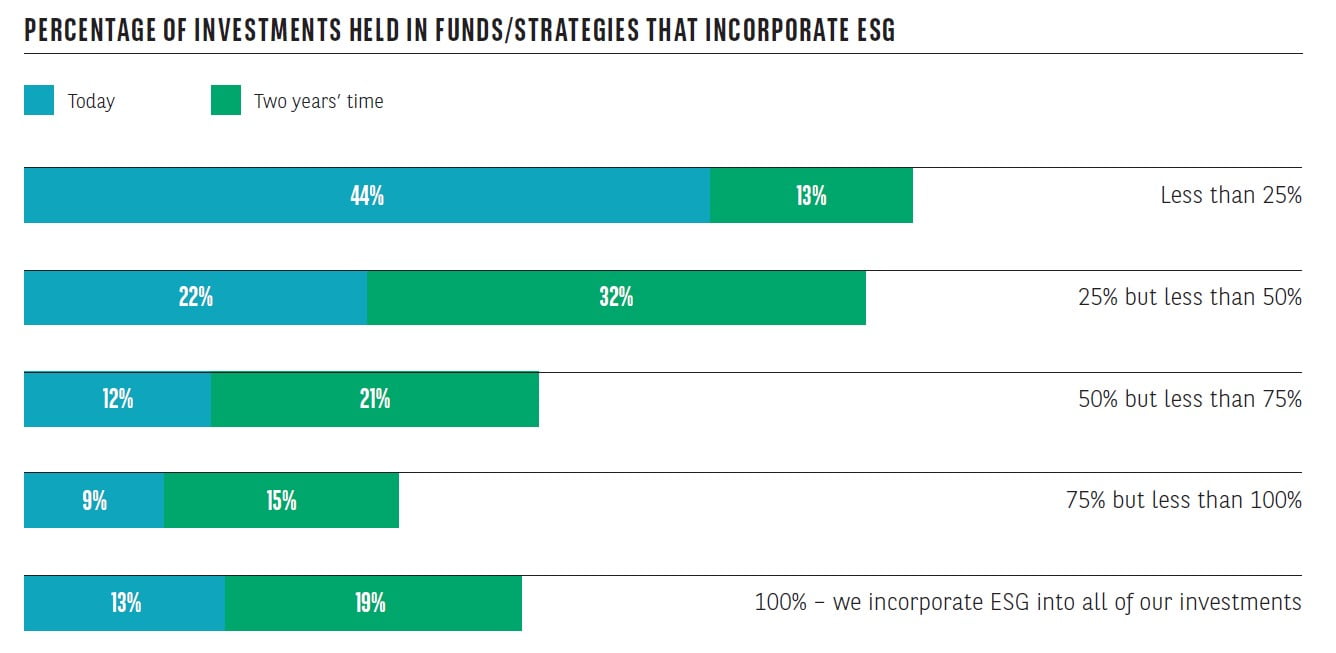

- More investors integrating ESG in at least 75% of their portfolio: 22% of respondents integrate ESG into at least 75% of their portfolios. In BNP Paribas’s 2019 survey, not one respondent envisaged this would be the case by 2021. Despite this, 66% of investors currently incorporate ESG into less than half of their portfolio.

- Differing stages of commitment to net zero: 37% of respondents have made a public commitment to align all or part of their portfolio with a 2050 net zero target, 36% have taken initial public steps but have not started reallocating capital, and 27% have made no such commitment.

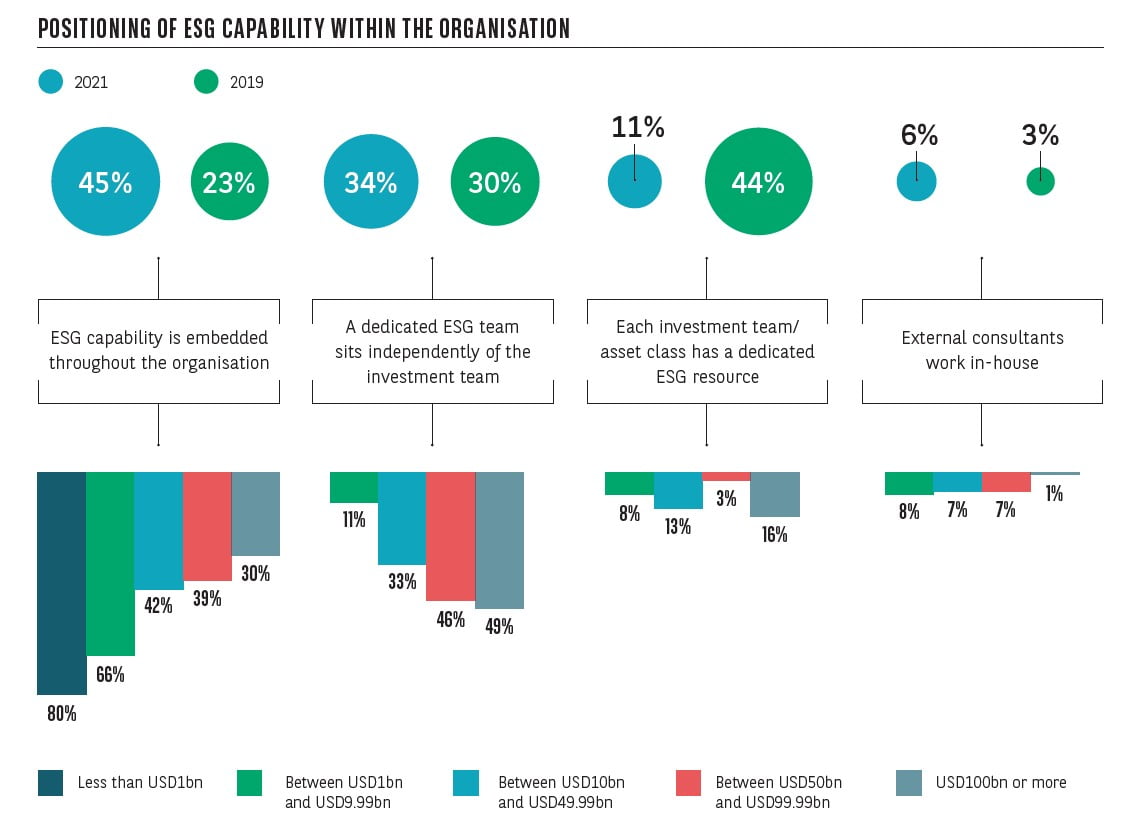

- ESG know-how is spreading: Almost half of institutional investors (45% vs 23% in 2019) say their ESG capabilities are embedded throughout the organisation and no longer the preserve of specialist teams.

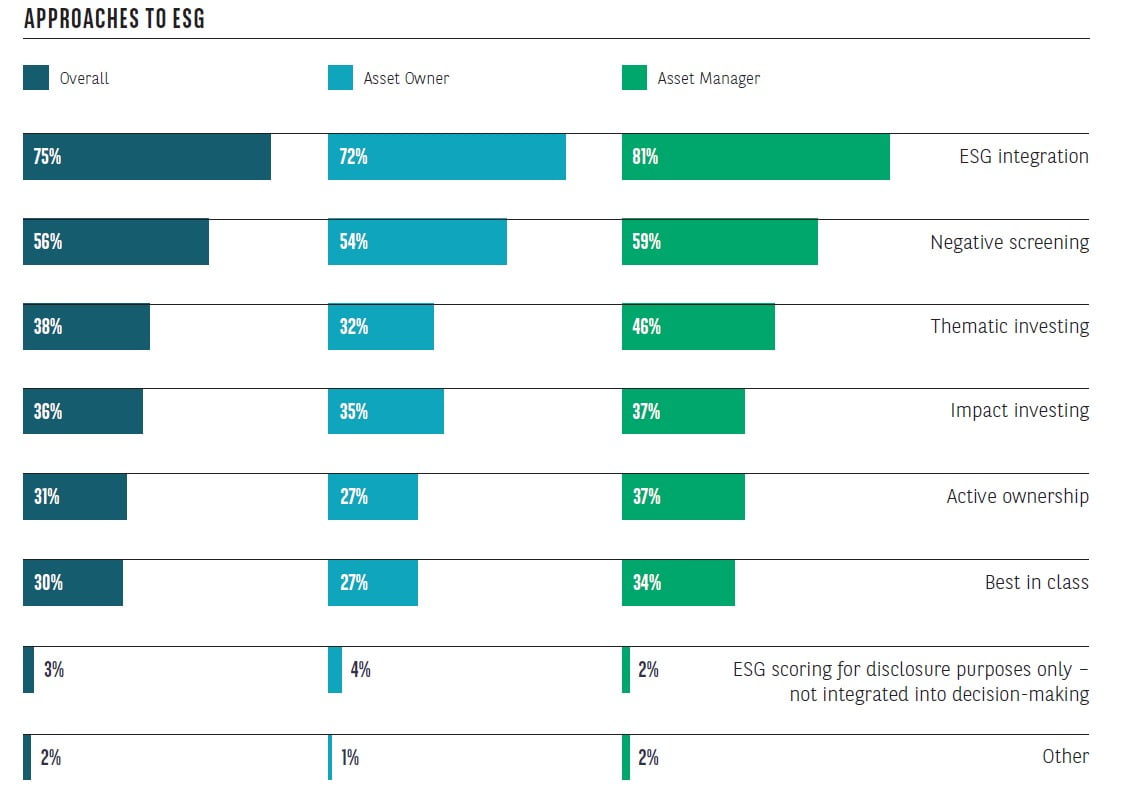

- Rise of thematic investing: 56% of institutional investors use negative screening and more than a third (38%) now use thematic investing[1].

- Growing application of ESG among alternative asset classes, including infrastructure (41% of investors), private equity/debt (38%) and real estate (37%).

- Brand and reputation (59%) has overtaken returns (45%) as the main ESG driver, signalling the growing importance of ESG as a societal issue.

- Shared values are key to asset owners: 47% (vs 27% in 2019) believe shared values are key when selecting an asset manager for an ESG mandate.

- Growing role of company engagement: 61% of investors engage with companies (beyond proxy voting) as part of their ESG strategy.

- Data remains the primary barrier to integration: 59% of respondents cite issues related to data as a top two impediment to integration. This compares to 66% in 2019.

- The social pillar of ESG remains the most difficult to integrate: 51% of respondents still rate social factors as the most challenging partly due to a lack of the right data.

Investors Are Also Embracing Thematic Investing

Florence Fontan, Head of company engagement, at BNP Paribas Securities Services, said: “The industry has come some way since our first ESG survey in 2017. Asset owners and managers are now more likely to embed ESG within their organisation and strategic decision-making. They’re also increasingly embracing thematic investing. This should stand the industry in good stead to accelerate asset allocation to ESG strategies, an urgent necessity as warnings on climate change grow starker.”

Delphine Queniart, Global head of sustainable finance and solutions, Global Markets, at BNP Paribas, said: “Growing ESG integration across asset classes, not least alternatives (infrastructure, private equity, real estate) is very much encouraging. Asset owners in particular are increasingly integrating ESG factors and looking into impact. This could trigger positive changes from a sustainable perspective, including increasing ESG disclosures and influencing changes from companies.”

About BNP Paribas

BNP Paribas is the European Union’s leading bank and key player in international banking. It operates in 68 countries and has more than 193,000 employees, including nearly 148,000 in Europe. The Group has key positions in its three main fields of activity: Retail Banking for the Group’s retail-banking networks and several specialised businesses; Investment & Protection Services for savings, investment and protection solutions ; and Corporate & Institutional Banking, focused on corporate and institutional clients. The Group helps all its clients (individuals, community associations, entrepreneurs, SMEs, corporates and institutional clients) to realise their projects through solutions spanning financing, investment, savings and protection insurance. In Europe, BNP Paribas has four domestic markets: Belgium, France, Italy and Luxembourg. The Group is rolling out its integrated retail-banking model across several Mediterranean countries, Turkey, Eastern Europe as well as via a large network in the western part of the United States. As a key player in international banking, the Group has leading platforms and business lines in Europe, a strong presence in the Americas as well as a solid and fast-growing business in Asia-Pacific.

BNP Paribas has implemented a Corporate Social Responsibility (CSR) approach in all its activities, enabling it to contribute to the construction of a sustainable future, while ensuring the Group's performance and stability.