By Frank Holmes

CEO and Chief Investment Officer

U.S. Global Investors

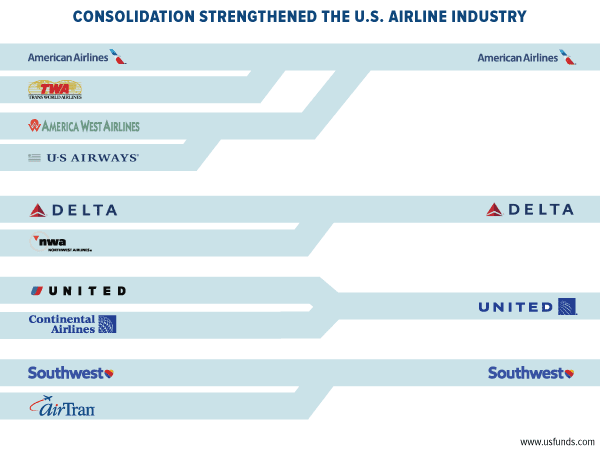

A little over 10 years ago, there were a dozen major domestic airlines. Following a wave of bankruptcies, the industry consolidated, and today four remain—American, Delta, United and Southwest.

For the past couple of years, these newly-strengthened carriers, along with a full roster of regional and low-cost carriers, have been beating expectations, generating record profits and free cash flow and rewarding shareholders with dividend growth and stock buybacks. Low fuel costs have served as an additional windfall.

click to enlarge

That doesn’t mean the industry now lacks the room to change (and improve), however. In February, the short-haul regional carrier Republic Airlines filed for bankruptcy—the first such filing in the industry since American’s in 2011—after losing a number of unionized pilots in a drawn-out salary dispute. (More on that later.)

And just this past weekend, 84-year-old Alaska Airlines announced it would be buying Virgin America, billionaire Richard Branson’s young, hip carrier.

Alaska to Become the Premiere West Coast Carrier?

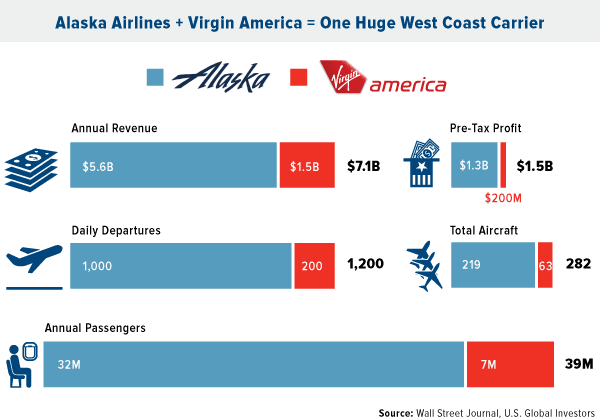

The $2.6 billion deal, awaiting shareholder approval in June, would create the fifth-largest U.S. airline by traffic and result in a much more competitive player, especially on the West Coast. (Alaska is based in Seattle, Virgin in San Francisco.) According to the Wall Street Journal, Alaska’s annual revenue could grow 27 percent because of the deal.

click to enlarge

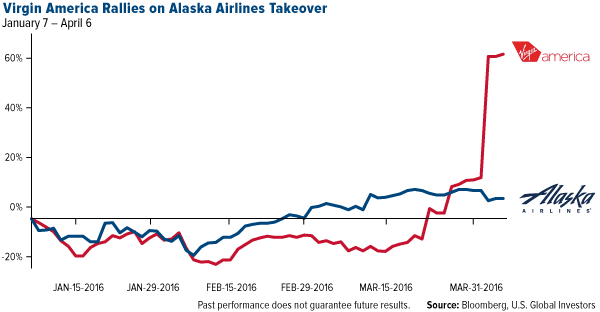

As I’ve pointed out in the past, the acquiree in deals such as this normally sees a short-term bump in share price, while the buyer’s stock might fall because, among other reasons, it must pay a premium for the acquisition. For the three-month period as of April 6, Virgin was up nearly 66 percent.

click to enlarge

Integration can sometimes be tricky for airlines—more so than for other industries—because they involve not just employees and aircrafts but also information technology systems, booking procedures, rewards programs and flight schedules. All of this must be accomplished while the carriers remain fully operational.

Airlines that have gone through this often-messy process have seen their quality ratings drop off. This was certainly the case with American as it slowly integrated and digested US Airways, a two-year endeavor that concluded in October 2015.

The Alaska-Virgin deal could end up being very different, though. Both carriers have an exceptionally firm handle on their operations and provide sterling customer service. Alaska has received the highest rating inJ.D. Powers’ North America Satisfaction Survey for eight consecutive years. For the fourth straight year, Virgin has held the top spot in the annual Airline Quality Rating (AQR) system, developed to rank airlines based on 15 “elements” such as on-time arrivals, mishandled baggage and the like.

Aircraft integration between the two companies poses arguably the most significant challenge—not just for Alaska and Virgin but also for jet manufacturer Boeing. Alaska exclusively flies the Boeing 737 while Virgin operates the Airbus A320, almost all of them leased. Once the Airbus leases are up in 2020, Alaska could choose to let them go, or it might decide to keep or even expand the fleet. At some point, this could be a concern for Boeing.

Pilot Shortage Intensifies While Demand Soars

Nevertheless, Boeing has an unprecedented seven-year order backlog of 5,800 commercial jets. To put that number in perspective, the U.S. airline industry collectively has 6,871 jets in its commercial fleet right now, according to the Federal Aviation Administration (FAA). Because of increased passenger and cargo demand, this number is expected to reach at least 8,400 by 2036.

This raises the question of who will be flying these additional aircrafts.

I’ve previously written about the imminent pilot shortage, which was spurred on by new FAA rules that tightened pilot training and service. Pilots must now retire when they reach 65, and they must have at least 1,500 hours of flight time before they can be considered for a position—usually with a regional carrier such as Republic for a starting salary close to $20,000. While Republic was trying to negotiate a new labor contract, it was losing about 40 pilots a month, according to Bloomberg.

This has contributed to an industrywide pilot shortage that could intensify as more and more pilots retire, with fewer and fewer new pilots to replace them. It also has the effect of encouraging capacity growth discipline.

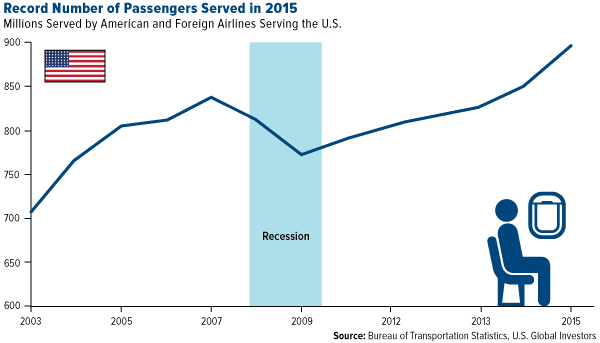

Meanwhile, commercial flight demand, both here and abroad, continues to climb. According to the Transportation Department, the number of passengers carried by U.S. airlines and foreign airlines serving the U.S. reached an all-time high of 895.5 million in 2015, a 5 percent increase from the previous year.

click to enlarge

Passenger traffic in the world’s busiest airport, Hartsfield-Jackson in Atlanta, also grew 5.5 percent year-over-year in 2015 to reach a record-breaking 100 million passengers, according to Airports Council International (ACI).

By the way, I want to congratulate Brussels Airport for (partially) reopening following the devastating attacks last month. The repairs will no doubt take a long time and cost millions of dollars, but this is the first step among many toward normalcy.

The role airports play in the U.S. economy is hard to exaggerate. They contribute a jaw-dropping $768.4 billion per year to the national economy, or nearly 5 percent of GDP, according to the Transportation Research Board’s Airport Cooperative Research Program (ACRP). What’s more, they generate $1.6 trillion in goods and services and provide 7.6 million jobs—4.3 percent of all U.S. jobs—that pay workers a combined total of $453 billion.

Clearly we depend on airports, but how are they funded? In a word: munis.

American airports as a whole have capital needs that average $14.3 billion per year, according to ACI estimates. The FAA annually provides $3.35 billion, leaving a difference of $10.95 billion. About 54 percent of that amount is typically funded with general obligation (GO) bonds and other municipal bonds that are tax-free at the federal level and often at the state and local levels.

Short-Term Municipal Bonds: The Solution to Rising Interest Rates and Skyrocketing Income Taxes

Besides the fact that they help make America strong and provide tax-free income, munis are attractive because they’re known to preserve capital, even in times of economic crisis.

This is key. Many investors have two huge fears right now: rising interest rates and skyrocketing federal income taxes. The Federal Reserve began rate normalization in December, and Chair Janet Yellen has stated that two hikes are likely this year alone. Bond prices fall when rates rise, and vice versa, but short-term munis are less sensitive to these fluctuations than longer-term bonds.

Also keep in mind that this is an election year, and it’s possible that we might vote to put a self-described socialist in the White House. By his own admission, income taxes will rise. Dramatically. It’s important, then, to have your wealth in something that provides tax-free income, like municipal bonds.

Speaking of socialism, I find it interesting that a great majority of the global public figures who have been identified in the leaked Panama Papers hail from far-left, socialist and communist regimes. This is what’s known as a “champagne socialist”: someone who is perfectly fine with the idea of high taxes—until he himself must pay them. This also goes to show that corruption is much more prevalent, and its magnitude much more significant, in countries with far-left governments. Corruption occurs everywhere—at all levels, in all countries, by people of all political stripes—but its frequency and depth seem to be much more extreme in such countries.

What Happens in Vegas Could Be Your Key to Successful Investing

On a final note, I want to invite you to plan a trip to Las Vegas next month to attend the 35th anniversary MoneyShow, where I’ll be speaking on gold and the airline industry. The MoneyShow is one of the most widely-attended investing conferences today, and best of all, registration is free! I’ll be joined by a number of highly-respected thought leaders in the industry, including Gary Shilling, Jeffrey Hirsch, Peter Schiff and many more. The conference will be held between May 9 and 12 at the beautiful Caesars Palace Hotel & Casino. I hope to see you there!

Index Summary

- The major market indices finished down this week. The Dow Jones Industrial Average lost -1.21 percent. The S&P 500 Stock Index fell -1.21 percent, while the Nasdaq Composite fell -1.30 percent. The Russell 2000 small capitalization index lost -1.82 percent this week.

- The Hang Seng Composite lost -0.50 percent this week; while Taiwan was down -1.34 percent and the KOSPI fell -0.08 percent.

- The 10-year Treasury bond yield rose 5 basis points to 1.72 percent.

Domestic Equity Market

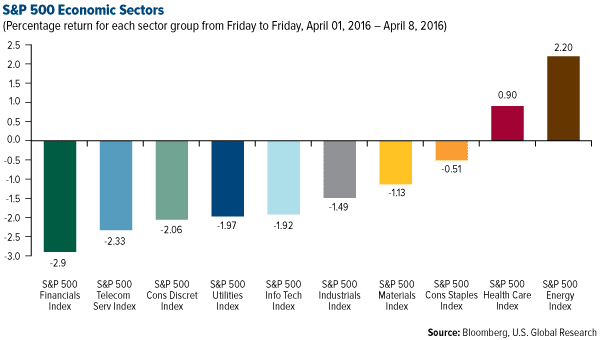

click to enlarge

Strengths

- Energy was the best performing sector for the week, increasing by 2.20 percent versus an overall decrease of -1.22 percent for the S&P 500.

- Edwards Lifesciences was the best performing stock for the week, increasing 16.18 percent. The company unveiled clinical trial data showing that a procedure using its heart valve device Sapien 3 was superior to open heart surgery for some patients.

- Alaska Air filed a bid for Virgin America. The $2.6 billion deal is subject to shareholder and regulatory approval. The combination would create the fifth-largest U.S. carrier by traffic.

Weaknesses

- Financials was the worst performing sector for the week, falling by -2.90 percent versus an overall decrease of -1.22 percent for the S&P 500.

- Gap was the worst performing stock for the week, falling -19.04 percent. The stock slid amid weak March sales results that show the company’s continued sales funk, and marked its twelfth consecutive monthly decline for the key revenue measure.

- The U.S. Department of Justice filed a suit to block Halliburton’s acquisition of Baker Hughes, alleging that the deal threatens competition in the oil services industry. The proposed merger was valued at $34 billion when announced. Regulators in the European Union and Australia have also expressed concerns over the combination.

Opportunities

- If the Federal Reserve is now on hold because the U.S. economy is at risk from a global backlash, then foreign-sourced profits are unlikely to snap back. That is not a recipe for adding market risk to equity portfolios. Instead, high quality equities should remain a focal point.

- The S&P managed care sub-industry could see a performance reversal. The pressure on payers of medical services relative to the providers of those services has diminished because overall health care outlays are no longer accelerating relative to total spending. That should open the door to an acceleration in relative performance.

- The latest personal consumption expenditures report showed that cable outlays, in real terms, have begun to move higher again after flat-lining for two years. The cable industry has monopolistic properties, enjoying decades of rising “real” pricing power. Now that real spending has reaccelerated, it increases the probability that real selling prices will follow suit. A consensus fear had been that slowing sales and rising subscriber churn would force cable providers to ramp up investment to retain customers. However, the largest cable distributors reportedly saw their total cable subscribers decline only 1 percent in the fourth quarter, similar to the loss in the third quarter, reinforcing that cord cutting is ebbing. The downtrend in capital spending to sales has been a major driver of the expansion in operating margins. If capital spending is not going to accelerate, then profit margins won’t come under much pressure. The convergence of these factors should be positive for cable and satellite companies.

Threats

- The U.S. Department of Labor finalized rules that will require financial advisors handling individual retirement accounts and 401(k)s to act as a fiduciary to their clients. Previously, advisors had been subject to a less-stringent suitability requirement. The broader definition of fiduciary will take effect in April 2017, with full implementation of the rule to begin January 1, 2018. This will likely put pressure on margins for asset managers, brokers and financial advisors.

- On Tuesday, the U.S. Treasury imposed new rules on tax inversions designed to make it more difficult for U.S. companies to combine with firms in other countries in order to reduce their tax liability. The rule had immediate impact with U.S.-based Pfizer and Irish-domiciled Allergan, calling off a pending $160 billion merger after the rule was released.

- The lingering threat of tighter U.S. monetary policy puts the burden on a global growth rebound to support a sustainable broad market advance. Global equities have lagged significantly, and breadth has been terrible, warning that no business cycle reacceleration looms. Given the large foreign contribution to S&P 500 profits, the message from lagging overseas stock performance is that downward earnings pressure remains. Against this backdrop, it seems unrealistic to expect renewed valuation expansion.

The Economy and Bond Market

Strengths

- The ISM Non-manufacturing composite index increased to 54.5 in March from 53.4 in February.

- Home prices were up by 6.8 percent year-over-year in February.

- The number of Americans filing for unemployment benefits fell more than expected last week, suggesting the labor market continued to strengthen despite tepid economic growth. Initial claims for state unemployment benefits declined 9,000 to a seasonally adjusted 267,000 for the week ended April 2, the Labor Department said on Thursday.

Weaknesses

- The U.S. Education Department reported that 43 percent of borrowers from the government’s main student loan program are not making payments or have fallen behind. The department’s loan portfolio totals $1.2 trillion. That’s a slight improvement from a year ago, when the figure stood at 46 percent, but includes a surge of those entering a program for distressed borrowers. Difficulty handling student loan debt is believed to be holding back household formation in the U.S., which has significant long-term economic impacts.

- Puerto Rico governor Alejandro Garcia Padilla signed a one-year government debt moratorium into law. The move buys time for the island’s government while it awaits help from Washington to deal with its debt crisis.

- The March minutes revealed split views, but general concern about downside risks from global factors and low inflation. The asymmetric nature of policy (easy to hike, hard to ease) also reinforced a cautious stance for most of the Federal Open Market Committee (FOMC). The market sees only a 20 percent chance of a June hike.

Opportunities

- U.S. growth has been decelerating since the second quarter of last year. One recent positive development is that the trend in the manufacturing sector is showing some signs of improvement. However, confidence that the economic outlook will improve markedly requires evidence of stronger household spending. Next week we will get an update to U.S. retail sales (Wednesday) and consumer sentiment (Friday).

- U.S. March consumer price index (CPI) will be released next Thursday. Recent inflation reports have surprised on the upside and have been inconsistent with the dovish rhetoric coming from the FOMC. Key Fed officials, including Chairperson Janet Yellen, have been much more concerned with the downside risks to U.S. outlook coming from the weak global economy. A soft CPI report next week could help to alleviate the Fed’s dilemma.

- With policy expectations, term premia, and inflation expectations all at extremely low levels in Germany and Japan, both bond markets remain vulnerable to any change in growth expectations. As a result, the risks favor staying underweight Germany and Japan versus the U.S. and U.K., favoring the higher yields in the latter two markets.

Threats

- While investment grade corporate bonds outperformed the duration-equivalent Treasury index by +262 basis points in March, BCA’s U.S. bond strategists argue an underweight stance remains warranted. Their Corporate Health Monitor moved further into deteriorating health territory in fourth-quarter 2015. The indicator has now been signaling worsening balance sheet quality for eight consecutive quarters. The non-financial corporate sector’s return on capital, and free-cash-flow-to-total-debt have been especially weak, while interest coverage has been firm. This is a typical late cycle pattern. In the late 1990s cycle, weaker profits caused free-cash-flow-to-total-debt to roll over in 1996 and the return on capital to follow suit in 1997. Interest coverage remained strong initially, supported by low interest rates. However, interest coverage fell as the Fed tightened policy in 1999, leading to a default cycle and much wider credit spreads. This could likely play out again in the current cycle. Furthermore, the relative performance of bank stocks was not able to rebound alongside other risk assets in March, which is another negative signal for the corporate bond market. Post-recession drawdown in relative bank equity performance in excess of 25 percent has tended to foreshadow corporate bond underperformance in past cycles. It has now reached 27 percent.

click to enlarge

- Capital formation has been stalling as a consequence of fading risk tolerance. That is robbing the corporate sector of much needed growth capital, and will reinforce the need for retrenchment. As a result, the outlook for capital market profitability is bearish.

- Some economists now see first-quarter growth as negligible, and it could easily turn out to be negative. Economists shaved already weak growth forecasts by a few more tenths Friday, after wholesale inventories fell 0.5 percent month-over-month in February, much more than the anticipated 0.1 percent decline. January was also revised down by 0.4 percent. The closely watched Atlanta Fed GDPNow model shows first-quarter growth tracking at 0.1 percent, compared to a 0.4 percent estimate earlier in the week.

Gold Market

This week spot gold closed at $1,239.79, up $17.29 per ounce, or 1.41 percent. Gold stocks, as measured by the NYSE Arca Gold Miners Index, rose by 6.44 percent. Junior miners underperformed seniors for the week as the S&P/TSX Venture Index traded up just 3.87 percent. The U.S. Trade-Weighted Dollar Index slipped -0.42 percent for the week.

| Date | Event | Survey | Actual | Prior |

|---|---|---|---|---|

| Apr-4 | U.S. Durable Goods Orders | -2.8% | -3.0% | -2.8% |

| Apr-7 | U.S. Initial Jobless Claims | 270k | 267k | 276k |

| Apr-12 | Germany CPI YoY | 0.3% | — | 0.3% |

| Apr-13 | U.S. PPI Final Demand YoY | 0.3% | — | 0.0% |

| Apr-14 | Eurozone CPI Core YoY | 1.0% | — | 1.0% |

| Apr-14 | U.S. Initial Jobless Claims | 270k | — | 267k |

| Apr-14 | U.S. CPI YoY | 1.1% | — | 1.0% |

| Apr-14 | China Retail Sales YoY | 10.4% | — | — |

Strengths

- The best performing precious metal for the week was silver, up 2.05 percent. Reuters reports that Mario Cantu, the General Coordinator of Mining for Mexico (which the U.S. Geological Survey estimates was the world’s biggest silver producer in 2015), expects to see lower gold and silver production in 2016.

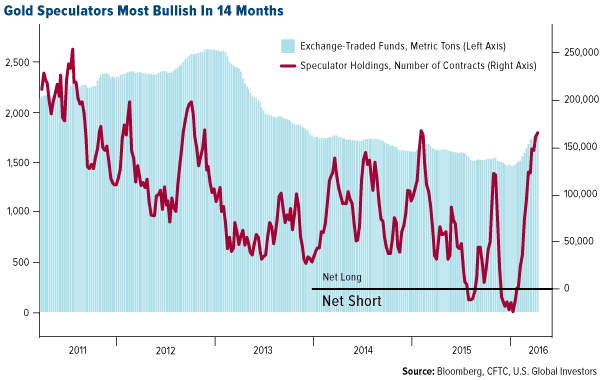

- Gold popped to a one-week high following Federal Reserve minutes that indicated policy makers would remain cautious on raising interest rates, reports Bloomberg. Gold speculators think the precious metal has more room to run too; while gold futures have dipped from a 13-month high, hedge funds are the most bullish in fourteen months as seen in the chart below.

click to enlarge

- Central banks are buying gold, according to Wealth Daily, which reports that banks added 483 tons of gold in net purchases. That is the second-largest accumulation of gold by central banks in a year since the end of the gold standard era, continues the article. Speaking of gold buying, Eric Sprott announced this week his purchase of 10 million Newmarket Gold shares from Luxor Capital for C$22.5 million, making him the second-largest holder according to Bloomberg data.

Weaknesses

- The worst performing precious metal for the week was palladium, down -4.58 percent. In a research note from UBS this week, the bank noted platinum and palladium as having limited attention from investors right now. Saying that “interest is lackluster and liquidity conditions are poor,” the group explains that both metals have “barely” reacted to news reports of auto sales, which are important since PGMs are used for catalytic converters.

- China added the smallest amount to its central bank gold reserves in March, reports Bloomberg, with the People’s Bank of China expanding holdings by 0.5 percent. In India, gold imports slumped 88 percent last month, as a strike by jewelers continues in several parts of the country. Inbound shipments declined to around 15 metric tons in March versus 133 tons a year earlier, reports Bloomberg.

- Strong manufacturing and jobs data out of the U.S. pushed gold down for earlier in the week, reports Bloomberg. Speculation that the American economy is gaining momentum could dampen demand for gold as an alternative asset.

Opportunities

- Integra Gold Corp. announced this week its $6 million strategic investment in Eastmain Resources by way of a non-brokered private placement. The private placement is conditional on the successful election of the revised slate of Eastmain Board nominees at the annual general meeting of shareholders on April 29. The proposed Board of Directors is a group of well-respected and experienced leaders in the mining space. Eldorado Gold, which owns a significant share of Integra, was also upgraded by Credit Suisse the same day as the Integra announcement to Outperform from Neutral, with an additional push coming from Scotia as well.

- Fed Chair Janet Yellen says she is prepared to allow inflation to overshoot and unemployment to fall below sustainable levels to prolong the U.S. economic recovery, reports the Financial Review. Yellen’s intentions to keep interest rates low for longer is a positive sign for gold. Credit Suisse also pinpointed opportunities for the precious metal this week. The group believes the equities rally isn’t over yet, and that gold could reach $1,300 an ounce on the back of ETF buying and a declining mine supply, reports Bloomberg.

- Last week the World Gold Council released its latest market update report, where the effects of negative interest rate policies on gold were covered. Not only does the report state that “negative interest rates double gold returns,” but also suggests investors “consider doubling their gold allocations amid negative rates.”

Threats

- Stan Druckenmiller, who compounded money at an annualized rate of return of 30 percent during his 25 years as a hedge fund manager, is warning investors, reports ZeroHedge. Druckenmiller believes the U.S. is heading for disaster. “When I look at the current picture of expected tax revenues combined with benefits promised to future generations, this is the most unsustainable situation I have seen ever in my career,” he states. JP Morgan has also expressed its doubt on the U.S. equity market in particular, adding that central banks can no longer save the day.

- The Federal Reserve announced Friday that it will hold a closed meeting on Monday April 11, with speculators stating the Fed will likely discuss the possibility of negative interest rates. The closed meeting will be held “under expedited procedures” during which the Board of Governors will review and determine advance and discount rates charged by the Fed banks, reports ZeroHedge. The last time the Fed held such a meeting they raised rates a month later in December 2015.

- The White House is pushing investors toward government accounts and out of private investment accounts, writes the Wall Street Journal, and President Obama’s regulators aren’t slowing down. The article explains that the Department of Labor says its so-called fiduciary rule will make financial advisers act in the best interest of clients. Continuing that what the rule fails to mention is that it carries an “enormous potential legal liability and demands such a high standard of care that many advisers will shun non-affluent accounts.” Perhaps the government would like to collect those management fees from retirement accounts versus the private sector. They have a wealth of experience managing Social Security assets.

Energy and Natural Resources Market

Strengths

- Oil prices posted their best week since March 4, with WTI rallying 7.4 percent. A surprise drop in inventories of U.S. crude, along with more chatter about the April 17 meeting in Doha, lifted sentiment.

- The best performing sector for the week was the NYSE Arca Gold Miners Index. The index of gold producers rose 6.4 percent for the week, supported by gold’s first weekly gain in a month after the International Monetary Fund (IMF) warned of risks to global growth.

- The best performing stock for the week in the broader natural resource space was Klondex Mines. The miner, with operations concentrated in Nevada, rose 13.4 percent for the week. The company announced it discovered new targets to the east of the main deposits, which, if confirmed, could extend the mineralization of the high-grade deposit.

Weaknesses

- Gasoline inventories posted a surprise build for the week, leading the refiner complex to underperform the broader energy space. The build came as a result of significantly higher utilization rates, together with an increase in imports.

- The worst performing sector for the week was the TSX Diversified Metals and Mining Index. The index of predominantly base metals miners dropped 5.8 percent for the week on the back of falling copper prices and fears that China may boost its exports of the metal, adding to the existing supply glut.

- The worst performing stock for the week in the S&P Global Natural Resources Index was Glencore. The copper miner and trader dropped 9.3 percent as sentiment toward copper waned.

Opportunities

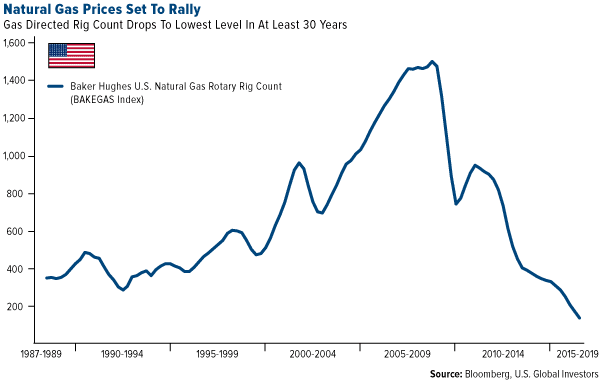

- Natural gas prices may rally and could double by next year, according to Arthur Berman, an industry consultant. The Energy Information Administration forecasts that the market could return to a deficit in the fourth quarter of 2016 as supply growth collapses. As the chart below shows, gas-directed rigs have collapsed to the lowest level since the data collection began in 1987, indicating that future supply growth will be challenged.

click to enlarge

- Iron ore prices may rally through 2021, even as China curtails steel capacity. Australia’s Department of Industry, Innovation & Science expects the country’s low-cost producers, together with Brazil’s Vale, will claim a greater share of global trade and boost prices as higher cost operations close down.

- Increasing demand from meatpackers sends cattle prices to their best performance in seven weeks. Rising demand has been met with falling supply as USDA data shows wholesale beef headed for a third consecutive weekly drop.

Threats

- Despite China’s Composite PMI rebounding strongly in March, Cornerstone Macro warns not to get too exuberant about the global economy. In China, employment activity fell to its lowest since 2009, which may hamper its ability to meet ambitious consumption growth targets.

- Copper dropped this week on rumors that excess inventory in China may result in a boost of refined product exports. A Reuters report polled four copper traders, all of which expect China to raise its copper exports in the next few months.

- BNP warns that crude may revisit its year lows. The bank’s analysts argue that Iran will not accept a freeze of its output until such time that lost market share, due to U.S. and EU sanctions, is reclaimed. Iran lowered its price for exports to Asia, in a clear attempt to regain market share by pricing its product at a discount to competing Saudi crude.

China Region

Strengths

- Malaysia was the best performing country this week, gaining 46 basis points. Foreign holdings of Malaysia’s sovereign and corporate bonds rose by 5.3 percent to 226.6 billion ringgit ($58 billion) in March, the biggest increase since May 2014, according to central bank data released on Thursday. Overseas investors boosted ownership of government debt by 5.7 percent to a record 186.7 billion ringgit.

- The Indonesian rupiah was the best performing currency this week, gaining 35 basis points against the dollar. The central bank has lowered rates at three consecutive meetings and signaled it may pause its monetary policy easing cycle.

- The financial sector was the best performing sector this week.

Weaknesses

- Thailand was the worst performing market this week, losing 2 percent. Consumer confidence may remain on a downtrend for the next three months because of drought and the weak global economy, University of the Thai Chamber of Commerce Economist Thanavath Phonvichai says.

- Malaysian ringgit was the worst performing currency this week, losing 32 basis points against the dollar and erasing gains from the prior week. The Australia and New Zealand Banking Group Limited said that the likelihood of the central bank lowering the rate in future has increased due to growing headwinds for growth and curbed inflation that will peak in the first half of 2016.

- The consumer staples sector was the worst performing sector this week.

Opportunities

- During a Bloomberg New Energy Finance Summit this week, U.S. Secretary of State John Kerry discussed how emerging economies like India, China and Brazil invested more in renewable technologies last year than the developed world, according to the Economic Times. “Over the past decade, the global renewable energy market has expanded more than six fold,” stated Kerry. “Last year, investment in renewable energy was at an all-time high – nearly $330 billion.”

- Chinese Premier Li Keqiang stated on state television Friday that the overall economic situation in the country was better than expected in the first quarter, and that he is confident the government would be able to maintain medium-to-high speed economic growth despite difficulties, reports Reuters. The Chinese government is set to release key economic data next week, which includes first-quarter economic growth.

- According to a statement from Chinese Premier Li Keqiang, the government will significantly relax restrictions on entry into markets such as electricity, telecommunications, transport, petroleum, natural gas, and municipal public utilities, remove hidden barriers, and encourage private companies to increase investment in these areas and participate in state-owned enterprise reform.

Threats

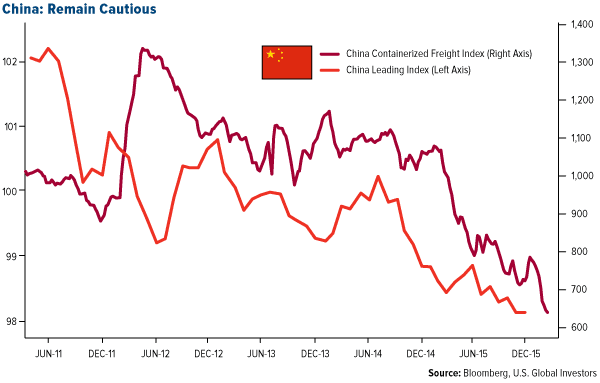

- As seen in the chart, China’s container freight index – the price to ship containers – continues to plunge, indicating little amelioration in global non-commodities trade. The tight correlation between China’s container freight index and the country’s leading index is a cause for concern about the economic outlook.

click to enlarge

- China, whose stockpiles of copper are near record highs, could be unleashing some of the metal to the global market, reports Reuters. According to the article, if higher exports materialize, this will be a major jolt to copper producers and investors across the world. This would also be a further sign of the country’s economy struggling against headwinds.

- China’s working age population is declining, reports the Wall Street Journal, which could have serious consequences for the Asian nation. According to China’s National Bureau of Statistics, the number of workers aged 16 to 59 dropped by a record 4.87 million in 2015, down from the previous year’s drop of 3.71 million. Larry Hu, leader of a Macquarie research team, stated that “China’s working age population has peaked and is set to decline, which will weigh on China’s long-term potential growth rate.”

Emerging Europe

Strengths

- Russia was the best performing country this week, gaining 1.1 percent. The Composite purchasing managers’ index (PMI) data for March was reported at 50.8 versus the prior reading of 50.6, while inflation unexpectedly declined. Brent crude oil gained 8 percent, closing above $40 per barrel.

- The Ukrainian hryvnia was the best performing currency this week, gaining 1.7 percent against the U.S. dollar. Inflation in Ukraine dropped to 20.9 percent, the lowest level in a year-and-a-half. The Central Bank of Ukraine’s target inflation is at 12 percent this year.

- The health care sector was the best performing sector among Eastern European markets this week.

Weaknesses

- Poland was the worst performing country this week, losing 2 percent. The Warsaw Stock Exchange sold off after strong appreciation during the prior week. The Central Bank of Poland left its main interest rate unchanged at 1.5 percent.

- The Turkish lira was the worst performing currency this week, losing 92 basis points against the U.S. dollar. The lira sold off after Moody’s Credit Rating Agency said the Turkish banks’ outlook is negative. Moody’s rates Turkey at Baa3 with a negative outlook. New Moody’s ratings will be announced after the close on Friday.

- The utility sector was the worst performing sector among Eastern European markets this week.

Opportunities

- The first review of Greece’s bailout program could be completed by the end of April or early May, which would allow Greece to receive another tranche of rescue programs, up to 86 billion euros (or $98 billion). The IMF’s managing director Christine Lagards said that the Washington-based lender is determined to help Greece, but that the country needs to implement reforms to make this possible. In terms of reforms, the Greek government is considering increasing indirect taxes on gasoline, natural gas, cigarettes, tax-pay TV, Internet and mobile usage, along with a possible tax levy on bank checks.

- Eastern European countries once governed by Communists provide both cheap labor and highly skilled employees. Figures released by the European Union’s statistic agency show Hungarians earned just 5.8 euros for an hour of work, Polish workers earned 7 euros, and Czech workers earned 7.2 euros (while the average EU hourly wage was calculated at 19 euros). Workers in Norway make as much as 41.9 euros per hour of labor, while Bulgarian counterparts were listed as the smallest earners at 3.4 euros.

- Russian inflation for March was reported at 7.3 percent, better than expected due to weaker consumer demand. The Central Bank of Russia will meet on April 29, and will decide whether to leave rates unchanged or to cut. Some analysts believe that it is too early for Russia to cut rates.

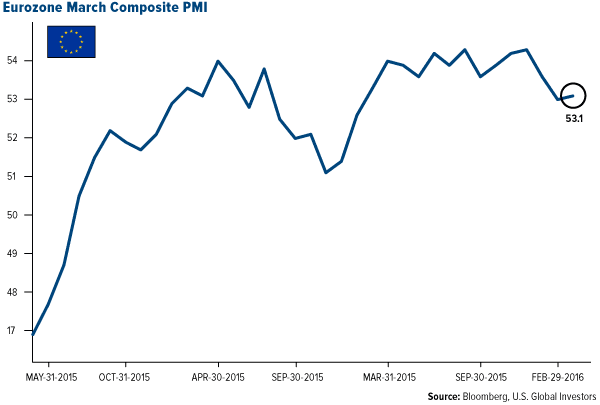

Threats

- The eurozone economy grew at a weaker pace in March than first indicated by a survey of purchasing managers. The final Markit Composite PMI was reported at 53.1 versus prior 53.7. In March the European Central Bank (ECB) announced a package of new measures to revive the economy and push inflation higher to its target of 2 percent. However, the central bank said it still expects inflation to be only 0.1 percent this year.

click to enlarge

- According to World Bank, Russia’s economic recovery will take longer than previously forecast, and an early end to sanctions would provide only a “limited and short-lived” boost to growth. The economy of the world’s largest energy exporter will shrink 1.9 percent this year versus prior forecasted contraction of 0.7 percent. If sanctions end, Russia will grow at 2 percent in 2017.

- Dutch voters rejected a European Union trade deal with Ukraine in referendum on Wednesday. The deal deepens economic and political ties with the former Soviet Republic and it has been ratified by the EU’s 27 other member states. The results of a “no” vote could provide a boost to the exit camp in the United Kingdom, which is holding a much bigger referendum on EU membership in June.

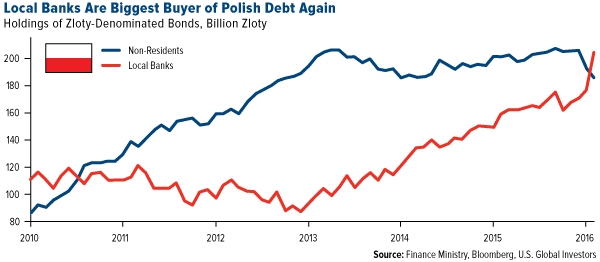

- Foreign investors have been selling zloty bonds and now local investors are the biggest owners for the first time since 2010, boosting holdings by 29 billion zloty ($8.7 billion) in February. The local banks have stepped up their purchases as bonds are excluded from the bank asset tax. Poland’s attractiveness to foreign investors was affected by Standard & Poor’s first credit rating cut in January, along with Moody’s rating agency stating that the Polish constitutional crisis is credit negative. Moody’s now rates Poland an A- with a stable outlook.

click to enlarge

Leaders and Laggards

| Index | Close | Weekly Change($) |

Weekly Change(%) |

|---|---|---|---|

| DJIA | 17,576.96 | -215.79 | -1.21% |

| S&P 500 | 2,047.60 | -25.18 | -1.21% |

| S&P Energy | 466.03 | +10.03 | +2.20% |

| S&P Basic Materials | 280.54 | -3.20 | -1.13% |

| Nasdaq | 4,850.69 | -63.85 | -1.30% |

| Russell 2000 | 1,097.31 | -20.37 | -1.82% |

| Hang Seng Composite Index | 2,794.95 | -13.92 | -0.50% |

| Korean KOSPI Index | 1,972.05 | -1.52 | -0.08% |

| S&P/TSX Canadian Gold Index | 197.24 | +13.23 | +7.19% |

| XAU | 74.02 | +4.30 | +6.17% |

| Gold Futures | 1,241.70 | +18.20 | +1.49% |

| Oil Futures | 39.53 | +2.74 | +7.45% |

| Natural Gas Futures | 1.99 | +0.03 | +1.58% |

| 10-Yr Treasury Bond | 1.72 | -0.05 | -3.11% |

| Index | Close | Monthly Change($) |

Monthly Change(%) |

|---|---|---|---|

| DJIA | 17,576.96 | +576.60 | +3.39% |

| S&P 500 | 2,047.60 | +58.34 | +2.93% |

| S&P Energy | 466.03 | +14.33 | +3.17% |

| S&P Basic Materials | 280.54 | +8.34 | +3.06% |

| Nasdaq | 4,850.69 | +176.31 | +3.77% |

| Russell 2000 | 1,097.31 | +24.55 | +2.29% |

| Hang Seng Composite Index | 2,794.95 | +75.23 | +2.77% |

| Korean KOSPI Index | 1,972.05 | +19.10 | +0.98% |

| S&P/TSX Canadian Gold Index | 197.24 | +16.15 | +8.92% |

| XAU | 74.02 | +7.42 | +11.14% |

| Gold Futures | 1,241.70 | -16.80 | -1.33% |

| Oil Futures | 39.53 | +1.24 | +3.24% |

| Natural Gas Futures | 1.99 | +0.24 | +13.41% |

| 10-Yr Treasury Bond | 1.72 | -0.16 | -8.58% |

| Index | Close | Quarterly Change($) |

Quarterly Change(%) |

|---|---|---|---|

| DJIA | 17,576.96 | +1,230.51 | +7.53% |

| S&P 500 | 2,047.60 | +125.57 | +6.53% |

| S&P Energy | 466.03 | +48.26 | +11.55% |

| S&P Basic Materials | 280.54 | +28.31 | +11.22% |

| Nasdaq | 4,850.69 | +207.06 | +4.46% |

| Russell 2000 | 1,097.31 | +51.11 | +4.89% |

| Hang Seng Composite Index | 2,794.95 | -11.76 | -0.42% |

| Korean KOSPI Index | 1,972.05 | +54.43 | +2.84% |

| S&P/TSX Canadian Gold Index | 197.24 | +55.51 | +39.17% |

| XAU | 74.02 | +26.92 | +57.15% |

| Gold Futures | 1,241.70 | +142.50 | +12.96% |

| Oil Futures | 39.53 | +6.37 | +19.21% |

| Natural Gas Futures | 1.99 | -0.49 | -19.62% |

| 10-Yr Treasury Bond | 1.72 | -0.40 | -18.90% |

U.S. Global Investors, Inc. is an investment adviser registered with the Securities and Exchange Commission (“SEC”). This does not mean that we are sponsored, recommended, or approved by the SEC, or that our abilities or qualifications in any respect have been passed upon by the SEC or any officer of the SEC.

This commentary should not be considered a solicitation or offering of any investment product.

Certain materials in this commentary may contain dated information. The information provided was current at the time of publication.

Some links above may be directed to third-party websites. U.S. Global Investors does not endorse all information supplied by these websites and is not responsible for their content.

All opinions expressed and data provided are subject to change without notice. Some of these opinions may not be appropriate to every investor.

Holdings are reported as of the most recent quarter-end. The following securities mentioned in the article were held by one or more accounts managed by U.S. Global Investors as of 12/31/2015:

Alaska Airlines

American Airlines Group

Baker Hughes Inc.

Boeing Co/The

Eastmain Resources Inc.

Eldorado Gold Corp.

Delta Airlines Inc.

Integra Gold Corp.

Klondex Mines Ltd.

Newmarket Gold Inc.

Pfizer Inc.

Southwest Airlines Co

United Continental Holdings

Virgin America

The Dow Jones Industrial Average is a price-weighted average of 30 blue chip stocks that are generally leaders in their industry.

The S&P 500 Stock Index is a widely recognized capitalization-weighted index of 500 common stock prices in U.S. companies.

The Nasdaq Composite Index is a capitalization-weighted index of all Nasdaq National Market and SmallCap stocks.

The Russell 2000 Index® is a U.S. equity index measuring the performance of the 2,000 smallest companies in the Russell 3000®, a widely recognized small-cap index.

The Hang Seng Composite Index is a market capitalization-weighted index that comprises the top 200 companies listed on Stock Exchange of Hong Kong, based on average market cap for the 12 months.

The Taiwan Stock Exchange Index is a capitalization-weighted index of all listed common shares traded on the Taiwan Stock Exchange.

The Korea Stock Price Index is a capitalization-weighted index of all common shares and preferred shares on the Korean Stock Exchanges.

The Philadelphia Stock Exchange Gold and Silver Index (XAU) is a capitalization-weighted index that includes the leading companies involved in the mining of gold and silver.

The U.S. Trade Weighted Dollar Index provides a general indication of the international value of the U.S. dollar.

The S&P/TSX Canadian Gold Capped Sector Index is a modified capitalization-weighted index, whose equity weights are capped 25 percent and index constituents are derived from a subset stock pool of S&P/TSX Composite Index stocks.

The S&P 500 Energy Index is a capitalization-weighted index that tracks the companies in the energy sector as a subset of the S&P 500.

The S&P 500 Materials Index is a capitalization-weighted index that tracks the companies in the material sector as a subset of the S&P 500.

The S&P 500 Financials Index is a capitalization-weighted index. The index was developed with a base level of 10 for the 1941-43 base period.

The S&P 500 Industrials Index is a Materials Index is a capitalization-weighted index that tracks the companies in the industrial sector as a subset of the S&P 500.

The S&P 500 Consumer Discretionary Index is a capitalization-weighted index that tracks the companies in the consumer discretionary sector as a subset of the S&P 500.

The S&P 500 Information Technology Index is a capitalization-weighted index that tracks the companies in the information technology sector as a subset of the S&P 500.

The S&P 500 Consumer Staples Index is a Materials Index is a capitalization-weighted index that tracks the companies in the consumer staples sector as a subset of the S&P 500.

The S&P 500 Utilities Index is a capitalization-weighted index that tracks the companies in the utilities sector as a subset of the S&P 500.

The S&P 500 Healthcare Index is a capitalization-weighted index that tracks the companies in the healthcare sector as a subset of the S&P 500.

The S&P 500 Telecom Index is a Materials Index is a capitalization-weighted index that tracks the companies in the telecom sector as a subset of the S&P 500.

The NYSE Arca Gold Miners Index is a modified market capitalization weighted index comprised of publicly traded companies involved primarily in the mining for gold and silver.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns.

The Purchasing Manager’s Index is an indicator of the economic health of the manufacturing sector. The PMI index is based on five major indicators: new orders, inventory levels, production, supplier deliveries and the employment environment.

The S&P/TSX Venture Composite Index is a broad market indicator for the Canadian venture capital market. The index is market capitalization weighted and, at its inception, included 531 companies. A quarterly revision process is used to remove companies that comprise less than 0.05% of the weight of the index, and add companies whose weight, when included, will be greater than 0.05% of the index.

The Markit Eurozone PMI Composite Index tracks business trends across both the manufacturing and service sectors, based on data collected from a representative panel of over 5,000 companies.

The (China) Leading Index is a joint development between The China Economic Monitoring Centre (CEMAC/NBS) and Goldman Sachs Asia (GS) for the monitoring of national economic performance. The components of the Index include: Industrial production, investment in fixed assets, retail sales, imports and exports, revenues, profits of industry, residential disposable income, financial loans, M2 money supply, CPI and the business cycle signal index.

The China Containerized Freight Index, sponsored by the Ministry of Communications of PRC and formulated by Shanghai Shipping Exchange, serves as the barometer of the shipping market and thus is widely applied to meet the demand of China’s fast-developing container transport market.

The Baker Hughes Rig Counts are an important business barometer for the drilling industry and its suppliers. When drilling rigs are active they consume products and services produced by the oil service industry. The active rig count acts as a leading indicator of demand for products used in drilling, completing, producing and processing hydrocarbons. Close

There is no guarantee that the issuers of any securities will declare dividends in the future or that, if declared, will remain at current levels or increase over time.

The ISM Nonmanufacturing index based on surveys of more than 400 non-manufacturing firms’ purchasing and supply executives, within 60 sectors across the nation, by the Institute of Supply Management (ISM). The ISM Non-Manufacturing Index tracks economic data, like the ISM Non-Manufacturing Business Activity Index. A composite diffusion index is created based on the data from these surveys that monitors economic conditions of the nation.

The S&P Global Natural Resources Index includes 90 of the largest publicly-traded companies in natural resources and commodities businesses that meet specific investability requirements, offering investors diversified, liquid and investable equity exposure across 3 primary commodity-related sectors: Agribusiness, Energy, and Metals & Mining.

S&P/TSX Capped Diversified Metals and Mining Index is an index of companies engaged in diversified production or extraction of metals and minerals.

Free Cash Flow (FCF) represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base.

The Consumer Price Index (CPI) is one of the most widely recognized price measures for tracking the price of a market basket of goods and services purchased by individuals. The weights of components are based on consumer spending patterns.