Investor asks Delaware court to block adoption of Masimo’s new bylaws

Politan Capital Management LP, an activist fund run by Elliott Management veteran Quentin Koffey, filed a 13D/A form with the SEC disclosing a Delaware lawsuit to block changes to Masimo Corp.’s bylaws.

Politan reported an unchanged 8.8% Masimo (NASDAQ:MASI) stake.

Q3 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Politan's Complaint Against Masimo

In the Oct. 21 filing, Politan said, "filed a Verified Complaint in the Delaware Court of Chancery against Masimo and its board seeking relief to (i) declare certain bylaw amendments unenforceable, (ii) find that the Director Defendants breached their fiduciary duties, (iii) invalidate certain change of control provisions in the Chief Executive Officer Kiani's employment agreement.

And (iv) permanently enjoin the company and board and its board from taking any actions to prevent Politan from exercising its rights in accordance with the company's prior corporate bylaws to nominate directors, as more fully described in the complaint."

What are other large shareholders doing?

BlackRock Inc. holds 5,775,228 shares representing 10.99% ownership of the company. In its prior filing, the firm reported owning 6,875,547 shares, representing a decrease of 19.05%. The firm decreased its portfolio allocation in MASI by 10.20% over the last quarter.

Vanguard Group Inc holds 4,918,892 shares representing 9.36% ownership of the company. The firm reported owning 4,775,660 shares in its prior filing, representing an increase of 2.91%. The firm decreased its portfolio allocation in MASI by 77.02% over the last quarter.

Fmr Llc holds 2,104,939 shares representing 4.01% ownership of the company. In its prior filing, the firm reported owning 2,069,501 shares, representing an increase of 1.68%. The firm decreased its portfolio allocation in MASI by 77.46% over the last quarter.

Nomura Holdings Inc holds 1,786,307 shares representing 3.40% ownership of the company. In its prior filing, the firm reported owning 0 shares, representing an increase of 100.00%.

State Street Corp holds 1,690,514 shares representing 3.22% ownership of the company. In its prior filing, the firm reported owning 1,730,991 shares, representing a decrease of 2.39%. The firm increased its portfolio allocation in MASI by 6.25% over the last quarter.

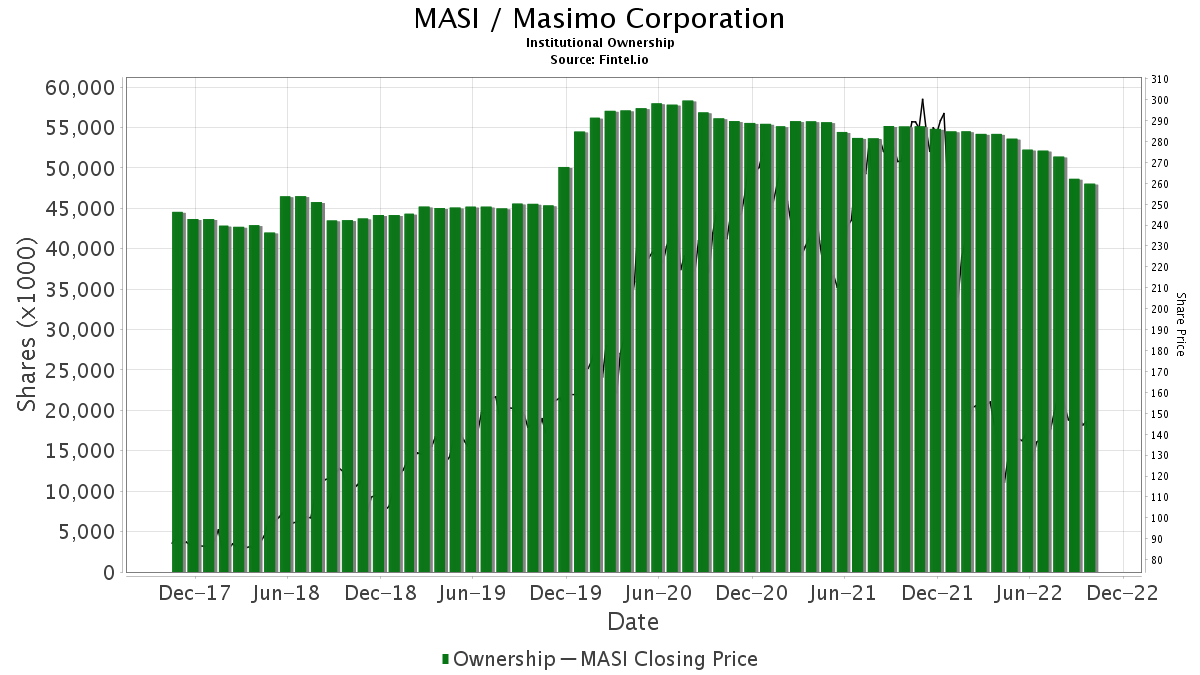

What is the overall institutional sentiment?

There are 913 funds or institutions reporting positions in Masimo Corporation. This is a decrease of 87 owner(s) or 8.70%.

The average portfolio weight of all funds dedicated to Masimo Corporation is 0.1770%, a decrease of 21.4499%. Total shares owned by institutions decreased in the last three months by 7.64% to 48,048,593 shares.

Based on this information, institutional sentiment is bearish.

Article by Fintel