- A more aggressive IRS will drive the adoption of cryptocurrencies

- Middle-class taxpayers likely to feel the impact of larger IRS most

Q3 2021 hedge fund letters, conferences and more

No To A Larger IRS

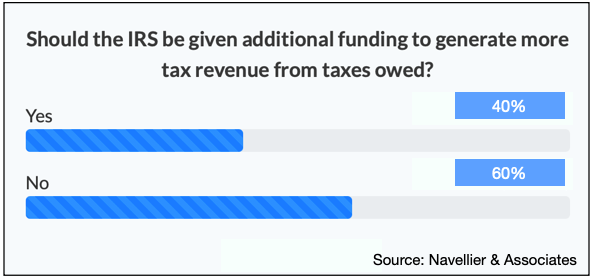

A survey by money manager Navellier & Associates found that a majority of retail investors do not favor additional funding for the Internal Revenue Service (IRS) to collect more of the taxes that are owed by taxpayers.

When asked the question: Should the IRS be given additional funding to generate more tax revenue from taxes owed? 60% said no and 40% said yes.

Of those against more funding for the IRS, a common concern was harassment of small businesses, and that additional funding would result in the polarization of the agency.

One respondent against new funding said: “More funding, especially the 85,000 new auditors just enables the IRS to harass more small businesspeople and political rivals.”

One respondent in favor of new funding said: “Owed is owed and the lack of ability to collect it doesn’t change that.”

Building Up The IRS Will Drive Taxpayers Toward Cryptocurrencies

Louis Navellier, chief investment officer of Navellier & Associates said, despite the noble aims of the initiative, the impact of building up the Internal Revenue Service will likely drive more taxpayers toward cryptocurrencies because it will enable them to become less visible to IRS agents.

“Ultimately,” he said, “A larger Internal Revenue Service could be the most effective catalyst for the adoption of cryptocurrencies so far.”

He added, “The adoption of cryptocurrencies may not be restricted to high-income earners. The middle class, who participate more regularly in the cash economy, are likely to embrace the anonymity that cryptocurrencies offer.” Further, the middle class, which participates more widely in the cash economy than high-income earners are more likely to feel the presence of new IRS agents.