Excerpted from Stanphyl Capital’s October 2020 letter to investors, discussing that there is no China growth story for Tesla.

Q3 2020 hedge fund letters, conferences and more

We remain short the biggest bubble in modern stock market history, Tesla Inc. (TSLA), which currently has a fully diluted market cap of approximately $429 billion, which is nearly 90% of those of Toyota, VW, GM, Daimler, BMW and Ford combined despite unprofitably selling fewer than 500,000 cars a year to their nearly 40 million. The core points of our Tesla short thesis are:

- Tesla has no “moat” of any kind; i.e., nothing meaningfully proprietary in terms of electric car technology, while existing automakers—unlike Tesla—have a decades-long “experience moat” of knowing how to mass-produce, distribute and service high-quality cars consistently and profitably, as well as the ability to subsidize losses on electric cars with profits from their conventional cars.

- Excluding sunsetting emission credit sales, in 2020 Tesla will again lose money, as it has every year in its 17-year existence.

- Unit demand for Tesla’s cars is only maintained via continual price cutting.

- Elon Musk is a pathological liar who under the terms of his SEC settlement cannot deny having committed securities fraud.

Tesla's Q3 Results

Tesla reported Q3 results in October, and excluding $397 million of pure-profit emission credit sales (an income stream that begins shrinking imminently, then likely disappears after next year when other automakers have enough EVs of their own) and a $43 million one-time D&O insurance payment received to compensate the company for its directors’ complicity in the self-dealing SolarCity buyout, Tesla would have reported just $77 million in pre-tax income attributable to common stockholders for Q3 2020.

However, Tesla’s Q3 warranty provision was only $175 million for 129,579 non-leased cars, which is just $1350/car despite a long history of replacing motors, battery packs and suspensions under warranty (often fraudulently reclassified as “customer goodwill repairs”) as its cars age, plus repaintings, etc. due to their poor build quality. If Tesla’s warranty provision were a more honest $3000/car it would have meant an additional $214 million hit to Q3 gross margin, lowering pre-tax income to negative $137 million. Indeed, warranty provisioning is perhaps Tesla’s most fraudulent accounting maneuver.

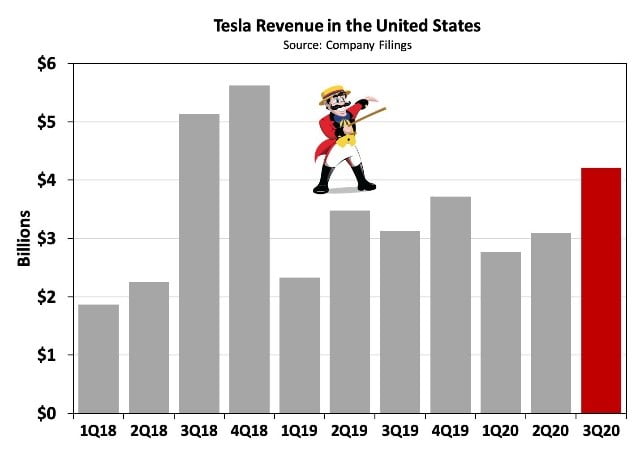

In fairness to Tesla though, Q3 had a non-repeating compensation expense of $338 million for Elon Musk’s egregious pay package, so let’s add that back to pre-tax income and call Tesla’s Q3 “honest & normalized pre-tax GAAP income” -$137 million + $338 million = $201 million. If we then adjust that for a typical 28% tax rate we get an estimated $145 million in after-tax GAAP income, which is an annualized rate of $0.53/share. Thus, at October’s closing price of $388/share Tesla has a normalized GAAP run-rate PE ratio of 732 vs. a PE of around 10x for the rest of the auto industry, despite year-over-year declining Tesla deliveries in Europe (in an electric car market that grew approximately 100% during that same period!) and U.S. revenue that’s lower now than it was two years ago:

Tesla's China Growth Story

What about Tesla’s “China growth story”? Tesla’s monthly China deliveries haven’t grown since May despite massive price cutting, plenty of excess production capacity and an overall fast-growing EV market. Here are Tesla’s sales in China for the last 5 months:

May: 11,565

June: 14,976

July: 11,456

August: 11,811

September: 11,329

Where is the growth???

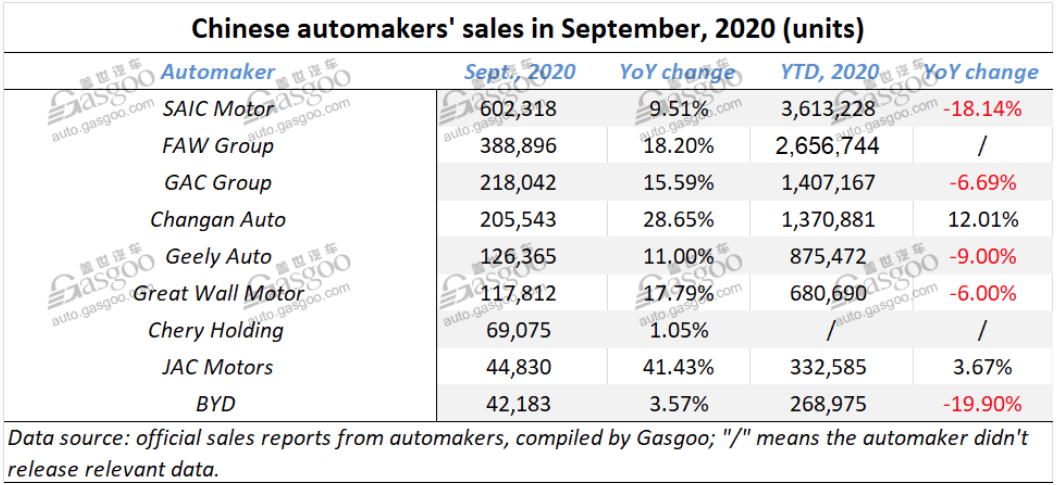

In Q3 Tesla sold only around 34,000 cars in China vs. its claimed manufacturing capacity of over 60,000 (for perspective, GM sold 771,000 and Ford sold 164,000!) and has so much excess capacity that it’s now exporting to Europe (another negative-growth Tesla market)! In September Tesla sold just 11,329 cars in China; lets see how everyone else did:

And China’s EV competitive landscape is about to get vicious thanks to rapidly increasing sales from local brands and massive commitments from foreign OEMs.

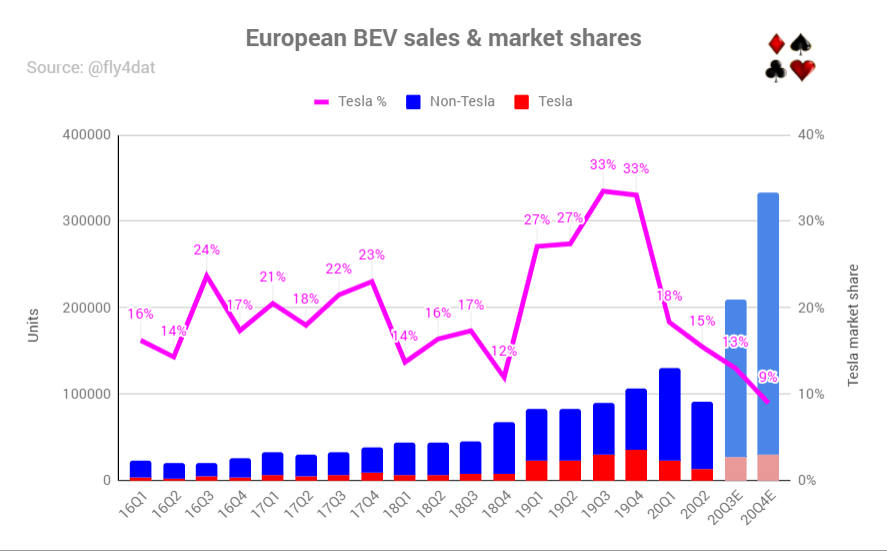

And for those of you who still think Tesla “is years ahead of the competition,” the most competitive EV region in the world is Europe, and in addition to Tesla’s outright year-over-year Q3 sales decline there, its European EV market share has dropped from over 30% to an estimated 9% (and in 2021 will be much lower). Courtesy of Twitter user @fly4dat, here’s a great chart showing that:

The Slim Profits Will Disappear

Thanks to continual price cutting Tesla delivered 139,000 cars in Q3, well short of the company’s self-proclaimed new current quarterly production capacity of 210,000. In fact if we consider Q2 to be the “COVID quarter” and Q3 to be the “make-up quarter,” averaging the two to 115,000 each means that despite massive price-cutting Tesla has barely grown from the 112,000 cars it delivered in Q4 2019, and as it’s forced to continue cutting prices its slim profits will disappear with its emission credit revenue.

Nothing is more amusing than seeing this giant stock promotion of a company try to perpetuate the illusion of being “supply constrained” by continuing to add capacity (expanding its Chinese factory while breaking ground on new factories in Texas and Germany) in order to desperately try to maintain an image of “limitless demand” while it continually slashes prices just to utilize far less than its existing capacity. Tesla’s “plan” is now obvious: keep slashing prices to move as much volume as possible while maintaining razor-thin profitability. But what’s the end game? If Tesla stops cutting prices volume will collapse. Tesla is no longer “a growth story”—it’s a nearly-profitless stock promotion for idiots!

As for Tesla’s newest “hope,” the Model Y, its quality is awful and it faces current (or imminent) competition from the much better built electric Audi Q4 e-tron and Q4 e-tron Sportback, BMW iX3, Mercedes EQB, Volvo XC40 Recharge, Volkswagen ID.4, Ford Mustang Mach E and Nissan Ariya, as well as the less expensive yet excellent all-electric Hyundai Kona and Kia Niro. Meanwhile, Tesla’s Model 3 now has terrific direct “sedan competition” from Volvo’s beautiful new Polestar 2 and the premium version of Volkswagen’s ID.3 (in Europe), and in 2021 from the BMW i4.

Cyberktruck Won't Be Much Of "Growth Engine"

And oh, the joke of a “pickup truck” Tesla previewed last year won’t be much of “growth engine” either, as it will enter a dogfight of a market.

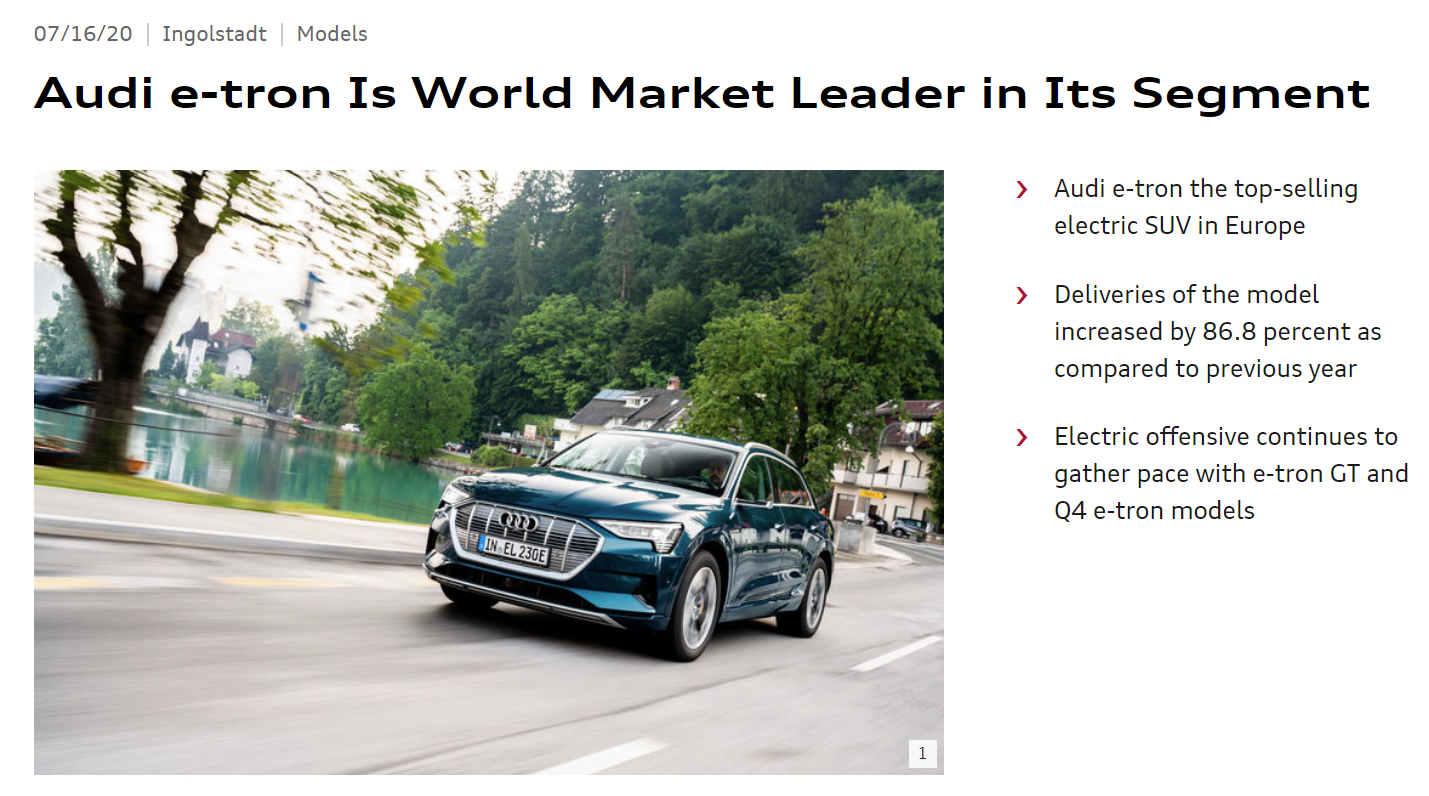

And in the high-end segment worldwide, the Audi eTron now outsells either of Tesla’s offerings (the Model S and the Model X)…

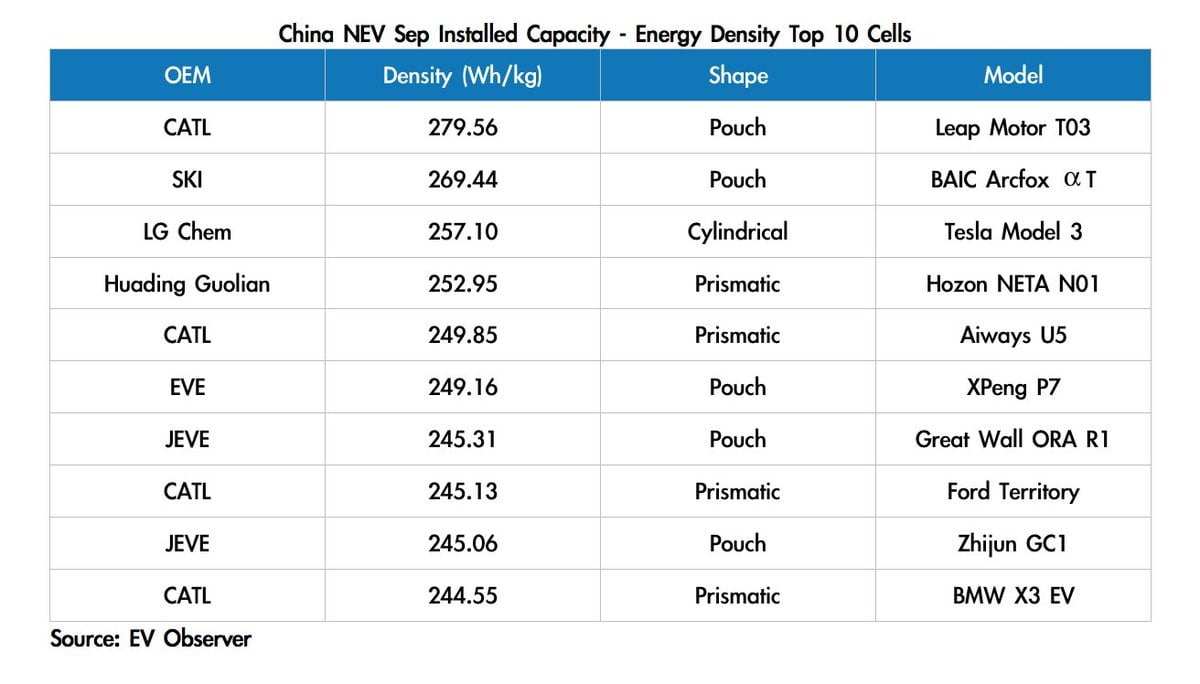

As for batteries, Tesla has nothing proprietary—it doesn’t make them, it buys them, and although the performance of all batteries is now so close as to be indistinguishable by the consumer, in China it isn’t even buying the best ones available:

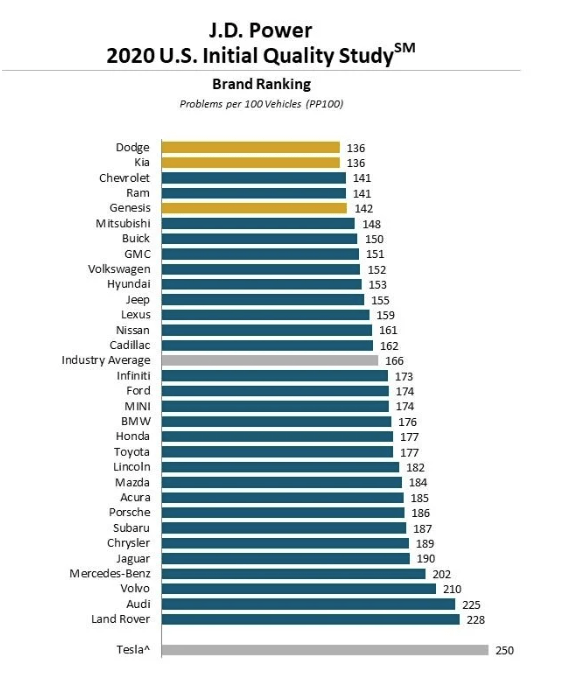

Meanwhile, Tesla initial quality is ranked dead last among 31 brands J.D. Power surveyed…

…while the latest What Car? survey shows similar results with Tesla finishing #29 out of 31.

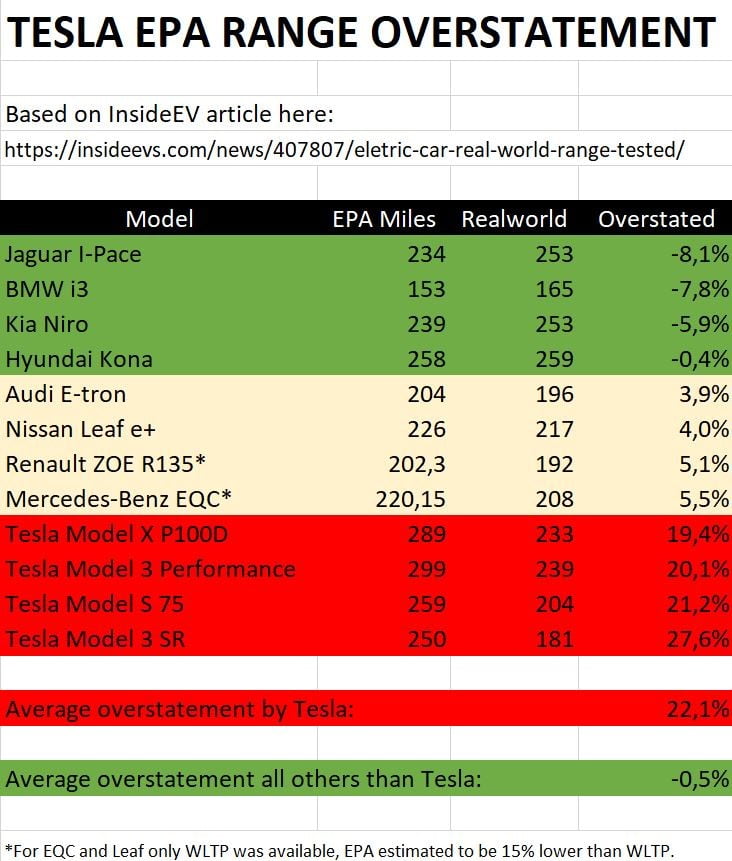

And here’s a great graphic from @clausMller17 showing Tesla’s blatantly fraudulent range claims:

Regarding safety, Tesla has been hit with at least one well-documented sudden acceleration class action lawsuit and for years knowingly sold cars that it knew were a fire hazard. And of course it continues to sell and promote its hugely dangerous so-called “Autopilot” system, which Consumer Reports has completely eviscerated; God only knows how many more people this monstrosity unleashed on public roads will kill, despite the NTSB condemning it as dangerous. In fact, Teslas have far more pro rata (i.e., relative to the number sold) deadly incidents than other comparable new luxury cars; here’s a link to those that have been made public. In other words, when it comes to the safety of customers and innocent bystanders, Tesla is truly one of the most vile companies on Earth. Meanwhile the number of lawsuits of all types against the company continues to escalate, including one proving blatant fraud by Musk in the SolarCity buyout. (If you want to be really entertained, read his deposition!)

Finally, Tesla has the most executive departures I’ve ever seen from any company; here’s the astounding full list of escapees. These people aren’t leaving because things are going great (or even passably) at Tesla; rather, they’re likely leaving because Musk is either an outright crook or the world’s biggest jerk to work for (or both).

So here is Tesla’s competition in cars

(note: these links are regularly updated)…

- Porsche Taycan

- Porsche Taycan Cross Turismo

- Porsche Macan EV to get Taycan platform and tech

- Volkswagen ID.3 Headlines VW's Electrified Future

- Volkswagen ID.4 electric SUV revealed with up to 323 miles of range

- Volkswagen ID.6 SUV spied testing in the Alps

- VW Group's first hot compact EV to be launched by Cupra brand

- VW Group to launch 70 pure electric cars over the next decade

- Audi e-tron: Electric Has Gone Audi

- Audi e-tron Sportback Whispers Electric Luxury

- Audi RS e-tron GT electric supercar to boast around 700bhp

- Audi Q4 e-tron Will Be the Cheapest Electric Audi

- Audi adding Sportback version of 2021 Q4 e-tron

- Audi TT set to morph into all-electric crossover

- Jaguar i-Pace Is Available Now

- Jaguar Land Rover to invest £1bn in three new UK-built EVs

- Mercedes EQS Electric Luxury Sedan Comes to the U.S. Summer 2021

- Mercedes EQC electric SUV available now in Europe & China and late 2021 in the U.S.

- Mercedes-Benz Launches the EQV, its First Fully-Electric Passenger Van

- Mercedes EQA electric SUV previewed in exclusive images

- Mercedes EQB Small SUV to boost brand's electric line-up

- 2022 Mercedes EQE electric saloon to rival Tesla Model S

- Volvo Polestar 2 Is Available Now

- Polestar 3 will be an electric SUV that shares its all-new platform with next Volvo XC90

- Volvo XC40 Recharge, a 408-HP Electric SUV comes in 2020

- Volvo confirms electric version of next XC90

- GM’s electric Hummer

- GM’s Bolt

- GM Will Have Twelve Electric Vehicles Soon

- Electric Ford Mustang Mach-E Available Late 2021

- The Electric Ford F-150 Will Be Here by Mid-2022

- Ford to build two European EVs based on VW’s MEB platform

- Hyundai Kona Electric: 258-mile range & under $38,000 before subsidies

- Hyundai set to turn Ioniq name into a global EV brand

- Genesis Electric Luxury SUV Coming in 2022

- Kia Niro Electric: 239-mile range & $39,000 before subsidies

- Kia Soul Electric: 243-mile range

- New 2021 electric Kia SUV to offer Porsche Taycan pace with 0-62mph in 3s

- Nissan vows to hop back on EV podium with Ariya

- Nissan LEAF e+ with 226-mile range is available now

- BMW leads off EV offensive with iX3

- Electric BMW iX1 SUV set for production

- The BMW i4 EV Will Be the Most Powerful 4-Series

- BMW iX (iNEXT) electric SUV comes in 2021 in three flavors, from 300 to 600 HP

- Rivian electric pickup truck- funded by Amazon, Ford, Cox & others- is on the way

- Renault upgrades Zoe electric car as competition intensifies

- New all-electric Renault SUV to arrive in next 18 months

- Peugeot 208 to electrify Europe's small-car market

- Peugeot to offer EV version of new 2008 small crossover

- Electric Mini Arrives 2020

- Toyota and Subaru Agree to Jointly Develop BEV-dedicated Platform and BEV SUV

- Mazda extends MX name to new MX-30 electric crossover

- Opel sees electric Corsa as key EV entry

- 2021 Vauxhall Mokka revealed as EV with sharp looks, massive changes

- Skoda Enyaq iV electric SUV offers range of power, battery sizes

- Electric Skoda Enyaq coupe to muscle-in on Tesla Model 3

- Citroen compact EV challenges VW ID3 on price

- FCA to invest $788M to build new 500 EV in Italy

- BYD will launch electric SUV in Europe

- The Lucid Air Achieves an Estimated EPA Range of 517 Miles on a Single Charge

- Maserati to launch electric sports car

- Bentley Will Offer Hybrid Versions of Every Car It Makes and Add an EV by 2025

- Meet the Canoo, a Subscription-Only EV Pod Coming in 2021

- Two new electric cars from Mahindra in India; Global Tesla rival e-car soon

- Former Saab factory gets new life building solar-powered Sono Sion electric cars

- Foxconn aims for 10% of electric car platform market by 2025

And in China…

- Volkswagen, Chinese ventures to invest 15 billion euros in electric vehicles

- SAIC Volkswagen kicks off production at MEB NEV plant

- China-built Audi e-tron rolls off production line in Changchun

- Audi Q2L e-tron debuts at Auto Shanghai

- Audi will build Q4 e-tron in China

- Audi negotiating electric vehicle joint venture with FAW

- FAW Hongqi starts selling electric SUV with 400km range for $32,000

- FAW (Hongqi) to roll out 15 electric models by 2025

- BYD launches six new electrified vehicles

- Top of Form

- Bottom of Form

- Daimler & BYD launch DENZA electric vehicle for the Chinese market

- Geely, Mercedes-Benz launch $780 million JV to make electric smart-branded cars

- Mercedes styled Denza X 7-seat electric SUV to hit market

- Mercedes ‘makes mark’ with China-built EQC

- BMW, Great Wall to build new China plant for electric cars

- BAIC Goes Electric, & Establishes Itself as a Force in China’s New Energy Vehicle Future

- BAIC BJEV, Magna ready to pour RMB2 bln in all-electric PV manufacturing JV

- Toyota, BYD will jointly develop electric vehicles for China

- Lexus to launch EV in China taking on VW and Tesla

- GAC Toyota to ramp up annual capacity by 400,000 NEVs

- GAC Aion

- GAC NIO kicks off delivery of HYCAN 007 all-electric SUV

- Chevrolet Menlo Electric Vehicle Launched in China

- Buick Launches VELITE 6 PLUS MAV Electric Vehicle in China

- Buick Velite 7 EV And Velite 6 PHEV Launch In China

- General Motors’ Chinese Venture to Sink $4.3 Billion Into Electric Vehicles by 2024

- Nissan & Dongfeng to invest $9.5 billion in China to boost electric vehicles

- Dongfeng’s premium EV-focused “VOYAH” unveiled as independent brand

- PSA to accelerate rollout of electrified vehicles in China

- Fiat Chrysler, Foxconn Team Up for Electric Vehicles

- Hyundai Motor Transforming Chongqing Factory into Electric Vehicle Plant

- Polestar said to plan China showroom expansion to compete with Tesla

- Nio

- Jaguar Land Rover's Chinese arm invests £800m in EV production

- Renault reveals series urban e-SUV K-ZE for China

- Renault & Brilliance detail electric van lineup for China

- Renault forms China electric vehicle venture with JMCG

- Honda Debuts New Everus VE-1 All-Electric SUV, But Only For China

- Honda to roll out over 20 electric models in China by 2025

- Geely launches new electric car brand 'Geometry' – will launch 10 EVs by 2025

- Mazda to roll out China-only electric vehicles by 2020

- Xpeng Motors sells multiple EV models

- Changan New Energy

- WM Motors/Weltmeister

- Chery

- Seres

- Enovate

- Evergrande Hengchi

- China's cute Ora R1 electric hatch offers a huge range for less than US$9,000

- Singulato

- JAC Motors releases new product planning, including many NEVs

- Seat to make purely electric cars with JAC VW in China

- Iconiq Motors

- Hozon

- Aiways

- NEVS launches electric-car output with Saab 9-3 platform in China

- Youxia

- CHJ Automotive begins to accept orders of Leading Ideal ONE

- Infiniti to launch Chinese-built EV in 2022

- Leapmotor

- Human Horizons

Here’s Tesla’s competition in autonomous driving…

- Consumer Reports finds Tesla's Navigate on Autopilot is far less competent than a human driver

- Navigant Ranks Tesla Last Among Automakers & Suppliers for Automated Driving

- Tesla has a self-driving strategy other companies abandoned years ago

- Fiat Chrysler, Waymo expand self-driving partnership for passenger, delivery vehicles

- Waymo and Lyft partner to scale self-driving robotaxi service in Phoenix

- Volvo, Waymo partner to build self-driving vehicles

- Jaguar and Waymo announce an electric, fully autonomous car

- Renault, Nissan partner with Waymo for self-driving vehicles

- Voyage Partners with FCA to Deliver Fully Driverless Cars

- Hyundai and Kia Invest in Aurora

- Aptiv and Hyundai Motor Group complete formation of autonomous driving joint venture

- Cadillac Super Cruise™ Sets the Standard for Hands-Free Highway Driving

- Honda Joins with Cruise and General Motors to Build New Autonomous Vehicle

- SoftBank Vision Fund to Invest $2.25 Billion in GM Cruise

- Ford's electric Mustang will offer hands-free driving technology in 2021

- Ford-VW alliance with Argo could redraw self-driving sector

- VW taps Baidu's Apollo platform to develop self-driving cars in China

- Amazon Buys Driverless Startup Zoox, Cites Ride-Hailing Goal

- Nvidia and Mercedes Team Up to Make Next-Gen Vehicles

- Daimler's heavy trucks start self-driving some of the way

- SoftBank, Toyota's self-driving car venture adds Mazda, Suzuki, Subaru Corp, Isuzu Daihatsu

- Continental & NVIDIA Partner to Enable Production of Artificial Intelligence Self-Driving Cars

- Mobileye and Geely to Offer Most Robust Driver Assistance Features

- Mobileye Starts Testing Self-Driving Vehicles in Germany

- Mobileye and NIO Partner to Bring Level 4 Autonomous Vehicles to Consumers

- Nissan gives Japan version of Infiniti Q50 hands-free highway driving

- Hyundai to start autonomous ride-sharing service in Calif.

- Pony.ai raises $462 million in Toyota-led funding

- Baidu kicks off trial operation of Apollo robotaxi in Changsha

- Toyota to join Baidu's open-source self-driving platform

- Baidu, WM Motor announce strategic partnership for L3, L4 autonomous driving solutions

- Baidu plans to mass produce Level 4 self-driving cars with BAIC by 2021

- DiDi completes over $500M fundraising round for its autonomous driving subsidiary

- BMW and Tencent to develop self-driving car technology together

- BMW, NavInfo bolster partnership in HD map service for autonomous cars in China

- FAW Hongqi readies electric SUV offering Level 4 autonomous driving

- Tencent, Changan Auto Announce Autonomous-Vehicle Joint Venture

- Huawei steps up ambitions in self-driving vehicles race

- BYD partners with Huawei for autonomous driving

- Lyft, Magna in Deal to Develop Hardware, Software for Self-Driving Cars

- Deutsche Post to Deploy Test Fleet Of Fully Autonomous Delivery Trucks

- ZF autonomous EV venture names first customer

- Magna’s new MAX4 self-driving platform offers autonomy up to Level 4

- Groupe PSA’s safe and intuitive autonomous car tested by the general public

- Mitsubishi Electric to Exhibit Autonomous-driving Technologies in New xAUTO Test Vehicle

- Apple acquires self-driving startup Drive.ai

- Momenta – Building Autonomous Driving Brains

- JD.com Delivers on Self-Driving Electric Trucks

- NAVYA Unveils First Fully Autonomous Taxi

- Fujitsu and HERE to partner on advanced mobility services and autonomous driving

- Lucid Chooses Mobileye as Partner for Autonomous Vehicle Technology

- Nuro’s Robot Delivery Vans Are Arriving Before Self-Driving Cars

Here’s where Tesla’s competition will get its battery cells…

- Panasonic (making deals with multiple automakers)

- LG

- Samsung

- SK Innovation

- Toshiba

- CATL

- BYD

- Northvolt (backed by VW & BMW)

- Ultium (General Motors & LG joint venture)

- PSA And Total Officially Launch Automotive Battery Cell Company

- UK companies AMTE Power and Britishvolt plan $4.9 billion investment in battery plants

- Verkor

- Farasis

- Microvast

- Akasol

- Cenat

- Wanxiang

- Eve Energy

- Svolt

- Romeo Power

- Solid-state batteries on track at Toyota

- ProLogium Technology Will Produce First Next Generation Lithium Ceramic Battery For EVs

- BMW invests in Solid Power solid-state batteries

- Ford invests in Solid Power solid-state batteries

- Hyundai Motor developing solid-state EV batteries

Here’s Tesla’s competition in charging networks…

- Electrify America is spending $2 billion building a high-speed U.S. charging network

- GM, EVgo partner to expand U.S. charging network

- Circle K Owner Plans Electric-Car Charging Push in U.S., Canada

- 191 U.S. Porsche dealers are installing 350kw chargers

- ChargePoint to equip Daimler dealers with electric car chargers

- GM and Bechtel plan to build thousands of electric car charging stations across the US

- Ford introduces 12,000 station charging network, teams with Amazon on home installation

- Petro-Canada Introduces Coast-to-Coast Canadian Charging Network

- Volta is rolling out a free charging network

- Ionity has over 150 European 350kw charging stations

- E.ON and Virta launch one of the largest intelligent EV charging networks in Europe

- Volkswagen plans 36,000 charging points for electric cars throughout Europe

- Smatric has over 400 charging points in Austria

- Allego has hundreds of chargers in Europe

- PodPoint UK charging stations

- BP Chargemaster/Polar is building stations across the UK

- Instavolt is rolling out a UK charging network

- Fastned building 150kw-350kw chargers in Europe

- Aral To Install Over 100 Ultra-Fast Chargers In Germany

- Deutsche Telekom launches installation of charging network for e-cars

- Shell starts rollout of ultrafast electric car chargers in Europe

- Total to build 1,000 high-powered charging points at 300 European service-stations

- Volkswagen-based CAMS launches supercharging stations in China

- Volkswagen, FAW Group, JAC Motors, Star Charge formally announce new EV charging JV

- BP, Didi Jump on Electric-Vehicle Charging Bandwagon

- Evie rolls out ultrafast charging network in Australia

- Evie Networks To Install 42 Ultra-Fast Charging Sites In Australia

And here’s Tesla’s competition in storage batteries…

- Panasonic

- Samsung

- LG

- BYD

- AES + Siemens (Fluence)

- GE

- Bosch

- Mitsubishi Hitachi

- Toshiba

- ABB

- Saft

- Johnson Contols

- EnerSys

- SOLARWATT

- Schneider Electric

- Sonnen

- Kyocera

- Generac

- Kokam

- NantEnergy

- Eaton

- Nissan

- Tesvolt

- Kreisel

- Leclanche

- Lockheed Martin

- EOS Energy Storage

- ESS

- UET

- electrIQ Power

- Belectric

- Stem

- ENGIE

- Redflow

- Renault

- Primus Power

- Simpliphi Power

- redT Energy Storage

- Murata

- Bluestorage

- Adara

- Blue Planet

- Tabuchi Electric

- Aggreko

- Orison

- Moixa

- Powin Energy

- Nidec

- Powervault

- Schmid

- 24M

- Ecoult

- Innolith

- LithiumWerks

- Natron Energy

- Energy Vault

- Ambri

- Voltstorage

Thanks and stay healthy,

Mark Spiegel