Over the next year we will be managing through the most volatile and uncertain investing environment we have ever known. With more technology, data and insight than we have ever had it has never been more important to get control of your investments.

Q1 2020 hedge fund letters, conferences and more

The update of SEC filing of financial statements for the first quarter is now complete with the appearance last week of the Retailers (they report a month later than the typical company). Evidence appears of a growth leadership shift away from the technology dominated sector towards commodities and industrials.

The recent strength in share prices is an excellent opportunity to sell slowing technology stocks at premium prices. Look for lower sales and falling gross profit margins companies and Sell those trading at premium prices.

Opportunities to buy depressed shares are fewer now after the recent market advance. Look for companies with a rising gross profit margin. Choose rising sales growth and good financial condition companies and Buy those with depressed share prices. Otos (visit otos.io) makes it possible to make an active decision on every stock in your portfolio.

Retailers Industry Recap

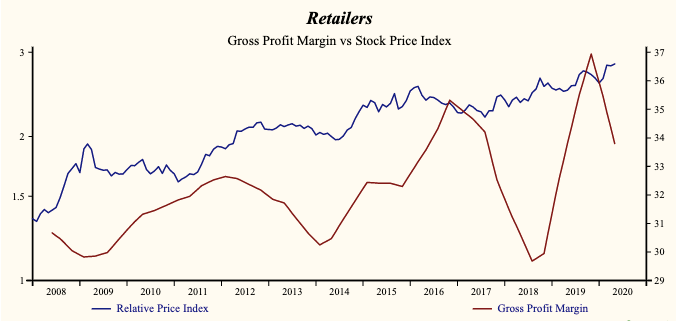

The share price index of the Retailers Industry has advanced by 25% relative to the Otos Total Market Index since the August, 2017 low. Current relative price-to-sales is near the lowest level in the record of the Industry.

We have collected first quarter sales data for 70 of the 81 comparable record companies in the Retailers Industry representing 98% of the capital value. The Industry capital weighted average sales growth rate is 4.2%. The proportion of Industry market capital accounted for by rising sales growth companies is up to 67.6%, compared to 57.9% last quarter.

Retail Industry Highlights (Q1/2020):

- Sales growth is low in the record and lower than last quarter

- High and falling gross margin (the share prices have been highly correlated with the direction of the profit margins)

- Proportion of total market capital accounted for by rising gross profit margin companies is down to 18.9% compared to 34.2% last quarter

- Inventories are up (diminishing the chance of a future increase in the gross margin)

- Interest costs are low and rising (higher interest costs not only slow cash flow growth but are often associated with lower valuation)

- SG&A expenses are high in the record of the industry and falling

- EBITDA margin is down because the gross margin is falling at a more rapid rate than SG&A expenses

The Retail Industry has further capability to accelerate EBITDA relative to sales or Cash Flow with lower costs. Choose wisely, this is a poor-quality growth trend to the extent that lower costs can insulate the bottom line from top line weakness for only a short time.

Join our Free June 24th Online Seminar

A special invitation to experience your financial reality as FREEDOM AND EMPOWERMENT.

OTOS will begin a free seminar series next Wednesday, June 24 at 4:30pm EST. In collaboration with The Financial Executives Networking Group (The FENG) these quarterly seminars will review the ‘Big Picture’, trends and projections as provided by the most recent financial statements. The panel will also present their views on Asset Allocation (Stocks or Cash), Sector Rotation (Sell Technology & Buy Industrials) and RISK (sell falling cash flow and poor financial condition).

Register here:

https://www.thefeng.org/chapters/rsvp.php?tid=13303

Hope to see you there!