David Pinsen, the founder of Portfolio Armor, discusses the The Hedged Portfolio Method.

Q1 2020 hedge fund letters, conferences and more

Table of Contents

Show

What Is A Hedge

- A hedge is something that always goes up in value when an underlying security goes down in value significantly.

- If you want to hedge stocks, other asset classes such as gold, or bonds are not hedges.

Black Swans: Why Hedge Individual Stocks

- JP Morgan Study: 40% of Russell 3000 stocks suffered catastrophic losses between 1980 and 2014.

- "Catastrophic loss" defined as a decline of 70% without recovering.

- 57% of information technology stocks experienced catastrophic declines during this period.

- Black swan examples: 2008 Financial Crisis, 2020 COVID-19 (e.g., cruise ships, REITs), antitrust action.

Black Rain: Hedging Portfolio And Market Risk

September 18th, 1989.

Black Rain

The Most Effective Hedge: Put Options

- Protection even if the underlying security goes to zero.

- Non-linearity means a little goes a long way, so less drag on returns.

Minimizing The Cost Of Hedging

- Decide how much you're willing to risk

- Look at OTM puts

- What's your max drawdown including hedging cost?

- Compare annualized cost as a % of position value

- (SPY $310..62 on Monday)

Minimizing Cost With Collars

- Giving up potential upside to reduce the cost of hedging.

How Much Should You Pay To Hedge?

- How much are you up on a position you can't sell?

- For other positions, is the cost of hedging greater than your expected return?

Starting From Scratch: The Hedged Portfolio Method

- Start with universe of hedgeable securities.

- Estimate potential returns for them.

- Calculate their hedging costs.

- Subtract hedging cost from potential returns.

- Sort by potential return net of hedging cost.

- Buy and hedge a handful of the names at the top of the list.

Top Names Performance, Unhedged

- Have outperformed SPY by 0.62% so far.

- Working to increase outperformance.

Hedged Portfolio Example, 12/26/2019

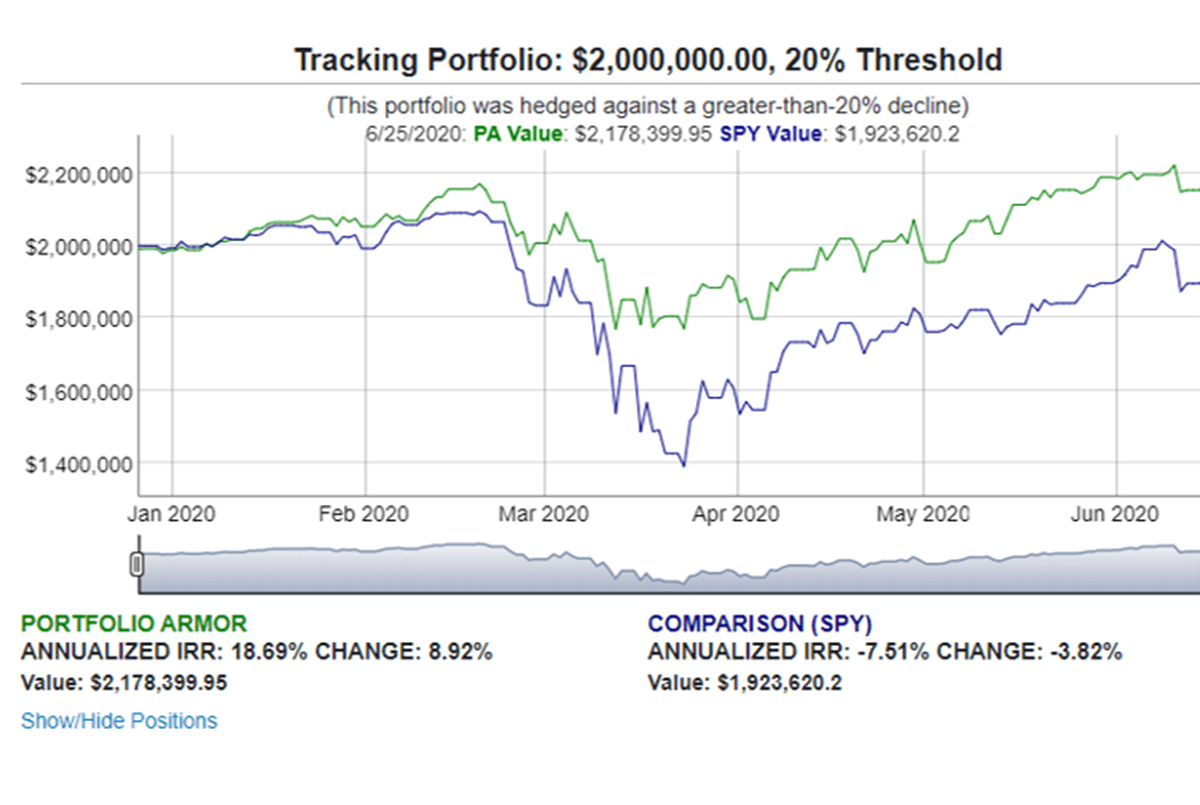

Performance Of That Hedged Portfolio

Putting Together A Hedged Portfolio

- Our hedging tool scans for optimal hedges.

- Our hedged portfolio construction tool creates portfolios following the hedged portfolio method, designed to maximize your returns while strictly limiting risk.

- Website: PortfolioArmor.com

- Coupon code for Portfolio Armor website: SFAAII.