Callon Petroleum Company (NYSE:CPE)’s acquisition of Carrizo Oil & Gas Inc (NASDAQ:CRZO) was dealt two blows this week when Institutional Shareholder Services (ISS) and Glass Lewis recommended against the deal, backing Paulson & Co.’s opposition. Paulson said Callon should consider selling itself instead. The 9.5% shareholder also said the company should have approached potential suitors before agreeing to buy Carrizo. It wants Callon to engage advisers to consider a sale as well as cut costs and improve cash flow.

Carrizo Oil & Gas merger off?

Callon said Monday that it “strongly disagrees with ISS’s recommendation,” citing buy-side analysts in support of its case and pointing to the synergies it expects to generate. The Houston-based company said it believed the deal would advance its four key objectives: “increase cash return on invested capital, generate free cash flow, reduce leverage, and maintain a long-term focus.”

Q3 2019 hedge fund letters, conferences and more

Following the publication of Glass Lewis’ report, Paulson said in a Wednesday press release that "a standalone Callon would be less risky and, combined with a reduction in its own operating costs, a shorter path to shareholder value than an overpriced acquisition."

What We'll Be Watching For This Week

- Will any new activist positions be revealed at the Sohn Conference in London on Thursday?

- How will shareholders of Callon Petroleum and Carrizo Oil & Gas vote regarding the merger of the two companies on Thursday?

- Will Telecom Italia find an investment partner to support its potential deal with rival Open Fiber?

- Will Leonardo Del Vecchio make headway with Mediobanca’s board after becoming the company’s largest shareholder?

Activist Shorts Update

Short seller Muddy Waters has been busy this year, with its latest report targeting Japan’s PeptiDream. Muddy Waters alleged that PeptiDream will likely fail to meet investor expectations due to "systematic limitations" in advancing its drug candidates.

The activist has had a busy year selecting targets globally and began 2019 with a short position in U.S.-based Inogen, claiming the manufacturer of portable oxygen concentrators has created "an egregiously false narrative" about its total addressable market’s size and growth. Muddy Waters set a target price of $46 per share, a 67% downside to the price as of February 8. In the following nine months, the company’s share price has dived 49%.

On July 8, Muddy Waters turned to Anta Sports, a Chinese sports apparel manufacturer that the short seller accused of falsely inflating its profit margins and said its financial reporting is far from reliable. Despite an initial 7.3% drop in Anta’s share price on the day of publication of the report, the stock has since shown a near 53% improvement.

Not long after its report about Anta, Muddy Waters placed a bet against U.K.-listed Burford Capital, lambasting the company for "heavily" manipulating key financial metrics to mislead investors on its fair value gains, concluding that the litigation finance provider is "arguably insolvent." The U.S.-based company’s stock tumbled nearly 40% at market opening following the report on August 7 but has since rallied 53.3%.

To arrange an online demonstration of Activist Insight Shorts, email us or view our product brochure to find out more.

Chart Of The Week

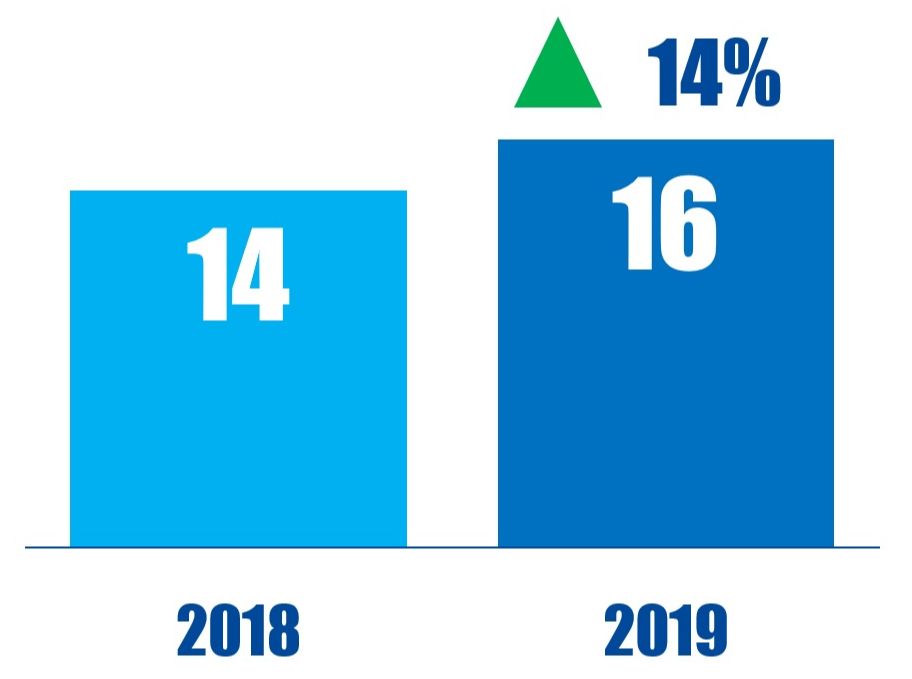

The number of U.K.-based financial sector companies publicly subjected to activist demands between January 01 and November 08 in respective years.