The U.K.’s oldest and largest director group, the Institute of Directors (IoD), urged politicians to set up a new framework that puts greater emphasis on social responsibility in an effort to regain public trust in U.K. businesses following recent high-profile collapses. Launching a 10-point manifesto, the IoD said that “high standards of corporate governance are essential” and called on all political parties to establish greater controls over corporate governance.

The IoD said the government should set up an independent corporate governance commission to oversee the nation’s stewardship framework, push for reforms to the regulation of auditors, determine prerequisites in terms of knowledge or professional training for directors, and create a government-backed fund to invest in the green economy, among other measures. The group also recommended that the government create a new classification of companies — a public service corporation — that would be legally required to balance the interest of employees, the supply chain, and other stakeholders alongside shareholders, similar to U.S. benefit corporations.

Q3 2019 hedge fund letters, conferences and more

What We'll Be Watching For This Week

- How will Acrux shareholders vote regarding Samuel Terry Asset Management’s nomination of Norman Gray to the board at the annual meeting on Thursday?

- How will Keybridge Capital shareholders vote regarding John Patton and Jeremy Kriewaldt’s re-election at the annual meeting on Friday amid the ongoing board brawl between Bentley Capital and Austrian Style Group?

- And how will Donaco International shareholder vote regarding Gerald Tan and Patrick Tan’s proposed replacement of the entire board with themselves and three of their representatives at the meeting on Friday?

Activist Shorts Update: Automotive leather and furniture

Hong Kong-based Kasen International Holdings’ stock lost 90% in value on Thursday before being halted at the firm’s request after Blue Orca placed a bet against the company, exceeding the activist’s predicted downside of 85%. The activist short seller said that the automotive leather and furniture manufacturer is "uninvestable" due to alleged accounting issues.

In its report, Blue Orca claimed that Kasen has "fabricated" financial statements to hide its true value and deceive investors into thinking that it is still a viable business. The short seller contended that the company had been looted by the chairman's family. The report alleged that the best parts of Kasen’s automotive leather and furniture business were sold to the chairman’s daughters three years ago, leaving the company with a single viable segment, property development, which is "a melting ice cube" as the firm is in the process of shedding the last of its remaining residential units.

To replace the sold assets and create an illusory impression that the firm was still strong, its leadership announced various development projects in Cambodia, which Blue Orca investigated and found "vacant, undeveloped plots of land which locals say are owned by someone else."

To arrange an online demonstration of Activist Insight Shorts, email us or view our product brochure to find out more.

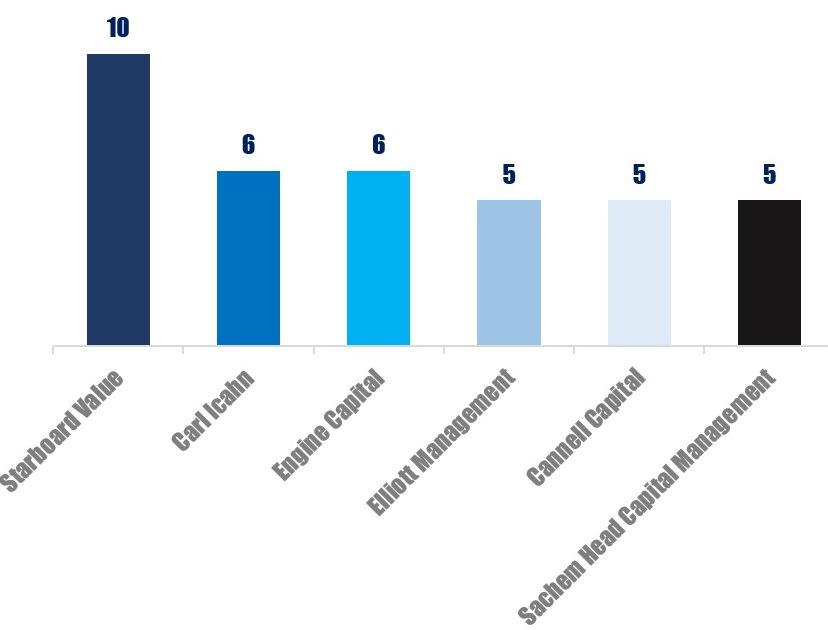

Chart Of The Week

Top activist investors ranked by the number of U.S.-headquartered companies publicly subjected to its activist demands in the period January 01, 2019 to November 22, 2019.