Bonhoeffer Capital Management commentary for the fourth quarter ended December 31, 2018.

Dear Partner,

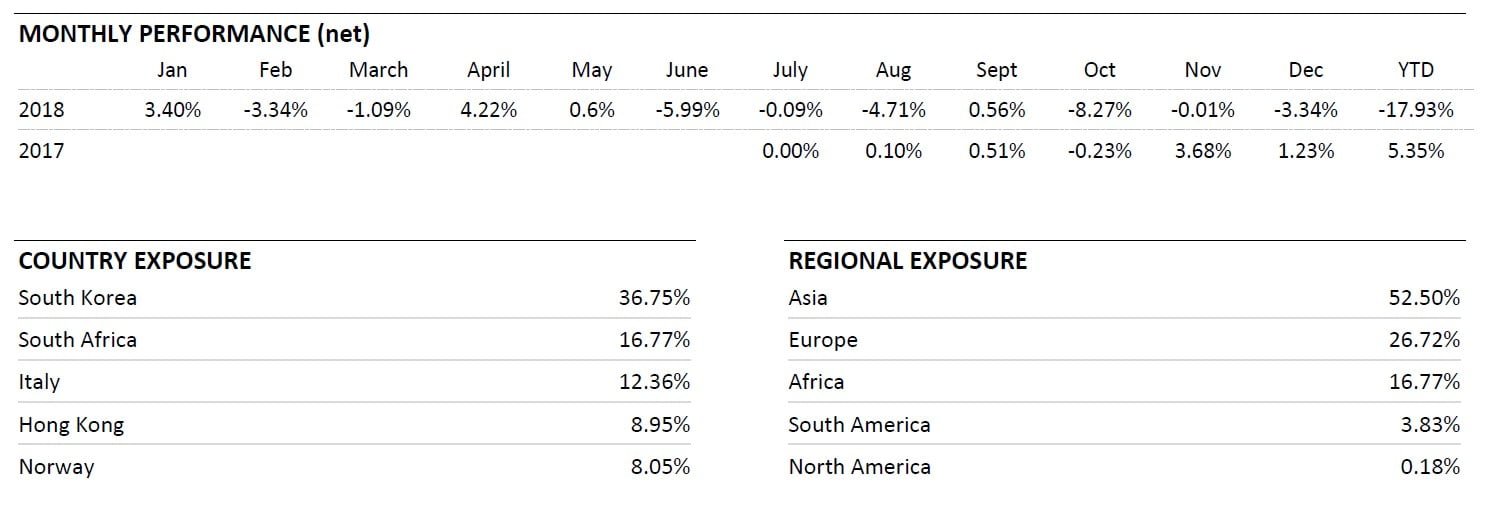

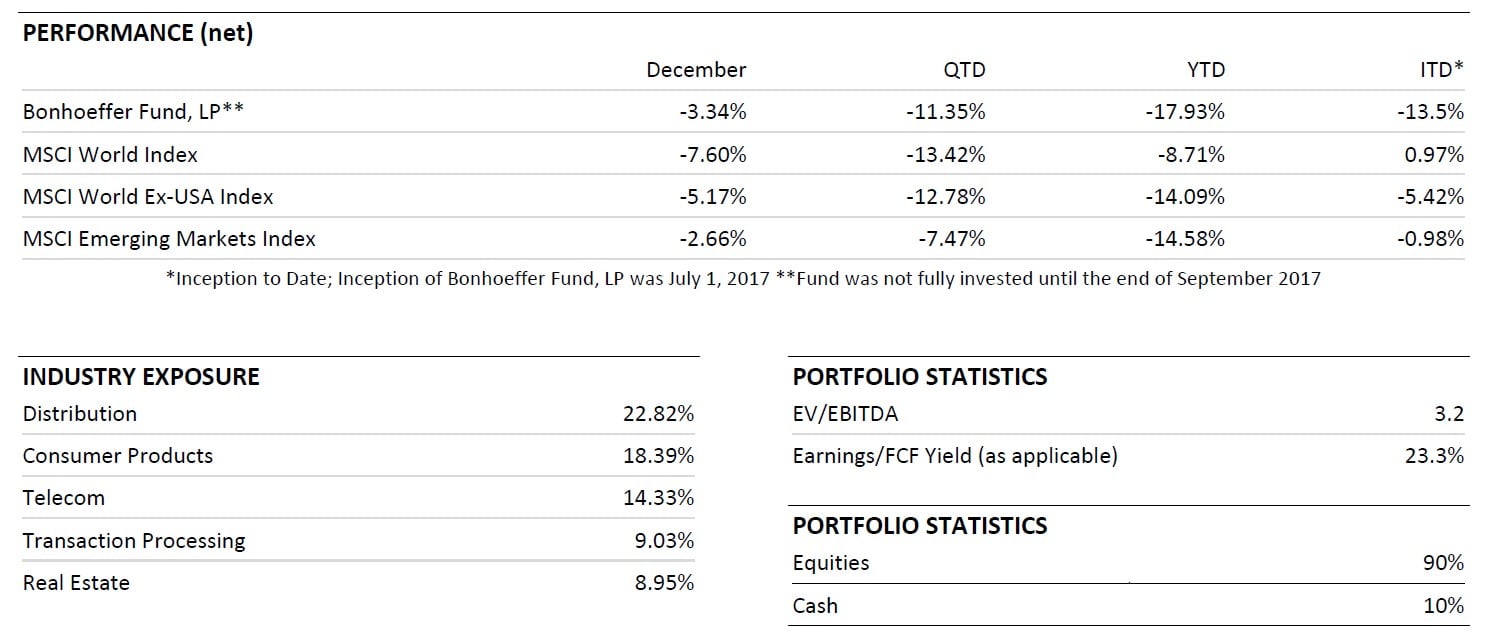

Bonhoeffer returned -17.9% net of fees in 2018, compared to -14.1% for the MSCI ACWI ex-US, our international benchmark. In the fourth quarter, Bonhoeffer slightly outperformed the index, declining by 11.4% compared to the MSCI ACWI ex-US’s decline of 12.8%. As of December 31st, our securities have an average earnings/free cash flow yield of 23.3% and an average EV/EBITDA of 3.2. The portfolio’s market valuation relative to my estimate of intrinsic value is at its widest gap since inception. Specifically, I believe the intrinsic value of the portfolio is roughly 3x the current market valuation. I do not know when this gap will close, but intrinsic value over time has a strong gravitational pull.

Q4 hedge fund letters, conference, scoops etc

This winter has been a stormy one thus far in both the weather in Upstate New York and in the financial markets. In Rochester, New York, we typically receive more than 100 inches of snow each winter. This year, there is also a snowstorm in the worldwide equity markets. We are prepared for the turbulence and plan to take advantage of every opportunity the frigid market forecasts present.

Bonhoeffer Fund Portfolio Overview

Our fund’s investments have not changed significantly in the last quarter. The largest countries represented in our portfolio remain South Korea, South Africa, Italy, Hong Kong, Norway, and Philippines. The largest industries in which Bonhoeffer Capital is invested include: distribution, consumer products, telecom, transaction processing, real estate, and media.

Since my last letter, we have only purchased one new position in an equipment rental firm. I have re-underwritten our positions which have declined the most over the past six months. I have determined that these positions have short-term challenges; a few have modestly lower growth expectations and still sell at significant discounts to our estimates of intrinsic value, the largest in the fund’s short history. I am also excited about some firms we are investigating in South Korea and South Africa.

Disruption

Disruption occurs when a new firm can provide an acceptable level of product/service quality for a lower price, typically with a new value chain. A very good disruption framework is found in Clayton Christensen’s book The Innovator’s Dilemma.1 Disruption can have devastating effects on formerly dominant firms such as Sears or Kmart in the retail industry or disk drive manufacturers over four development cycles.2 The new firms have typically developed a lower-cost value chain with initially unacceptable levels of quality that improved over time, ultimately becoming acceptable to customers who at one time dismissed the firm’s products due to low quality. Some incumbent firms have been able to adopt the innovation and thus have blunted disruption over time. An example is some incumbent US telecom firms (e.g., AT&T and Verizon) that have adopted telecommunications innovations such as wireless communications, high-speed internet, and content offerings to blunt the effects of newcomers. One of the key elements in disruption is time. If the incumbents have a reasonable amount of time and vision, then they can adapt to the new innovation.

Given the significant impact that disruption can have on a company, I will spend some time reviewing possible disruptive activities in the top six industries where our companies operate. As you can see by the valuation metrics noted above, our portfolio is cheap on a trailing cash flow basis. This can be a good thing if these firms are growing and are not being disrupted by new firms with new technological advantages.

The largest industry group in our portfolio is distributors. This includes auto distributors/dealers and industrial equipment dealers/leasers. Potential disruption can come from new modes of distribution or financing for the dealers/leasers. For the dealers, their ties to the manufacturers have been developed over the years and, while distribution over the internet with delivery may be possible for a segment of customers, most still want the services (like maintenance and parts) that dealers provide. Lease underwriting and management are skills developed over time by dealers working with customers according to geographic region. There is some competition from banks and specialty lenders. However, leasers can use sharing of equipment by geographic region as an advantage over the banks and specialty lenders.

Our second largest industry group is consumer products. This group’s companies include food and beverage and tire firms. Tire firms are included in the consumer products group because most of their sales and an overwhelming portion of the firms’ profits are from the aftermarket sales. Consumer products firms are being disrupted by new entrants with lower search costs and lower cost alternatives. In this case, our tire company is in the low-priced category, so we are a disruptor. Additionally, we enjoy the added benefit of having a place in the new electric car ecosystem. Our food and beverage firms have developed healthy beverage and food lines in addition to their traditional brands. One of our beverage firms is entering the beer market which is producing short-term losses with the prospect of long-term gains. Our food company has been developing new products and expanding into new Asian markets.

Our third largest industry group is telecommunications. This includes incumbent telecommunications firms/conglomerates in Asia and Europe. These firms are being disrupted by other telco firms in their respective markets and new entrants in Europe. In both cases, these firms own the last-mile infrastructure for much of their respective countries. In one case, there is pressure to spinoff this infrastructure and a duel between the largest shareholders that is causing the price to be depressed. In both cases, the revenue and cash flows have been flat to slightly up, with downward pressure coming from competition to offset new high-speed offerings and content.

Our fourth largest industry group is transaction processing. This includes financial transaction processors in Africa and Asia. These firms can be disrupted by new technologies (such as online/mobile transaction or direct payment systems); however, most incumbents, including our companies, have incorporated the new modes of purchasing into their existing technology offering. Direct payment systems have been most successful in countries where there is no existing payment infrastructure (like China). Our Asian processor is busy expanding/building relationships with governments and banks in Southeast Asia. Our African transaction processor also has investments in African telecommunications and financial services firms.

Our fifth largest industry group is real estate. This is a tough group to disrupt, as real estate development/investment is being performed in a way that is dependent upon relationships with local governments and contractors that cannot be developed electronically online.

Our sixth largest industry group is media. This includes a content provider and distributor and home shopping networks in Asia. Potential disruption can come from new modes of distribution for the content distribution and home shopping channels. The content provider and distributor and home shopping channels have already included over-the-top offerings in addition to traditional television, computer, and mobile device offerings, so they have reduced the effectiveness of pure play over-the-top players. In addition, the content of both of these firms is proprietary.

Investment Snapshots

In past letters, I have laid out the theses of some of our holdings in the BCM Case Study section of our letters. Today, I am offering investment snapshots on five of our holdings. These snapshots provide updates of the case studies’ theses, as well as sum-of-the-parts analyses (if applicable). We will be providing access to these snapshots in a separate link to our limited partners. Prospective investors can contact Jessica Greer at [email protected] for access to these snapshots.

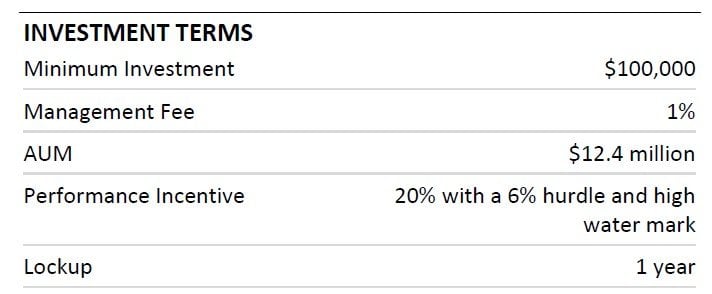

As stated in previous letters, Bonhoeffer Capital is a specialty fund and will likely experience greater volatility; thus, it is on the higher end of the risk spectrum of investments between short-term bonds to emerging markets equities. We have seen this volatility in 2018. Therefore, for most investors, Bonhoeffer should be a supplemental holding providing a noncorrelated way to generate above-average returns.

It is my hope that this letter provides some insight into the thought process behind the Bonhoeffer Fund and highlights the amount of thought and due diligence we are putting into investing your money. As always, if you would like to discuss any of this in deeper detail, then please do not hesitate to reach out. Until then, thank you again for your time and confidence in our work.

Warm Regards,

Keith D. Smith, CFA

This article first appeared on ValueWalk Premium