Things you will learn

- How Mohnish Pabrai thinks about intrinsic value and how he does those calculations

- The simple model that Pabrai uses to do his “back of the envelope” calculations

- Where to find the data to use for his model

- The three main components being Free Cash Flow, Cash & Cash equivalents, and Market Cap

- Many examples walking you through the process of finding the data and how to interpret it.

Q3 hedge fund letters, conference, scoops etc

“Heads I win, Tails I don’t lose that much.”

One of the perfect investing philosophies you could ever have from Mohnish Pabrai. This quote that he often repeats from his must-read book The Dhando Investor is incredibly illuminating and pretty much sums up his investing philosophy.

If you are not familiar with Mohnish Pabrai you need to learn more about him, he is a fantastic investor, author, and teacher.

He should be on every value investor’s list of people to learn from. Mohnish has this ability to explain complicated ideas in a way that you can easily understand them.

I have found him to be one of those individuals that are so smart he makes everything look easy, even though it is not.

The subject of intrinsic value calculations is a complicated one. What’s one person’s intrinsic value to others?

There are so many different ways to slice an apple, and the same applies to calculate intrinsic value calculations.

You have the Graham formula, discounted cash flows, dividend discount models, enterprise value versus market cap, and so on.

Today, I want to show you how Mohnish looks at intrinsic value calculations and how a “back of the envelope” calculation can look.

Intrinsic Value Calculations per Mohnish Pabrai

It is no secret that one of my favorite investors is Mohnish Pabrai, he has taken some of the principles of his mentors, Warren Buffett and Charlie Munger and applied them to his style.

He has a no-nonsense, clear-headed way of thinking about investing and is incredibly good at explaining his thoughts so that even I can understand him.

One of my favorite books is “The Dhando Investor,” and in it, he imparts much of his fantastic wisdom.

However, there is one particular chapter that I would like to focus on, that is Dhando 102: Invest in Simple Businesses.

In this chapter, Mohnish explains his concept of intrinsic value and why for most investors, it is wiser to find simple businesses and then buy them at prices that offer a sufficient margin of safety.

He expands on John Burr Williams’ concept of calculating intrinsic values by discounting cash flows. To quote Williams’ concept:

“Per Williams, the intrinsic value of any business is determined by the cash inflows and outflows—discounted at an appropriate interest rate—that can be expected to occur during the remaining life of the business. The definition is painfully simple.”

He goes on to illustrate this example by the example of a gas station.

“To illustrate let’s imagine that toward the end of 2006, a neighborhood gas station is put up for sale, and the owner offers it for $500,000. Further, let’s assume that the gas station can be sold for $400,000 after ten years. Free cash flow—money that can be pulled out of the business—is expected to be $100,000 a year for the next ten years. Let’s say that we have an alternative low-risk investment that would give us a 10 percent annualized return on the money. Are we better off buying the gas station or taking our virtually assured 10 percent return?

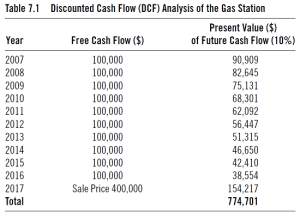

I used a Texas Instruments BA-35 calculator to do these discounted cash flow (DCF) calculations. Alternately, you could use Excel. As Table 7.1 demonstrates, the gas station has an intrinsic value of about $775,000.

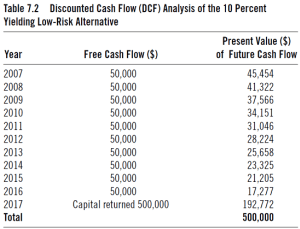

We would be buying it for $500,000, so we’d be buying it for roughly two-thirds of its intrinsic value. If we did the DCF analysis on the 10 percent yielding low-risk investment, it looks like Table 7.2.

Not surprisingly, the $500,000 invested in our low-risk alternative has a present value of exactly that—$500,000. Investing in the gas station is a better deal than putting the cash in a 10 percent yielding bond—assuming that the expected cash flows and sale price are all but assured.

The stock market gives us the price at which thousands of businesses can be purchased. We also have the formula to figure out what these businesses are worth. It is simple.”

Intrinsic Value examples per Mohnish

Keep in mind when we are doing any of these exercises that we are looking for approximate numbers here. We want to get in the ballpark when looking for intrinsic value.

Remember what Warren Buffett has said about calculating intrinsic value.

“It is better to be approximately correct, than precisely wrong.”

On to the example that Mohnish outlined in his book.

He uses a real-life retail business, Bed Bath and Beyond (BBBY).

“As I write this, BBBY has a quoted stock price of $36 per share and a market cap of $10.7 billion. We know BBBY is being offered on sale for $10.7 billion. What is BBBY’s intrinsic value?

BBBY had $505 million in net income for the year ended February 28, 2005. Capital expenditures for the year were $191 million, and depreciation was $99 million. The “back of the envelope” net free cash flow was about $408 million. (FCF = Net Income plus Depreciation, which is a non-cash expense minus Capital Expenditure)

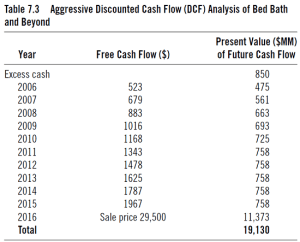

It looks like BBBY is growing revenues 15 percent to 20 percent and net income by 25 percent to 30 percent a year. It also looks like it stepped up capital expenditure (CapEx) spending in 2005. Let’s assume that free cash flow grows by 30 percent a year for the next three years; then grows 15 percent a year for the following three years, and then 10 percent a year after that. Further, let’s assume that the business is sold at the end of that year for 10 to 15 times free cash flow plus any excess capital in the business. BBBY has about $850 million in cash in the business presently (see Table 7.3).

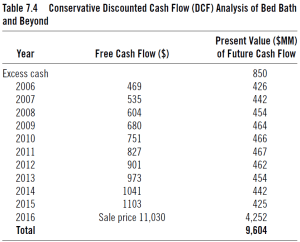

So, the intrinsic value of BBBY is about $19 billion, and it can be bought at $10.7 billion. I’d say that’s a pretty good deal, but look at my assumptions—they appear to be pretty aggressive. I’m assuming no hiccups in its execution, no change in consumer behavior, and the ability to grow revenues and cash flows pretty dramatically over the years. What if we made some more conservative assumptions? We can run the numbers with any assumptions. The company has not yet released numbers for the year ended February 28, 2006, but we do have nine months of data (through November 2005). We can compare November 2005 data to November 2004 data. Nine-month revenues increased from $3.7 billion to $4.1 billion from November 2004 to November 2005. And earnings increased from $324 million to $375 million. It looks like the top line is growing at only 10 percent annually and the bottom line by about 15 percent to 16 percent. If we assume that the bottom line growth rate declines by 1 percent a year—going from 15 percent to 5 percent and its final sale price is ten times 2015 free cash flow, the BBBY’s intrinsic value looks like Table 7.4.

Now we end up with an intrinsic value of $9.6 billion. BBBY’s current market cap is $10.7 billion. If we invested, we would end up with an annualized return of a little under 10 percent. If we have good low-risk alternatives where we can earn 10 percent, then BBBY does not look like a good investment at all. So what is BBBY’s real intrinsic value? My best guess is that it lies somewhere between $8 to $18 billion. And in these calculations, I’ve assumed no dilution of stock via option grants, which might reduce intrinsic value further.

With a present price tag of around $11 billion and an intrinsic value range of $8 to $18 billion, I’d not be especially enthused about this investment. There isn’t that much upside and a fairly decent chance of delivering under 10 percent a year. For me, it’s an easy pass.”

The goal of this exercise is not to determine whether or not BBBY would be a good investment or not.

Rather the goal is to show that the method of calculating the intrinsic value using the formula given to us by John Burr Williams, and then later discussed by Warren Buffett is simple, however calculating for any given business may not be so.

Real Life examples of Intrinsic Value Calculations

Let’s take a look at some different companies from different types of industries. These calculations can give us a good look at how this model will work with a broad range of companies.

A few I would like to look at:

- Hormel(HRL)

- CVS (CVS)

- Corning (GLW)

- H&R Block (HRB)

- Credit Suisse (CS)

First, let’s dig into Hormel a little bit. Hormel engages in meat and food production, some of the brands they own are Skippy, Jennie-O, and Country Crock among others.

To help us find the intrinsic value let’s gather some numbers to help us out.

- Free Cash Flow, which we will gather from the cash flow statement.

- Market Cap, which we will get from the income statement

- Cash & cash equivalents, which will come from the balance sheet.

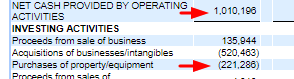

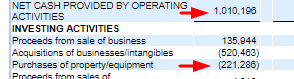

First up, let’s get the free cash flow from the latest 10-k for Hormel, filed in October 2017. I like to use the 10-ks because they have them audited, whereas the quarterly reports are not.

All numbers shown here will be in millions unless otherwise stated.

The formula for calculating free cash flow is:

FCF = Net cash from Operating activities + Capital Expenditures ( Purchases of property/equipment)

Plugging in the respective numbers.

FCF = 1,010,196 + -221,286

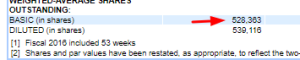

FCF = 778,910

Free Cash Flow for Hormel is $778,910.

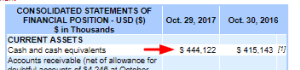

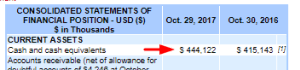

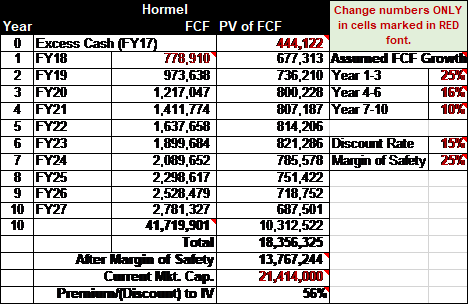

Next up will be the cash & cash equivalents from the balance sheet.

As you can see the cash & cash equivalents are $444,122

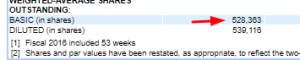

And lastly, let’s figure out the market cap, which is shares outstanding times the current market price.

Shares outstanding is found in the income statement.

Market cap = shares outstanding x current market price

The Market Cap = 528,363 x $40.53

Market cap = $21,414 billion

Now that we have all of our numbers we can plug it into the calculator and determine the approximate intrinsic value of Hormel.

We are going to use some growth rates of the free cash flow, based on estimates from gurufocus.com. These numbers are based on historical numbers but are only estimates, and you shouldn’t get hung up on them.

I will say this again, remember what Warren Buffett always says, “it is better to approximately right than precisely wrong.”

As you can see the market cap is coming under the current market cap which is telling you that Hormel is undervalued, currently.

To further help you determine a better price to buy at, divide the future market cap by the current shares outstanding to arrive at a future price to look for, I would calculate it based on the margin of safety number.

Future price = 13,767,244 / 528,363

Future price = $26.21

Based on the current price of $40.53, as of October 2018, this company is overvalued and would not give us the required margin of safety to invest in currently.

Does this mean I think Hormel is a bad investment or company? No Way!

They are a fantastic company with a lot of room to grow and a great track record of dividend payments.

The problem being there is no margin of safety if my investment thesis is way off and my assumptions for my calculations are faulty.

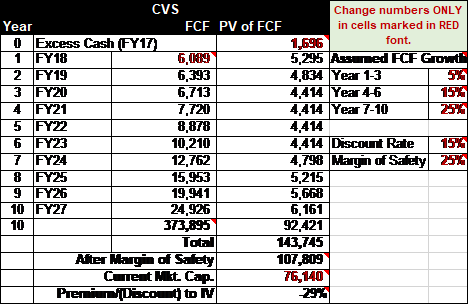

Intrinsic Value of CVS

Let’s take a look at CVS. There are known for their pharmaceutical sales and a growing company.

Okay, let’s gather our info.

Market cap for CVS is:

Shares outstanding equals 1024 times the current market price of $74.36.

Market cap equals $76.14 billion

Next up is the cash and cash equivalents from the balance sheet.

So, cash & cash equivalents are 1,696

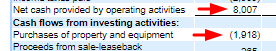

Last up, the free cash flow for CVS.

Free cash flow for CVS is 8007 + -1918 equals 6089.

Let’s plug in our numbers into our spreadsheet.

According to our calculations, CVS is currently undervalued and has room to grow. If you look at the company’s financials, they appear to have a lot of financial strength and could be a great investment opportunity.

The current price of $74.36, with a future price of $105.28 based on the increased growth of the free cash flow over the next ten years.

Of course, this is all theoretical and is again cause for a margin of safety.

Using this “back of the envelope” intrinsic value calculation is a great exercise in screening our investment ideas and is one of the first steps in determining great companies for investment opportunities.

More Intrinsic Value Calculations for Corning, H&R Block, and Credit Suisse

Now that we have done a few of these I am going to zip through a few to give you more ideas of how easy this is and that you should make it a staple of your investment screening process.

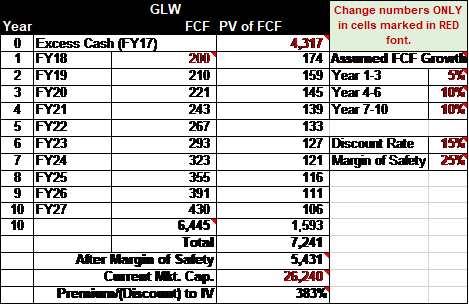

Corning: GLW

As you can see, it is currently overpriced based on the weak FCF forecasted for the company. Now if you are more bullish on the company, you could change the inputs.

These calculations would lead to a different result, one that may be more favorable to you. However, you should balance this out on the trend in the financials which is trending downward at this time.

This is all part of the screening process, and these calculations can help you dig deeper into each companies financials to find out the real story.

In Corning’s case, the last few years have seen a struggle based on the nature of their business, based largely overseas. With the change in the US tax laws and their hedging efforts against foreign currencies, they have had difficulty creating free cash flow.

I am simplifying things a bit, but you get the idea.

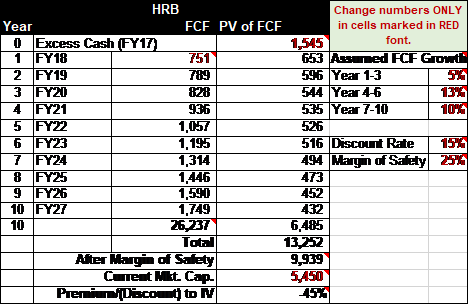

H&R Block: HRB

Interesting, based on our calculations H&R Block has a nice margin of safety and would bear some more looking into as a possible investment.

The current price is $26.52, and we are looking at a possible future price of $47.28, which gives us a nice cushion in case our investment thesis is completely off base.

Lastly, let’s look at Credit Suisse

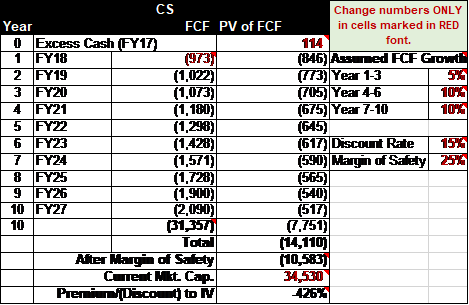

Credit Suisse: CS

Well, that was illuminating. As I looked at the financials, it was pretty evident that Credit Suisse is still on the struggle bus.

As you can see from the above chart, there is no margin of safety, and they are currently not producing any free cash flow. Digging into the financial statements you can see lots of wild swings just in the cash flow statement.

All those are signs of a company that is struggling and staying away from Credit Suisse as a viable investment at this time.

Final Thoughts

Finding the intrinsic value of a stock is as much art as it is math. There are multiple ways to do it. Some of the more popular methods are the Ben Graham formula, and of course using a discounted cash flow model.

The discounted cash flow model is great and is a fantastic method of really digging into the financials of the company. The only drawback to the model is that it can be a bit laborious.

When I came across this “back of the envelope” idea from Mohnish Pabrai I thought “aha” this could be a great way to help screen for stocks using an abbreviated version of the DCF.

And it could help me quickly find great investment ideas that I could then spend some time digging into the story that the financials would tell me.

By using this model, you can quickly determine companies intrinsic value and decide based on the results whether it bears further research.

Additionally, it can help you determine a margin of safety in our calculations, which can help reduce our potential loss of capital. In the case of a faulty thesis or our numbers are just plain wrong.

The thing I love about this model is the simplicity, and that is a hallmark of Mohnish Pabrai’s investment philosophy. He is one of those people that is so smart that he makes everything look easy.

Investing is not easy, by any stretch of the imagination, but with these tools such as a “back of the envelope” DCF, we can make it easier on ourselves and help us make better decisions.

I will include another link to this calculator here. Please feel free to use it to help you with these calculations.

If you have any questions or concerns, please don’t hesitate to share them with me.

As we say on our podcast, have a great week, invest with a margin of safety, emphasis on the safety.

A note for you, there is an affiliate link in this article to Amazon Associates program and if you buy the above book I will receive a small commission, this does not increase your price in any way.

Article by Intrinsic Value Formula