South Africa, famous for Great White sharks, could be the next focus for currency vigilantes.

2018 has been marked by various emerging market crises. From Turkey to Argentina, confidence has eroded, resulting in bond and currency chaos. There is a growing focus on South Africa, and our analysis suggests that will continue.

[REITs]Q2 hedge fund letters, conference, scoops etc

When examining whether an emerging market country is at risk of a currency crisis, the economic indicator of choice is Import Cover. This gives a measurement of the amount of a country’s foreign exchange reserves relative to its imports. It is usually expressed in terms of how many months of imports the foreign exchange reserves are able to buy before they run out. An emerging market country with 10 or more months of import cover is considered to be stable. South Africa’s Import Cover is 5.5 months, down from 7.2 months at the end of 2015. According to World Bank data, that’s about the same as Turkey. (For perspective, China’s Import Cover is 16 months.) What this means is that there is increasing pressure on South Africa’s foreign exchange reserves, which not only have to pay for imports but also have to service the country’s external debt. Reserves are also used to defend a currency from attack via intervention, but a country with low reserves has little defense. And once the currency market sharks get a sniff of blood in the water, it can get quite frenzied very quickly.

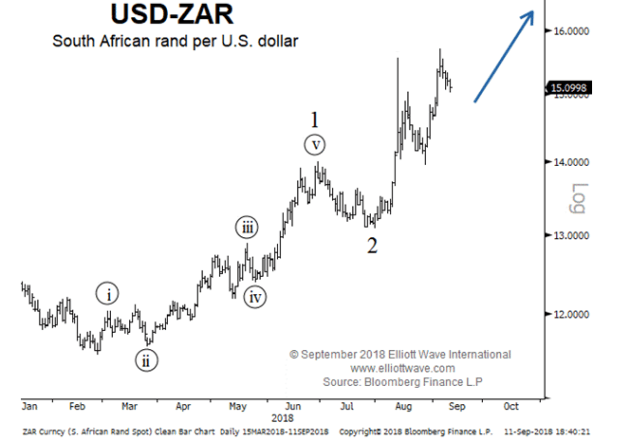

Thankfully, we do not have to guess about all the different economic variables that could or could not happen. We rely on what we consider to be the best lead indicator – the market price. The chart below shows the amount of South African rand needed to buy one U.S. dollar. The exchange rate hit a low of 11.5078 in February this year, and it currently hovers around 15. Our Elliott wave analysis is pointing to much higher levels in the exchange rate, meaning a depreciating rand. Expect fears of a South African rand crisis to grow.

About Murray Gunn

Murray Gunn is Head of Research for Elliott Wave International’s Global Market Perspective, a monthly summary of the firm’s 25 analysts’ views on every major freely-traded market in the world. After earning his Master of Arts (Honors) degree in Economics from the University of Dundee in Scotland in 1991, Gunn went into fund management. He quickly realized that textbook descriptions don’t apply to real-world markets, which in turn led him to technical analysis and the Elliott Wave Principle. He worked as a fund manager in global bonds, currencies and stocks, including long posts at Standard Life Investments and a five-year stint in the Middle East at the Abu Dhabi Investment Authority. Gunn then joined HSBC as Head of Technical Analysis. He has served on the board of the Society of Technical Analysts and delivered lectures on the Elliott Wave Principle to students at The London School of Economics, Queen Mary University and Kings College London. You can read Gunn’s commentary in Elliott Wave International’s Global Market Perspective, Interest Rates and Currency Pro Services, and on deflation.com.

About Elliott Wave International

Elliott Wave International is the largest independent technical analysis firm in the world. Its award-winning publications provide useful insights and engaging commentary on all major financial asset classes and indexes around the globe. EWI’s unique perspective on market behaviour and cultural trends sets it apart from other financial publications.