Tyler here with this week’s Macro Musings.

As always, if you come across something cool during the week, shoot me an email at [email protected] and I’ll share it with the group.

Recent Articles/Videos —

Buy Gold? — AK reviews what’s happening in the precious metals space.

Articles I’m reading —

There’s a brand new website out called Where Is Beeks? that has a hilarious collection of old trader war stories. Kevin Muir from the Macro Tourist has been working on the project — so you know it’s good.

If you need a break from the daily grind check this site out. Each story takes about 2-5 minutes to read — a perfect break from the day.

Here were the last two I read:

Behavior Issues

Soros’ Worst Trade

They are also taking submissions, so if any of you guys have some fun trading war stories hit them up!

Video I’m watching —

Raoul Pal and Real Vision recently put out a YouTube video going through Raoul’s latest macro views. (Link here)

Even though I disagree with much of what he had to say, I still watched to the end as a way to Red Team my current market assumptions.

Here are the highlights:

Raoul thinks Google is one of the most important charts in the world — and if that chart cracks it will send all the other high flying tech stocks down with it.

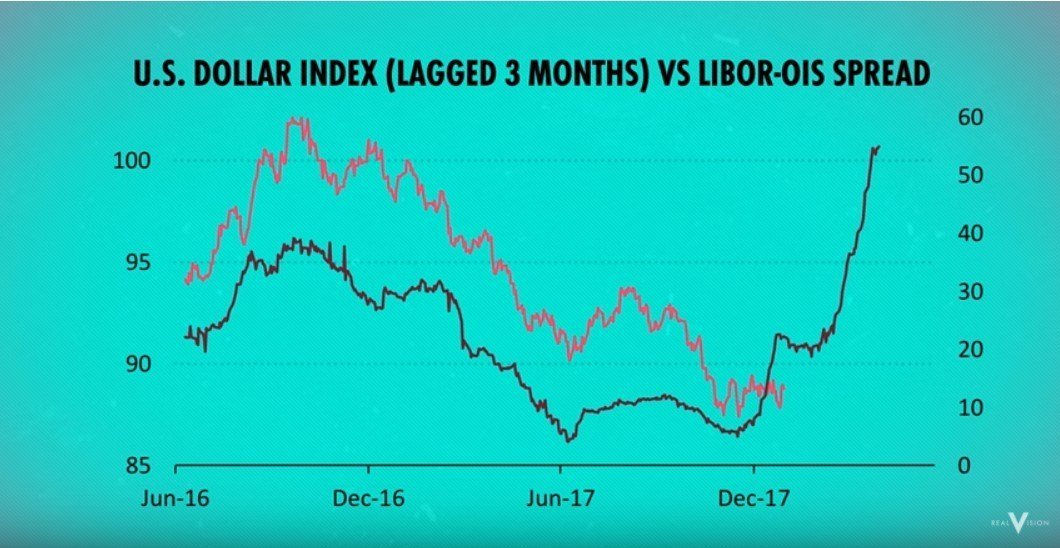

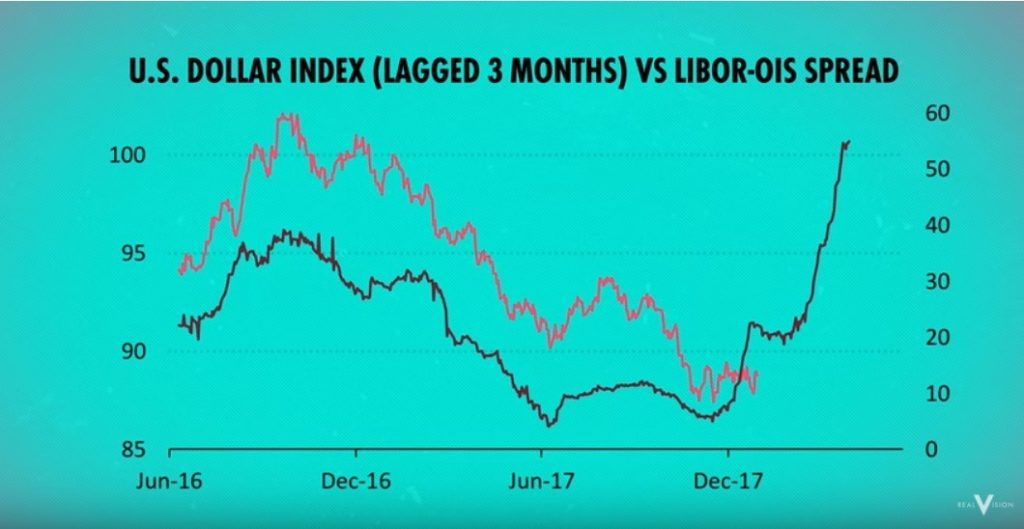

He’s also closely watching the LIBOR/OIS spread and claims that its recent rally is a harbinger for dollar strength.

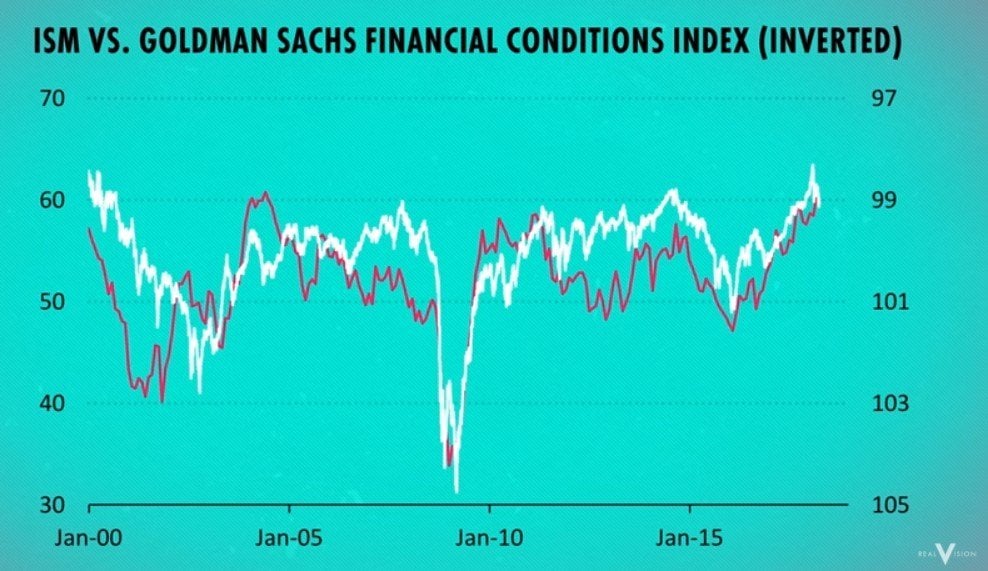

Finally, he’s been looking at the Goldman Sachs Financial Conditions Index which shows that liquidity is starting to tighten.

All of these signs entrench him firmly in the deflationary camp i.e. long bonds and USD paired with falling equities.

Book I’m reading —

I picked up Nassim Taleb’s latest book, Skin In The Game, and have thoroughly enjoyed it. If you liked his first three books, you’ll like this one as well.

My favorite part of the book so far was a rehash of the green lumber fallacy from Antifragile.

A fellow made a fortune in green lumber without knowing what appears to be essential details about the product he traded –he wasn’t aware that green lumber stood for freshly cut wood, not lumber that was painted green. Meanwhile, by contrast, the person who related the story went bankrupt while knowing every intimate detail about the green lumber, which includes the physical, economic, and other aspects of the commodity. The fallacy is that what one may need to know in the real world does not necessarily match what one can perceive through intellect: it doesn’t mean that details are not relevant, only that those we tend (IYI-style) to believe are important constitute a distraction away from more central attributes to the price mechanism.

It’s a great reminder as to why a macro trader must honor his stops. Price is king and we have to respect it regardless of how good our thesis looks on a slide deck.

Chart(s) I’m looking at —

I’ve been tweeting this chart out all week. (If you want to follow me in real time here’s a link to my twitter account)

SHY/HYG is a rough proxy for credit spreads. Credit spreads and the VIX are highly correlated so we can use this time series as a way to get a jump on the direction of future volatility as well as the direction of the SPX.

So far the spread has failed at resistance and has broken its short-term uptrend. That’s good for equity bulls.

But if this chart turns around and decisively breaks out of that grey box then it will be another 3-months or so of high volatility chop. If that’s the case then we’ll have to wait until fall for a nice risk on move in equities.

Trade I’m looking at —

I dipped my toe in the water on the short side of bitcoin using the XBT future traded on the CBOE. It’s a pretty small contract, $1.00 per point, so it’s a nice way to get your feet wet if you want to play in this new market.

I’ve been shorting into these new lows.

The nice thing about BTC is that since the market is so young, super basic trend following rules work pretty well. I’m using a simple 20-MA/50-MA cross right now to get me short. The first short signal that occurred in January of this year worked out really well. And so far this second signal has paid too.

I think bitcoin will continue to go down as crypto bros sell off coins to pay the IRS. The risk-off action in conventional markets also puts a huge headwind on something as speculative as bitcoin.

My target for this short is right around the $4,000 area.

Quote I’m pondering —

Real knowledge is to know the extent of one’s ignorance. ~ Confucius (551- 479 BC)

Taleb would agree.

That’s it for this week’s Macro Musings.

If you’re not already, be sure to follow us on Twitter: @MacroOps and on Stocktwits: @MacroOps. Alex posts his mindless drivel there daily.

Here’s a link to our latest global macro research. And here’s another to our updated macro trading strategy and education.

Article by Alex, Macro Ops