Most investors just buy and forget about their stocks. Expecting that in a couple decades that their nest-egg will be huge enough so they can safely retire.

We see people like Warren Buffet and Mark Cuban all rich and happy. And your financial advisor tells you that it’s something you can have too.

“Just keep investing and dollar-cost averaging each paycheck. . .”

But history is littered with the corpses of those we don’t see – the 95% that get ruined this way.

It’s not like Forbes posts articles about the Biggest Portfolio Failures. . .

That’s why at Palisade we invest in a different way. We want to position ourselves to avoid “blowing up”.

Not only do we want to endure – but we want to profit during the calamity.

Here’s how. . .

This strategy of profiting from chaos is exactly what Mark Spitznagel does for his clients at Universa Investments.

Spitznagel’s very unorthodox when it comes to portfolio management. He loves gold and uses a strategy called ‘tailhedging’ – he does so because he knows how well they work, but most importantly – he understands true risk.

True risk to us is insolvency and loss of principle, whereas risk in Modern Portfolio Theory means ‘beta’ – how volatile a stock price is.

That’s why most models they make can’t foresee sudden company bankruptcies or get caught off guard when countries like Greece default – they’re busy gauging risk wrong.

For example – what’s riskier to you? A gold mining stock that has a clean balance sheet, trades at 1/4th Book Value, and owns a world class asset, but has a volatile share price. Or a tech company that has billions in debt and no cash flow, yet their share price keeps going up.

In my eyes, the gold mining stock is less risky. But for Wall Street, it’s the other way around.

I’ll have another article soon talking about True Risk vs Wall St Risk. So let’s stay focused on what we learned from Mark Spitznagel here.

During the blood bath which was ‘Black Monday’ on August 24th, 2015 when the DOW collapsed over 1,000 points at the open – many scrambled.

But Spitznagel’s clients netted over $1 billion – or 20% – in that morning.

It’s things like this that makes him one of my favorite investors. . .

He understands the hidden forces of true risk and – especially – using volatility to his advantage.

He knows that volatility isn’t as uncommon as experts tell us – so he positions himself to gain from it.

Mark published new research lately that I think you need to know about.

It’s goes over what he calls ‘The Volatility Tax’.

Here’s the gist. . .

Most investors do the classic ‘buy and hold’ strategy – just like Warren Buffet preaches.

And your portfolio hopefully makes on average 6% a year – after fees.

A decade later – and your portfolio is up 60%.

Then suddenly, a crisis like 2008 happens. . .

And you lose all your profits.

Now you must start all over with a whole decade towards your retirement gone.

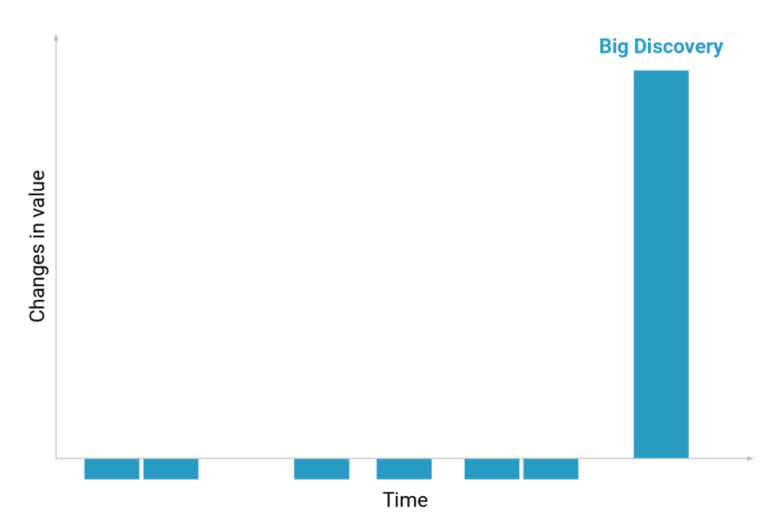

These sudden spurts of huge losses are what kill your long-term gains – what he calls the Volatility Tax.

See, it’s not small one-year losses that ruin you – but rather the rare and large crashes. . .

“The volatility tax is the hidden tax on an investment portfolio caused by the negative compounding of large investment losses.”

To put it in perspective – if your portfolio falls 50%, you need to make 100% just to get back to break even.

So the conclusion is – avoid huge losses during times of negative volatility.

Unfortunately, that’s easier said than done. . .

But using Spitznagels strategy – we can improve our odds at doing so.

We at Palisade want to make sure we get as much as possible from volatility – so we are heavily involved in gold equities and gold mining stocks and their warrants (basically long-term options).

One thing we learned early on from people like Spitznagel is that to make huge outsized gains – you must do things differently.

Using gold-silver options and quality junior mining stocks is a great and cheap way to protect your portfolio from The Volatility Tax – as well as actually profiting during times of chaos.

Just look at the average price of gold during times when the S&P 500 fell more than 15% over the last 20 years. . .

You can see that during times when market’s collapse more than 15%, gold positions would do very well. The gold mining equities and warrants even better.

These gains would offset any losses in your overall portfolio. . .

It’s this understanding of how well gold does during market volatility that’s made our investing strategy the anti-thesis of portfolio management.

Instead of the traditional way of making 5-8% per year then suddenly ‘Blow Up” and lose it all – we do the invert of this.

We make smaller amounts of annual gains but make an absolute killing during times of chaos or high volatility – since we are so leveraged to gold related equities and commodities.

The best thing about this strategy is that you can tailor it to your own comfort level. . .

Instead of being over-aggressive like us, you can do a conservative 90/10 split – for example, 90% of your capital in the S&P 500 and 10% in quality gold mining stocks, warrants, and physical metals.

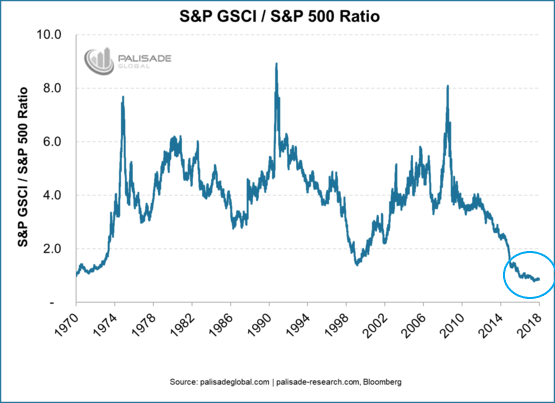

But you should know that right now, commodities are at their cheapest relative to the S&P 500. . .

That makes right now the best time to rotate out of the over-valued DOW/S&P 500/NASDAQ and into commodities like gold and silver.

Make sure to adopt this strategy and take advantage of the cheap metal prices.

This is a practical strategy – we use it ourselves. It’s all about finding ways that limit your downside while keeping your upside potential huge.

It’s up to you how to weight it – 90/10 or 75/25 or even 50/50.

In doing so you can be like Spitznagel and have your portfolio hedged – and even profit – during periods of volatility and chaos.

Article by Adem Tumerkan, Palisade Research

About The Author

Adem Tumerkan - Editor-in-Chief of Palisade Research

Before joining Palisade Global Investments, Adem was a Research Analyst at Stansberry Research – under Agora Financial. Adem is a born contrarian and has extensive knowledge of markets, financial history, and economics. He is a value investor and fascinated with cycle theory. But his focus on ‘black swans’ and how to position oneself to make huge returns during volatile times is what really separates him from the rest.