An update on our favorite hedge fund yet again of course we mean the AltMoney Hedge Fund – see his latest commentary below

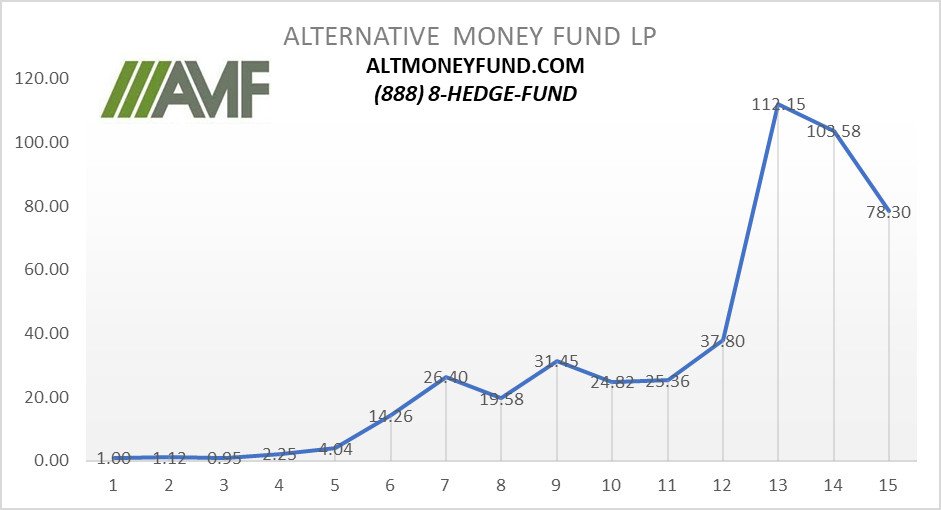

Crypto Currency Hedge Fund: Alternative Money Fund LP (AMF) February Draw-Down Widens from Mid-Month Update -30.19% YTD

Check out our H2 hedge fund letters here.

February Draw-Down Widens from Mid-Month Update:

This month has proven to be quite difficult and the fund significantly under-performed bitcoin as we saw altcoins fall significantly from their prior peeks in the last 1-2 months. At the mid-point in February, after the bounce, the loss diminished significantly from the first week of massive selling to merely being down 7%. Instead of making major changes to the portfolio, we have held things quite consistently. We do believe that there will be a significant bounce, and when it happens asset prices will increase again. January and February were some of the most difficult months that most traders and investors can remember in recent history. The China ban, the Korea ban, the Facebook Advertising ban on all things crypto, tax selling, credit card purchasing ban by credit card companies, are just a few of the factors that led to the massive deleveraging and drop in asset prices.

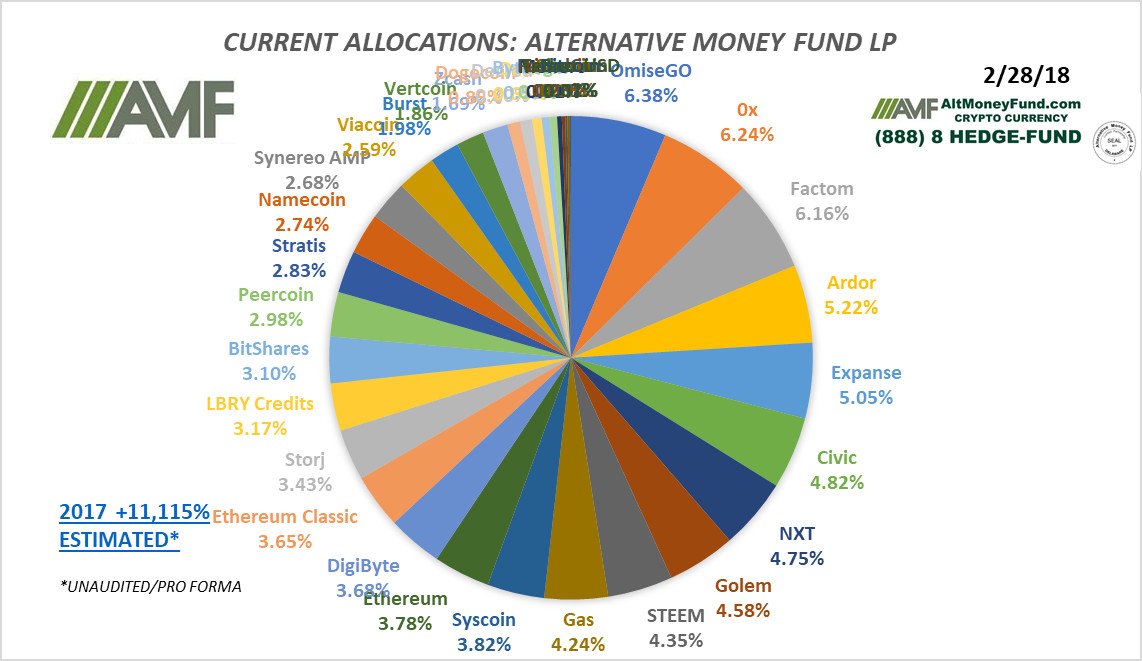

But the final 2 weeks of the month were quite difficult as selling persisted. Macro-economic factors dominated as the volatility got extreme and the correlation of bitcoin to the general markets started to go step-by-step. Altcoins were decimated. To close out the month, the fund’s losses ballooned to being down 24.41 percent for the month of February. People often ask us, when is a good time to invest and where will an opportunity emerge to allocate capital. We feel that time is now. Currently YTD the fund is down 30.19% for 2018, after having a tremendous year of being up 11,115% for 2017.

Altcoins are very over-sold at these levels. The fundamentals are evolving. Circle buying Poloniex was a major move that was a catalyst to yesterday’s move that we saw. I would not be surprised to see a massive Altcoin rally at the beginning of next month and new capital being put to use at the beginning of March by fund of funds and hedge fund managers.

Redemptions Dampen End of Month Rally

As bitcoin climbed back to 11,000 – we saw a massive wave of redemptions across the board, pummeling the markets back down to 10,400 during the final day of February 2018. Its going to be a long year. We are just 16% of the way through the year. That means we have 84% of the year left and a lot to be optimistic about. Despite the obstacles that the markets face, there is much upside in the cryptocurrency markets, and investors should allocate capital based on their risk appetite to be a part of the gains in future months to come.

As Vitalik stressed, one should be ready to experience draw-downs and traditional investments offer a much safer approach for the majority of one’s net worth invested in the markets.

One of the Most Vicious Bear Markets in History

As written in August of last year: We have had bear markets in the crypto space before, so this is not new. This indeed reminds me of September and July of 2017 where we had similar monthly performance issues with draw-downs in the 20 percent range.

When I dip, you dip, we dip/ The CME and CBOE effects

The day the CME Bitcoin futures contract launched marked the top of this bull run. The BitMEX Bitcoin Index (.BXBT) flirted with $20,000 on that fateful morning. The following two months proved that it was an amazing top at which to short Bitcoin. Now that large financial institutions could short Bitcoin by only posting USD, the thinking was/is that they will use their financial might to short Bitcoin into the ground. The first thing most financial reporters fail to understand is that on a futures exchange, there is a long for every short. By definition, a futures exchange has no net impact. If the shorters at the margin are willing to accept lower prices than buyers at the margin, the contract will trade at a discount. At that point, market makers will be net buyers, and then sell or short-sell Bitcoin on the spot markets. If the open interest is sufficient large, then this backwardation can negatively affect the price.

We Feel that The Following Sums It Up Pretty Well (Excerpt from our Favorite Blog at: https://blog.bitmex.com/when-i-dip-you-dip-we-dip/)

Wall Street is shorting Bitcoin spot

The evil bankers can’t stand a coterie of misfits becoming millionaires and billionaires, so they crashed the party by aggressively shorting Bitcoin in the spot markets.

The large financial institutions do not own Bitcoin in large quantities, if at all. They are hamstrung by KYC/AML concerns surrounding Bitcoin. That means that if they wanted to sell Bitcoin, they would need to borrow it from a credible counterparty.

Assuming banks borrowed Bitcoin with the intention of shorting it, they would need to sell it on an exchange. Given the skittishness that inhibits counterparties globally from placing large amounts of capital on an exchange, I highly doubt any compliance department at a bulge-bracket bank would approve opening an account.

Let’s suspend reality and assume they allowed trading desks to open accounts on the largest Bitcoin spot exchanges. The maximum the desk could make is 100% if Bitcoin went to zero. But, if the market instead face-ripped them by 50% on a $100-million position, that loss would reach the global head of trading and of the investment bank.

If you were the line executive that green-lit that trade, you would lose your job. You shorted Bitcoin, and lost a huge sum of money. That would make it into the financial press; you and your bank would be ridiculed.

The career and operational risk of trading Bitcoin and then shorting it would dissuade any bank from acting.

Korea trading ban

After the Chinese passed the crypto trading baton to South Korea, all policy actions emanating from South Korean territory were closely watched. When a South Korean Department of Justice official proclaimed that they would attempt to ban crypto trading in Korea, the market crashed.

However, unlike China, there is legal due process in South Korea. Also unlike China, South Korea’s economy is open. When the dust settled, the legislators clarified that they merely wished to have more visibility into who was trading what. Korean punters must now use real-name accounts; minors and foreigners are prohibited from trading. This is hardly draconian or a ban on trading.

The South Korean government is captured by crypto. The country’s National Pension Fund even holds equity investments in many of the largest trading venues. Korea’s most successful technology startup, Kakao, owns the largest exchange by trading volume, Upbit. Is the government really going to torpedo an industry that millions of voters love, and an industry that is creating high-paying jobs? No. Your average Kim will keep the faith, and continue to trade crypto.

The exchanges were halted from accepting new accounts. That measure will be lifted sometime in February. With more new blood in the market, expect the negative sentiment to wane.

China bans crypto again

I don’t know why markets continue to react to negative policy announcements from China. The regulators instructed all financial institutions to do a self-assessment and ban any payments connected with crypto trading. This was in response to the rampant OTC trading occurring after they shut down public trading of crypto on the large exchanges.

While the on-ramp into cryto is more cluttered, Chinese punters will find ways to obtain any financial exposure they wish. If people can find a way to build illegal power plants in China, they can surely figure out how to buy and sell crypto against Beijing’s wishes.

Tether big-bang theory

Like many religions, the prelate deems us laypeople unworthy of speaking the their language of the gods. As such, the majority of the crypto world, myself included, has no idea how Tether works.

The CFTC subpoena relating to Bitfinex and Tether spooked the markets. However, I don’t believe this is a net negative event.

If Tether were in serious trouble, FinCEN and the US Treasury would be the agencies inquiring into its inner workings. If they wanted to shut it down, the first action would be a cease-and-desist order. Given that it was the CFTC that issued the subpoena and that Tethers continue to be created, what the agency is after most likely is not fatal to the currency.

Even if a cease-and-desist order were issued, that would cause a market spike in the value of most large-cap cryptos instead of a plunge. Traders who wished to receive any real value at all would sell Tether and buy any crypto they could.

The price of Bitcoin/Tether would spike, and this would drag the Bitcoin/USD value higher as well. This is similar to what happened when the banking issues on Bitfinex drove people to sell USD IOUs on Bitfinex and purchase Bitcoin, and then withdraw it. Bitfinex led the market higher, and the rest of the exchanges followed.

If you believe there is actually trouble in the Tether Hotel California, then go long on Bitcoin. But the market action suggests that the latest legal issues are benign.

What has fundamentally changed?

The prices of the entire crypto complex crumpled. However, on a year-over-year basis, Bitcoin is up multiple hundreds of percent. Maybe your favourite altcoin isn’t, but that’s just the game. Don’t let CNBC fool you into buying tops and selling bottoms.

If the publicity surrounding this asset class diminishes, that could elongate the bear market. However, the financial presstitutes, as Nassim Nicholas Taleb calls them, are hooked on crypto. There is real pathos in this industry. The most-read financial stories will continue to be about this space and people therefore will continue to wonder what all the fuss is about. That will continue to drive new money into the system.

For short-term traders, the amount of new fiat entering the system is the most pressing concern. If you believe the correction results in no new blood entering, then as weak hands cash out they will drive prices lower on the margin. However crypto traders are volatility junkies. Once you trade crypto, even when the equity market “crashes” 5%, you merely brush it off your shoulders.

For long-term “investors”, nothing has changed about the technological merits of Bitcoin or your favourite altcoin. Either the coin or token will be useful or it won’t. The market gyrations are irrelevant.

Do Cryptocurrencies Have Intrinsic Value?

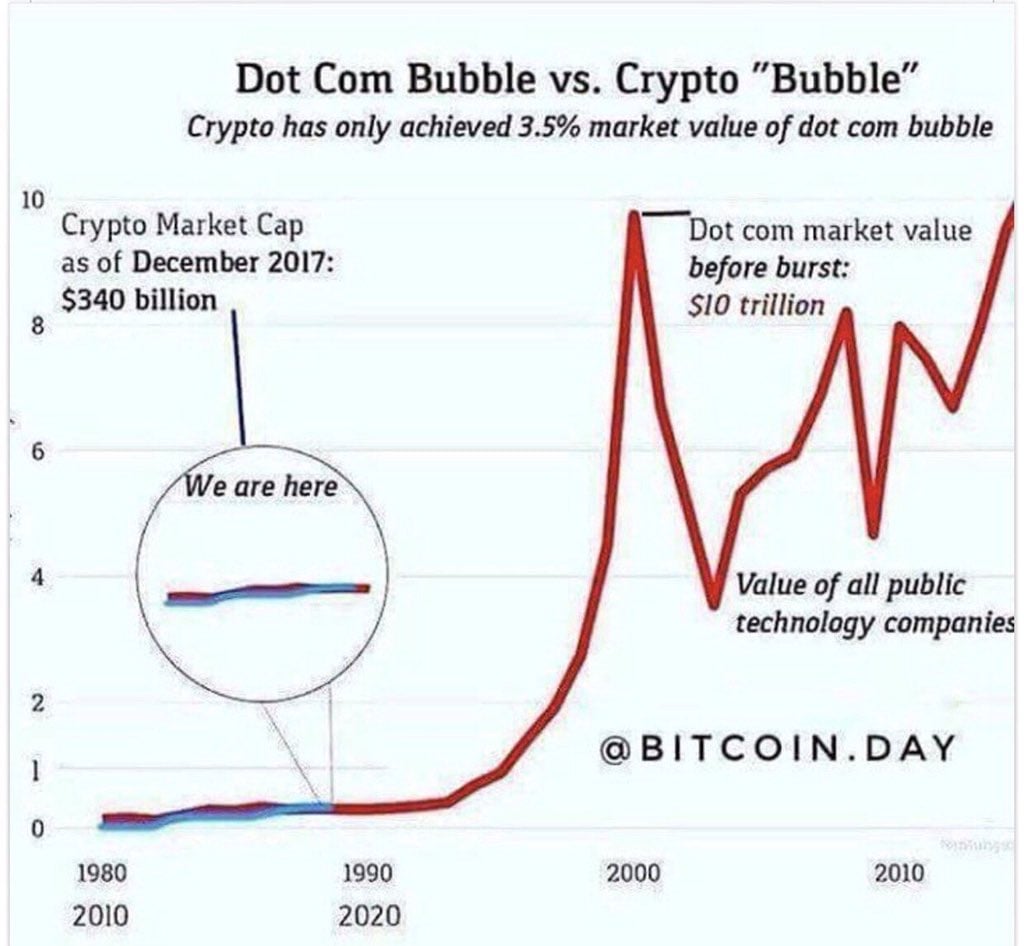

Cryptocurrencies have experienced significant increases in value in the last year. But things have looked less clear in the past few months. As there has been talk of the bubble bursting in the stock market, so too has there been talk of a cryptocurrency bubble pop. Is now a good time to assess the value of cryptocurrencies from a more reasoned perspective?

In order to predict cryptocurrencies’ future value, we should work to understand how value is derived. Value is a measurement of the ‘goodness’ of a given thing. Some things are instrumental goods, meaning they are goods because they allow us to access some other good. Intrinsic goods are good in and of themselves -- they are the thing we work to attain.

Adam Smith said in the Wealth of Nations that “money can serve no purpose other than purchasing goods." Currencies are instrumental goods. To be effective, currencies have to be mediums of exchange and stores of value.

So, the value of a currency is in its ability to do those things efficiently and effectively: facilitate transactions and act as stores of value.

Cryptocurrencies as Mediums of Exchange and Stores of Value

A few years ago, when digital currency was just rising in value, Paul Krugman asked this question, in a blog post titled “Bitcoin is Evil.” He wrote, “to be successful, money must be both a medium of exchange and a reasonably stable store of value. And it remains completely unclear why Bitcoin should be a stable store of value.”

Talking with Bitcoin boosters, Krugman complained, “When I try to get them to explain to me why Bitcoin is a reliable store of value, they always come back to with explanations about how it’s a terrific medium of exchange.” Krugman was saying that a currency’s ability to store value and its ability to mediate exchange are different matters entirely. But how are those two issues related?

(Read: Bitcoin Price and Real Time Updates)

Mediums of Exchange can become Stores of Value

If a currency is going to be a store of value, the value of it has to be stable. For a currency to have a stable value, it has to be an effective facilitator of transactions. For a currency to be that, it has to be ubiquitous. The ubiquity of a currency, and the increase of value that comes with it, is referred to as the network effect. The more widely a currency is used, the more flexibility that currency has to facilitate transactions, which stabilizes its value, because simply, the more people accept it as a valid form of payment, the more people will use it as a form of payment. And as a currency’s ubiquity rises, so too does its value.

Think about it: if you and two other people are the only ones to accept seashells as a valid form of payment, this means seashells aren’t a very useful medium of exchange. You can only exchange with those two who also accept seashells. And, if one of you stops accepting seashells, the utility, and thereby the value, of seashells drops significantly, because the flexibility of shells as a facilitator of transactions just dropped.

If the value of a currency is predicated on its flexibility and ubiquity, then that currency’s ability to become viable depends on its users understanding it as a better facilitator of transactions than other mediums of exchange. If a cryptocurrency is going to replace paper money, users have to believe that instruments like Bitcoin and Ether are better at facilitating transactions. So, then, the question is, in what ways does cryptocurrency improve on the technology of paper money?

(Read: IMF Urges Banks to Invest in Cryptocurrency)

The Case for Crypto

Before we move on, it’s important to know that cryptocurrencies are often lauded by anarchically-inclined communities. The relative anonymity they allow for, the difficulty to trace transactions, the inability of governments to regulate or restrict transactions, the limited amount of Bitcoin that will be printed (meaning that governments cannot simply print more money in order to pay for things, thereby creating massive inflation) and the potential of destabilizing and decentralizing government backed paper currency are all points of excitement for anarchists.

Allow me to make a case for cryptocurrency in straight-forward, non-pro-anarchical terms. Since the vast majority of us are not anarchists, those arguments won’t be very convincing in the context of an argument that cryptocurrency will grow as its network of users grows.

Money is an instrument that helps us achieve our goals. In his 2011 book, "Debt: The First 5,000 Years," author David Graeber argues that while standard accounts of the history of money and transactions claims that bartering was the initial form of transaction, it’s more likely that this was not the case; credit was. Credit has always been a good medium of exchange when those engaged in the deal considered each other to be "credit-worthy", such as the small tribes in which we initially evolved. As societies grew, barter and cash, and then fiat currencies arose in response to problems of trust and reciprocity.

Fiat comes from the Latin “let it be done,” meaning that the currencies we use today, which are fiat currencies, are valuable only because they have the “full faith and credit” of the economy in which they exist. We collectively invest meaning in paper currency because a government entity tells us it is credible, saying “it shall be” currency, prints it and accepts it as the only valid form of tax payment.

So, paper money replaced trade and barter because it was a more efficient medium of exchange that also dealt with problems of trust and reciprocity. If a cryptocurrency is going to overtake a paper currency, it will have to be a more efficient medium of exchange than paper money, while continuing to deal with the problems of trust and reciprocity.

Bitcoin is a more effective facilitator of transactions than paper money. It’s more flexible, and it’s flexibility will only increase as the network grows; it’s digital, it can be used for international transactions; there are no conversion fees; and transaction fees are substantially lower. The central technology of all cryptocurrency, the blockchain, deals more effectively with issues of trust and reciprocity than a central bank. Moreover, the distributed nature of the blockchain increases the security of the currency and makes it less susceptible to manipulation or attack than a central bank. Cryptocurrencies’ major challenge is to overcome prospective users’ suspicion, and become known as a legitimate medium of exchange for legal purposes.

(Read: What Could Make Cryptocurrencies Go Mainstream)

Bullish on Cryptocurrency

In an interview with CNBC, NYU Stern Professor of Finance, Aswath Damordan, was bullish on cryptocurrencies in general, for the reasons I’ve given above. He predicted that digital currencies will eventually be as important as major paper currencies: “I think there is going to be a digital currency sooner or later that competes with the major currencies.”

Even more recently, Damordan wrote a blog post, The Crypto Currency Debate: The Future of Money or Speculative Hype? In it, he argues that the future of cryptocurrencies, as a legitimate form of payment, will have to lose some of its attributes that make it so alluring as a speculative asset. This is because the things that make them so exciting -- their price swings, their volatility, their potentially lucrative payoff -- actually make them terrible currencies. In the end, Damordan says that the cryptocurrency that has the brightest future is the one thinks about itself “as a transaction medium, and acts accordingly.”

This should effect your investments: “If you think that bitcoin will eventually get wide acceptance as a digital currency,” it’s a worthwhile investment. But, if you believe the opposite, it might be time to recognize that, “this is just a lucrative, but dangerous, pricing game with no good ending.”

So investing in cryptocurrencies might be a prudent investment, but which one that should be is a more complex question, with fewer clear answers

But, the real investment opportunity in this field might be not only cryptocurrencies, but innovative applications of the blockchain.

There is a small presentation that does not necessarily go into the strategy that much, but it does touch on some other things.

- 30 or so names in the portfolio

- discretionary, not systematic

- technically driven bottom-up, primary.

- fundamental research, secondary

- performance not directly correlated to the price of bitcoin. Good addition for Bitcoin holders.

factsheet: http://altmoneyfund.com/AMF-factsheet.pdf

http://altmoneyfund.com/AMF_2.pdf

http://altmoneyfund.com/AMF.pdf

John Chalekson ([email protected])

Managing Member

Alternative Money Fund Management, LLC

Http://www.AltMoneyFund.com

Alternative Money Fund, LP

(888) 8-HEDGE-FUND / 310-704-1405

Alternative Money Fund, LP® is a crypto currency hedge fund that is committed to provide exceptional returns through an actively managed portfolio of blockchain assets. With the emergence of Bitcoin, Altcoins and this exciting new technology has created a new asset class for investors. The volatility associated with the cryptographic verification and game theoretic equilibrium, these blockchain-based digital assets create valuable opportunities in an actively traded portfolio, Our trading strategy does NOT use leverage or margin. Returns are reported monthly and capital accounts may be increased or redeemed each month.

Blockchain tokens are emerging which add a monetary incentive layer to p2p protocols and facilitate equity crowdfunding that anyone in the world can participate in. This means for the first time, open source software developers can monetize their networks at the protocol level, and users of the network are the equity owners of the network. In this model, disproportionate returns go to holders of the tokens rather than investors in private companies built on top of the protocols.

Statement of Confidentiality

The contents of this e-mail message and any attachments are confidential and are intended solely for addressee. The information may also be legally privileged. This transmission is sent in trust, for the sole purpose of delivery to the intended recipient. If you have received this transmission in error, any use, reproduction or dissemination of this transmission is strictly prohibited. If you are not the intended recipient, please immediately notify the sender by reply e-mail or phone and delete this message and its attachments, if any.