Activist investor Jana Partners has turned its focus from higher returns to parental guidance with its latest target, making it the most recent activist to dabble in environmental, social and governance (ESG) work. Barry Rosenstein’s firm is launching a new impact investing fund, and recently partnered with pension fund California State Teachers’ Retirement System (CalSTRS) to pressure technology giant Apple to study the effects its iPhone has on teenagers. The pair collectively own approximately $2 billion worth of stock (a new holding for Jana, according to quarterly filings) and have requested the board take a more proactive approach in providing parents with “more choices and tools to help them ensure that young consumers are using [Apple] products in an optimal manner.”

Jana’s involvement in particular is likely to intensify a debate about whether activist investors help the long-term prospects of the companies they invest in, and muddy the waters between activism and stewardship, the latter of which tends to amplify words like sustainability, rather than value. According to the hedge fund’s joint letter with CalSTRs, “Increasingly today the gap between “short-term” and “long-term” thinking is narrowing, on issues like public health, human capital management, environmental protection, and more, and companies pursuing business practices that make short-term sense may be undermining their own long-term viability. In the case of Apple, we believe the long-term health of its youngest customers and the health of society, our economy, and the company itself, are inextricably linked, and thus the only difference between the changes we are advocating at Apple now and the type of change shareholders are better known for advocating is the time period over which they will enhance and protect value.”

What we'll be watching for this week

- Will a U.S. court deem Valeant Pharmaceuticals and Pershing Square’s $290 million settlement “reasonable and fair” in the Allergan insider trading case?

- Will Institutional Shareholder Services (ISS) recommend against J. Alexander’s merger with 99 Restaurants, with activist investor Marathon Partners Equity Management attempting to convince the proxy advisory firm of the transaction’s shortcomings?

- Will Italy-based Ferrero win a bidding battle for Nestlé's U.S. candy business?

Activist shorts update

Activist short seller Citron Research has revealed a short position in Aurora Cannabis, accusing the company of accounting fraud. The short seller tweeted last Wednesday that the medicinal cannabis company “sports Enron type accounting and is the weakest player in the space.” Citron also accused Aurora of having related party transactions, no path of profitability, and a lack of intellectual property.

The Canadian company is currently in a bidding war for peer CanniMed Therapeutics. CanniMed recently sent its shareholders a letter expressing its concerns with Aurora’s bid, saying CanniMed’s acquisition of NewStrike Resources would be a better transaction for the company. On Wednesday, Citron said Aurora’s hostile bid demonstrates how the company “irresponsibly allocates capital” as it spends $600 million on a deal whose “barriers to entry are deteriorating.”

Stat of the week

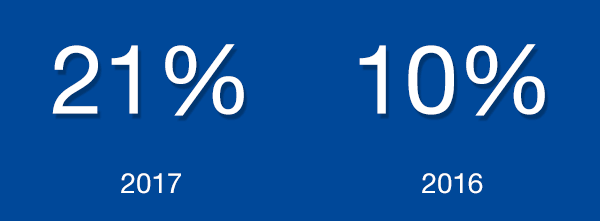

The proportion of all Australia-based companies publicly subjected to activist demands by an activist headed outside of Australia:

For bespoke data requirements, contact our team at [email protected] or subscribers of Activist Insight Online can visit our interactive statistics page.

Article by Activist Insight