1 in 4 young New Jerseyans have received Bank of Mom & Dad funding since the start of the pandemic.

Q4 2020 hedge fund letters, conferences and more

- 78% say there is no interest on loans from parents.

- 1 in 5 parents admit they are not confident they will be paid back.

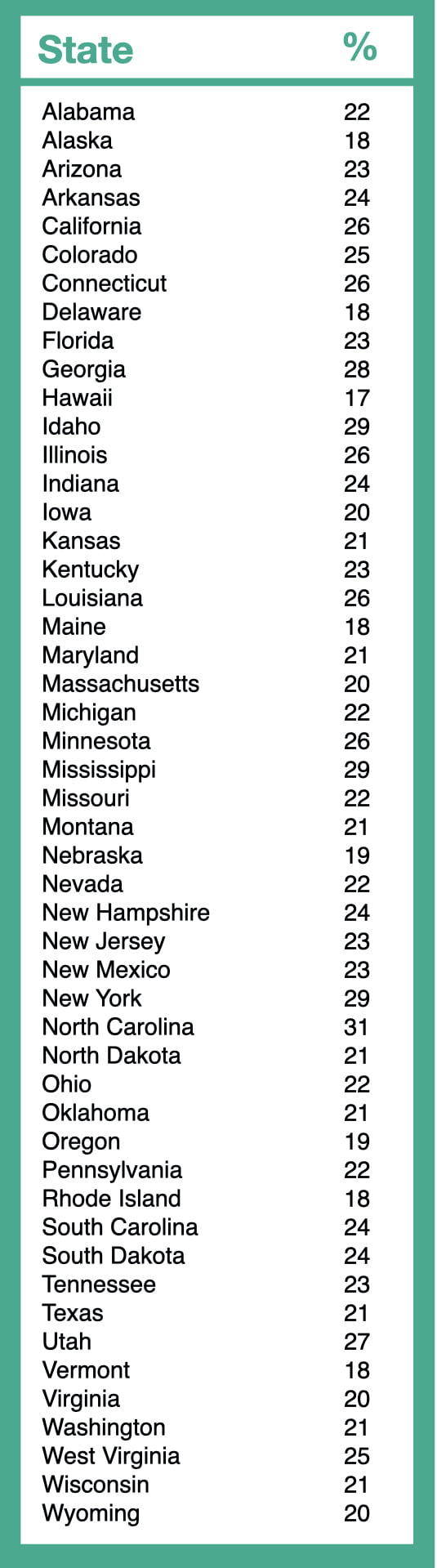

- Infographic showing results across America.

Florida State Bank of Mom & Dad's Lending Program

The Florida State Bank of Mom & Dad is beginning to turn on the lending taps to children, signalling a shift in the way young New Jerseyans are accessing credit since the start of the pandemic.

The USAWillGuru.com survey of 4,500 20-29 year olds provides a snapshot of young people’s living circumstances since the biggest economic shock in modern times. As Gen Z moves into adulthood and millennials advance into middle age, an overwhelming trend has emerged, revealing that 23% of young New Jerseyans have relied on parents to help pay the bills since the start of the pandemic (March 2020).

The survey revealed that young people are no longer tapping parents for non-essential purchases, such as vacation money. Instead, credit is being requested for making ends meet for day-today living. The categories most parents are requested to help pay for are: Rent: 52%; Car: 22%; Groceries: 15%; Childcare: 11%.

No Interest On The Loans

For those respondents who have accessed funds from the Bank of Mom & Dad, 78% say there is no interest on the loans (with 5% saying repayment terms had not even been discussed). And for those who have moved back in with parents, an equally high figure (72%) say they are living rent-free.

However, in a sign that it is not only young people being affected by the economic crisis, 52% of parents who have given adults children money since the start of the pandemic, admit that they haven’t been able to provide the full amount requested. The majority said that this was simply because they didn’t have the funds available, but a significant 1 in 5 admitted that they were not confident their children would pay them back.

32% of 20-29 year olds surveyed said the first place they would turn to cover a sudden $1,000 expense they could not afford would be the Bank of Mom & Dad.

“We are living in unprecedented times” says Martin Brieger, editor of USAWillGuru.com. “The Bank of Mom & Dad is as old as the history of finance. However, what we are seeing now is a squeeze on both sides, with data showing a significant proportion of parents unable to provide the full amounts requested by children. We expect to see a trend of parents funnelling funds previously set aside for inheritance to be transferred earlier than previously planned.”