A.T. Kearney’s Global Business Policy Council (GBPC) predictions for the coming year are so on the mark that we already had to take one out, because it came true last week. And with the GBPC’s broad sweep, there’s something in it for everyone.

From geopolitical and economic disruptive forces to new technologies and regulations causing shifts in the socioeconomic landscape, Year-Ahead Predictions 2019 runs the gamut from the consolidation of cryptocurrencies to the outlook for U.S.-China trade wars, from superpower default alliances to sci-fi medical innovations, predictions for what to do with waste, and who would have thought, the shortage of a material so prolific we take it for granted (spoiler alert: not water).

Q3 hedge fund letters, conference, scoops etc

GBPC’s 10 major predictions, fleshed out in the study, are based on continuous scanning of the horizon across dimensions of demography, economy, environment, geopolitics, governance, resources, and technology. In 2018, many of GBPC’s predictions unfolded more or less as described.

In this year’s study, you’ll find the outlook for 2019 on:

- Cryptocurrencies, why Bitcoin will lead and how the regulatory outlook will change

- Emerging markets’ economies

- The global waste management crisis

- The global shipping industry

- Africa

- Medical advances

- Shifts in global leadership

- And more.

Year-Ahead Predictions 2019

Companies must prepare for significant global events that will occur and trends that will gain momentum in the coming year.

In 2019, trade tensions and geopolitical realignment will intensify. At the same time, underreported resource challenges will rise in urgency.

Predictions 2019 #1: The US–China trade war will intensify.

US–China relations worsened significantly in 2018 as US President Donald Trump took a hardline approach to reducing the bilateral trade deficit with China. Over vocal opposition from the business community, the Trump administration imposed tariffs on $250 billion of Chinese imports after negotiations failed. Beijing retaliated with tariffs on $110 billion of US imports and took steps to create a more restrictive business environment for US companies in China (see figure 1). More than half of US companies reported slower approvals or enhanced inspections by Chinese authorities following the imposition of tariffs. Beijing has also refused to address long-standing US complaints related to China’s industrial policies, weak intellectual property protections, and forced technology transfers. Negotiations were in a standstill until early December, when Presidents Trump and Xi agreed to resume talks for 90 days.

This short “ceasefire” is unlikely to last, however, so the US–China trade war will intensify in 2019. Insufficient progress on key issues will likely lead President Trump to raise tariff levels on Chinese imports. The administration may even impose tariffs on an additional $267 billion of Chinese goods—encompassing essentially the entire value of Chinese imports in 2017. And while Democrats will have a majority in the US House of Representatives, the bipartisan disapproval of China’s trade practices will sustain President Trump’s trade agenda. China’s retaliation will likely include increased tariffs on some US imports and efforts to offset potential losses for domestic companies. Beijing will also look to secure alliances, dispel growing opposition to its trade practices, and fortify its domestic economy. China will therefore focus on diversifying its trade and reducing its dependence on the United States, including pressing ahead with free trade agreements. Southeast Asian economies will likely benefit from the trade war as US importers shift production and supply chains to avoid tariffs on Chinese goods. This move will begin the long process of restructuring supply chains (subscription required) for many companies. The International Monetary Fund (IMF) estimates that the trade war will translate to a small but significant 0.2 to 0.4 percentage point reduction in global economic output in the long term.

Predictions 2019 #2: Bitcoin will lead the consolidation and maturation of the cryptocurrency market.

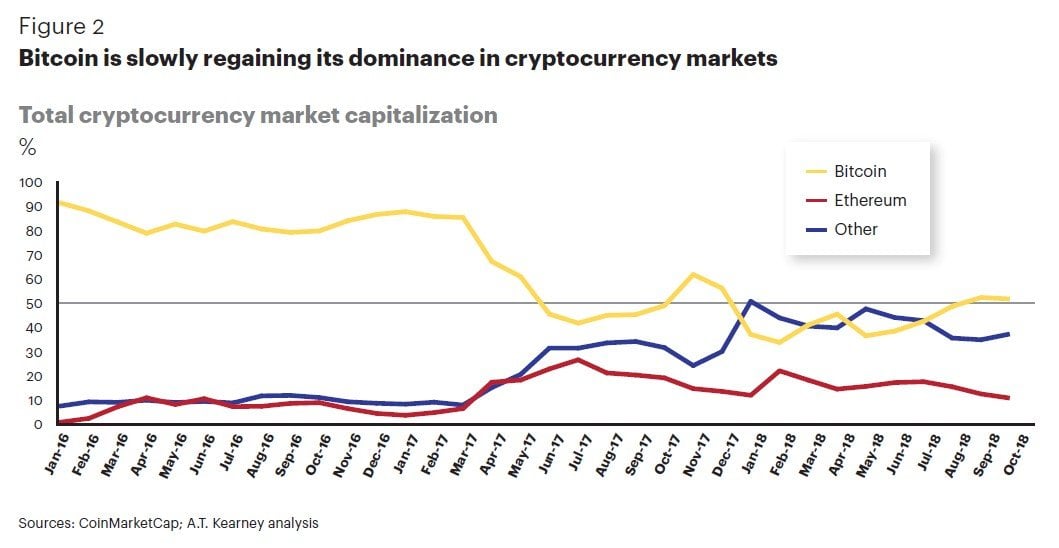

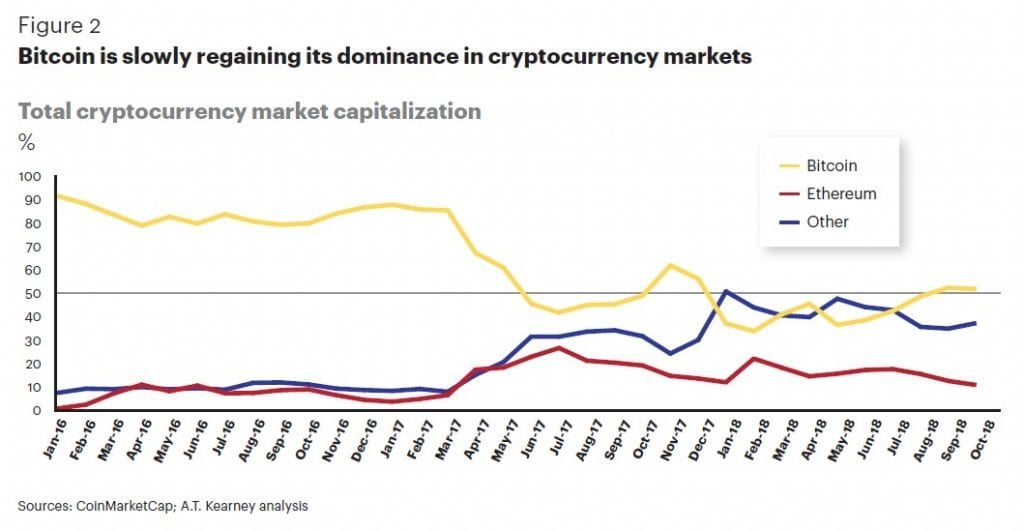

Bitcoin celebrated its tenth birthday in October 2018 under clouds of doubt regarding the long-term future of cryptocurrencies. All cryptocurrencies saw a rapid price spike in 2017—and Bitcoin alone soared 1,375 percent that year. But Bitcoin dropped from more than 90 percent of the total cryptocurrency market capitalization in January 2016 to just a 33 percent share in February 2018 as a result of the rapid proliferation of “altcoins” (see figure 2). And the cryptocurrency market overall collapsed spectacularly in 2018; the 10 largest cryptocurrencies lost more than 80 percent of their collective value between January and September. This decline was fueled by security breaches and hacks, spiking fees, and the popping of a highly speculative bubble. In September, the New York Attorney General’s Office released a report saying that crypto exchanges were at risk of market manipulation while failing to provide basic consumer protections.

Despite these obstacles, the cryptocurrency market will begin its second decade in a state of post-crash consolidation and maturation. By the end of 2019, Bitcoin will reclaim nearly two-thirds of the crypto market capitalization as altcoins lose their luster because of growing risk aversion among cryptocurrency investors. More broadly, financial regulators will soften their stance toward the sector. The UK Parliament’s Treasury Committee, which wants to end the “wild west” of crypto markets, will pursue regulations intended to stifle criminal activity and reduce price volatility as it tries to make the United Kingdom a hub for cryptocurrency markets. At the same time, the US Securities and Exchange Commission will warm to Bitcoin exchange-traded funds and, with the US Commodities Futures Trading Commission, will continue to work to improve market transparency. Ironically, for cryptocurrencies to see a third decade, the only viable path forward involves this acceptance by the international financial system that Bitcoin once sought to defeat. Cognizant of this, the recently formed Blockchain Association will begin to lobby American policymakers to improve cryptocurrencies’ image in 2019.

Predictions 2019 #3: The global trash crisis will spur innovations in waste management.

The world became unable to ignore the unsustainable status quo in the handling of waste in 2018. Over the course of the year, China and several Southeast Asian countries imposed limits on imports of plastics. The result was shipping containers piled up outside of Asian seaports with no alternative locations to bring the world’s recyclables except landfills or illegal dump sites, including oceans and rivers. The policy shift spurred bans across the developed world on plastic straws and other single-use plastic items. But these prohibitions do little to solve the overall challenge represented by plastics—or to address the broader issue that the world faces vis-à-vis its trash. According to the World Bank, global annual waste generation will grow 70 percent between 2016 and 2050. Food waste still represents the largest share, but the rise of e-commerce is causing an exponential increase in cardboard and other packaging trash. In emerging markets, nearly 90 percent of waste is either openly burned or illegally dumped. And landfills contribute significant greenhouse gas emissions. Recognition of the global trash crisis is rising, along with efforts to create a “circular economy” that more efficiently reduces, reuses, and recycles waste.

In 2019, innovation in waste management processes will accelerate. Government initiatives such as the Clean India Mission and Beautify Malawi will continue to improve trash collection and disposal in emerging markets. In developed markets, more municipal investment in artificial intelligence technologies and robots that can detect and sort items by material type will lead to greater efficiencies and reduced costs, allowing more recycling to occur within the markets where waste is generated. New entrants to the waste management industry will also disrupt traditional practices. For instance, Scrapo matches disposers of waste with those who want to recycle it for their own purposes, TerraCycle sells reusable containers for a variety of household items, and Ecovative uses food waste to create faux leather and other goods. Additionally, more companies will follow Alphabet’s lead in announcing technology-based solutions for their facilities’ waste disposal systems. The Google parent company’s Quayside community in Toronto, to be opened in 2020, is one example. It will include “smart” trash removal, such as sensors to meter trash usage, autonomous robotic trash collectors, and other solutions that reduce landfill waste by 90 percent. Finally, recent materials science breakthroughs will take steps toward commercial viability, including those for a new plastic-like polymer that can be recycled indefinitely.

Predictions 2019 #4: The global shipping industry will crash into new sulfur regulations.

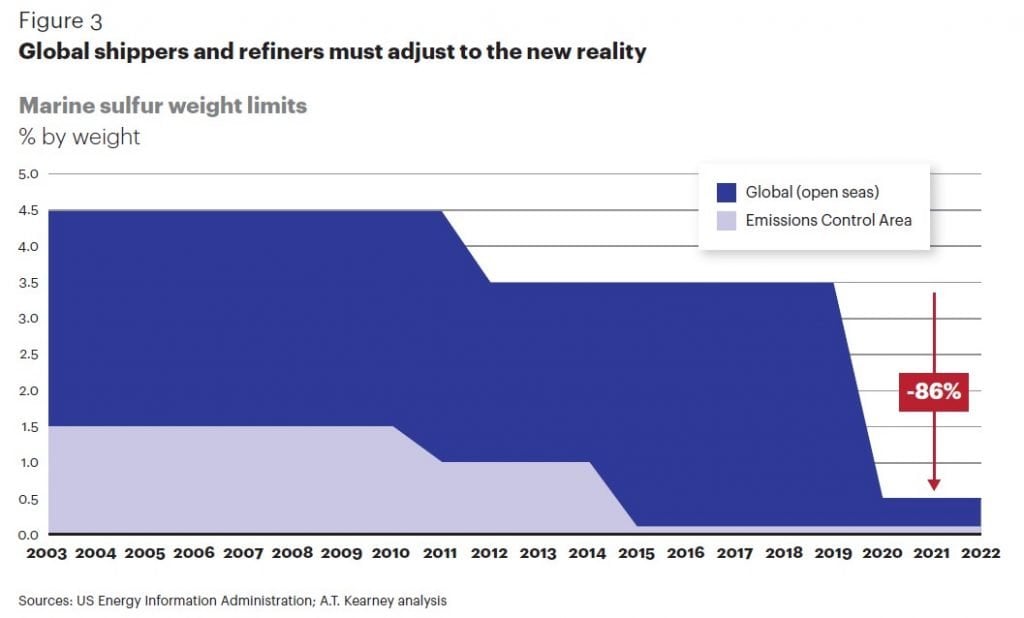

The International Maritime Organization (IMO) is on the cusp of implementing new sulfur regulations that will have significant implications for the shipping industry—and the 90 percent of global trade that relies on it. On January 1, 2020, the IMO will enforce a ban on ships using fuel that has a sulfur content of 0.5 percent or higher (see figure 3). Ships will have the option to purchase “scrubbers” to reduce emissions from higher-sulfur fuel, but because the cost is between $1 million and $10 million per ship, it is not surprising that less than 3 percent of the global fleet has made this investment. The new regulations are part of the IMO’s effort to reduce the shipping industry’s greenhouse gas emissions by 50 percent from 2008 levels by 2050. They will set a new global standard for shipping fuel, with the exception of the stricter sulfur limit of 0.1 percent in the existing Emissions Control Areas (ECA) in North America, the Caribbean, the Baltic, and the North Sea.

Given the low level of readiness to comply with these regulations, the global shipping industry will undergo a disorderly and disruptive transition to the new environment in 2019. The implications will go far beyond the shipping industry. With every month that passes, prices for a variety of fuel types—including high and low sulfur bunker fuel, diesel fuel, and jet fuel—will be more volatile as refiners and fuel purchasers pursue a pricing advantage before the January 1, 2020 deadline. Ship owners are already sounding the alarm about fuel scarcity and the estimated $60 billion in additional fuel bills (equal to the total industry fuel spend in 2016). Some of the largest crude oil tankers could see a 25 percent increase in shipping costs, resulting in higher oil and gas prices for consumers. In fact, higher seaborne freight costs for all goods will raise prices for companies and households around the world by the end of 2019. And while the disruption to the global shipping industry will begin in 2019, the drama will continue to unfold in 2020.

Predictions 2019 #5: The Xi–Putin relationship will be the world’s most consequential bromance.

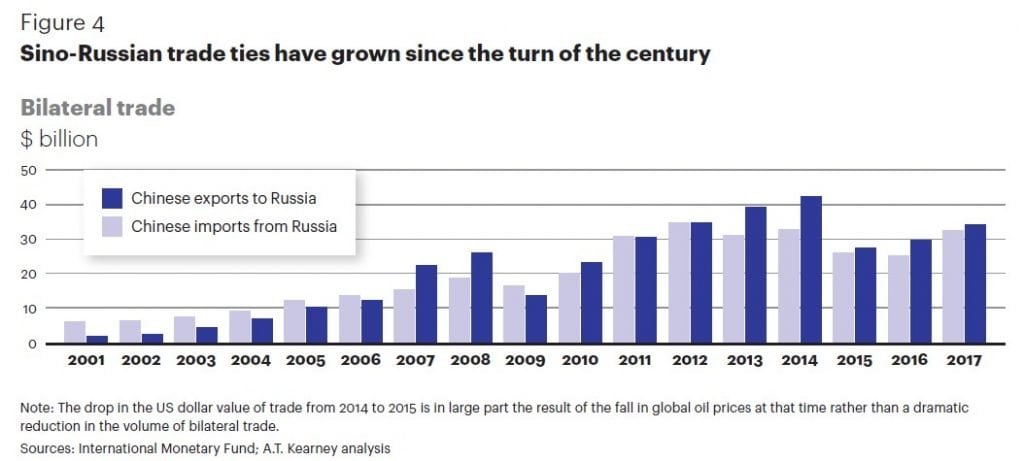

Chinese President Xi Jinping gave Russian President Vladimir Putin a “best friend” medal in June. This honor came a year after Xi received Russia’s Order of St. Andrew medallion—the highest state award. Sino-Russian economic ties have also grown steadily in recent years, in large part because of China’s growing demand for Russian oil and gas (see figure 4). In September, Xi participated in Putin’s Eastern Economic Forum (EEF) in Vladivostok for the first time, and he remarked that it was his third meeting with Putin in four months. Among the outcomes of the EEF was the announcement of a joint venture between the Chinese e-commerce giant Alibaba, the Russian firm Mail.ru, Russia’s sovereign wealth fund, and the telecom MegaFon to further develop the Russian e-commerce market. And as Russia remains under the weight of US sanctions and China remains locked in an intensifying trade war with the United States, the two leaders are embracing their shared strategic interest in counterbalancing American influence. Quickly following the EFF, China participated in Russia’s largest war games since the end of the Cold War—the latest signal that these Eastern powers are aligned in the face of growing geopolitical instability and rising tension with the West.

Xi and Putin will deepen their relationship even further in 2019. They will become more vocal critics, both together and separately, of US trade policies and other “America First” actions as they seek to portray themselves as credible alternative global leaders. Sino-Russian coordination on North Korea and other global security challenges will strengthen. The two countries will also collaborate more in the Arctic, where they have already agreed to develop trade routes jointly. The 2019 opening of the Power of Siberia pipeline to supply China with Russian natural gas will further solidify Sino-Russian energy relations for the long term. This link, following the beginning of liquefied natural gas (LNG) shipments to China from the Russian Arctic Yamal LNG project in 2018 and growing agricultural and military goods trade, will strengthen bilateral economic ties. Although both countries’ economic relationships with the West will continue to be much more significant than their relationships with each other, growing economic, diplomatic, and military ties will increase the geopolitical importance of the Sino–Russian friendship.

Predictions 2019 #6: The global anxiety epidemic will lead to a proliferation of new products.

More than 300 million people—nearly 5 percent of the world’s population—suffer from clinical depression or anxiety, costing the global economy $1 trillion each year. In the United States alone, nearly 20 percent of the population reports suffering from anxiety-related disorders. The problem is growing rapidly, as the global prevalence of anxiety and depression has increased by 15 and 18 percent respectively since 2005. And the Gallup 2018 Global Emotions Report, which surveys people across 146 countries, shows that world happiness is at its lowest level since the survey was first conducted in 2006. The World Health Organization estimates that depression and anxiety will match cardiovascular diseases as the world’s largest major health disorders by 2020. Young people are increasingly vulnerable to the effects of depression and anxiety, suggesting the problem will persist for many years to come. To ease this global epidemic, consumers are finding comfort in not only medications, but also a variety of products designed to alleviate their stress and anxiety such as adult coloring books, essential oils, meditation apps, weighted blankets, fidget spinners, and the non-psychoactive cannabis compound cannabidiol (CBD).

The incredible rise in popularity of such anti-anxiety products is only the beginning of a monumental consumer wave. In 2019, there will be a proliferation of such consumer products hitting the shelves, supporting a multibillion-dollar market for treatment of anxiety disorders and depression. A vast gamut of products will be offered, ranging from affordable items such as new supplements and oils to costlier technology gadgets such as headgear and electrotherapies. Beverage companies, including producers of both wellness and alcoholic drinks, will announce new product lines featuring CBD as an ingredient. This trend will be accelerated by a confluence of global generational traits. Many Millennial and Generation Z young professionals, for instance, are turning to such products for self-care. Meanwhile, the global geriatric population—in which depression and anxiety are most common—is increasing as the large Baby Boomer generation ages. Between 2016 and 2050, the global share of people over 65 years old will double from 8.5 percent to nearly 17 percent of the population. As a result, more anxiety and depression therapies will be developed for their demographic. And because access to health services can often be difficult or cost-prohibitive, quick-fix consumer items, regardless of efficacy, will remain the most attractive treatment options for the anxiety epidemic in 2019.

Predictions 2019 #7: A sand shortage will grind the gears of the global construction industry.

Urbanization and infrastructure development are resulting in a global shortage of sand, the second most extracted natural resource after water. Two-thirds of construction material is concrete, which itself is composed of two-thirds sand. The global construction boom is therefore having a significant impact on global sand prices. To get a sense of scale, China used more sand between 2011 and 2013 than the United States did during the entire 20th century. In India, the construction boom is fueling not only a price spike—with reports of price increases between 100 and 150 percent in the past two years—but also a sand mafia that has become notorious for violence. There are similar criminal groups operating in Indonesia and elsewhere in Asia. US prices for cement and concrete rose nearly 70 percent between 2004 and mid-2018, driven in part by sand-intensive hydraulic fracturing (fracking) in the oil and gas sector. Even desert-based construction hotspots such as Dubai must import construction-grade sand, often taken from beaches, riverbeds, and lakebeds across the world. This rising sand demand is having devastating environmental effects, including rapidly intensifying the erosion and degradation of water-based ecosystems around the world.

In 2019, rising sand prices will put financial strain on the construction industry, particularly in emerging and frontier markets. This trend could lead to the slowing or cancellation of some projects. Countries such as Vietnam will be particularly sensitive, given that sand prices there rose about 200 percent in 2017 alone as the government seeks to eliminate illegal sand dredging. Singapore, the world’s largest sand importer, will face greater scrutiny and delay of development projects as global attention to the issue rises. The country is already subject to sand export bans from Vietnam, Indonesia, and Cambodia for alleged long-term participation in sand smuggling. In rapidly urbanizing sub-Saharan Africa, increasing sand prices will continue to cause construction strains in countries such as Uganda, which has exhausted local supplies and is now turning to imports. As a result, countries and construction companies—particularly those in Asia, where the illegal sand trade is receiving growing attention—will come under more pressure to demonstrate that they are complying with the law. Effects will include a further rise in legal sand prices as well as downward pressure on the global construction boom.

Predictions 2019 #8: The looming emerging markets credit crisis will grow in both scale and scope.

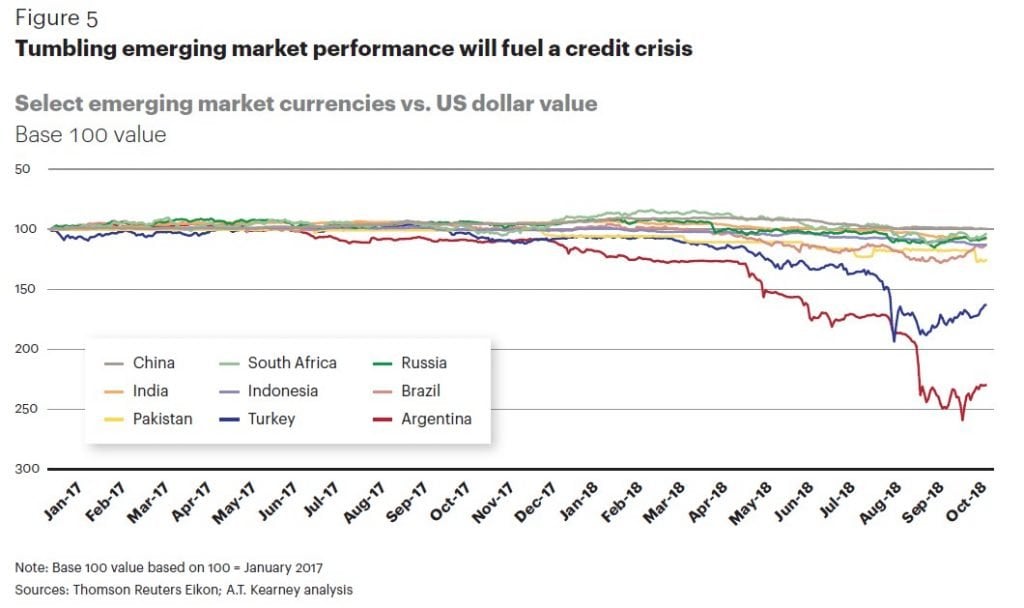

Some emerging markets have come under serious economic and financial stress as a result of foreign-denominated debt and currency depreciations (see figure 5). Argentina’s balance of payments has been strained by both domestic and foreign investors liquidating their positions in onshore peso assets. As a result, the IMF dispersed a three-year Stand-By Arrangement loan of $57 billion (subscription required) with Argentina in 2018—the first time the IMF has done so with a member country in crisis in more than two years. Pakistan recently announced it also intends to seek an IMF bailout as its foreign currency reserves dwindle. In Turkey, the lira is down 40 percent to the US dollar since the start of 2018, while the Indian rupee is down 15 percent. Zambia is on the verge of default, worsened by significant borrowing from Chinese creditors and a quickly depreciating kwacha. Venezuela is being devastated by hyperinflation, which the IMF estimates will exceed a record 1 million percent for 2018 as a result of economic mismanagement.

An emerging markets credit crisis will unfold in 2019. China—which is owed roughly 20 percent of African nations’ external government debt (subscription required)—will not have its debts due by the end of the year serviced, and its role as a major creditor to emerging and frontier markets will diminish as it uses its resources to limit the damage to its domestic economy caused by ongoing trade tensions with the United States. Pressure on emerging markets will also mount as the US Federal Reserve increases interest rates and the dollar strengthens, raising the cost of repaying foreign currency-denominated loans. And despite a recovery in the prices of commodities, which are fundamental exports and serve as the foundation for many emerging market economies, currency depreciation for many exporters such as Zambia will prevent these countries from climbing their way out of systemic volatility. As a result, at least two more countries will join Pakistan in requesting an IMF bailout in 2019.

Predictions 2019 #9: Africa will be more connected than ever.

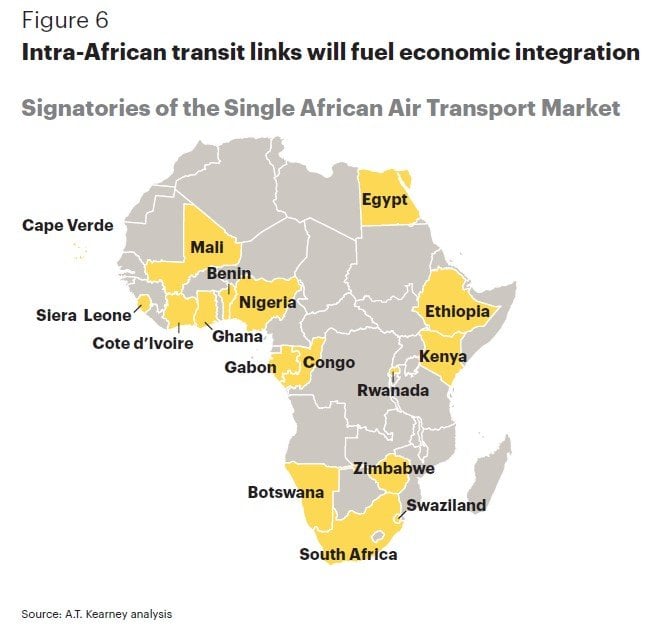

African countries have increased their commitment in recent years to promote regional economic integration and reduce intra-continental trade barriers. In 2016 and 2017, several countries announced updated policies for issuing “visas on arrivals” to Africans—drastically reducing the red tape required for African citizens to travel within the continent. Furthermore, in January 2018, the Single African Air Transport Market (SAATM) was signed, which will strengthen the connectivity between African states by lowering airfares and providing more direct flights (see figure 6). Several airlines, both African and foreign, have already announced additional stops and flight paths across the continent. And the African Continental Free Trade Area (AfCFTA), which has the potential to boost intra-African trade by 52 percent by 2022, was signed by 44 countries in March 2018—a number that has since risen to 49 signatories. Another positive development was the historic peace agreement signed by Eritrea and Ethiopia in July, which ended two decades of war and opened border access between the countries.

Intra-African cooperation and economic integration will accelerate in 2019. AfCFTA will enter into force after the number of countries ratifying the agreement surpasses the 22-country minimum. Signatories will include South Africa, which has so far not ratified the agreement for domestic reasons. Nigeria—one of the continent’s largest economies and the biggest holdout from the AfCFTA—will likely sign onto the agreement after its general election in February. Intra-African economic integration will begin to drive a virtuous circle, as greater economic activity fuels expanded airline routes within the continent and additional railway investments. Furthermore, digital connectivity will strengthen. But while Africa will become more connected than ever in 2019, each of these efforts will require concerted commitments by AU member states to realize the long-term gains of improved economic connectivity.

Predictions 2019 #10: Real-life “Iron Man” will materialize in the form of exoskeletons.

Although the first exoskeletal device was tested by a team from GE and the US military in the 1960s, viable “exosuits” have failed to materialize because of weight, mobility, and power limitations. Now, after more than half a century of research and development, exoskeletons are being developed for medical, industrial, and military applications. For example, exoskeletons have enabled some paraplegics to regain long-lost mobility in the past five years. And the new clothing start-up Seismic is incorporating sleek exoskeleton designs into “robotic underwear” meant to help treat ailing muscles and joints. In terms of industry applications, car manufacturer Ford recently deployed exoskeletons in 15 of its assembly plants—a small but promising sample size—to improve worker safety and productivity. The exoskeletons reduce the strain caused by keeping one’s arms elevated for long periods of time. And in the military domain, Lockheed Martin developed the Fortis exoskeletons system in 2014 for US troops to lighten the loads they carry. Russia and China are similarly working to develop their own “special forces exoskeletons.” Despite these important use cases, however, most businesses and individuals are unaware of the promise of these devices.

In 2019, exoskeletons will shed their sci-fi image and become popular across a number of industries. More manufacturers will follow Ford’s example by introducing and integrating exoskeletons in their production processes. New technologies such as artificial intelligence will also help address previously difficult design challenges such as functionality, weight, and mobility. Interest from both entrepreneurs and venture capitalists seeking to profit from this budding trend will prove to be an important catalyst in the technology’s growth as more start-ups are created and investments pour in. In addition, there will be a growing market for exoskeletal suits designed to support injured or weak muscles and joints—particularly as the large Baby Boomer generation continues to age. The clearing of regulatory hurdles will likewise accelerate adoption. For instance, the FDA approved the Japanese-created Hybrid Assisted Limb exoskeleton in early 2018. And as the popularity of exoskeletons grows for physical rehabilitation purposes, new cybernetic treatment centers will be developed in parallel where specialists can safely use exoskeletons on patients.