From the peak in 2018, US Corporate average sales-growth has fallen from 13.5% to the current annual rate of 5.4%. Fifty percent of companies, accounting for 65% of market capital, are achieving an improvement in sales-growth. At the low point in the second quarter of last year, only 25% of companies, accounting for 40% of market capital, recorded an increase in sales-growth.

[soros]Q4 2020 hedge fund letters, conferences and more

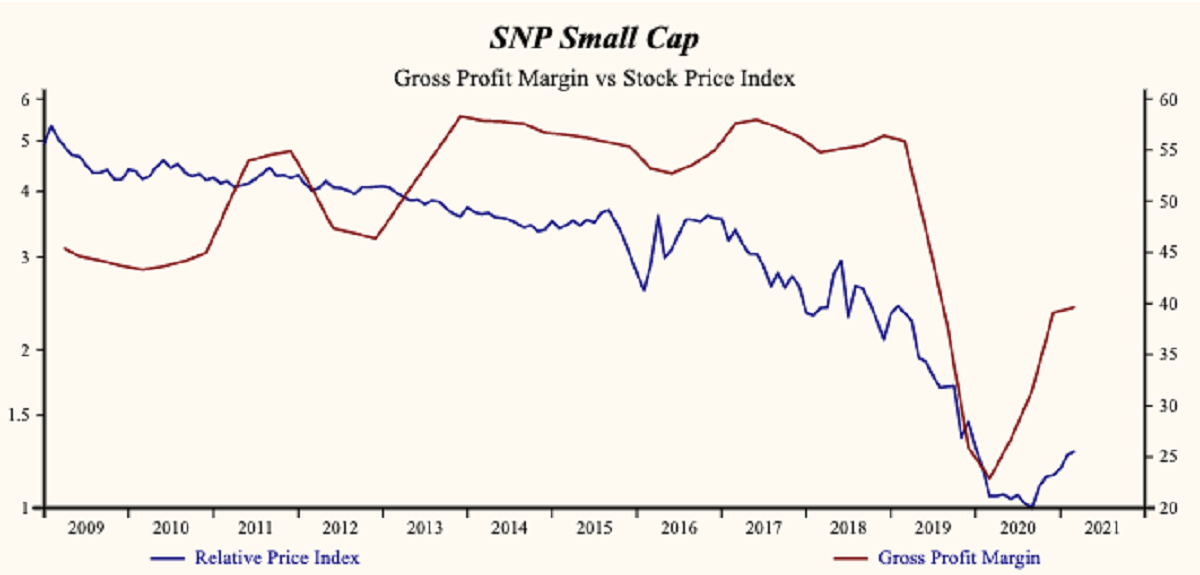

This is a broad sales-growth improvement and illustrates that top-line sales-growth for large companies were better than small companies.

Big Versus Small

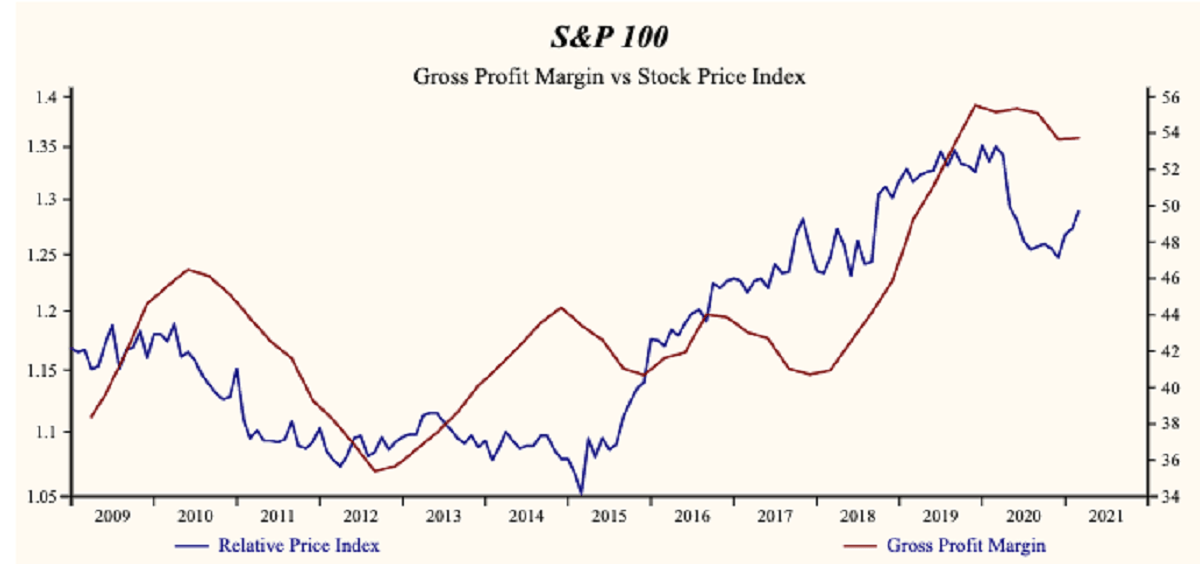

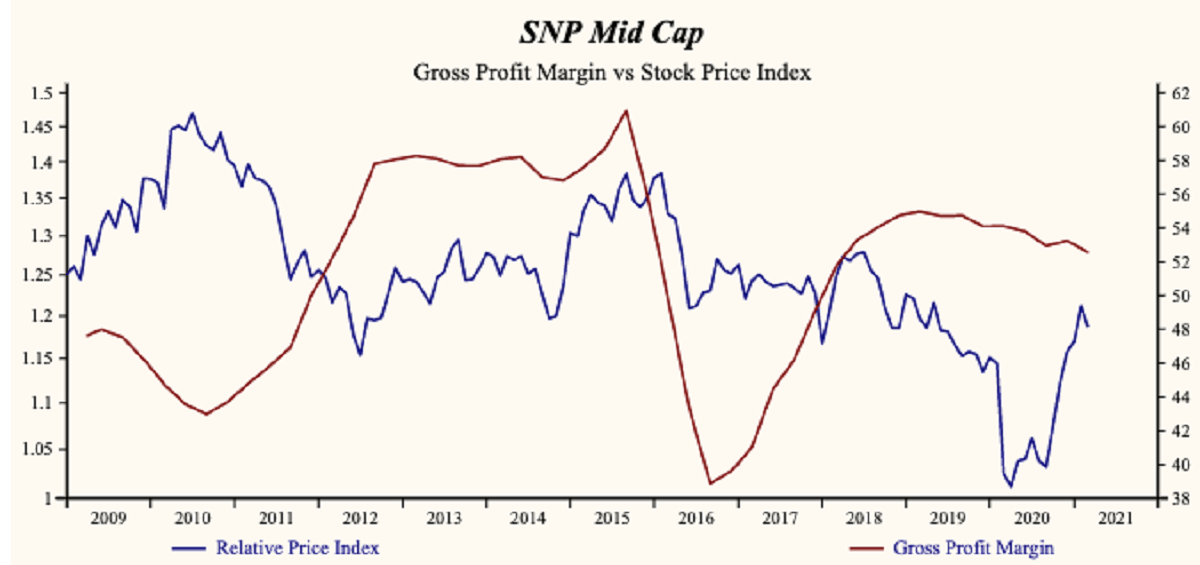

Over this past two-year downturn, the average gross profit margin declined from the peak of 53% to 45% (last period).

We currently have over 60% of 2020 SEC reporting companies in our database which accounts for 47% of market capital. For these companies, improvement in the gross profit margin illustrates that, conversely to sales growth, small companies are achieving a gross margin improvement more commonly than large ones. There was a higher frequency of gross margin improvement among companies with sales growth either negative, falling or both.

These companies are shrinking, laying off people, closing capacity and applying available cash to debt obligations to forestall bankruptcy long enough for a recovery to take hold. These are particularly risky stocks and more commonly trading at premium prices after the recent risk-seeking shift in the market.

Retirement Funds Toxic?

March was another astonishing month as bond prices continued to decline and bond yields advanced. This is clearly in anticipation of a soon to be strong growth recovery. From our last quarterly update, we referred to bonds as ‘toxic‘ for long term investors as age-based allocation methods leave older investors with a dangerous overexposure to bonds at exactly the wrong time.

The long-term bond price index fell 4% last month and with the major stock index up 4% this is adding 8% to the total return of stocks vs bonds and lifting stock prices and valuation to a new all-time high. All of that might have been expected in the context of a strong growth recovery without inflation.

Zero Treasury Bills

What is unexpected and even bizarre is Treasury Bills (T-bills) have declined closer to zero, now 0.08%, the lowest ever! T-bills are the risk-free rate, zero default risk, zero interest rate risk and act as a valuation benchmark in many asset-allocation models. As interest rates approach 0%, the value of assets approaches infinity. An asset worth $100 before covid when T-bills yielded 1.5% is now worth $8,300 with T-bills yielding 0.08%. That exponential increase in recent months in asset valuation appears from new higher prices in every high-risk asset class, very high-risk asset classes like crypto currency and stocks of insolvent companies are staging the biggest gains.

Adjustable-Rate Mortgages (ARM)

Low risk rates of return are forcing people into higher risk assets and recently that has driven a broad increase in asset prices. They also have an influence on the liability side. The huge gap that has opened between short-term and long-term interest rates are forcing people into Adjustable-Rate Mortgages (ARM) at exactly the wrong time. More than 30 years of lower interest rates have lulled people into financing a long-term asset with a short-term debt.

If interest rate fall, this high-risk financing policy will pay off. However, with long term interest rates up and the short-term rates at near zero, an ARM may be the only financing option available.

Typical Household

For the typical household, this adds a toxic liability (the ARM at the lowest rate ever) to a toxic asset (long term bonds in the retirement portfolio) and doubles the vulnerability of net worth. So far, only the bond asset price has fallen, the next shoe to drop is a dramatic increase in the cost of the mortgage. For long term fixed rate mortgage holders, the cost of refinance is already up significantly. As for Adjustable-Rate Mortgage holders, the surprise is yet to come.

Is Cash Trash For Everyday Savers?

For savers, the stock-market is the only place for returns. Although you should be holding small cash balances as a tactical defense against a market correction from these all-time high prices, you should no longer expect a sustained market decline.

Growth is now better (at least not falling on average and improving more broadly).

Investors do not wait. Act now!

That broader market growth improvement means that your portfolio of companies must have more acceleration attributes (higher sales growth and higher profit margins). We have improved those attributes in the past three months by selling higher risk stocks at a premium price and buying lower risk stocks at a discount price.

A shift back to riskier stocks will be considered when their growth rates turn-around and can support an extended share price. For now, cash is trash but holding a cash position now seems opportune or at least until growth trends become clearer. The new update for the first quarter 2021 will begin in early April and will peak on May 8, 2021.

STAY TUNED AND STAY SAFE