Worm Capital, LLC letter to investors for the year ended December 2020, discussing portfolio diversification in a winner-take-all industrial dynamics.

Q3 2020 hedge fund letters, conferences and more

Dear Partners,

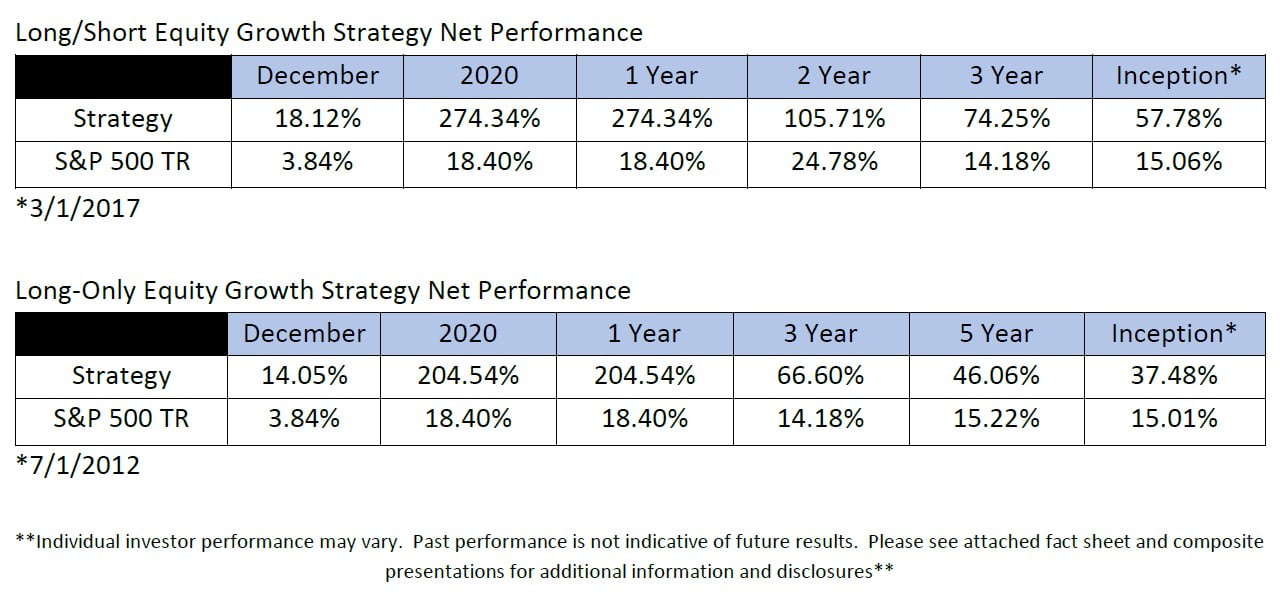

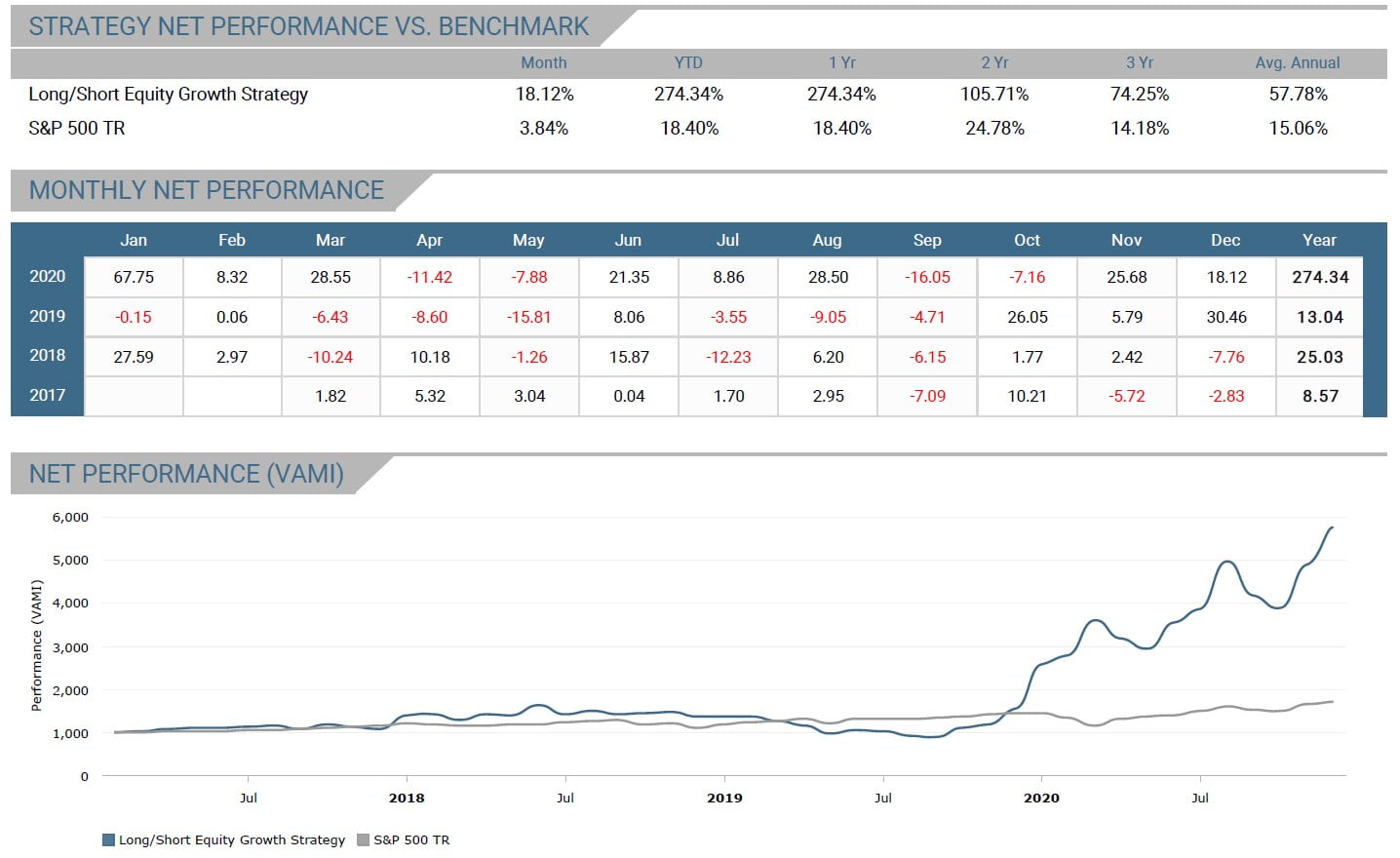

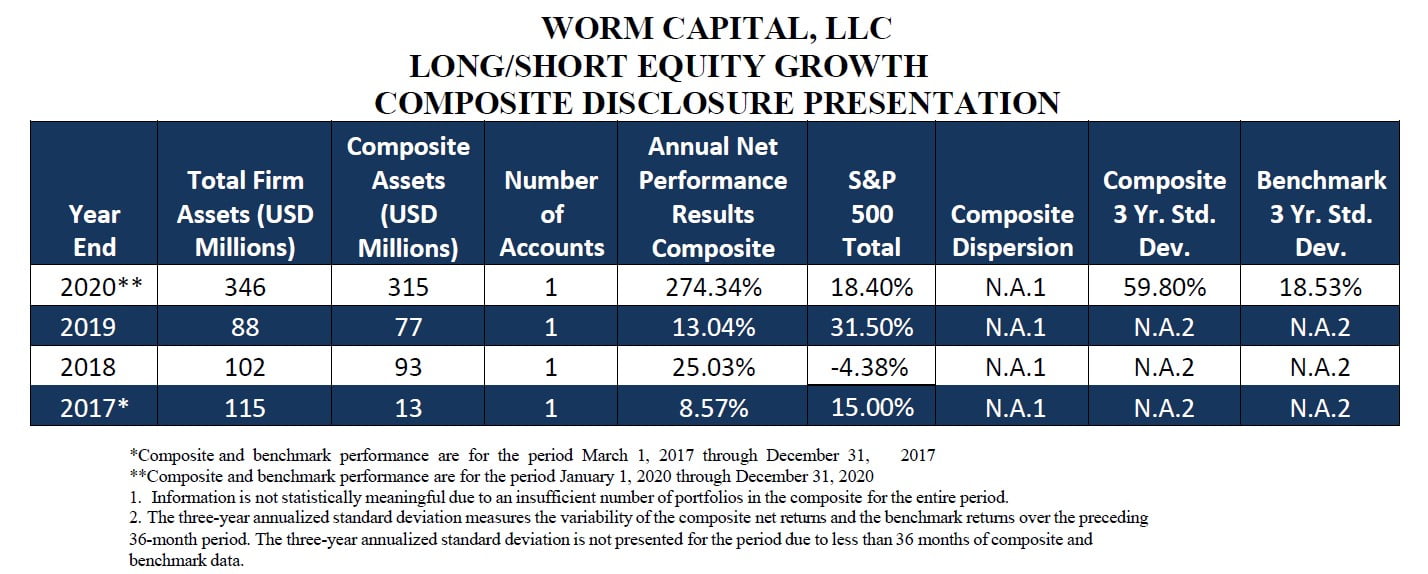

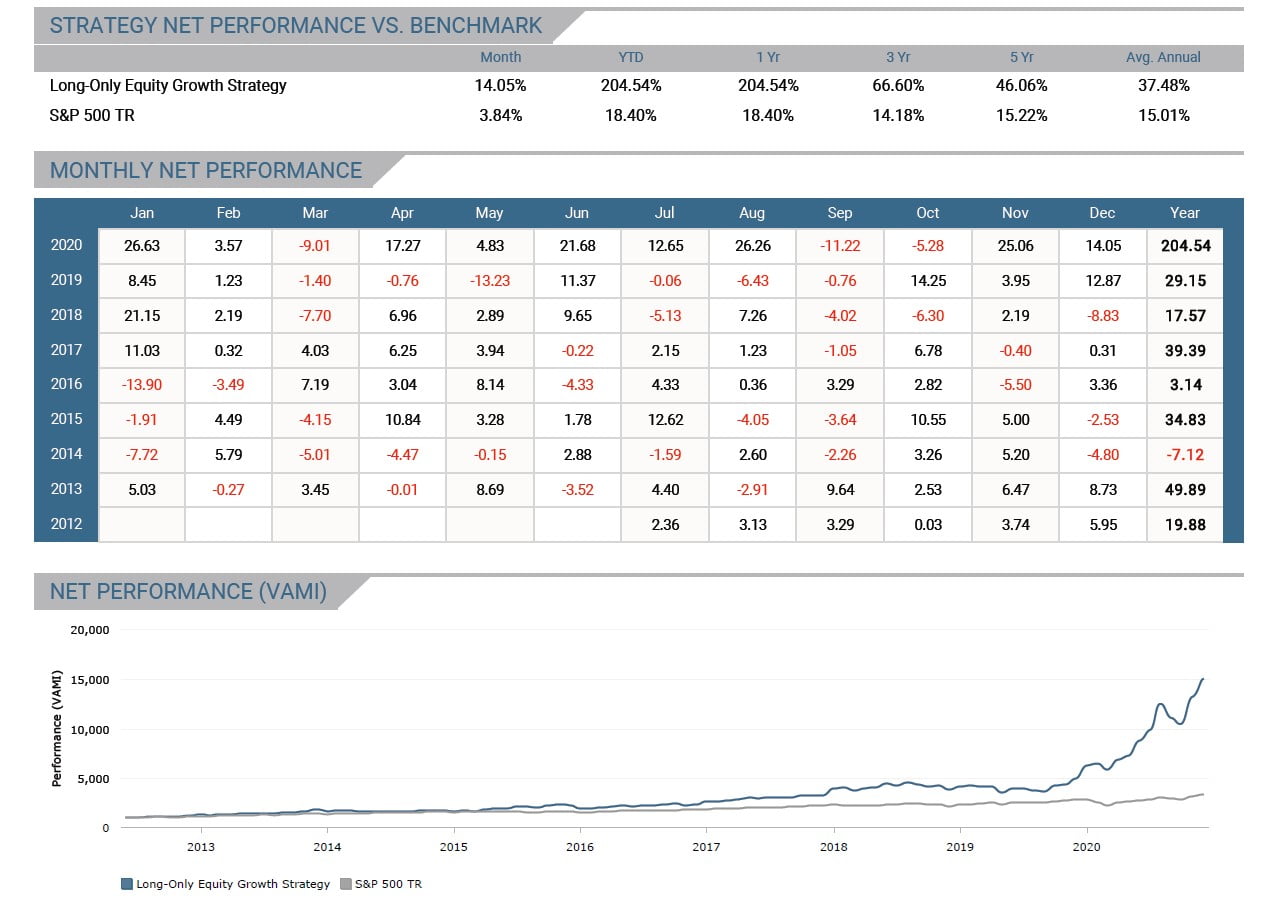

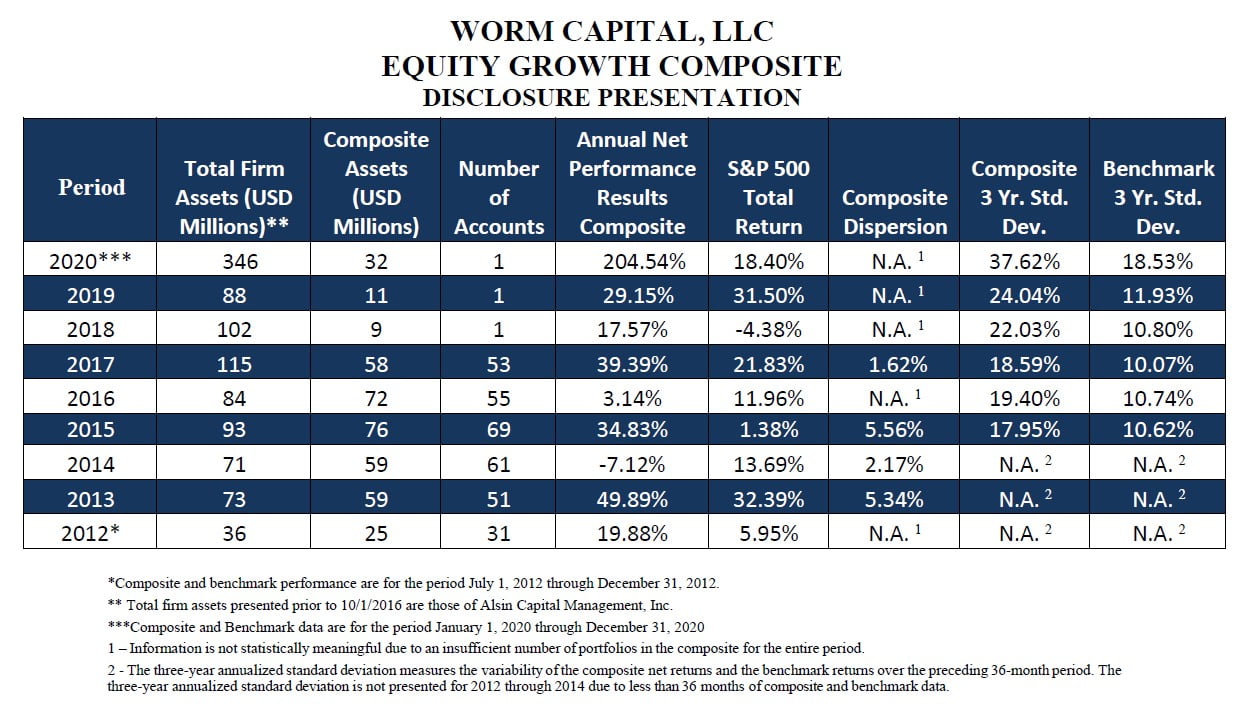

In 2020, our long/short equity strategy returned 274.34% net of fees, and our long-only strategy1 returned 204.54% net of fees. This was compared to the S&P 500 TR of 18.40% over the same period.

Please see below for results since inception.

In our opinion, the next several years could yield significant opportunities for investors. From our perspective, the pace of innovation is accelerating. The wealth pie is being carved up—and it’s expanding. We’re hurtling towards a cleaner, more efficient, more automated economy.

Interest rates are near zero, and in our view, stocks are the only place to be invested for the next several years. But beware: The market is lurking with hidden dangers and value traps. Some incumbent industries—oil, gas, automakers, retailers—are going to struggle to survive into the 2020s if they cannot adapt. We’ve said it before, but it bears repeating: This business environment is Cambrian. It’s a competitive marketplace where only the fit will survive. In our opinion, this creates a stock picker’s paradise.

Diversification In A Winner-Take-All Industrial Dynamics

Long-term investing boils down to two fundamental components: Stock selection, and position sizing. And in this new era, we must emphasize that sizing here is imperative. We believe academic concepts around “proper” diversification can be out of touch with today’s winner-take-all industrial dynamics. In our view, concentration in our best ideas, at the proper weighting, is our best chance at protecting capital, beating the market, and attempting to deliver performance worth paying for.

Finding these ideas isn’t necessarily hard; what is hard is separating the noise from the signal to develop deep conviction in the right companies. At a high level, we look for industries undergoing big, confusing changes. Our gameplan is clear: We stay quiet, focused, and patient. We go deep on the research, and we build up positions in disruptive companies with the highest long-term value potential.

This year may seem like a homerun, but our mentality is pretty simple: Each day is a new at-bat. No victory laps. We’re just trying to stay fit and focused on each pitch, make contact, get on base, and win seasons. We’re in it for the long-term and we need to constantly evolve, stay agile. Like Yogi Berra said, "In baseball, you don't know nothing." Same with investing. We’re only as good as our last at-bat.

In my opinion, it’s foolish to focus on short-term performance (and I’d consider one year to be shortterm). And despite the gains this year, we judge ourselves based on multiple years, not months. We’re always looking for ways to improve our game; we just want to get better, knowing we’ll never be perfect.

Holding For The Long-Term

Our longs delivered strong results this year, but not because we timed anything with particular precision. By frontloading the research of a company, we do our best to develop the conviction to hold for the long-term despite any massive swings in price, in either direction. We spend months, and sometimes years, building valuation frameworks for companies based on our fundamental analysis—and constantly update them. We vacuum as much information as possible—both from the company, as well as from customers—to gauge progress, making sure our thesis remains intact. If it doesn’t, again, we cut bait or pare down. On the other hand, if the fundamental value continues to improve, but stock prices move really quickly pulling forward valuations, what do we do? Well, pretty often we just… let them run.

As we start 2021 going through various hypothetical scenarios over the next few years, we continue to view our core positions as fundamentally undervalued relative to their long-term intrinsic worth—which perhaps is a long-winded way of saying we haven’t made too many changes to our portfolio. (Just yet at least.)

There are several new opportunities and business models we’re currently tracking and studying, but we’re just not yet ready to write about them yet. Expect to hear more from us in our Q1 2021 on this subject. As always, feel free to reach out to our team if you want to discuss any of our current investments.

Building generational wealth

In our opinion, successful long-term investing is also about being right for the duration of the investment. Some of our positions increased substantially in a relatively short period of time this year—but price movements alone are not necessarily a reason to sell. Selling a high conviction position with big potential upside too soon can be a disastrous blunder.

Viewed through that lens, in order to sell a position, we first must develop the conviction to deploy that capital elsewhere, into another investment with a higher risk/reward dynamic.

But what if there aren’t any?

Many of our competitors on Wall Street are bound by what we would consider arbitrary portfolio constraints, and so when a position runs up in price in their portfolios, they are forced to sell, so that one position is not larger than, say, 10 or 15 or 25 percent of their portfolio. Is that “risk management”? Actually, we’d argue that process could introduce more investment risk to capital, especially if the investor is forced to exit a high conviction investment in favor of a second-tier idea, simply because a movement in price triggered a rebalance in the portfolio. We believe that over-diversification, especially in winner-take-all industrial dynamics, can creates its own subset of risk.

Each day we are confronted with permutations of many potential decisions to make about the portfolio. Doing nothing while a position runs up or down may seem like inaction, but embedded within inaction is a series of decisions—even if the net output decision is to do nothing.

The decade ahead

In our opinion, the 2020s will be a historically unique period in which industrial wealth is created and destroyed at an accelerating rate. Studying, identifying, and ultimately investing in the disruptors of this period is our core focus. We believe we are entering an age of exponential growth. We think the key is to be in position in the right companies—with the right weightings—in order to achieve market-beating returns over a period of years.

Where to look? Well, energy and transportation are two trillion-dollar sectors we are studying because of the magnitude of changes we see unfolding. We’re tracking several dozen companies across these fields. We suggest you read this recent Q&A between our Director of Research, Eric Markowitz, and renewables expert, Tony Seba on how the future of energy is looking a lot like the early days of the Internet itself—a platform on which the marginal costs of new unit creation are near-zero, and a system in which new business model innovations create a flourishing framework for economic activity.

Finding the right investments with the greatest long-term potential is only a small fragment of the work embedded in delivering sustained, multi-year absolute returns. More often than not, these investments are staring you right in the face. But by staying focused on the underlying growth and value propositions of each business—and frankly by avoiding what we consider noisy media commentary and superficial, herd-mentality Wall Street research—we strive to develop such strong convictions in our investments that enable us to hold them for the long term.

On treasure hunting and detective work

One final thought: As investors, we like to imagine we’re part treasure hunter—part detective. As treasure hunters, we’re in constant pursuit of the next great opportunity, but the moment we find something interesting—that’s when the real detective work begins.

This pursuit requires some key personal qualities—humility, competitiveness, optimism mixed with a healthy amount of cynicism, to name a few—but above all, it takes an insatiable curiosity and relentless drive to be right on an investment idea.

If you’re reading this as a prospective investor and would be interested to learn more, contact Philip Bland at [email protected]

Above all, we want to express our sincere gratitude to you, our partners. We know 2020 may have been a challenging year on a personal and professional level, but we see bluer skies ahead for our country and our economy. We are moving faster towards a cleaner, more efficient world, and we’re thankful to have you on this journey with us.

Best,

Worm Capital

Founder/CIO

Arne Alsin