Whitney Tilson’s email to investors discussing his webinar replay; finding great value in hated stocks; new CEO at Kraft Heinz; you are not as good at kissing as you think.

1) Over the weekend, more than 100 people signed up for my new newsletter, the Empire Investment Report. If you want to watch a replay of the webinar about it last Wednesday, you can do so here. We’re still offering a great deal, so just click the link on the page if you’d like to subscribe.

Q1 hedge fund letters, conference, scoops etc

(A final reminder: a few people e-mailed me to say that they had trouble accessing the website or got a busy signal when they called, so if you tried to subscribe last Wednesday but were unable to, please call 800-961-2618 and we'll make sure you get the special deal we offered.)

2) Continuing the series of articles I'm publishing around the launch of my newsletter, in this one, Betting on Orville: Finding Great Value in Hated Stocks, I discuss how I've made money in some of the worst industries. Excerpt:

You can make a lot of money if a stock or industry goes from being terrible to mediocre... mediocre to OK... OK to good... or good to great. (My friend Steve Sjuggerud calls this concept "bad-to-less-bad trading.")

You may have to look closely for these opportunities, but it's well worth your time. Once the market realizes its mistake, the gains can pile up fast.

3) Kraft Heinz (KHC) just replaced its CEO: Buffett-Backed Kraft Heinz Climbs as It Replaces CEO Hees. I covered the hard times this company has encountered in three e-mails in February:

- Will Buffett buy KHC?; Is the #3G model flawed?

- KHC analysis and feedback; Why Buffett won't buy it

- KHC follow-up

Also, here's a WSJ "Heard on the Street" column about the company: How Kraft Heinz Ate Its Seed Corn. Excerpt:

Kraft Heinz is mixing mayonnaise with still more condiments. This is unlikely to turn around its reputation for lackluster innovation, especially when the numbers show it has been skimping on research and development for years.

The food giant has endured withering criticism and seen its share price plummet 33% since it announced disappointing earnings, a dividend cut, a multibillion-dollar write-down of its brands and an investigation into its accounting practices, all on Feb. 21...

In 2017, the company spent $93 million on research and development compared with a combined $242 million that H.J. Heinz and Kraft Foods spent in their final fiscal years as independent companies, according to regulatory filings. This drastic 62% decline is even more severe than the 34% cut in advertising spending over the same period.

4) Early in my investing career, I discovered the field of behavioral finance – thank you, Charlie Munger! This is the fancy name for the study of how and why almost all human beings are highly irrational when it comes to money and financial decisions.

It's one of the most important areas to understand if you want to have any chance of being a successful investor. I quickly recognized this and have been studying this field deeply ever since – more than two decades now.

As I did with my "12 questions to ask before you marry someone," I'm going to start including important lessons I've learned in this area in some of my e-mails going forward.

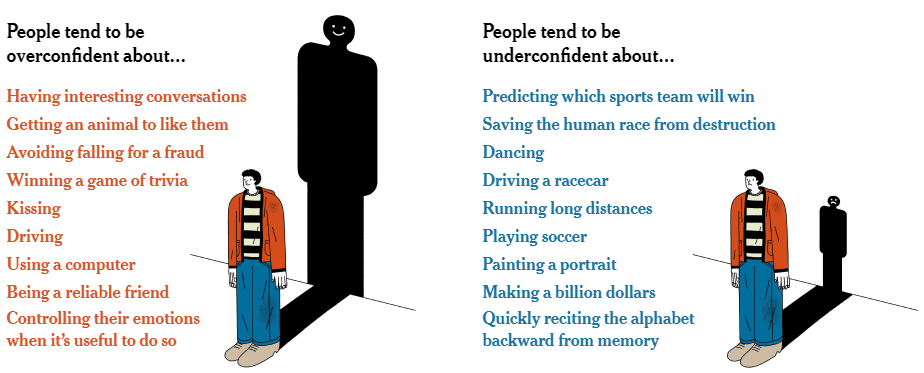

I'll start today by linking to this New York Times article, which has the ultimate "clickbait" headline: You Are Not as Good at Kissing as You Think. But You Are Better at Dancing. Excerpt:

Do you think you are an above-average driver, as most people do? How do you compare with others as a parent? Are you better than most at dancing? Where do you rank in your capability to save humanity?

Many of you will answer these questions incorrectly. For some of these skills, you will think you are better than you actually are. For others, you will think you are worse...

There was great variation in how people assessed their relative skills at a task. On average, people rated themselves better than 75% of others in their ability to use a computer, for instance. But people rated themselves better than only 32% of others in their ability to knit a sweater.

People tended to overestimate how they compared with others in their ability to dodge a fraud, win a trivia contest or cuddle. But they tended to underestimate how they ranked in their ability to predict the outcome of a sporting event, win a fistfight or dance.

The author went on to note the four traits that overconfident people consistently share. They are:

- Subjectivity: How much one's skill level at this activity is a matter of personal opinion.

- Experience: How experienced people say they are at performing the activity. (While being familiar with a skill would almost certainly make you better at it, it doesn't make you as much better at it as you might think.)

- Character: How much people think that good performance at the activity reflects a person's underlying personality or character.

- Easiness: How easy people say the activity would be for them to carry out.

Best regards,

Whitney