Long-time director made seven VPG stock purchases in February in less than a week

Sometimes it takes a subtle nudge to make me pay attention to a stock. In this case, the nudge was spending some time looking at Fintel’s Insider trading dashboard. And the stock is Vishay Precision Group (NYSE:VPG).

Q4 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

I have NYSE-listed Vishay on my watchlist because it's one of 60 companies included in the BlueStar Israel Global Technology index, or BIGITech. That gauge includes shares of tech firms with more than half of their operating assets in the start-up nation.

I’ve closely followed Israel stocks for the past decade, mainly via the four country exchange-traded funds, including the BlueStar Israel Technology ETF (NYSEARCA:ITEQ), which tracks that BIGITech index. And, to be honest, I hadn’t looked at Vishay, despite its $616 million market capitalization.

The shares only make up 0.64% of the ITEQ holdings, which are otherwise dominated by much more familiar Israel tech names, like the NASDAQ-listed CyberArk Software Ltd. (NASDAQ:CYBR) and the American Depository Receipts of NICE Ltd. (NASDAQ:NICE).

But it’s a number of recent insider purchases that caught my eye. The trades by director Wes Cummins were spotted on Fintel’s insider trading analysis page for VPG.

VPG stock has an insider sentiment score of 89.68, as generated via Fintel’s multi-factor quantitative model that identifies companies with the highest levels of insider accumulation. That score ranks it at number 160 among the 14,794 screened companies for the greatest levels of insider trading activity.

There is significant academic research that suggests corporate insiders outperform the market when buying shares in their own companies.

Which leads us to Vishay board member Cummins. According to SEC Form 4’s filed on his behalf, he bought a total of 73,500 VPG shares in seven transactions between Feb. 17 and Feb. 24, at an average price of $42.94. The stock closed yesterday at $45.28 before adding another 1% in after hours trading.

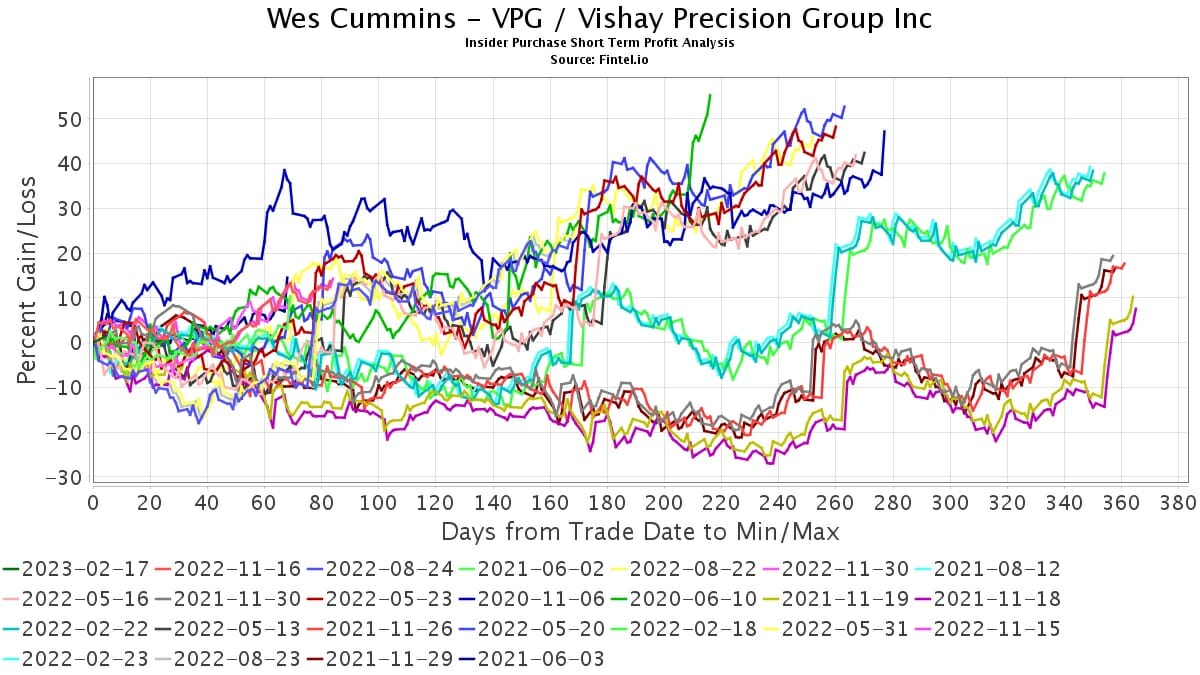

(The chart below shows the short-term stock performance of VPG shares subsequent to each open-market, non-planned purchase made. The performance of each trade is plotted until it reaches its maximum, or one year later, whichever comes first.)

Cummins, who has been a director on Vishay’s board since July 2017, made a similar series of purchases starting in mid November, late August and last May. All told, he owns a total of 463,278 shares, both direct and indirect.

While there have been other VPG insider transactions in recent months, they’ve been sellers. For example, company CEO Ziv Shoshani sold 4,204 shares in January, reducing his total owned (both direct and indirect) to 235,376 shares. CFO William Clancy was also a seller that month, disposing of a small lot, 845 shares, to bring his total owned to 40,858 shares, according to the Form 4 filed on the sale.

The director’s purchases last month came days after the precision measurement technology firm reported fiscal fourth quarter adjusted earnings of $0.76 per diluted share, which compared to $0.56 in the year-ago period. Net revenue in the December-end period was $96.2 million, up from $95 million.

To be sure, it would be easy enough to blow by Vishay. Trading in the shares is low, with an average daily volume just shy of 60,000.

And, only two analysts cover it, according to Vishay’s investor relations page, with one, Sidoti & Co.’s John Franzreb, contributing to S&P Capital IQ, with an estimate of $0.59 a share for Q1 2023, versus actual $0.46 per share in Q1 2022.

But some of the institutional holders are also worth noting. Among the top five are BlackRock (NYSE:BLK) at 7.36% of the outstanding shares; Dimensional Fund Advisors, at 7.56%; and, Renaissance Technologies, at 5.09%.

Article by Robert Lakin, Fintel