- Confidence amongst investors hits the lowest score since HL started tracking Investors’ Confidence in May 1995. The next lowest score was in December 2018, with a score of 52.

- The index has decreased by 27 points this month, and is now 44.

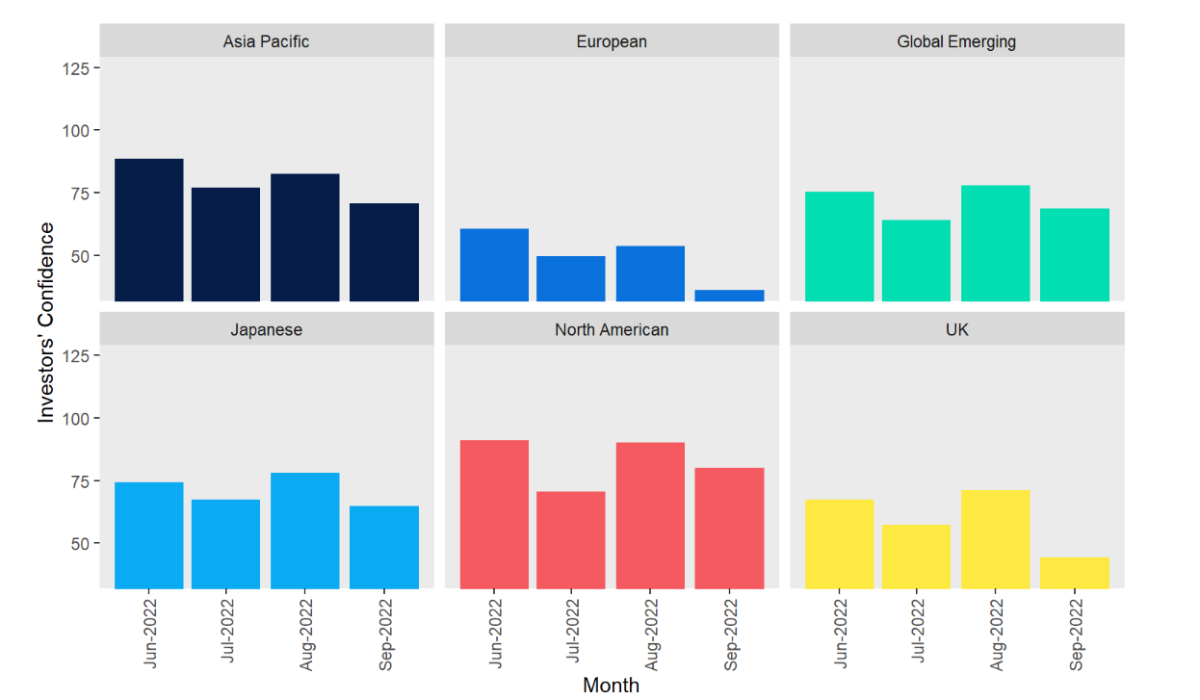

- Confidence has decreased in all global sectors, the largest decrease being the UK sector

Investor Confidence Falls

Investor confidence has sunk to just 44 points – the lowest on record since HL started surveying investors in May 1995. The last time the tracker dipped to these levels was in December 2018 – when markets globally tumbled on fears of growing political unrest between China and the US – though with a more appetising score of 52.

Q2 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

There are many contributing factors to current investor malaise, but the cost-of-living crisis is the most pressing. Energy prices across the globe remain inflated, putting significant pressure on households and businesses, despite promises of political relief.

Uncertainty around how long these inflationary pressures will last is a cause for concern, and rising interest rates provide respite for savers, but a concern for borrowers, whether it be a mortgage or corporate debt.

Stock market performance year to date has also disappointed, meaning animal spirits are low – investors often struggle to be contrarian, and despite periods of underperformance often being some of the best opportunities to buy into markets, Investment Association fund flows reveal that 2022 has seen some of the worst outflows on record.

All eyes will be on Central Banks and Governments to deliver a measured response to the crisis – particularly the new UK Government who are poised to deliver a mini-Budget tomorrow.

Top Funds, September (net buys, alphabetical)

| Fundsmith Equity |

| Lindsell Train Global Equity |

| Rathbone Global Opportunities |

| Baillie Gifford American |

| JPMorgan Emerging Markets |

| LF Lindsell Train UK Equity |

| Baillie Gifford Managed |

| IFSL Marlborough UK Micro-Cap Growth |

| Stewart Inv Asia Pacific Leaders Sustainability |

| abrdn Global Smaller Companies |

Top Investment Trusts, September (net buys, alphabetical)

| Scottish Mortgage Investment Trust plc Ordinary Shares 5p |

| Witan Investment Trust plc ORD GBP0.05 |

| Monks Investment Trust plc Ordinary 5p |

| City Of London Investment Trust Ordinary 25p Shares |

| Greencoat UK Wind plc Ordinary 1p |

| F&C Investment Trust plc Ordinary 25p |

| Edinburgh Worldwide Investment Trust Ordinary 1p |

| RIT Capital Partners plc Ordinary GBP1 |

| Scottish American Investment Co plc Ordinary 25p Shares |

| Tritax Big Box REIT plc Ordinary 1p |

Article by Emma Wall, Head of Investment Analysis and Research, Hargreaves Lansdown