What’s New In Activism – Twitter Deal Goes To Court

Elon Musk withdrew from his purchase of Twitter Inc (NYSE:TWTR), saying that the social media platform had breached the terms of the merger agreement.

In a July 8 letter, Musk wrote that his decision was due to Twitter’s failure to provide information he requested about its monthly daily average users and the number of spam or fake accounts on the platform.

Musk first requested the information on May 9, he said, as well as on four subsequent occasions. On June 6, he publicly threatened to terminate the deal if this information was not provided.

Q2 2022 hedge fund letters, conferences and more

Find A Qualified Financial Advisor

Finding a qualified financial advisor doesn't have to be hard. SmartAsset's free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you're ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Following Musk's withdrawal, Twitter Chairman Bret Taylor said that the board was committed to closing the transaction and "plans to pursue legal action to enforce the merger agreement."

Activism chart of the week

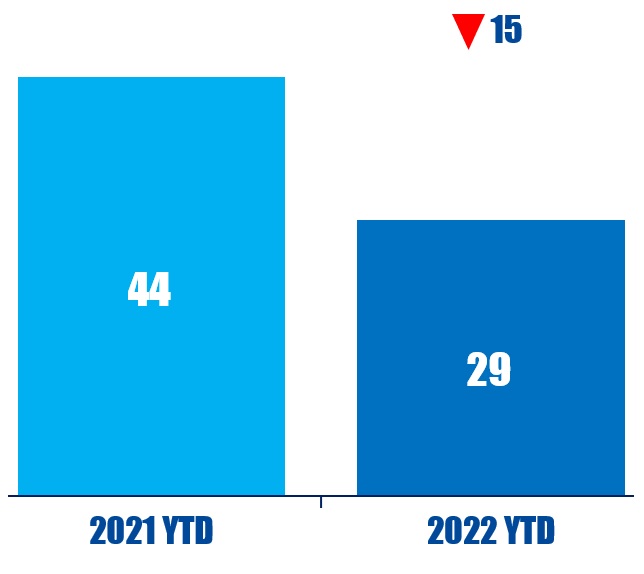

So far this year (as of July 8, 2022), globally, 29 companies have been publicly subjected to activist demands opposing M&A. That is compared to 44 in the same period last year.

Source: Insightia | Activism

What’s New In Proxy Voting - Tesla Under Pressure

SOC Investment Group, the union pension fund applying pressure to Tesla Inc (NASDAQ:TSLA) over its board independence since 2016, asked the SEC to halt publication of the company's proxy statement.

In a June 17 letter, SOC said that the departure of Larry Ellison from the Tesla board without a replacement violated a consent decree between Tesla and the SEC by leaving the company with a smaller proportion of independent directors.

SOC noted that Tesla had seven independent directors prior to the 2018 settlement with the SEC, falling to five independent directors following Ellison's departure.

The investor drew a direct parallel between the board's supposed lack of independence and the actions of CEO Elon Musk, who it argued had harmed shareholders following "sharp gyrations in the value of their shares, largely stemming from exactly the type of off-the-cuff statements from Mr. Musk that prompted the SEC to take action."

Voting chart of the week

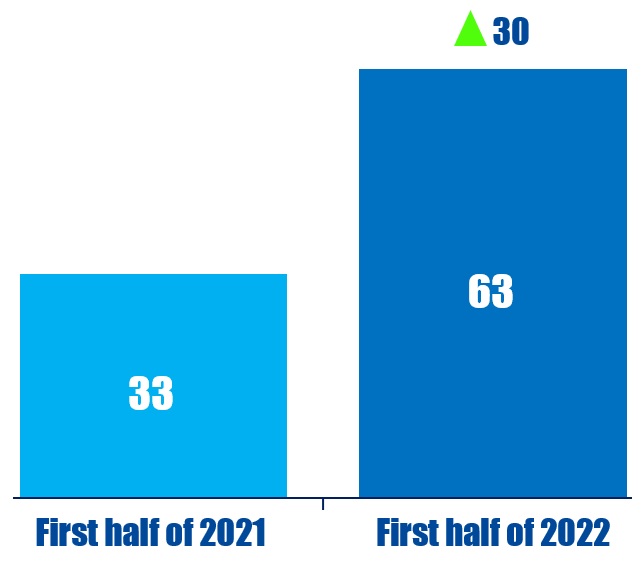

In the first half of this year, there were 63 environmental shareholder proposals at U.S.-based companies. That is up from just 33 over the first half of 2021.

Source: Insightia | Voting

What’s New In Activist Shorts - Culper Research v Veru

Veru Inc (NASDAQ:VERU) shares fell as much as 8% on a July 8 Culper Research report, the second by the short seller.

In the report entitled "More data, more problems," Culper argued that a study released by Veru to deflect the initial short attack was flawed.

The oncology-focused drug development company is trialing one of its cancer drugs as a treatment for COVID-19. However, Culper believes the placebo patients in Veru's trials were sicker than the ones taking the company's drug, sabizabulin, and that regulatory approval was unlikely.

Culper's first report on May 2 knocked about a quarter off the stock price but investors quickly bid the stock back up to near-term highs.

Shorts chart of the week

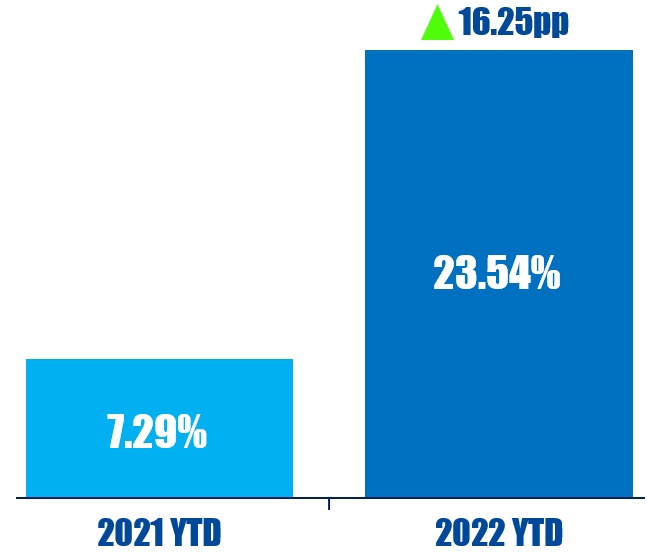

So far this year (as of July 8, 2022), Hindenburg Research's one-week campaign return for public activist short campaigns is 23.54%. That is up from 7.29% in the same period last year.

Source: Insightia | Shorts

Quote Of The Week

This week's quote comes from Vernon Hill who stepped down as chief executive of Republic First Bancorp after a court cleared the way for his board rivals to oust him. Read our reporting here.

“I made this decision [to resign] reluctantly, as the actions of this faction of the board show they are serving their own narrow interests instead of those of the shareholders.” – Vernon Hill