Trading Small-Caps Comes With Risks and Rewards, Could News-Based Strategies be the Ideal Solution?

Q2 2020 hedge fund letters, conferences and more

Trading Small-Caps Can Be Lucrative But Involves High Risk

Small-caps have traditionally been viewed as a potentially lucrative but high-risk niche. Whilst two-thirds of stocks are Small-Cap, they represent only 10% of the investable universe by size and account for an even smaller average portion of portfolios.

There are valid reasons for the underweighting, as investment writer Joseph Mariatheson puts it: “Dedicated smaller company strategies are a difficult business proposition. They require at least the same or, arguably, much more work per company. The high idiosyncratic risks - and greater risk of bankruptcy and fraud - require close monitoring and well-diversified portfolios.”

That said, excessive risk-aversion or reluctance to allocate resources may be blinding investors to some of the class’s advantages, particularly when it comes to its performance in quantitative trading strategies, that make use of aggregated online financial news information, such as that provided by alternative data vendor RavenPack. It is arguably in this field that the asset classe’s strengths really come to the fore.

Overall, the evidence suggests, investors might wish to reconsider continuing to underweight their portfolios with Small-Caps, since the adoption of news-based investment strategies has the potential to provide them with a profitable source of alpha.

Higher Returns

The scarcity of news and information about Small-Caps - something that has always been seen as a drawback by investors - is actually a boon to traders using automated news-based strategies.

The lack of news actually means that when news does come out about a Small-Cap company it usually has a greater ‘shock’ value, causing a more volatile price jump - and as all traders know, volatility is an essential ingredient for successful trading.

"When Small-Cap companies do actually hit the news, the weight placed by the market on such information is greater since it triggers market participants to make larger adjustments to future expectations or prospects for the company." Says Peter Hafez, Chief Data Scientist, at RavenPack.

In this particular area, Small-Caps also perform better than their Large-Cap peers.

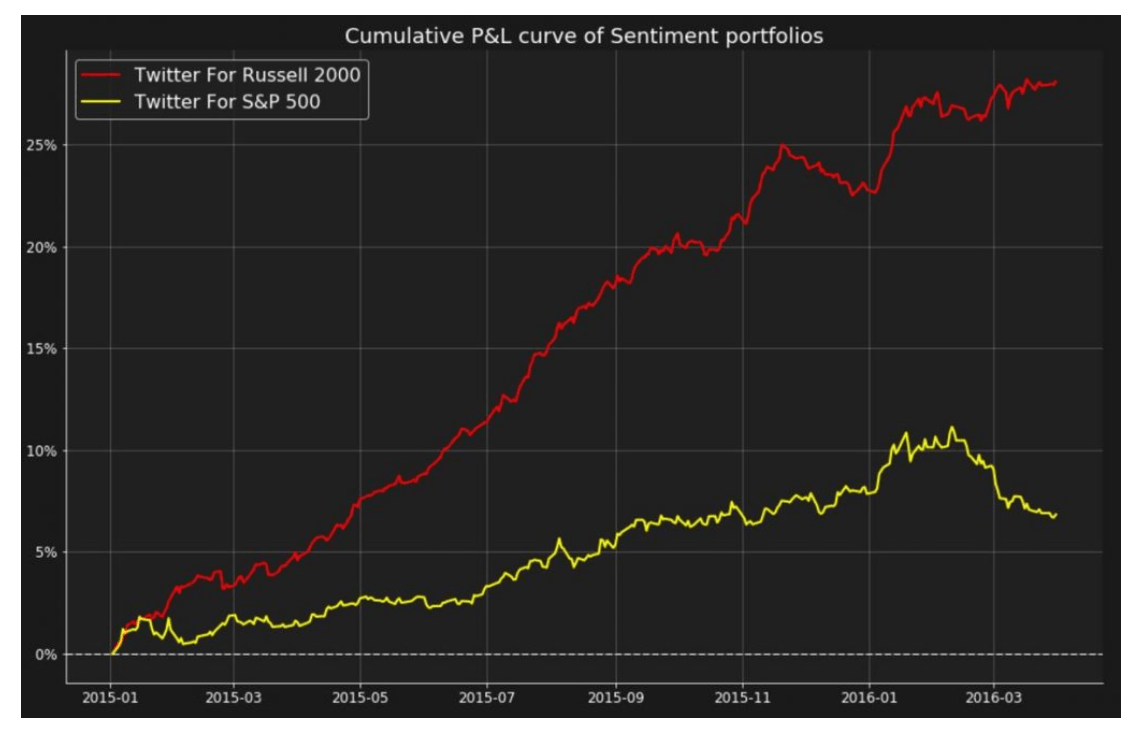

The chart below compares the performance of a social media news-based systematic trading strategy on the S&P 500, a Large-Cap index, and the Russell 3000, a Small-Cap index. As can be seen, the Small-Cap index far outperforms that of its Large-Cap brethren.

Sources: Bloomberg, 2017

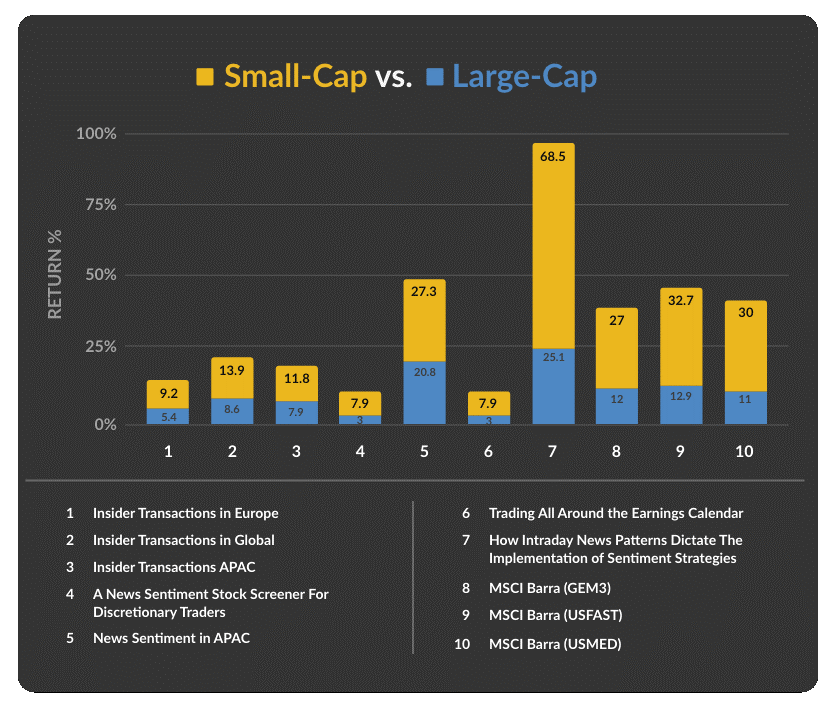

The chart below provides further evidence. It shows a list of key news-based trading strategies using RavenPack news-analytics data with annualized returns. The comparisons clearly show how in every case Small-Caps have outperformed Large-Caps.

Source: RavenPack, 2020

Transactions Costs

Despite the strong results cited above, critics often point to the higher transaction costs of Small-Caps as a major drawback.

For strategies with a high turnover - and many news based strategies fit into that category - this can be a problem, but in the case of Small-Caps, whose signals decay at a slower rate than Large-Caps, the problem is less acute.

An example of a strategy that performs well over a longer period uses signals based on information and news about how company insiders - top executives of publicly traded companies - trade their own holdings, using RavenPack’s Insider Transactions module.

In the case of this strategy, a much slower signal decay was observed for Small-Caps - especially in the Asia-Pacific region.

“Signals continued to be successful for up to a month ahead,” writes RavenPack’s Peter Hafez, in the strategy White Paper.

“For Australia & New Zealand the optimal holding period seemed to be about a week, whilst APAC as a whole exhibited IRs greater than 1 for Mid/Large-Cap and 2.5 for Small-Cap for holding periods of up to a month.” Added Hafez.

The study concluded, “decay was slower for the Small-Cap than for the Large/Mid-Cap, because of the former’s lower liquidity and slower incorporation of news information.”

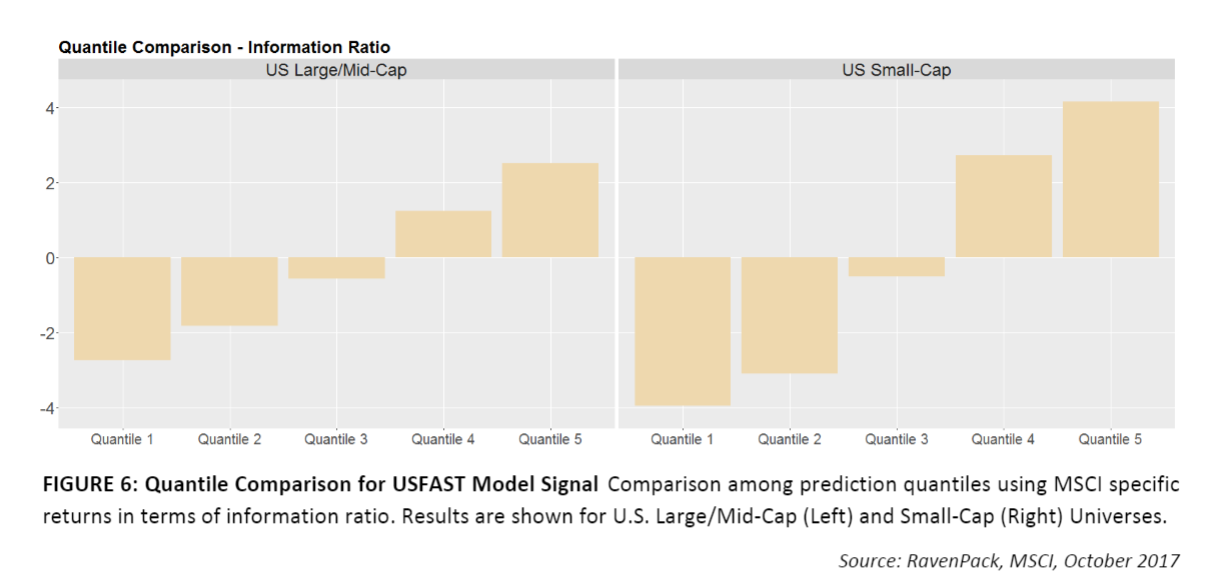

This is not the only strategy - in another White Paper that tested RavenPack’s news sentiment data’s orthogonal value, the results showed much slower signal decay for Small-Caps.

The highest returns came from trading Small-Caps with extreme quintiles of news sentiment.

“For Russell 2000...we observe a much slower decay, providing steady performance even when using a one-month signal aggregation.” Writes Peter Hafez. “The specific return signals not only provide higher cumulative returns but also lower volatilities. This implies a significant improvement in IR regardless of the length of the aggregation window.”

Systematic vs Discretionary

Small-Caps are suited to automated quant strategies because they bypass the need to spend time, effort, and resources on fundamental research, which given the lack of information about Small-Cap’s can prove difficult, costly and time consuming to generate.

The lower liquidity of Small-Caps also means there is insufficient supply for some larger funds to invest heavily in them and results in less favorable economies of scale, making investment in expensive research departments difficult to justify.

“Very few people can manage Small-Cap actively on a global basis,” says Simon Hallett, Managing Director at Cambridge Associates, a U.S.- based advisory service. “Think of the resources that you would need to do the due diligence to ensure that you have sufficient confidence in the management teams and the businesses you invest in, spread across the globe. Passive or quant strategies may be the best way to manage global Small-Cap.”

In a word, Small-Caps lend themselves to automation, and to broad-based systematic investment strategies, which are also those most suited to signals generated by aggregated news sentiment data.

A fund that specializes in developing quantitative Small-Cap strategies is Global Systematic Investors (GSI). GSI’s co-founder, Garrett Quigley, a former investment director at DFA in Europe, believes there are more systematic return effects that can be captured in Small-Caps to produce strategies that can outperform a passive benchmark, have a low turnover to minimize transaction costs and offer high capacity.

The firm believes that Small-Caps are by their nature also predisposed to offering investors a more ESG-friendly alternative to Large-Caps as they exclude the large oil, gas, and heavy industry players that are always a major component of Large-Cap indexes and usually score low for ESG.

This can give Small-Caps an a priori advantage over other asset classes since research shows ESG-friendly stocks outperform their less ESG-friendly equivalents over the long-term.

What’s more, combining ESG with news sentiment data can lead to strategies that further enhance returns, according to another RavenPack research study “Generate Alpha by Enhancing ESG Ratings With News Sentiment”.

Finally, Small-Caps also benefit from a backdraft effect simply from their inchoate size, since they have more innate growth potential than their Large-Cap peers.

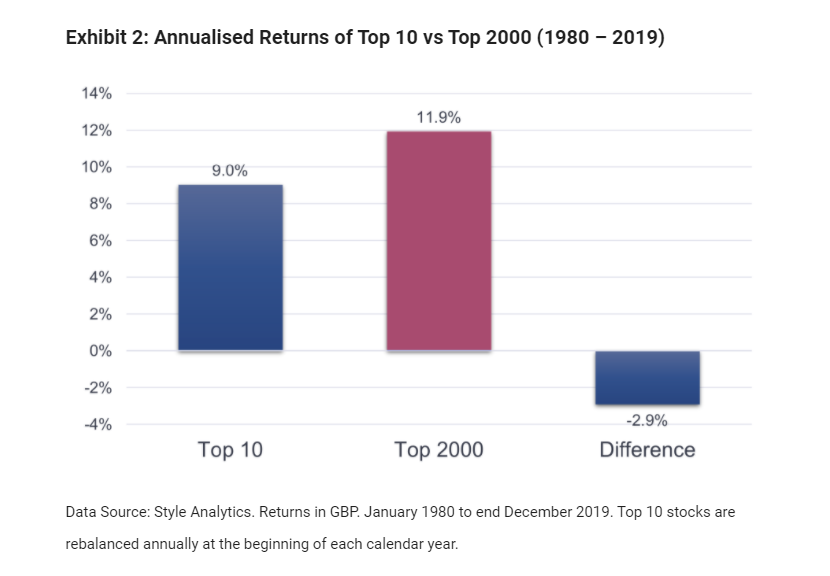

“In the longer term, the stock returns of the top 10 companies fail to keep up with smaller companies and companies trading at lower valuation multiples.” says Bernd Hanke, Portfolio Manager at GSI.

Thus, in more than one way, it could be argued that this underestimated, overlooked sub-class of stock deserves a bigger slice of the pie.