Tootsie Roll Industries (TR) has a dividend growth track record that few companies can rival. The company has increased its cash dividend for 52 consecutive years and has paid continuous quarterly dividends for even longer. That puts the company among the elite Dividend Kings, a small group of stocks that have increased their payouts for at least 50 consecutive years. You can see the full list of all 25 Dividend Kings here.

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

Dividend Kings are the best of the best when it comes to rewarding shareholders with cash and this article will discuss TR’s dividend and valuation outlook.

Business Overview

TR traces its roots back to 1896 when Leo Hirschfield began selling his candy from a family recipe in his shop in Brooklyn. He then went to work for The Stern & Saalberg Company, which later became The Sweets Company of America, and eventually morphed into the enterprise we know today.

The company’s history of innovation when it comes to candy products began with Hirschfield’s inventive mind creating various patents surrounding the way candies are made and indeed, the very texture of the company’s signature Tootsie Roll. That spirit of innovation was key to TR’s beginning and its growth, something that was helped along by two world wars.

This advertisement from World War 1 shows the company’s flagship product – while it was still known as The Sweets Company of America – in relation to soldiers on the march in Europe. TR saw tremendous growth and mainstream adoption of its candies during WW1 and WW2 as Tootsie Rolls were added to military rations, owed to their very tough texture that could go anywhere soldiers could.

While WW1 and WW2 were unspeakably horrible events in human history, they helped make TR into what it is today. To its credit, TR seized the opportunity to supply its treats to the US military and that relationship continues through today.

TR’s market cap is right at $2B and the company is expected to produce just over $500M in revenue this fiscal year. The vast majority of sales are made in the US but it does sell in Canada and Mexico as well. It sells its products through a network of 4,000 customers that include wholesalers, discount chains, dollar stores, supermarkets, the US military and others.

TR’s brands have grown over the years from the Tootsie Roll to various spin-offs of that candy as well as new lines.

TR branched out into bubble gum with its 2004 acquisition of Concord Confections; it also makes lollipops of various types and some chocolate products as well. Although TR has moved into some different candy products, it still has a very narrow focus and while that allows it to be very good at what it does, it also means growth opportunities are limited.

TR certainly has its niche built out in the world of candy but it is not without its risks. First, it is beholden to commodities prices. TR obviously buys a lot of sugar and corn syrup and as a result, swings in the prices of those commodities can significantly impact the company’s profitability. It hedges these commodities at times but it cannot escape the fact that it is subject to the whims of the markets in which these and other commodities trade. Indeed, this was a significant problem in 2017 compared to 2016 and impacted profitability.

In addition, there is also the matter of TR’s dual class structure and the fact that it is run essentially like a private company by the Gordon family. The family controls the vast majority of the voting rights of TR so the company is under complete control, just as it would be if it were private. Information is therefore tough to come by and there have also been repeated complaints in the past couple of decades about the Gordon’s funding an extravagant lifestyle with company money, in addition to disagreements from large shareholders in terms of strategic direction.

So long as the Gordon family is in charge, it appears TR is going to simply maintain status quo instead of chasing growth opportunities or a sale of the company.

TR possesses a long list of customers but it is particularly reliant upon Wal-Mart (WMT), which accounts for about one-quarter of TR’s total revenue. That’s an enormous reliance upon one customer and while it means TR has a great relationship with WMT that works, it also means that should WMT decide to dedicate valuable shelf space to a different product, TR could lose a tremendous amount of revenue. TR’s relationship with WMT has grown over the years so this isn’t an imminent risk, but it is certainly something for investors to watch given that TR is so reliant upon this particular relationship.

Growth Prospects

You might guess that TR has a hard time growing and you’d be right. The company produced $539M in total revenue in 2013 and since that time, it has steadily fallen to $516M as of last year. TR doesn’t spend a material amount of money on R&D so new products really aren’t a huge factor most of the time.

What TR has tried to do to generate some growth is create seasonal innovations like Tootsie Roll Eggs, as well as new product extensions, like the Andes bar that can be snapped apart into pieces. TR’s core products don’t change much so barring some sort of meaningfully sized acquisition, this is really the only avenue of growth TR has, as evidenced by years of stagnating revenue.

Q4 earnings were characteristically uninspiring as TR produced basically flat revenue and adjusted earnings that were much lower than the prior year’s comparable quarter. EPS grew from 28 cents in 2016’s Q4 to 51 cents in 2017, but 32 cents of the latter number was due to tax reform. That implies that on an adjusted basis, TR saw earnings decline 32% in Q4.

The company cited forex concerns – particularly in Mexico – but also pricing pressure from its retail partners. With TR’s manufacturing costs largely fixed, pricing pressure from its distribution partners is a killer for margins, as we saw in Q4’s results and indeed, for all of 2017. Higher costs for ingredients, labor and packaging materials all contributed to lower margins in 2017 despite revenue that was basically flat.

As mentioned above, R&D isn’t really a meaningful expense for TR as management seems happy with the assortment it has. The only real innovation comes from seasonal lines or product extensions but those don’t drive transformational growth. Management seems fine with the way things are as acquisitions are infrequent and innovation isn’t a priority.

One thing that is being done to fuel some growth is a focus on efficiency in its manufacturing operations, as well as sourcing initiatives that aim to lower cost of goods sold. With TR’s focus away from generating higher levels of revenue, margins are the only other logical place to expend effort. However, judging by 2017’s performance, there is still a long way to go in terms of producing some progress on this front.

TR is a company that seems to be fine with literally no top line growth and with margins deteriorating, there really isn’t any sort of material growth catalyst on the horizon. This company is happy with ~$500M in revenue and maybe $60M or $65M in net earnings each year; that’s pretty much what you can expect going forward.

Competitive Advantages & Recession Performance

TR’s competitive advantages include its product line and its distribution partnerships. TR has built a niche with its core Tootsie Roll line and its spin-offs like Tootsie Pops as well as the fruit-flavored versions of the classic candy. Tootsie Rolls are unlike any other candy in the market – just as it was over a hundred years ago when it launched – and that is something that competitors cannot replicate.

TR does, however, make a pretty narrow assortment of candy with its biggest departure from its core being the Concord acquisition. Keep in mind that was 14 years ago, so it isn’t like TR is out there buying up bolt-on companies to grow; as mentioned earlier, management seems fine with the status quo.

TR cannot compete with the depth and breadth of a company like Hershey (HSY) but again, TR isn’t trying to be all things to all people. It does have some pretty lucrative distribution partnerships – including Wal-Mart – but it also has a diverse network of thousands of distribution points.

TR’s products are ubiquitous and easily accessible, which is something most small food manufacturers cannot say. The reliance upon Wal-Mart is a bit unnerving but TR’s strong history with its core products means that the odds of it being supplanted are relatively low.

This affords TR the good fortune of being fairly resistant to recessions, which is a key benefit when considering a dividend stock. TR’s earnings-per-share during and after the Great Recession are below:

- 2007 earnings-per-share of $0.70

- 2008 earnings-per-share of $0.54 (decrease of 23%)

- 2009 earnings-per-share of $0.75 (increase of 39%)

- 2010 earnings-per-share of $0.76 (increase of 1%)

Revenue fared very well during this period as it never dipped more than 1% from year-to-year, an astonishing accomplishment given the depths of the recession we all experienced. However, margins performed erratically due to input costs and TR’s income tax rate also moved around a bunch. That led to some lumpy earnings performances but on the whole, revenue was basically flat and earnings fell but fairly quickly recovered; TR is a decent performer in recessionary environments.

Valuation & Expected Returns

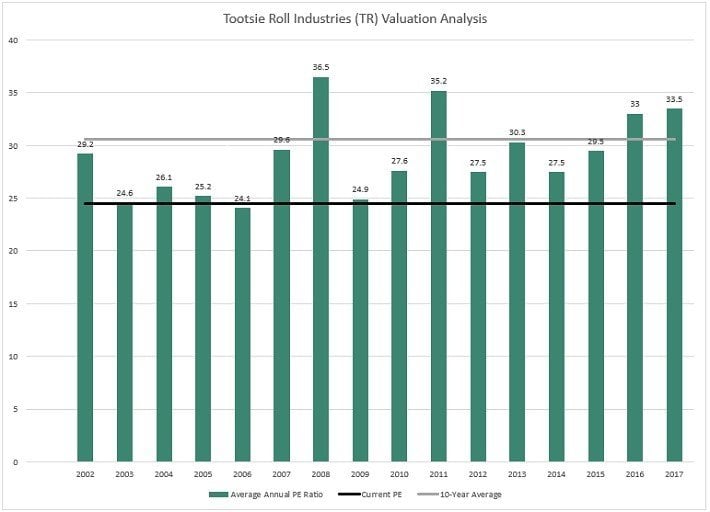

ValueLine analysts expect TR to generate earnings-per-share of $1.20 in 2018. As a result, the stock trades for a price-to-earnings ratio of 24.5. This is a high valuation for a low-growth business. In the past 10 years, the stock held an average price-to-earnings ratio of 30.6.

Source: ValueLine

TR does not have high enough growth to justify either its current valuation, or its 10-year average. Therefore, TR stock looks to be overvalued right now. Earnings have been around $1 annually for more than a decade, the product of revenue that never really moves and margins that fluctuate rather than trend upward. This type of business is typically assigned a relatively low multiple simply because growth prospects are limited, a description that certainly fits the bill for TR.

However, the stock is going for a PE in the mid-20s today and that is steep by any standard. It is very steep when you consider that 2017’s adjusted earnings were below that of 2006, implying long term earnings growth is basically nothing. That necessarily keeps a lid on multiple expansion going forward and to be fair, TR’s multiple should probably contract given its struggles with growth.

One potential way out of this for TR is to go acquire another business but it hasn’t been a serial acquirer by any means. As long as the Gordon family is in charge, acquisitions appear to be just a dream of investors so I certainly wouldn’t count on that.

Its focus on margins may bear some fruit but thus far, it hasn’t. TR could certainly use some work on that front but it is still largely beholden to commodity prices and downward pricing pressure from its distribution partners.

From a shareholder’s perspective, TR does provide a decent level of capital returns. The dividend is only good for a 1.2% yield at present but of course, it is very safe and has been around for more than 50 years. Growth in the payout has been slow given that earnings have been flat for what seems like forever, so there won’t be much in the way of growth here either. However, it is a nice, steady tailwind for total returns.

The other tailwind TR has is a 3% annual stock dividend it pays to shareholders. This is a bit of a strange way to reward shareholders these days as stock dividends are uncommon, but TR has been doing it for a long time. Essentially, the company gives each shareholder 3% of her shares each year as a form of capital returns that can either be held or sold to create a cash dividend of sorts. If you think of it that way, the actual cash dividend is worth 1.2% and the stock dividend is worth 3%; if you sell the stock you receive as a dividend, your annual yield would be north of 4%.

From a total return perspective, that’s about all one can expect from TR. I mentioned the multiple and it is really quite high, meaning further expansion seems unlikely. If anything, the multiple could contract as the stock looks very overvalued here. As a result, total returns from earnings growth and dividends could be in the 6% to 8% range, but a declining valuation could reduce annual returns to the low-single digit range.

Final Thoughts

TR isn’t a high-yield dividend payer by any means but it does offer the quirky kicker of a 3% stock dividend each year. That’s something investors don’t get most places and it can either be used to increase one’s stake in absolute terms or it can be sold to create a large cash payout. However, TR has a lot of fundamental issues that make it such that the stock looks very expensive here. Margins are in focus but haven’t improved while sales growth clearly isn’t a priority for management. The stock lacks meaningful growth catalysts, and as a result total returns are likely to be low going forward.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

Article by Josh Arnold, Sure Dividend

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.