“What winning traders share, however, is that they all understand that losing is part of the game, and they all have learned how to lose.” ~ Jim Paul, “What I Learned Losing A Million Dollars”

Good morning!

Q3 2020 hedge fund letters, conferences and more

In this week’s Dirty Dozen [CHART PACK] we look at increasing trend fragility in the SPX, track the trend in semis, discuss the prospects for “old economy” stocks, cover the relationship between fiscal and commodity returns, and more…

Let’s dive in.

90 Years Of SPX

- I shared a number of *almost* yearly charts last week but waited till the official new year to share this one. 90 years of SPX.

- Our aggregate sentiment and positioning indicator is coming off a 90th percentile reading. This denotes significant trend fragility. Our shorter-term indicators suggest the path of least resistance is still up but the market is likely to hit a speed bump in the second half of this month. Watch the tape and keep yo eyes peeled!

- Semis are the group to watch, they’re breaking out of a multi-week wedge. Expect them to lead on the way up as well as the way down.

The Old Economy

- I’ve been saying this for a few months but the place to be digging right now is in the “old economy”.

- Redistributional policies drive wealth-velocity (spending per unit of wealth) as money to the lower-income brackets tends to go straight into consumption, hence the correlation between it and the return of commodities.

- This greater consumption is going to meet head-on with tight supplies.

The Benefit Of La Nina

- Ags also have the benefit of La Nina this year which tends to lead to rising commodity prices.

- And the global economy will continue to benefit from the historic surge in credit.

- Precious metals just entered their strongest seasonal period of the year and the charts suggest a breakout may be underway.

- Platinum is also one to watch. It’s breaking out of a 3-year base and Specs are positioned more neutral versus the other metals.

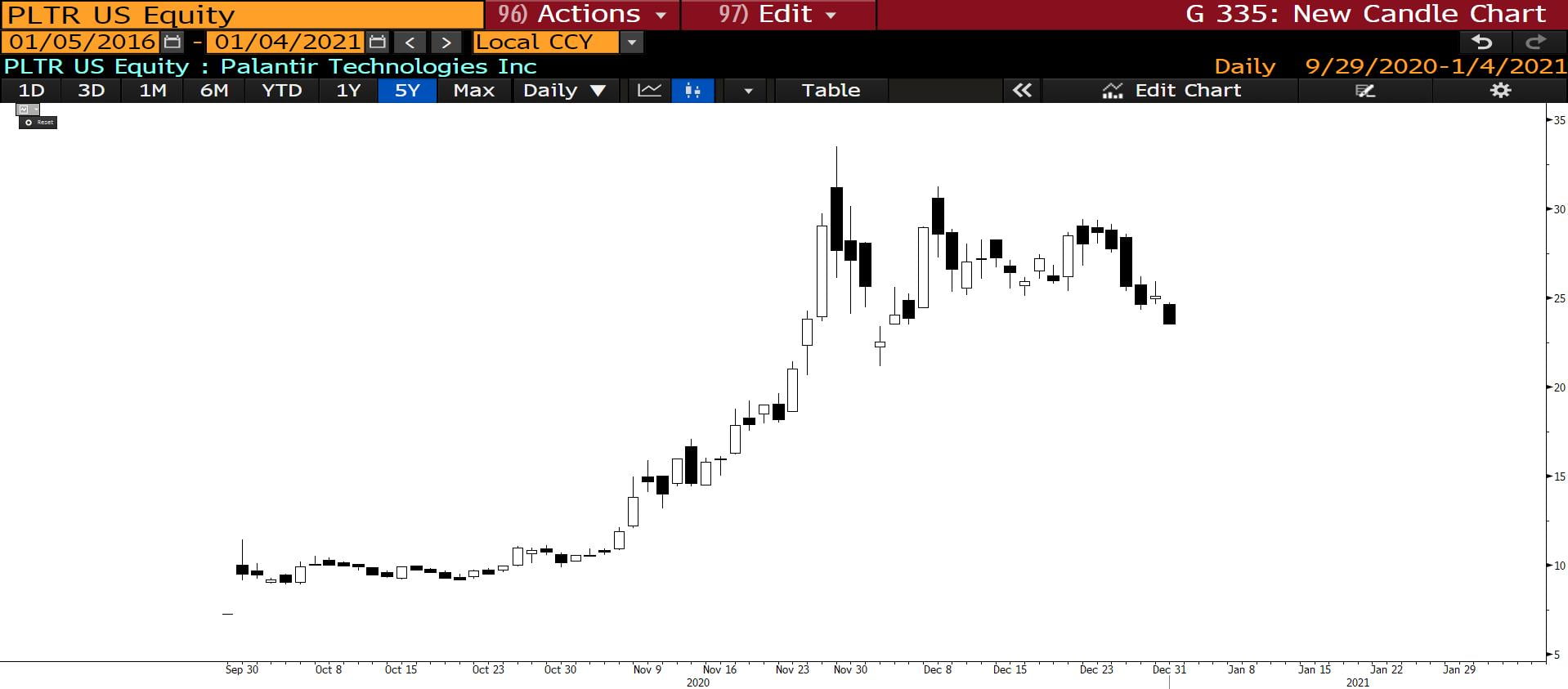

Shorting Palantir, Mosaic Trading Near Its Lowest Price-To-Sales Ratio

- We’ve been adding some shorts to our book for the first time since Feb / March, Palantir is on our list. The company is a retail favorite, it’s trading over 46x sales, and its growth runway is not nearly as long as the market believes (I should know as I used to consult for them). Plus, we just saw a nice technical breakdown last week.

- Speaking of Ags, Mosaic (MOS) a potash producer, is trading near its lowest price-to-sales ratio in history. It tends to track the soft commodity cycle which just so happens to be kicking off a new bull market.

***Note: The annual enrollment for our Collective is running until the end of the week.

The Collective is our full-kit soup-to-nuts service that provides research, theory, and a killer community that consists of dedicated traders, investors, and fund managers from around the world. We’ve been told that there’s nothing else like it on the web. If you’d like to tackle markets with our group (whom, I should note, has been having a great year in markets), then just click the button below and sign up. And, as always, don’t hesitate to shoot me any Qs!***