The GYM Group PLC (LON:GYM) is the second-largest low-cost gym operator in the UK. It has 184 locations and ~578K members as of January 2021. The company was one of the hardest-hit by the COVID pandemic. Despite those headwinds, GYM is the best-positioned company to take advantage of the UK reopening.

Q4 2020 hedge fund letters, conferences and more

There are three reasons we love the GYM trade:

- The GYM Group’s low-cost model will allow it to take share as mid-tier gyms struggle to compete on price

- GYM’s industry-leading balance sheet allows it to emerge from COVID in a strong position, leading to further store expansions while other gyms hemorrhage losses.

- Traditional accounting metrics hide GYM’s fast-growing and highly profitable per-store unit economics, making it “un-screenable” for traditional value-based investors.

More UK residents are exercising now than ever before. As of 2019, nearly 16% of all UK residents are members of a health/fitness club. That’s up from 12% in 2007. Within the 16% of UK gym members, only 4% of residents belong to a low-cost gym operator. A 2019 PwC report estimated that low-cost gyms would account for 5-7% of gym memberships, nearly doubling current penetration rates.

The company has superb unit economics on its mature gyms. The GYM Group spends ~GBP 1.33M in initial site investment. Once built, each gym generates ~GBP 970K in revenue and GBP 440K in EBITDA (45% margin). Subtract taxes and maintenance CAPEX, and you get ~ GBP 300K in NOPAT per gym. That’s a 28% ROIC on a pre-tax basis.

Last year’s financials distort GYM’s true cash-generating capability. In 2019 GYM generated GBP 153M in revenue, GBP 48.5M in EBITDA, and GBP 34M in FCF (or owner’s earnings). The company currently spends 30-40% of its revenues on expanding new stores, but only 6-7% on maintenance CAPEX.

The GYM Group’s transition from aggressive expansion to maintenance mode will result in substantial owner earnings for equity shareholders. At the current stock price, you can buy GYM for ~12x 2019 owner earnings.

The next year (or two) will look ugly as GYM gets back to pre-COVID levels. But if you’re willing to take the long-term view, today’s prices look cheap. We see a path towards GBP 50M+ in free cash flow by 2026.

If you want to learn more about the company, please read these two write-ups:

- Tollymore Letter (2018)

- Jorge Robles Seeking Alpha (2019)

The Different Types of UK Gyms

There are two main types of gyms in the UK: private and public. Think of public gyms as your local YMCA. Public gyms are government-sponsored and offer various services like sports halls, swimming pools, and private fitness studios. Public gyms usually lack the best/newest equipment, nor do they have a wide selection of personal trainers.

There are two main types of gyms in the UK: private and public. Think of public gyms as your local YMCA. Public gyms are government-sponsored and offer various services like sports halls, swimming pools, and private fitness studios. Public gyms usually lack the best/newest equipment, nor do they have a wide selection of personal trainers.

Then there are private gyms, which bifurcate into two sub-categories: traditional and low-cost. Traditional gyms offer a paid membership, fixed contracts, and tiered pricing based on several services offered. These gyms provide everything you could imagine from tennis courts, swimming pools, saunas, and coffee/smoothie bars. Members pay between GBP 30 – 80 per month for such amenities and facilities. As expected, mid-to-premium tier gyms sport significantly higher cost structures than their counterparts. The lower-end, of course, is where the GYM Group takes advantage.

Low-cost gyms provide everything a gym-goer needs and nothing more. Members can enjoy free-weights, cardio equipment, and other resistance machines without any bells and whistles like saunas, pools, or fresh juice bars.

By offering only the essentials, low-cost gyms can charge lower monthly rates while maintaining a favorable margin profile. Low-cost gyms also have better membership structures. Expensive gyms typically lock customers into fixed-duration contracts. And if you cancel early (for any reason), you pay a hefty cancellation fee.

Like most low-cost operators, GYM offers flexible membership programs that allow members to cancel anytime for no cost.

GYM Plays The Easier Game

On the one hand, gyms are commoditized goods. Weights weigh the same regardless of your monthly fee. Plus, it doesn’t matter where you squat as long as you have a bar and a rack.

That said, mid-to-upper tier gyms can distinguish themselves by providing even more services to their members. I can squat at any gym, but not every gym has a Nespresso machine. Increased amenities sound remarkable for its members (who wouldn’t want “free” espresso?), but it comes at a cost: increased membership fees.

In other words, if you’re not playing the low-cost game, the only way to win is to charge more for more lavish amenities. The need to provide more creates a dangerous feedback loop. Here’s what I mean. More services mean higher membership fees. Higher membership fees mean fewer members and higher churn rates.

Higher churn rates mean less/no expansion and building new gyms. No new gyms mean existing members bear the burden as management can’t spread its costs across a broader range of gyms.

Can you see the impending nightmare? You’re probably thinking, “why don’t these mid-to-upper tier gyms simply cut price?” They can, but they’ll die. Mark Walker of Tolleymore Partners puts it perfectly in his 2018 letter (emphasis mine):

“Mid-tier and premium competitors have lower margins than GYM. This lowers their headroom for profitable price cuts. The competitive response from the mid-tier/premium segment seems to have been benign. Mid-tier/premium operators have upgraded their service to warrant the premium they charge and/or have increasingly targeted the top end of the market, which they argue is not addressed by the low-cost segment. Mid-tier and premium gyms have consistently increased their fees each year. One mid-tier operator, Fitness First, did attempt to create a low-cost arm, opening Klick Fitness in 2012 with six gyms. Just over 12 months later the group exited the sub-sector”

The issue with mid-tier gyms specifically is that they’re stuck in the middle. They’re “fancy” enough to charge higher prices but low enough for members to justify switching to lower-cost options. Upper-tier gyms can claim “exclusivity” and get away with fewer members at higher prices.

The issue with mid-tier gyms specifically is that they’re stuck in the middle. They’re “fancy” enough to charge higher prices but low enough for members to justify switching to lower-cost options. Upper-tier gyms can claim “exclusivity” and get away with fewer members at higher prices.

GYM plays the more straightforward game. The GYM Group’s model is simple: pay the lowest amount for everything you need, nothing more. The company’s low-cost model starts with the application process. Members never interact with an employee and can join either online or via a touch-pad kiosk at the gym. Members have 24/7 access to a GYM Group facility through an app. Members use a QR Reader to scan into the gym, providing access whenever they need it.

Lower Costs + Solid Financial Position = Aggressive Gym Expansion

The low-cost model allows GYM Group to expand its sites more aggressively than its peers with higher-cost structures. It makes sense to add more gyms when each mature site produces 30% ROICs. The company recognizes lower costs in its per-store employee numbers via fully digital application and member management processes.

The GYM Group spends (on average) 6% of their revenue on staffing compared to the average mid-market operator at 25%-30%.

Another reason why GYM can expand faster than its peers is its financial position. The company ended 2019 with GBP 47.4M in net debt, or <1x Net Debt/EBITDA. PureGym (a private British comparable) has ~4.5x Net Debt/EBITDA.

Leverage ratios matter when it comes to negotiating lease contracts for gym space. A highly leveraged company might not get a lease that a GYM would. And if they did, they’d pay significantly higher interest rates to account for the risk.

Leverage ratios matter when it comes to negotiating lease contracts for gym space. A highly leveraged company might not get a lease that a GYM would. And if they did, they’d pay significantly higher interest rates to account for the risk.

Build-out prices should also compress over time for a few reasons. First, post-COVID real estate terms should favor renters like GYM. Commercial real estate companies want rent checks, and in a post-COVID world, they’ll take what they can get. Second, the GYM Group benefits from economies of scale that allow them to command lower prices for equipment and cleaning services (more equipment and more square feet to clean).

It also helps when landlords give GYM ~12 months in free rent as they outfit a new gym. A 12-month runway allows GYM to operate on a negative working capital cycle (I.e., landlord/initial members pay for the build-out).

What Can GYM Generate in 2026?

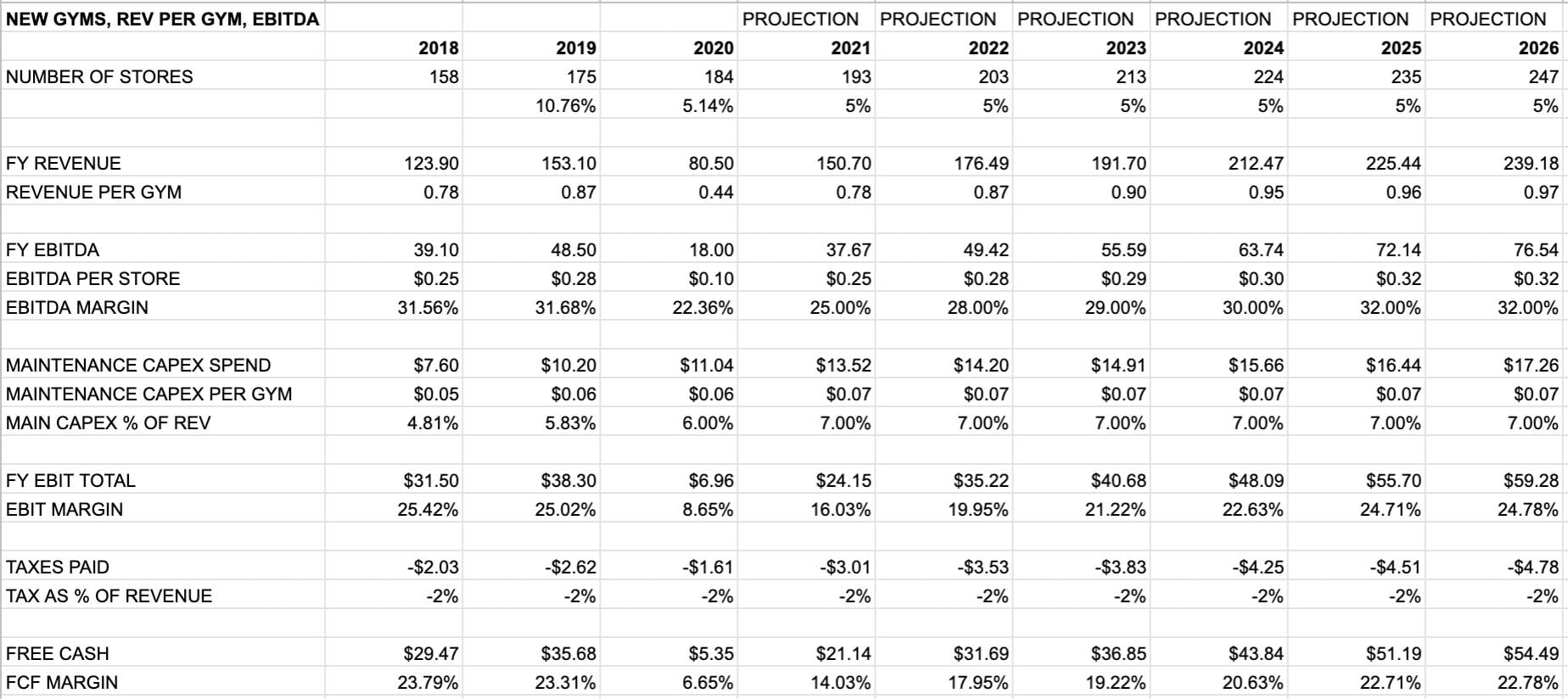

Since we know (roughly) what an average gym generates in revenues and EBITDA, we can make a back-of-the-envelope guess on 2026 operating figures. Let’s assume the company grows gym sites ~5% until 2026. That gives us 247 locations.

Each passing year more GYM Group locations become mature sites, generating higher revenue and EBTIDA per store. We’re assuming that by 2026 the average gym will generate 970K in revenue for a total of GBP 239M. For reference, the average GYM location generated GBP 780K in revenue in 2018.

We’re also assuming each store generates (on average) GBP 320K in EBITDA. That gives us a 32% margin which is in line with historical data. The company expects to pay ~6-7% in maintenance cap-ex over the next few years. We assumed 7% of revenues spent on maintenance CAPEX in 2026.

Subtracting our CAPEX and taxes gets us ~GBP 55M in FCF by 2026 (see below). That’s a 13% yield at the current stock price. If we can sell our GYM shares to another willing buyer at 15x 2026 FCF, we get ~GBP 817M in market cap, or GBP 4.95/share.

Concluding Thoughts on The Gym Group

The Gym Group is an excellent business with phenomenal unit economics taking share in a fast-growing industry. Recessions (or pandemics) can turn a profitable business into a great company.

COVID turned GYM into a great business. The company emerged from the crisis with the most robust balance sheet in its industry. GYM’s low-cost offering bodes well in good/bad times and should protect equity investors during the next recession.

The competition will surely emerge, trying to eat away GYM’s mouth-watering ROIC and margin profile. But so far, they haven’t. And with each new gym the company opens, it further entrenches its competitive advantage in the market. You can get all this for half of what it’s worth in five years.

Article by Macro Ops