Absolute Return Partners letter for the month of May 2018, titled, “The Death Of Fossil Fuels? Really?”

A century ago, petroleum – what we call oil – was just an obscure commodity; today it is almost as vital to human existence as water. – James Buchan

Q1 hedge fund letters, conference, scoops etc

The End of Indexing

My new book – The End of Indexing – was finally released on the 26th March and has since gone on holiday to Dubai (Exhibit 1). No wonder it needs a break after all that hard work. Just wish I could be there too!

Exhibit 1: The End of Indexing on holiday in Dubai

Source: Martin Bernhardt

Although I haven’t seen any sales numbers yet, the publisher seems pretty happy so far. I could actually do with some help. If you have read the book already (but only if), and you have an account with Amazon, it would greatly help my cause if I could persuade you to spend a few minutes reviewing the book on Amazon. In these social media times, there sorts of things are very important. Apparently, for Amazon to accept your review, all you need is an Amazon account. It is not a necessity that you actually bought the book through them.

A recap of last summer’s story on oil

Changing subject, in June of last year, I wrote an Absolute Return Letter under the title Oil Price Target: $0 (by 2050), and that raised a few eyebrows. At the same time, I added The Death of Fossil Fuels to the growing list of structural trends that I have identified, and that I believe will impact the global economy and financial markets for years to come. Brent oil was hovering around $50 at the time.

Although I did make it crystal clear that it was indeed a very long-term target, and that oil prices could easily move the other way in the short to medium-term, I still took a fair amount of stick from readers, many of whom thought I had finally lost the plot (to tell you the truth, that happened years ago, but that’s a story for another day).

Oil prices will never go to $0, many readers screamed, and they are (probably) correct. Take the chemical industry’s use of oil. A meaningful amount of it is used every day to produce various plastic products, and neither renewable energy forms nor fusion energy (whatever energy form is going to replace fossil fuels in the long term) can ever replace oil when producing plastic products.

I concur with that view, but oil prices are not likely to trade anywhere near current levels in a world that only needs 20-25% of the amount of oil that we need today to make the global economy turn around. Moreover, both gas and coal prices could certainly go to $0. Furthermore, given the direction in which governments all over the world are moving these days, isn’t it quite likely that many plastic products will eventually be outlawed, further reducing demand for oil?

A recap of events since last summer

Fast forward to late April 2018, and the price of Brent oil is suddenly in the mid-$70s – about 50% higher than when I declared The Death of Fossil Fuels; hence the need for another letter on the topic.

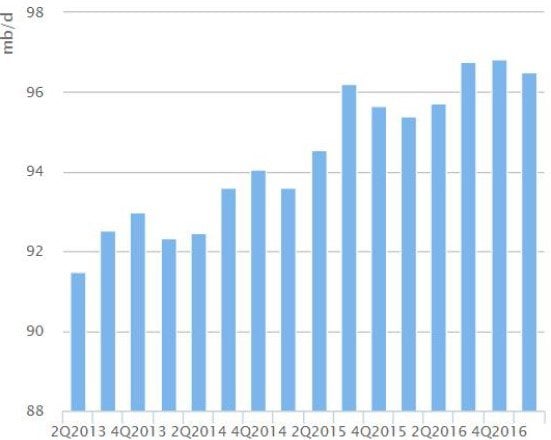

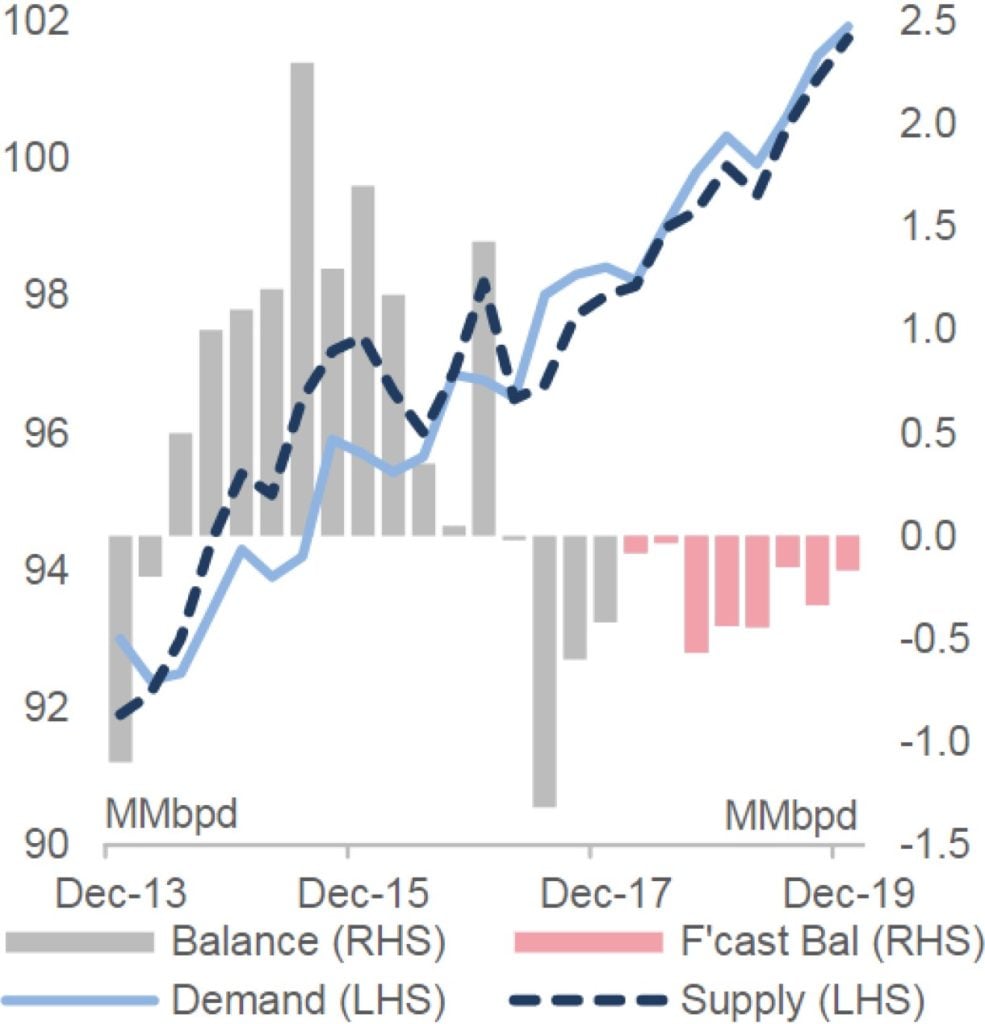

The two most important drivers of stronger crude oil prices more recently are probably (i) relatively robust demand for oil (Exhibit 2) caused by the global economy (finally) firing on almost all cylinders again, and (ii) a meaningful decline in global inventories, partially caused by the solid economic growth just referred to and partially caused by an uncharacteristically disciplined OPEC. The two factors in conjunction have had the effect of shifting the overall balance between demand and supply quite dramatically (Exhibit 3).

Exhibit 2: Global oil demand

Source: IEA

In that context, allow me to make two further points. Firstly, a virtual collapse of Venezuela’s oil industry hasn’t done any harm to oil prices either. Secondly, if one were to look even further ahead than the researchers at Scotiabank do in Exhibit 3, assuming you base your long-term supply forecast on the current forward curve, the imbalance between global supply and demand widens even further, with demand significantly exceeding supply in the years to come.

Exhibit 3: Global crude oil supply & demand

Source: Scotiabank Economics

The rebalancing of global oil markets has led to a remarkable change in the general attitude towards oil amongst investors. Whereas they were mostly bearish before OPEC finally got its act together, sentiment has swung around and is now quite bullish (Exhibit 4).

Exhibit 4: Call Bias on Brent Options

Source: Alex Longley

Another reason to be bullish

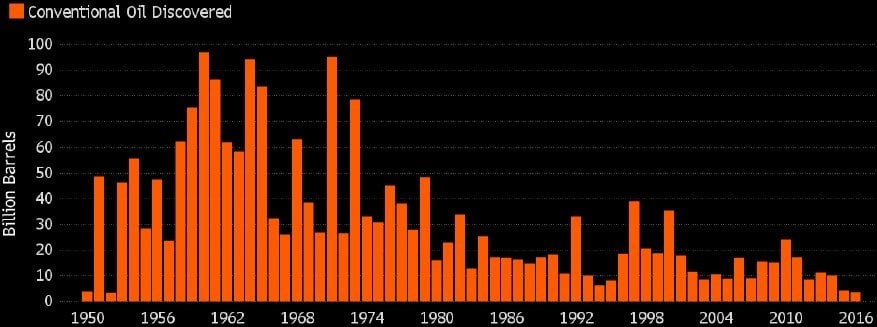

One part of the bull story that gets a surprisingly modest amount of attention is the poor replacement ratio amongst oil producing nations. Over the last five years, whereas 170 billion barrels of oil have been consumed globally, only 40 billion barrels of new oil have been discovered. New oil discoveries are on a steep downward slope (Exhibit 5), and that should further support oil prices as long as fossil fuels remain such a critical part of global energy requirements.

Exhibit 5: Annual oil discoveries since 1950

Sources: Wood Mackenzie, Bloomberg

Is oil becoming a crowded trade?

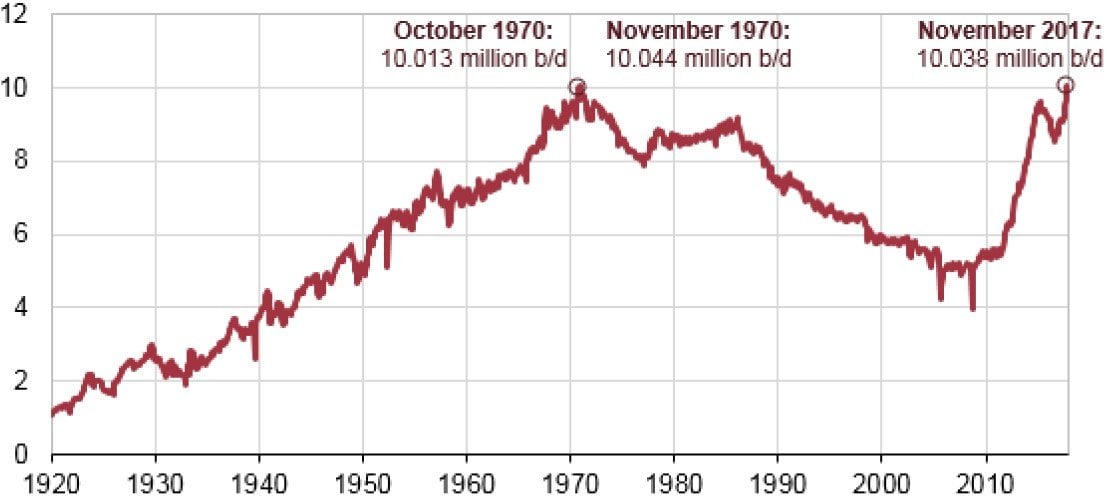

What is even more remarkable is that crude oil prices have strengthened during a period of rapidly rising American oil production, which is now at an all-time high (Exhibit ). That got me thinking. Is it possible that oil markets are perhaps getting a little too crowded for their own good?

Stories of financial buyers piling into oil are coming in thick and fast. This has raised a question in my head. Is it possible that investors are getting carried away? That recent events (e.g. the trouble in Syria) are being assigned too much importance and that shale oil (predominantly from the US) will eventually kill the show?

Exhibit 6: US monthly crude oil production (million barrels per day)

Sources: US Energy Information Administration

I have seen Syria mentioned more than once as one of the key reasons why oil markets have been so strong recently, but that is quite frankly a bit of a red herring. Syrian oil production peaked in 2002 and has subsequently fallen by about 96%, accounting for less than 0.03% of global crude oil production in 2016. (Source: BP Statistical Review of World Energy June 2017). To argue that Syria is a meaningful player on the global stage is a gross exaggeration.

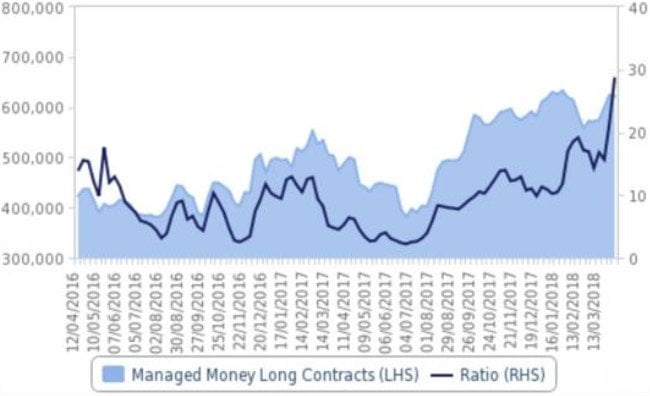

Having said that, whether Syria is or isn’t to be blamed for the latest rise in oil prices, it is a fact that oil increasingly looks like a crowded trade. A record net long position in Brent plus a record high ratio of long-to-short positions suggest an overstretched market (Exhibit 7), prone to profit-taking.

Exhibit 7: Net long position in Brent & ratio of longs-to-shorts

Sources: BMI Research

The bear story

Putting my (very) long-term bearishness on fossil fuels aside for a moment, there is also a bear story with the potential to unfold in the short to medium-term, but that bear story is a very different one. It is a story about GDP growth likely to suffer as a consequence of the oil industry’s insatiable appetite for working capital, which is presumably a function of the low hanging fruit having been picked already.

In the US today, the oil industry ties up 31 times more capital per barrel of oil produced than it did in 1980, when we came out of the second oil crisis. (Note: I am referring to the US here, as that is the only country I have those statistics on. That said, I have no reason to believe it is much different in any other country. Source: MacroStrategy Partnership LLP). Such a hefty capital requirement is a significant tax on economic growth. Think of it the following way. Capital is a major driver of productivity growth, which again is a key driver of economic growth. Capital tied up by the oil industry cannot be used to enhance productivity elsewhere, i.e. overall productivity growth suffers as more and more capital is ‘confiscated’ by the oil industry.

I am tempted to remind you (yet again!) of one of the most important equations in the world of economics:

∆GDP = ∆Workforce + ∆Productivity

We already know that the workforce will decline in many countries in the years to come; hence productivity growth is the only solution to a world drowning in debt, if that debt is to be serviced. Why? Because we need economic growth to be able to service all that debt.

Now, if productivity growth is going to suffer for years to come, all this fancy new stuff that we all count on to save our bacon (advanced robotics, artificial intelligence, etc.) may never be fully taken advantage of, because the money needed to make it happen won’t be there. It is not a given but certainly a risk that shouldn’t be ignored.

Concluding remarks

For that reason, we need to retire fossil fuels as quickly as possible. Ageing of society (older workers are less productive than their younger peers) and a global economy drowning in debt (servicing all that debt is immensely expensive, leaving less capital for productivity enhancing purposes) are widely perceived to be the two most important reasons why productivity growth is so pedestrian at present.

I am not about to tell you that those two reasons are not important. They certainly are. However, the adverse impact the oil industry is having on overall productivity should not be underestimated.

Think about it the following way. In the good old days, before the world fell in love with debt, it was quite common for GDP to growth by $1 for every dollar of added debt. In other words, the economy grew pretty much in line with the growth in debt, but not anymore. The US economy only grows by $0.20-0.25 now for every dollar of added debt. One could therefore argue that up towards 80% of all capital (debt) is misallocated – at least in economic terms; i.e. it doesn’t generate any economic growth.

Now to the difficult part. What is causing all that misallocation of capital? Is it servicing the growing mountain of debt? Is it servicing the growing number of elderly? Is it the excessive use of capital in the energy industry? Is it something entirely different? My guess – but it is admittedly only a guess – is that it is a combination of them all.

Whatever the answer, fact of the matter is that, in an economy where almost 80% of capital is misallocated, it shouldn’t surprise anybody that productivity growth is struggling. The ultimate solution to this problem is (most likely) fusion energy which, unfortunately, is still many years away. In the short to medium-term, the most viable solution is therefore renewable energy combined with Electrification of Everything (which is one of ‘my’ eight structural mega-trends), so that the need for fossil fuels can at least be curtailed.

Anyway, I am going off piste now – let me try and get back on track. In the early days of shale, producers needed $80-90 to break even but, in most US shale fields, that is no longer the case. The break-even in the most productive US shale fields is no more than $50-55 today and, although it is much higher elsewhere, it is coming down everywhere.

This is important, because it implies that shale has effectively put an upper limit on the oil price, and that the upper limit continues to come down. In the short term, oil prices can certainly go to $80 and probably even $90 but, short of a major political incident in the Middle East, I don’t expect the peak levels of 2008 (around $140) to ever be reached again.

Famous last words?

Investment Theme: Electrification of Everything

Article by Absolute Return Partners