21Q1 All-Time Quarterly Record: Sustainable Finance Bonds Totalled US$286.5bn; More Than Double 20Q1 Issuance Levels

Q1 2021 hedge fund letters, conferences and more

Sustainable Finance Review: Overview

Refinitiv’s Sustainable Finance Review is the most comprehensive view of sustainable financing and advisory activity around the world.

With its combination of both sustainable products and sustainable companies, Refinitiv Deals Intelligence Sustainable Finance league tables are the first and only to adjoin these two aspects of the market into one ranking. The rankings capture sustainability related deals including green bonds (the result of a partnership with Climate Bonds Initiative to validate transactions consistent with ICMA green bond principles), social bonds and sustainability linked bonds or loans, the use of sustainable proceeds, and companies operating in sustainable industries to provide a complete view of total capital raising in support of sustainable outcomes.

More information on the coverage universe and criteria can be found on page 13 14 of this review. For more coverage of global deal making, please visit www.refinitiv.com/dealsintelligence

First Quarter 2021 Highlights: Debt Capital Markets

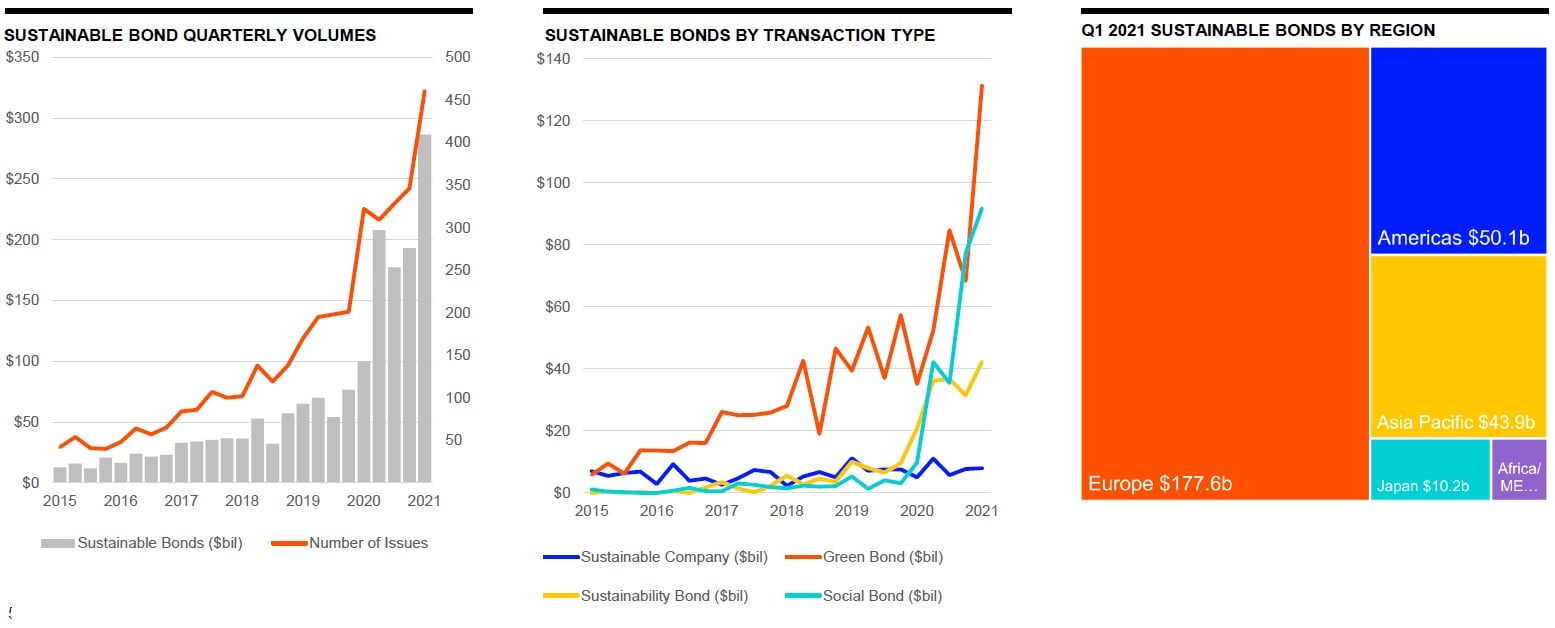

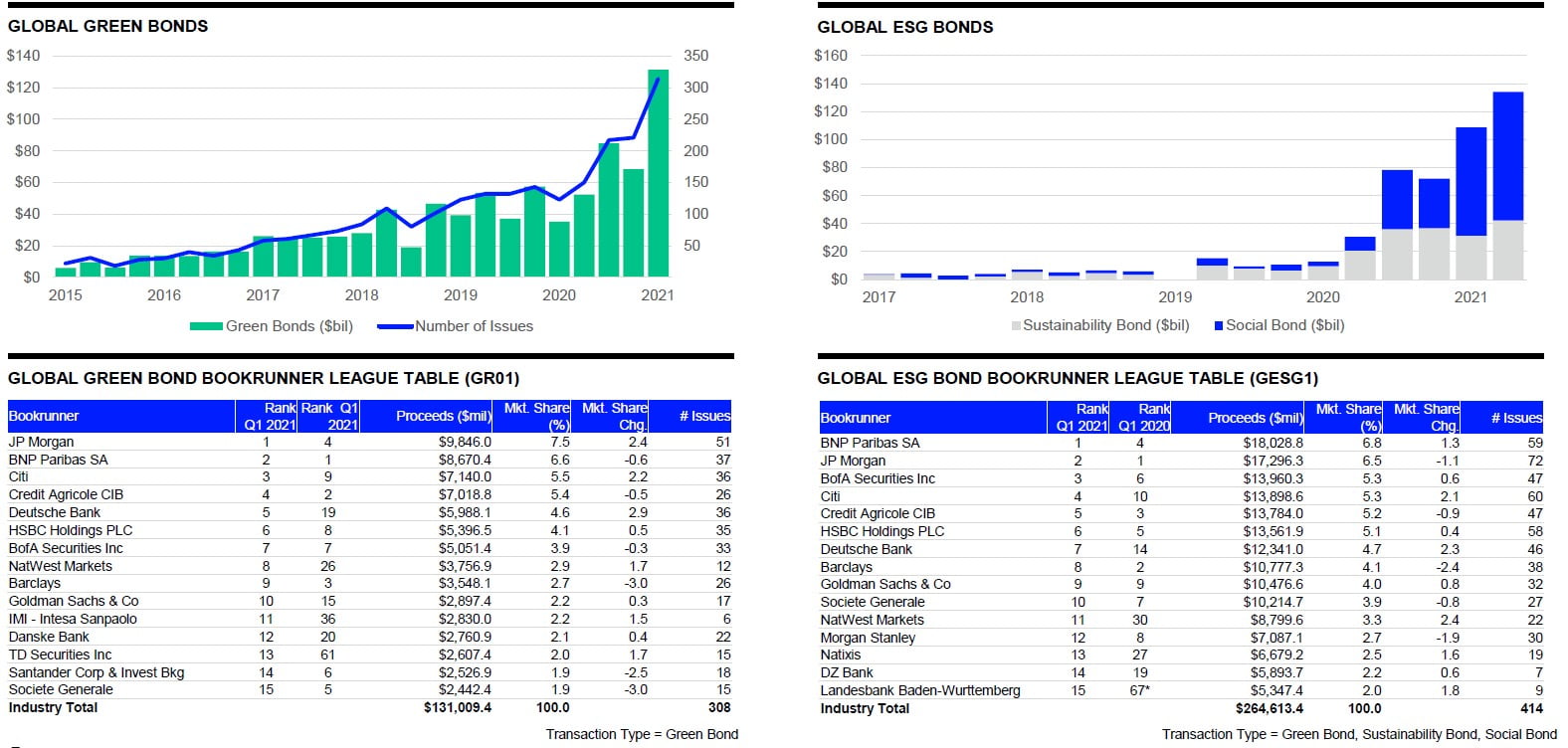

- Sustainable Finance bonds totalled US$286.5 billion during the first quarter of 2021, more than double issuance levels seen during the first quarter of 2020 and an all time quarterly record. Sustainable Finance bonds increased 48% compared to the fourth quarter of 2020, marking just the second ti me that Sustainable bond issuance surpassed US$200 billion during a quarter. The first quarter of 2021 marks the highest quarterly total, by proceeds and number of issues, for Sustainable Finance bonds since our records began in 2015. As a percentage of global debt capital markets proceeds, Sustainable Finance bonds accounted for a record 11.5 % o f first quarter activity, up from 9.5% during fourth quarter 2020.

- During the first quarter of 2021, Green bond issuance totalled US$131.3 billion, an increase of more than four times first qu art er 2020 levels and all time quarterly record. Green bond issuance surpassed US$100 billion for the first time during a quarter and also set an all time quarterly record for number of issues during the opening quarter of 2021.

- The Sustainability and Social bond categories each set all time quarterly records during first quarter 2021. Bolstered by a rec ord breaking offering from the European Union, Social bond issuance totalled US$91.8 billion during the first quarter of 2021, nearly 10 times the total raised during first quarter 2020. Social bond issuance accounted for 32% of the Sustainable Finance bond market during first quarter 2021, compared to 10% during first quarter 2020.

- Sustainability bond issuance reached US$42.2 billion during first quarter 2021, more than double the levels seen during first qu arter 2020 and an all time quarterly record. The number of Sustainability bonds increased 144% compared to a year ago.

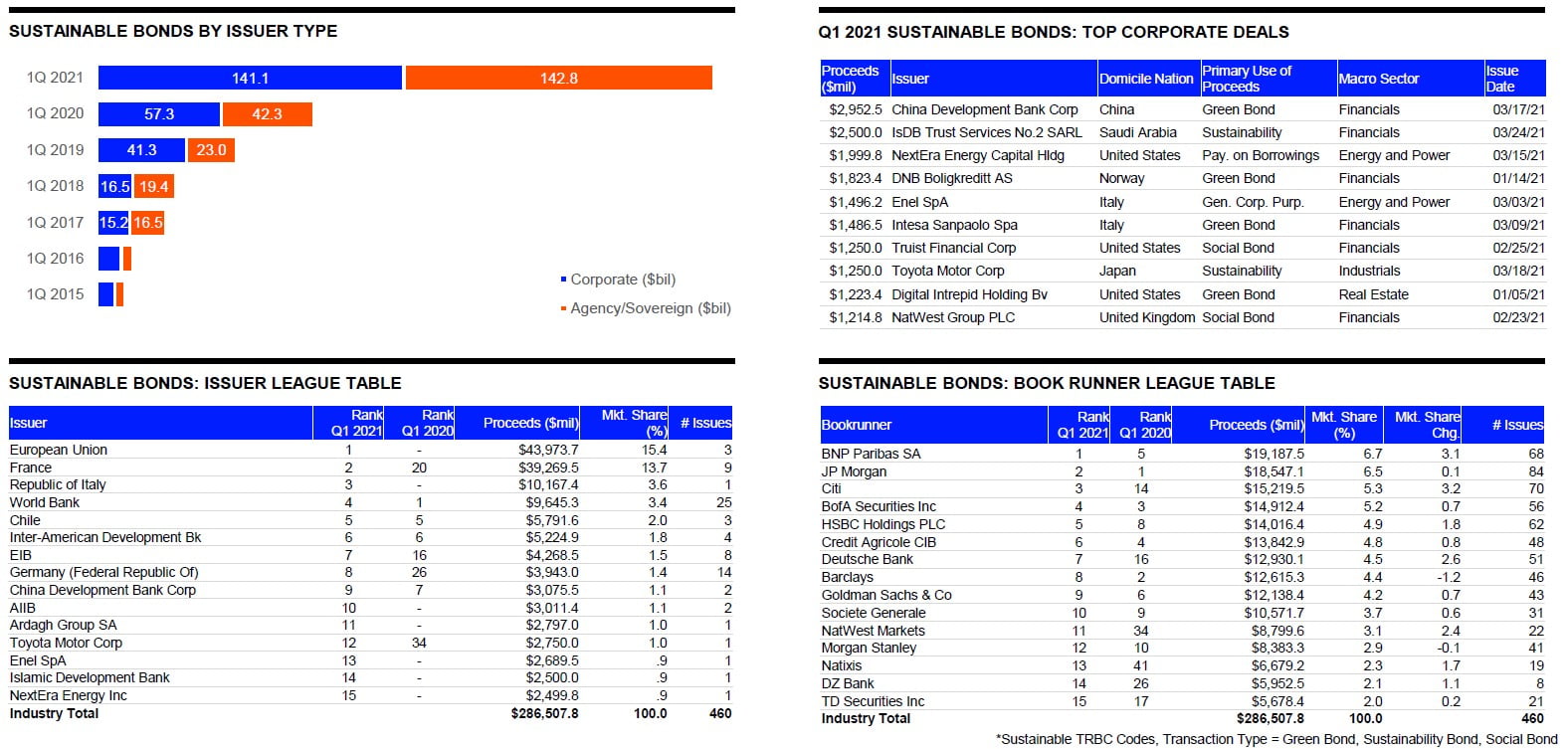

- Agency and Sovereign issuers accounted for 50% of overall activity during the first quarter of 2021, down from 64% of Sustain able Finance during the fourth quarter of last year. Registering a 146% increase compared to a year ago, Corporate issuers accounted for 49% of issuance, up from 35% during the f our th quarter of 2020. Corporate Sustainable Finance bond offerings accounted for a record 10% of global corporate debt issuance during the first quarter of 2021, up from 7% during the fourth quarter of last year.

- European issuers accounted for the largest regional market for Sustainable Finance bonds with 62% market share during the fir st quarter of 2021, compared to 18% from the Americas and 15% from Asia Pacific.

- BNP Paribas moved into the top spot for Sustainable Finance bond underwriting with 6.7% market share during first quarter 202 1, an increase of 3.1 market share points compared to a year ago. JP Morgan and Credit Citi rounded out the top three underwriters during the first quarter. The top t en Sustainable Finance bond underwriters comprised 50.2% of the overall market during first quarter 2021, up from 37.8% a year ago.

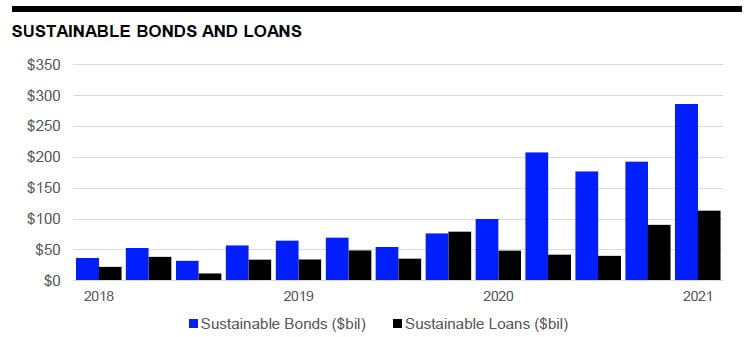

Syndicated Loans

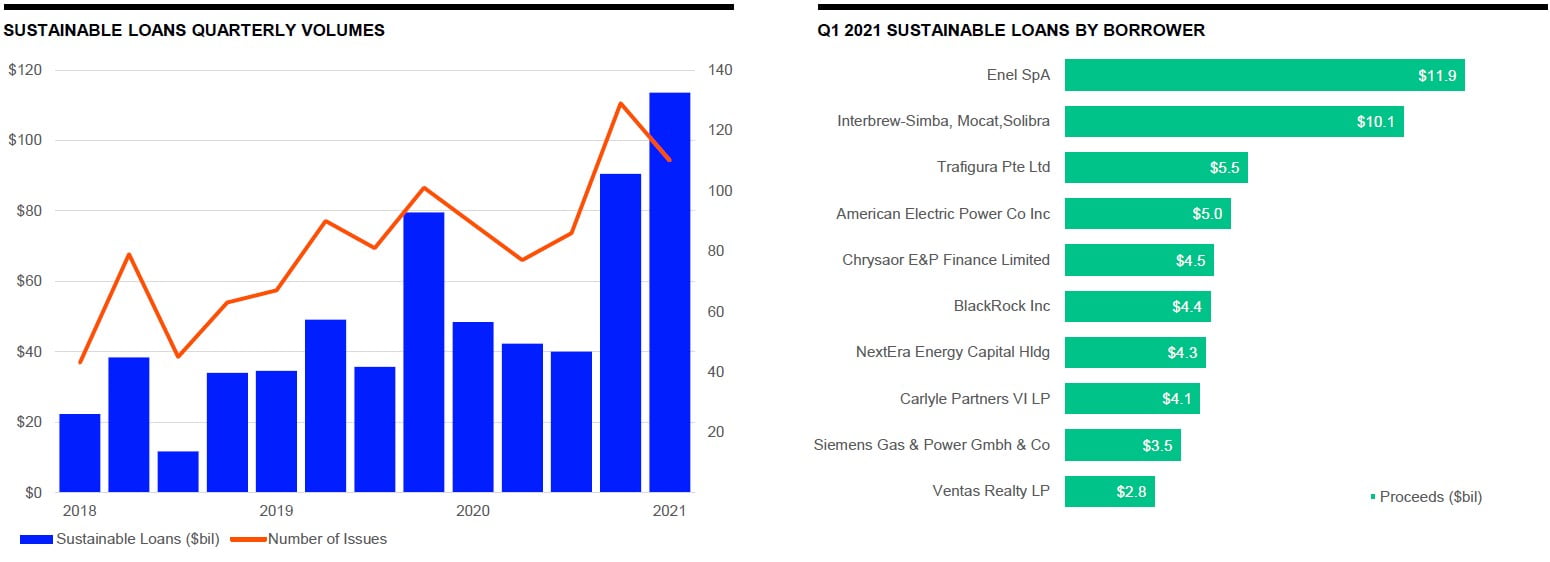

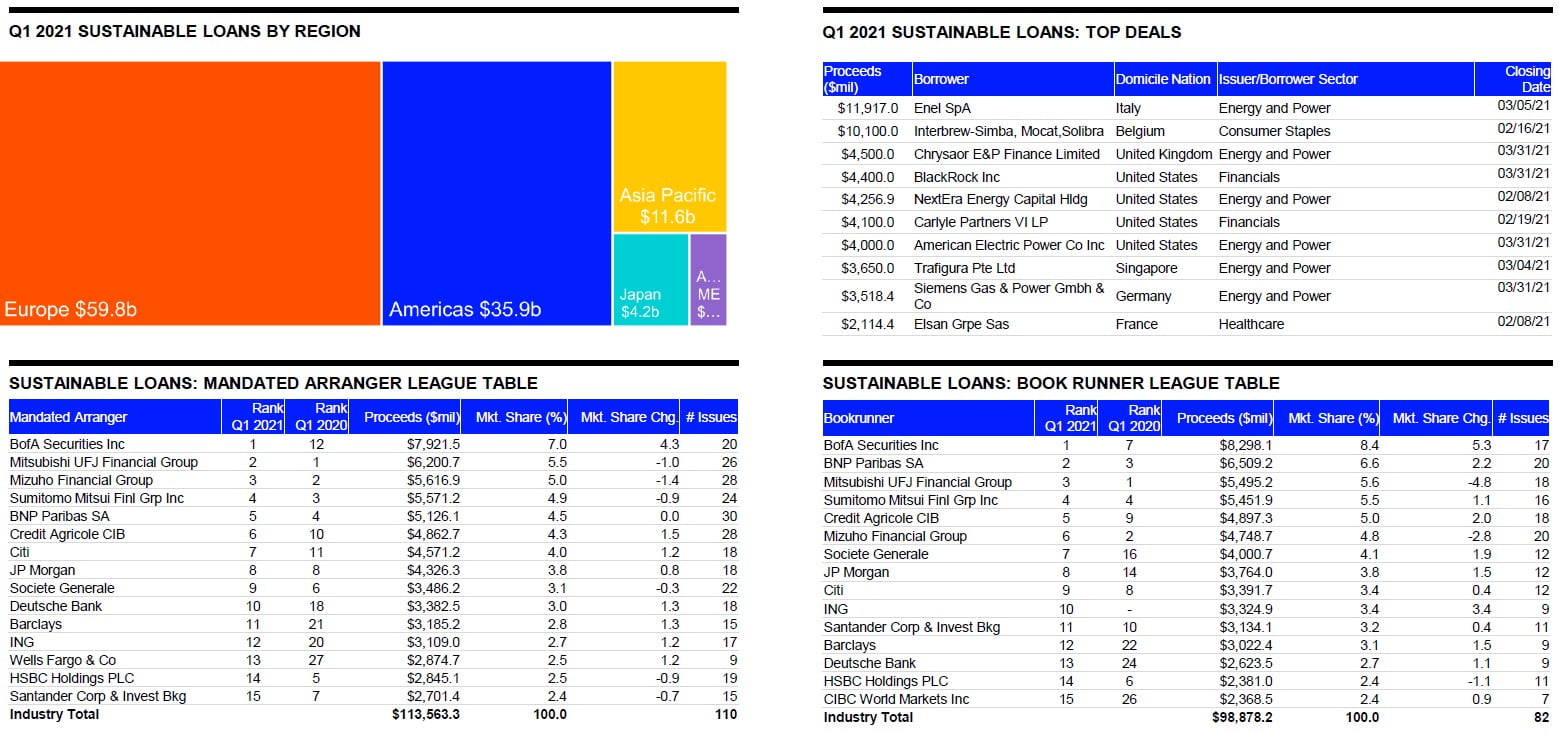

- Sustainable lending totalled US$113.6 billion during the first quarter of 2021, more than doubling year ago levels and surpas sin g US$100 billion for the first time during a quarter. The first quarter registered a 26% increase compared to the fourth quarter of 2020 and marks the second consecutive quarterly in crease for sustainable lending, after three consecutive quarterly declines during 2020.

- European borrowers accounted for 53% of overall sustainable lending during the first quarter of 2021, led by facilities for I tal y’s Enel SpA and Belgium’s Interbrew Simba. Lending in the Americas accounted for 32% of first quarter 2021 activity, the highest percentage since the first quarter of 2019, whi le Asia Pacific lending accounted for 10%.

- BofA Securities moved into the top spot for sustainable syndicated loan mandated arrangers during first quarter 2021, with 7. 0% market share, an increase of 4.3 market share points, followed by Mitsubishi UFJ Financial Group with 5.5% and Mizuho Financial Group with 5.0%.

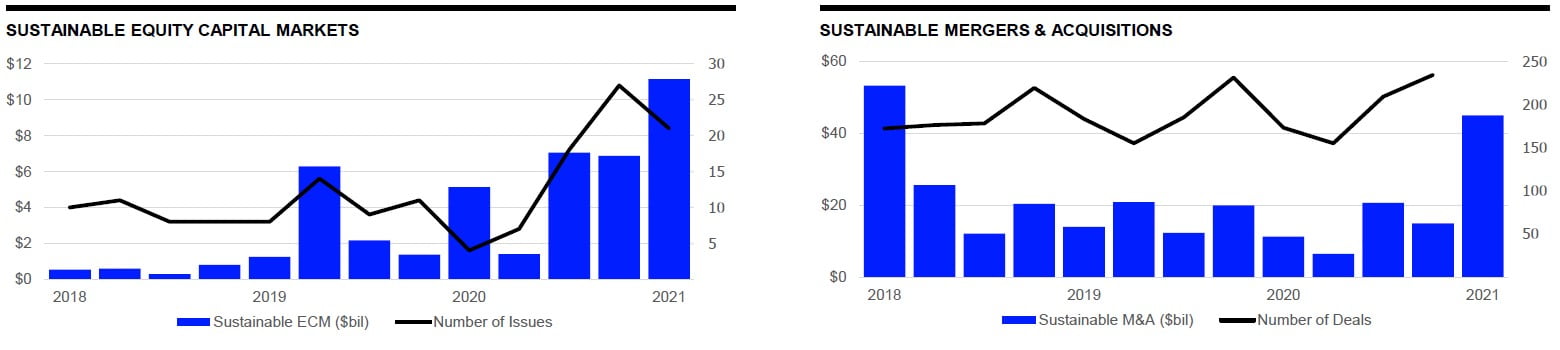

Equity Capital Markets

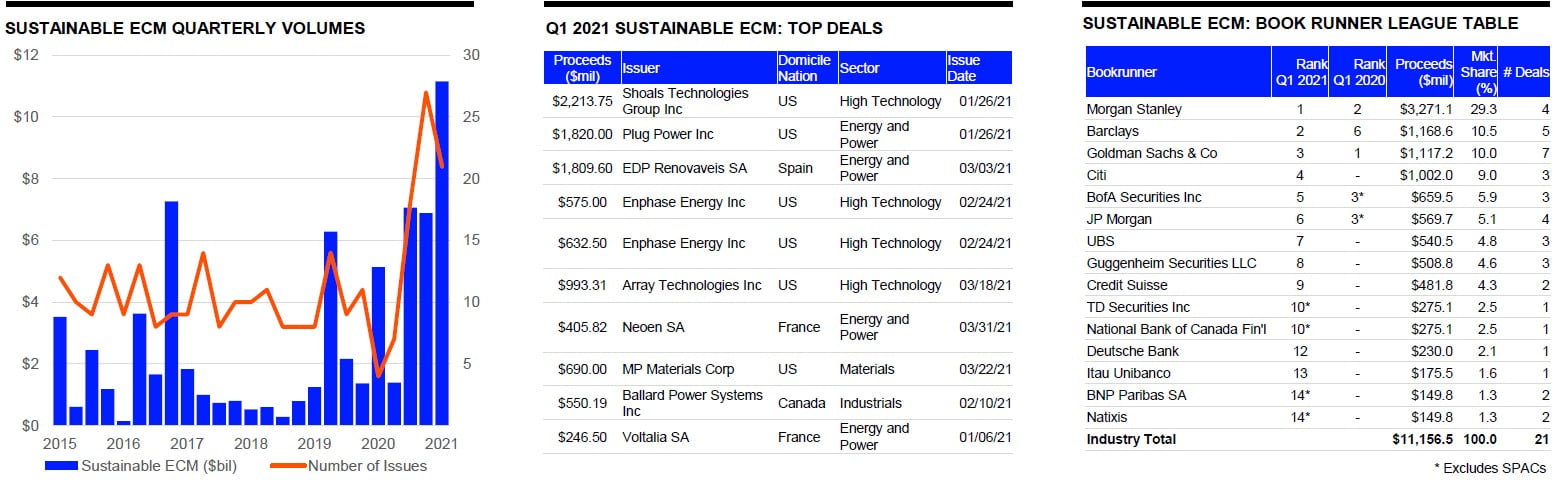

- Equity Capital Markets activity for sustainable companies totalled US$11.2 billion during the first quarter of 2021, more tha n d ouble activity levels during the first quarter of 2020 and an all time quarterly record. By proceeds, first quarter 2021 sustainable equity issuance increased 62% compared to the four th quarter of 2020, despite a 22% decline by number of offerings compared to the previous quarter, which set an all time quarterly record by number of new issues.

- The Americas accounted for 75% of overall equity capital markets activity during the first quarter of 2021, followed by Europ e w ith 24%. Morgan Stanley, Barclays and Goldman Sachs topped the list of bookrunners for sustainable equity offerings during the first quarter of 2021, registering a combine d m arket share of 50%.

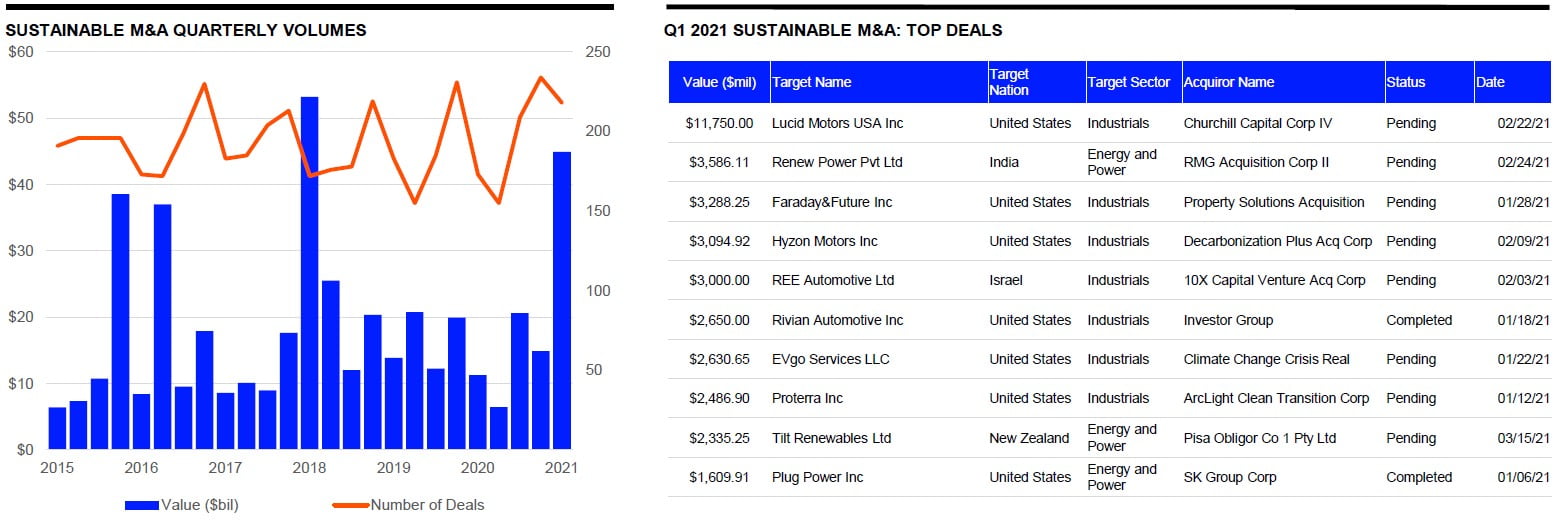

Mergers & Acquisitions

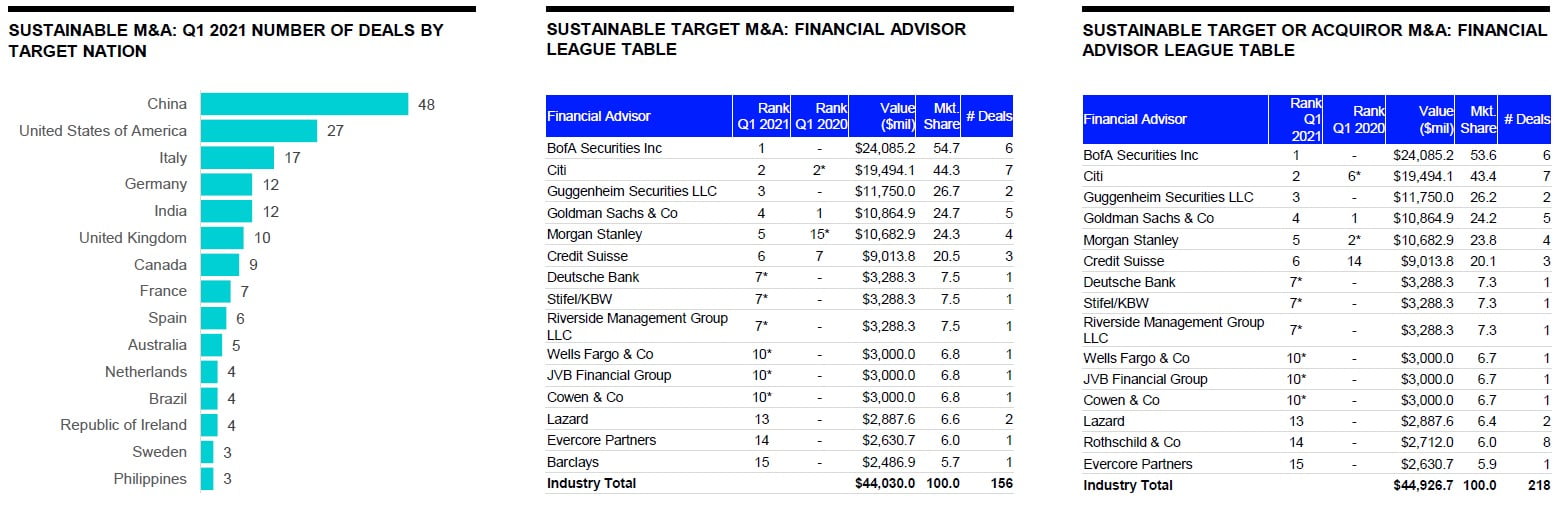

- Mergers & Acquisitions activity involving sustainable companies totalled US$44.9 billion during the first quarter of 2021, mo re than four times first quarter 2020 levels and a three year high. Two hundred and eighteen sustainable deals were announced during first quarter 2021, a 26% increase compared to a year ago. By number of deals, China accounted for 22% of total sustainable deal making activity during the quarter, followed by the United States (12%), Italy (8%) and Ger man y and India (6%).

- Sustainable acquisitions by Special Purpose Acquisition Companies (SPACs) totalled US$31.4 billion, or 70% of total announced M& A activity during the first quarter of 2021.

- Based on deal making involving targets or acquirors operating in sustainable industries, BofA Securities led the advisory lea gue tables for the first quarter of 2021, advising on six deals valued at US24.1 billion. Citi and Guggenheim Securities rounded out the top three financial advisors.

Sustainable Finance: Debt Capital Markets

Sustainable Finance bonds totalled US $ 5 billion during the first quarter of 2021, more than double issuance levels seen during the first quarter of 2020 and an all time quarterly record . Sustainable Finance bonds increased 48% compared to the fourt h quarter of 2020, marking just the second time that Sustainable bond issuance surpassed US$200 billion during a quarter. The first quarter of 2021 marks the highest quarterly total, by proceeds and number of issues, for Sustainable Finance bonds since our records began in 2015.

During the first quarter of 2021, Green bond issuance totalled US $ 3 billion, an increase of more than four times first quarter 2020 levels and all time quarterly record . Driven by an increase in capital raising by sovereigns, multilaterals and banks for Covid 19 relief and recovery efforts, the Sustainability and Social bond categories saw tripe digit percentage gains compared to a year ago and set all time quarterly records.

Sustainable Finance: Syndicated Loans

Sustainable lending totalled US$ 113.6 billion during the first quarter of 2021, more than doubling year ago levels and surpassing US$100 billion for the first time during a quarter. The first quarter registered a 26% increase compared to the fourth quarter of 2020 and marks the second consecutive quarterly increase for sustainable lending, after three consecutive quarterly declines during 2020.

European borrowers accounted for 5 3 % of overall sustainable lending during the first quarter of 2021, led by facilities for Italy’s Enel SpA and Belgium’s Interbrew Simba. Lending in the Americas accounted for 3 2 % of first quarter 2021 activity, the highest percentage since the first quarter of 2019, while Asia Pacific lending accounted for 10%.

Sustainable Finance: Equity Capital Markets

Equity Capital Markets activity for sustainable companies totalled US$ 11.2 billion during the first quarter of 2021, more than double activity levels during the first quarter of 2020 and an all time quarterly record. By proceeds, first quarter 2021 sustainable equity issuance increased 62% compared to the fourt h quarter of 2020 , despite a 22% decline by number of offerings compared to the previous quarter, which set an all time quarterly record by number of new issues.

The Americas accounted for 75% of overall equity capital markets activity during the first quarter of 2021, followed by Europe with 24%. Morgan Stanley, Barclays and Goldman Sachs topped the list of bookrunners for sustainable equity offerings during the first quarter of 202 1 , registering a combined market share of 5 0 %.

Sustainable Finance: Mergers & Acquisitions

Mergers & Acquisitions activity involving sustainable companies totalled US $ 9 billion during the first quarter of 2021, more than four times first quarter 2020 levels and a three year high. Two hundred and eighteen sustainable deals were announced during first quarter 2021, a 26% i n crease compared to a year ago. By number of deals, China accounted for 22% of total sustainable deal making activity during the quarter followed by the United States (12%), Italy (8%) and Germany and India (6%).

Based on deal making involving targets or acquirors operating in sustainable industries, BofA Securities led the advisory league tables for the first quarter of 2021, advising on six deals valued at US24. 1 billion. Citi and Guggenheim Securities rounded out the top three financial advisors.