Tech M&A is still setting records in 2022, largely due to a spate of megadeals, raising questions about whether the buying spree can continue as interest rates climb and markets turn sharply bearish.

According to S&P Global Market Intelligence’s latest Tech M&A analysis by 451 Research, the pace of deal-making in 2022 is on track to match or exceed 2021’s record pace. For the year through May, 2,272 industry transactions were signed, totaling $386.95 billion. By comparison, 4,321 deals were signed during full year 2021 for an aggregate value of $790.94 billion.

Q1 2022 hedge fund letters, conferences and more

Key highlights include:

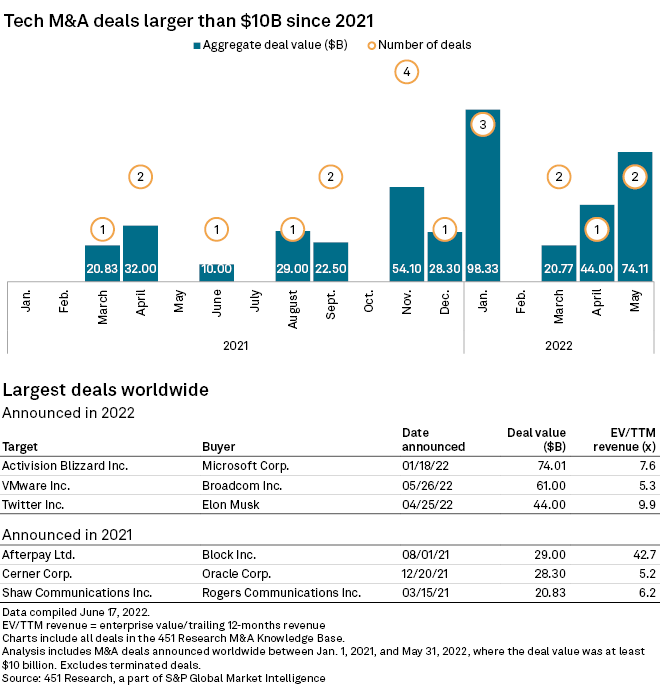

- Between January and May, acquirers announced eight technology and telecommunications transactions that crested the $10 billion mark. The prior year saw 12 11-figure transactions over the year.

- Record-breaking purchases include Microsoft Corporation (NASDAQ:MSFT)'s $74 billion catapult into gaming development with its acquisition of Activision Blizzard, Inc. (NASDAQ:ATVI), Broadcom Inc (NASDAQ:AVGO)'s expansion of enterprise software with its $61 billion bid for VMware, Inc. (NYSE:VMW) and Elon Musk's eccentric $44 billion play for social media platform Twitter Inc (NYSE:TWTR).

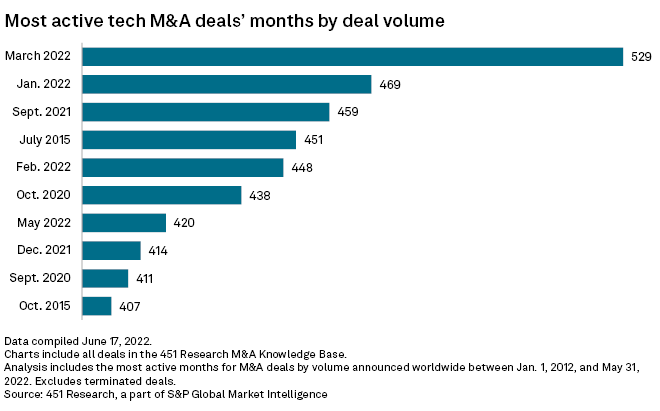

- March and January 2022 were the top two most-active months of the past decade for technology and telecommunications M&A volume, respectively, even as March recorded about half the aggregate deal value of January.

- Technology and telecommunications acquirers are paying an average of 3.7x enterprise value-to-trailing revenue through May. That is down from the 4.3x average for full year 2021.

The full analysis is available here: Megadeals buoy tech M&A totals, but how long can it last?