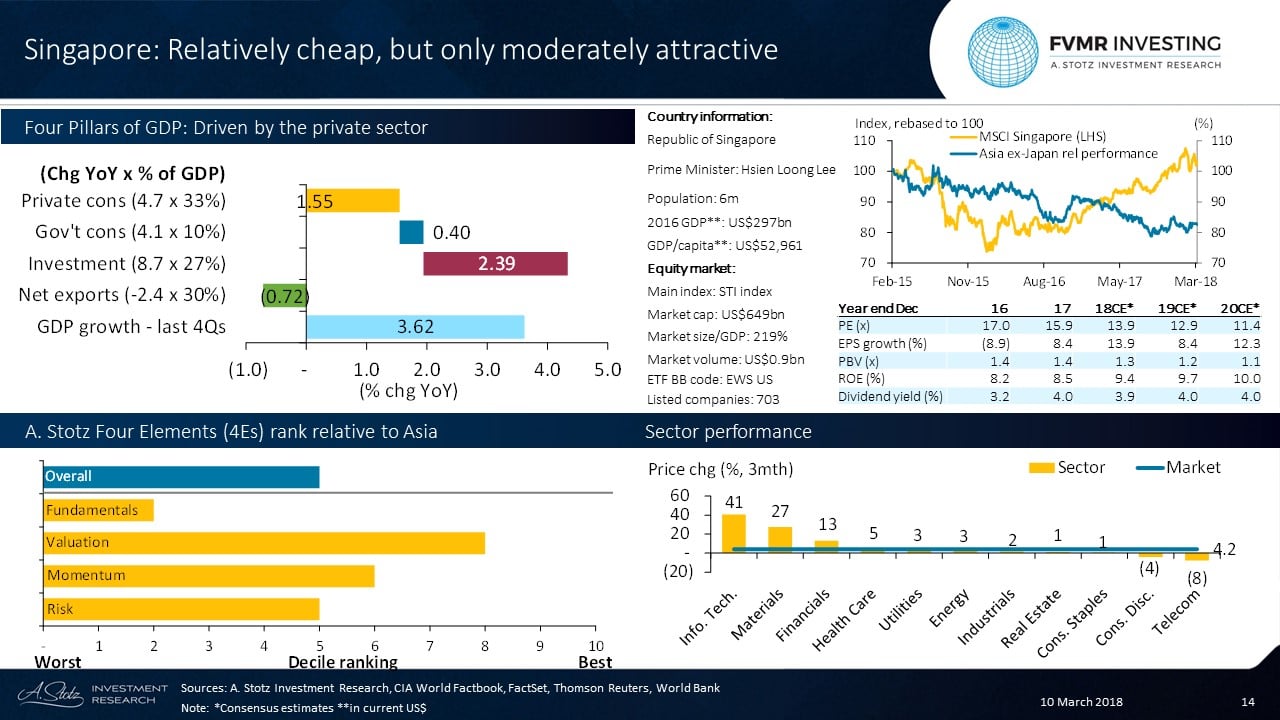

Four Pillars of GDP: Driven by the private sector

Singapore has moderate GDP growth, driven mainly by private investments and private consumption. Net export was a drag on GDP growth in the past four quarters.

PE and growth for Singapore look attractive relative to ASEAN

Singapore’s 2018CE* 13.9x PE is in line with Asia ex Japan and below ASEAN. EPS growth is in line with Asia ex Japan for 2018CE* but above ASEAN. Nice dividend yield, only Taiwan has higher in Asia.

A. Stotz Four Elements: Singapore’s rank relative to Asia

Overall, Singapore appears moderately attractive in Asia considering all our four elements: Fundamentals, Valuation, Momentum, and Risk.

Fundamentals: Poor ROE, only Hong Kong has lower ROE in Asia.

Valuation: Cheap on PB and second highest dividend yield in Asia.

Momentum: Decent price momentum and earnings growth in line with Asia.

Risk: Moderate risk in Singapore.

Massive price return in Info Tech, Telecom still challenged

Top 3 largest sectors: Industrials: 26% of the market; Financials: 24%; Real Estate: 22%.

Best sector & stock: Information Technology: +40.6% & Hi-P International Ltd: +49.8%.

Worst sector & stock: Telecom: -7.6% & StarHub Ltd: -13.6%.

*CE is consensus estimates.

Article by Become A Better Investor