Silver is to reach US$30 soon, and we see it move to its all-time high at US$50 and beyond already within this year. Best traders take a simple approach to the markets to be able to take advantage of such moves. That doesn’t mean not a lot of work has to go into arriving at such a minimized approach, but the mind needs to be free and data points limited not to get overwhelmed when it comes to good execution. Silver being in the limelight right now can only by browsing news data become an overwhelming trading vehicle with all the variant opinions and speculations. Let’s simplify! Plan, Scan, Execute.

Q1 2021 hedge fund letters, conferences and more

Plan:

- First, you need to set a goal like: “I want to become a consistently profitable trader.”

- Secondly, you want each day to look at the market from a top-down perspective (large time frames first). Then plan your game plan for the next day (see our daily call).

- Thirdly, be precise in what you will be scanning for the next day (i.e., sideways days fade highs and buy double bottoms, directional days: fade in the direction of the trend and don’t counter-trend trade).

- Also, select times for execution (every day the same time segment).

Scan:

On the day of a possible execution, one is now fortified with a clear set of rules on what to look for and primarily on what not to do. This allows for participation with reduced risk to get sucked into market action on smaller time frames. Instead, you should

- identify pre-planned patterns

- determine sensible low risk entry points

- and verify whether your daily call is still in play or if your prior day assessment is proven wrong (which would disqualify this day as an execution day).

Execute:

Once entry criteria are verified (price patterns, indicator readings, price levels, and so forth), your job is to evaluate if the math fits the trade.

First, mark your stop based on a support resistance level. Secondly, identify the next reasonable resistance zone for your trade, and if the distance towards your stop is smaller in size of the distance towards your first target (r/r ratio=1:1.5, see our Quad exit strategy ), you’re in business. Identify your following two targets as well. If the trade fits preset criteria, you are obligated to execute the trade.

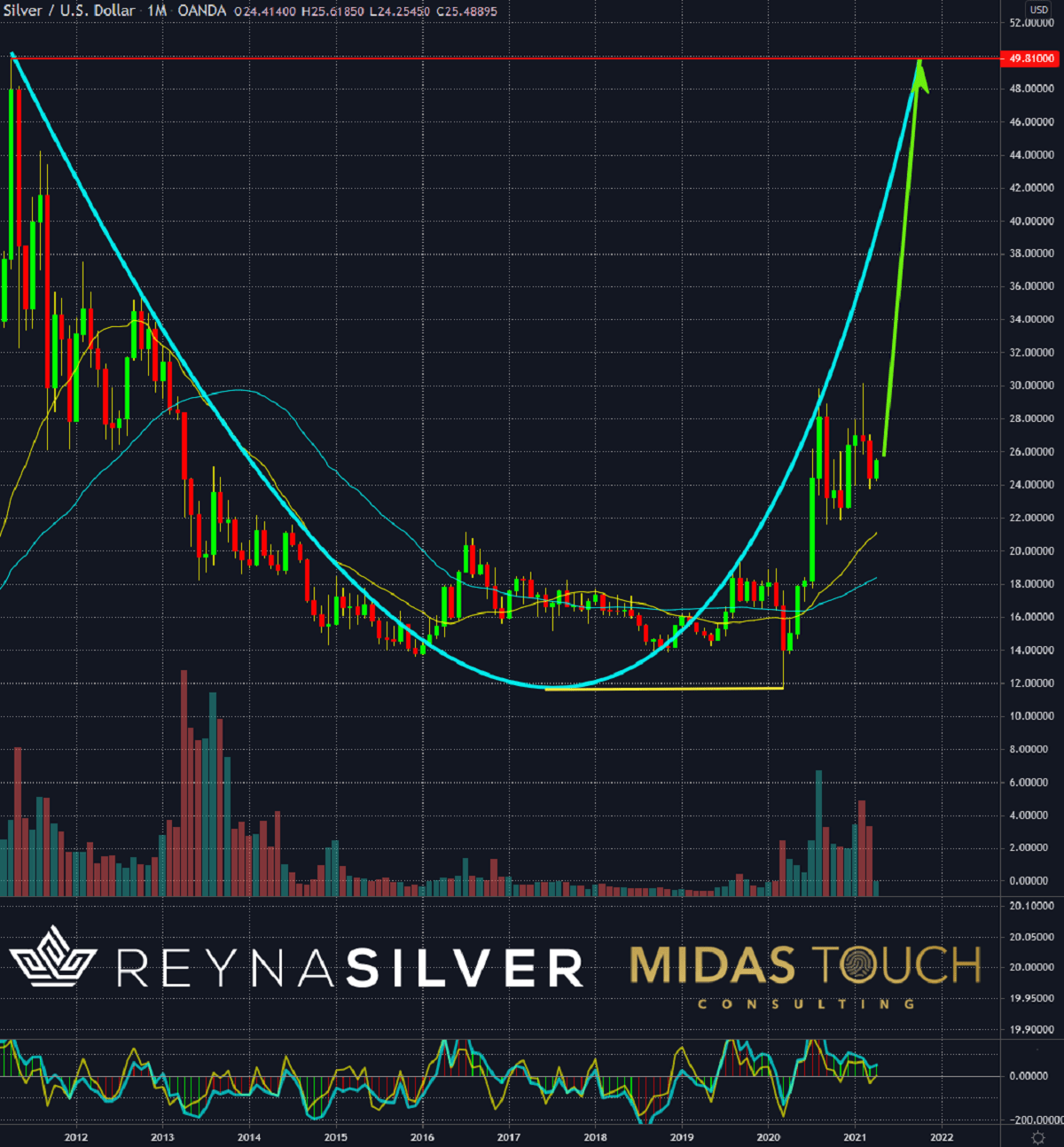

Silver in US-Dollar, Monthly Chart, The plan:

Silver in US-Dollar, monthly chart as of April 15th, 2021.

Larger timeframe plays work much alike since your process sheet approach is principle-based and expandable to the larger picture. We looked for a wealth preservation vehicle and found in Silver what fits the bill due to overwhelming fundamental data.

The monthly chart above shows a projection chart where we see prices heading. One can see how Silver prices were declining from 2011 highs till 2015. Then the Silver market traded sideways until March last year. From that point on, we quickly advanced in just five-month to US$30. We find evidence that prices should go higher from here.

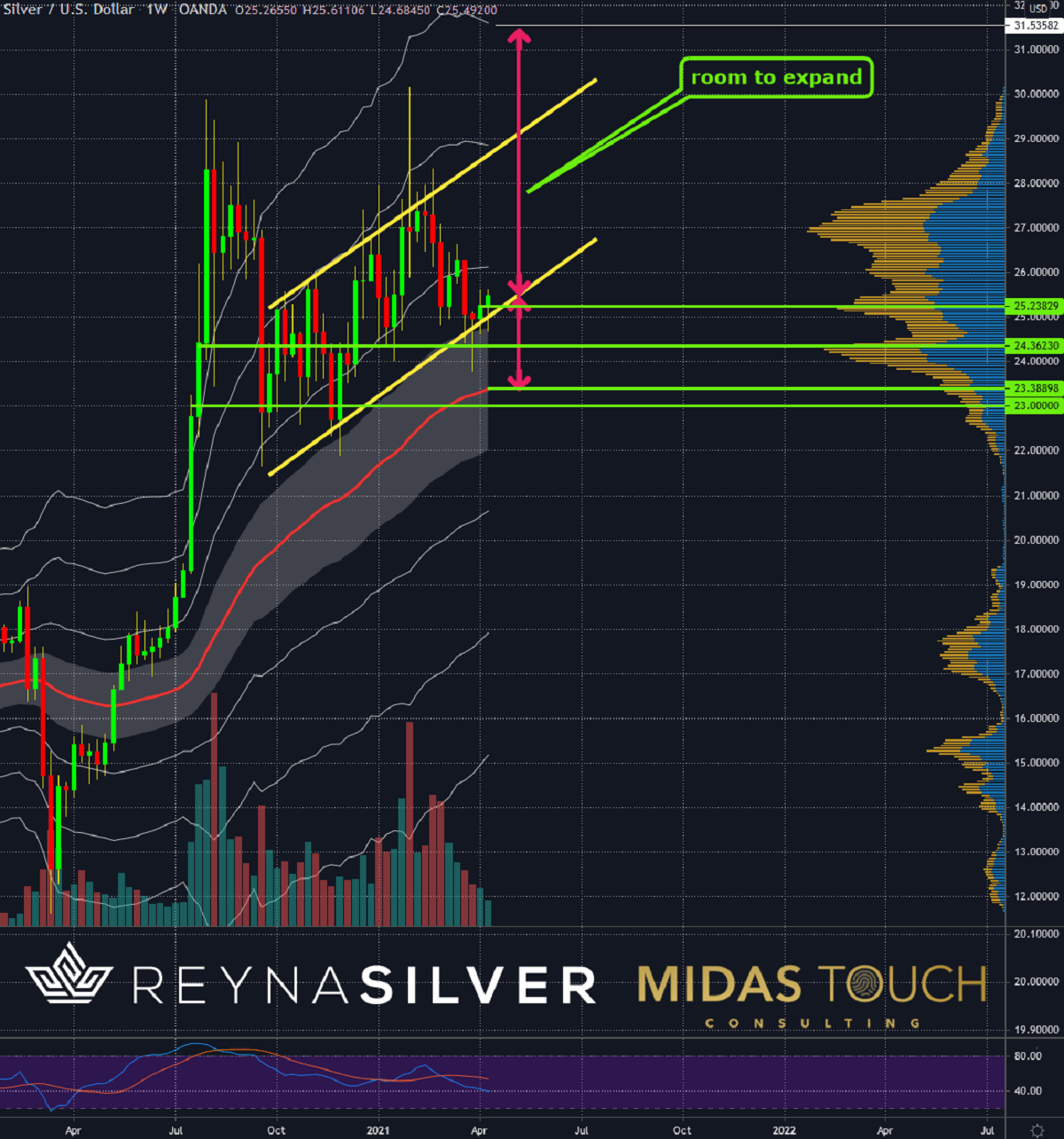

Silver in US-Dollar, Weekly Chart, The scan:

Silver in US-Dollar, weekly chart as of April 15th, 2021.

The look at the weekly chart is confirming a possible play. The yellow trend-lines indicate direction. We are trading near the lows of this support channel and near the mean (red line). Silver extending to three standard deviations from a volatility model is within the norm. As such, our projection allows for a substantial expansion of price from here (see red vertical line). With four levels of support (green horizontal lines), we are confident that lower supply zones (two-volume transaction nodes at US$25.24 and US$24.36, the mean at US$23.39 and the round figure US$23) are holding up price. A third test of the US$30 resistance zone could break through that supply zone, promising higher price levels.

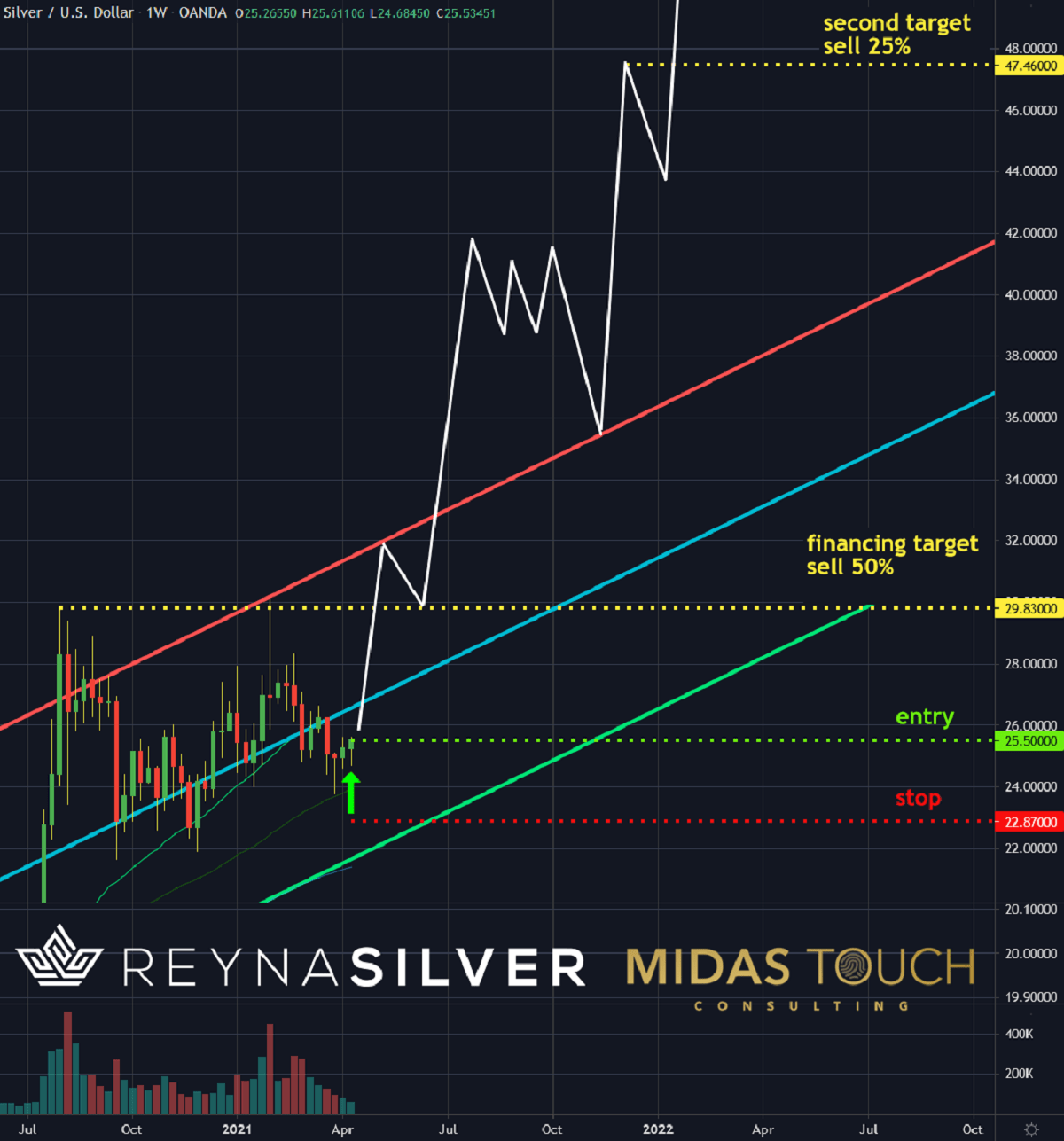

Weekly Chart, Silver in US-Dollar, The execution:

Silver in US-Dollar, weekly chart as of April 15th, 2021.

With an entry near US$25.50, the long-term investor could engage into the market with a stop set at US$22.87 and a financing target near US$29.83. (see our Quad exit strategy). This would provide for a risk-reward ratio of 1:1.64. The next target being US$47.46, allows for ample profits to let the runner take its course for much higher price levels (triple-digit) until we get substantial counter signals to exit the final part of the position.

Plan, Scan, Execute:

Scrutinize all parts of this three-step instruction setup. People have set goals like becoming a millionaire and lost half their profits on the day they hit the seven-figure number. A subconscious part set in that they would be not worthy of such a sum. We mean to say the devil is in the details. Clearly, we are not trying to simplify trading here and make it sound easy. We see many traders make mistakes since they do not have a detailed, clear instruction plan that they follow religiously. Such a process sheet reduced to its mere bone structure is essential.

Feel free to join us in our free Telegram channel for daily real time data and a great community.

If you like to get regular updates on our gold model, precious metals and cryptocurrencies you can subscribe to our free newsletter.

Article by Midas Touch

About the Author: Korbinian Koller

Outstanding abstract reasoning ability and ability to think creatively and originally has led over the last 25 years to extract new principles and a unique way to view the markets resulting in a multitude of various time frame systems, generating high hit rates and outstanding risk reward ratios. Over 20 years of coaching traders with heart & passion, assessing complex situations, troubleshoot and solve problems principle based has led to experience and a professional history of success. Skilled natural teacher and exceptional developer of talent.Avid learner guided by a plan with ability to suppress ego and empower students to share ideas and best practices and to apply principle-based technical/conceptual knowledge to maximize efficiency. 25+ year execution experience (50.000+ trades executed) Trading multiple personal accounts (long and short-and combinations of the two). Amazing market feel complementing mechanical systems discipline for precise and extreme low risk entries while objectively seeing the whole picture. Ability to notice and separate emotional responses from the decision-making process and to stand outside oneself and one’s concerns about images in order to function in terms of larger objectives. Developed exit strategies that compensate both for maximizing profits and psychological ease to allow for continuous flow throughout the whole trading day. In depth knowledge of money management strategies with the experience of multiple 6 sigma events in various markets (futures, stocks, commodities, currencies, bonds) embedded in extreme low risk statistical probability models with smooth equity curves and extensive risk management as well as extensive disaster risk allow for my natural capacity for risk-taking.