Saga Partners commentary for the third quarter ended September 30. 2018.

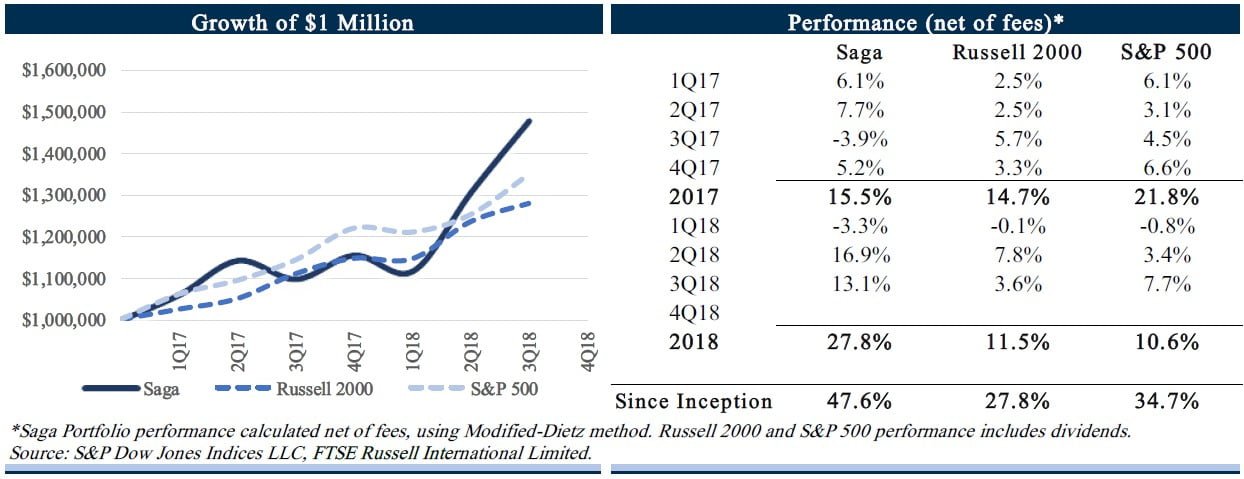

During the third quarter of 2018, the Saga Portfolio (“the Portfolio”) increased 13.1% net of fees. This compares to the overall increase, including dividends, for the Russell 2000 and S&P 500 Index of 3.6% and 7.7%, respectively. Since inception on January 1, 2017, the Saga Portfolio returned 47.6% net of fees, compared to the Russell 2000 Index and the S&P 500 of 27.8% and 34.7%, respectively.

Strategy update – expanding the investment universe

When we launched the Portfolio at the beginning of 2017, we made the decision to categorize ourselves as a small and mid-cap (SMID cap) portfolio for two main reasons; 1. the Portfolio was likely to be invested in small and mid-cap companies because that is where we found and expected to continue to find the highest returning investment opportunities, and 2. it is easier to bucket a particular investment strategy into a certain category such as a SMID cap fund.

Q3 hedge fund letters, conference, scoops etc

There are ~4,000 publicly listed U.S. companies with a market cap above $100 million (roughly our investable universe within the U.S.), yet the majority of time and energy is spent analyzing and discussing the 750-1,000 largest companies. Since we expected the majority of our investments that would make up the Portfolio would likely be in the less efficient corners of the market, we did not believe limiting ourselves to small and mid-cap companies would be overly restrictive.

The fact of the matter is that restricting the investment universe to certain companies limits the number of opportunities available and therefore hurts the Portfolio’s potential returns. It would be a lie to say we have not passed on attractive opportunities solely based on the fact that a company’s market cap was greater than our self-defined small and mid-cap threshold. By avoiding attractive opportunities, current results are lower than would be otherwise if we were free to allocate money to the best opportunities available regardless of market cap.

Many institutional investors do not like an all cap generalist investment strategy because it does not fit neatly into one of their investment policy buckets. After a lot of reflection on what was best for our current investor base, largely consisting of close family and friends, combined with the goal of compounding capital at the highest possible rate over the long-term, we made the decision to remove the SMID cap restriction. Going forward, the Saga Portfolio will not be confined to a specific part of the public market and will pursue the best opportunities available at any given time, regardless of market capitalization, geography, or industry.

When it comes to money management, we think the last thing the world needs is another index-hugging, crowd-following investment fund that’s primary purpose is to gather more and more assets through expensive marketing and a false sense of risk management. Fortunately, given our current size and fairly low overhead costs, we feel no pressure to aggressively grow assets by sacrificing the long-term performance of the Portfolio. We want to be different from the crowd in that the Portfolio’s sole purpose is trying to earn the best returns over the long-run.

Our only marketing to-date has been through our current investor base referrals and people who just come across our website or letters. We think this is the best way to grow. It acts as a self-screening mechanism because potential investors will already get to know us even before they reach out. It helps us spend more time on what’s important such as managing the Portfolio rather than sitting in a lot of meetings trying to explain our strategy which is likely not a great fit for many investors looking for something more conventional.

Benchmarks

Now that the Portfolio is not restricted to small and mid-cap companies, the next reasonable question is what benchmark should be used to compare performance. No index truly provides a good proxy for the Portfolio given its relative concentration, but we still believe both the S&P 500 and Russell 2000 indices provide reasonable benchmarks over the long run. We like the S&P 500 as general proxy for the market because it is a widely referenced and easily investible index for the passive investor representing ~80% of U.S. publicly traded companies.

A large portion of the Portfolio will likely continue to be allocated to smaller cap companies because that space will continue to be a good hunting ground to find high quality, undiscovered or misunderstood "compounder" companies. Given the greater allocation to small and mid-cap companies, it is reasonable to expect short-term performance to be more correlated to the Russell 2000 index.

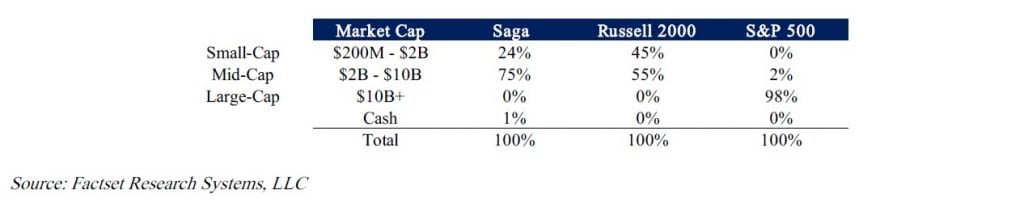

Below is a chart of Portfolio’s market cap allocation compared to the Russell 2000 and S&P 500 at the end of September. In terms of benchmarks, we will continue to provide relative performance for both indices and obviously each investor is free to compare the Portfolio with whichever index they prefer.

Interpretation of results and long-term thinking

Writing quarterly letters could instill a sense of shorter-term thinking, but we believe these letters are the best way for us to communicate our thoughts about investing and portfolio management. We err on the side of greater transparency by providing regular updates and reiterating our philosophy to help investors better understand how we think and manage their capital.

Following a fairly volatile month of October where both the Russell 2000 and S&P 500 declined a respective 16% and 10% from their September peaks to recent lows, it makes this a good time to bring up an excerpt from John Keynes’ 1936 The General Theory discussing public equity investing:

“For most of these persons (investment professionals) are, in fact, largely concerned, not with making superior long-term forecasts of the probable yield of an investment over its whole life, but with foreseeing changes in the conventional basis of valuation a short time ahead of the general public. They are concerned, not with what an investment is really worth to a man who buys it 'for keeps', but with what the market will value it at, under the influence of mass psychology, three months or a year hence.”

Over 80 years later and this quote still applies today in how most public market investing is based on trying to predict where a stock will trade based on expectations of what other people’s expectations will likely be at that time. It’s more of a speculative activity, which Keynes defined as forecasting the psychology of the market vs. an investing or enterprising activity, defined as forecasting the prospective yield (i.e. cash flow) of assets over their whole life. The stock market is full of people “interested in discovering what average opinion believes average opinion to be.”

Keynes goes further, suggesting a way to decrease speculation by making “the purchase of an investment permanent and indissoluble, like marriage, except by reason of death or other grave cause, might be a useful remedy for our contemporary evils. For this would force the investor to direct his mind to the long-term prospects and to those only.” If you imagined the stocks in your investment account are wholly owned businesses that you can’t sell for at least 10 years, daily quotations would no long matter. The fact there is always a quoted price and the ability to sell shares back every day can cause normal, although potentially disadvantageous, human reactions when prices fluctuate.

Ben Graham created a parable, later popularized by Warren Buffett, to help investors think about how the market works. He personified the market as a manic-depressive business partner named Mr. Market. Everyday Mr. Market shows up at your door and quotes a price at which he will either buy your interest in the business or sell you his. Even if the private business you both own together is fundamentally stable, Mr. Market may feel euphoric one day, only seeing upside in the business and therefore quote a very high price. At other times he may feel depressed and see nothing but trouble ahead and quote a very low price. Without a doubt, Mr. Market will show up each day and provide a quote based on whatever mood he may be in.

Fortunately Mr. Market can be ignored. Investors do not have to listen to him because he will always be back again with a new quote. Therefore, the more manic-depressive Mr. Market behaves, the more you can take advantage of him. Although one should note, his emotions can rub off if you are uncertain you know the value of the business. That is why the key to successful investing, whether in public or private markets, comes from making good business decisions and not being influenced by the manic swings in the market. While the Mr. Market metaphor may seem unconventional to how most of Wall Street operates, we think it helps us stay more rational while the rest of the world may be acting irrationally.

Short-term returns are more or less random, and it is a poor use of your time for us to try and explain performance that was largely arbitrary and unpredictable. Therefore the question becomes, if you should ignore short-term returns in the Portfolio, how should you judge the Portfolio’s performance in the short-term? We think the best answer is based more on qualitative factors. You should check our decision making for both new and existing positions based on our four main investment filters:

1. Will the company be around and prospering in 10+ years?

2. Is the company building a durable competitive advantage?

3. Is management high caliber and aligned with shareholders?

4. Does the current price provide an attractive return if the company is owned for 10+ years?

To help you judge if the investments pass these four filters, we try to lay out our decision-making process for relevant portfolio activities, particularly with any material new holdings. We’ll also report any major activities during the quarter for the top positions.

Rather than have the daily price quotations tell us how the companies are performing, we look to the company’s operating results, although quarterly and even annual fundamentals can also have irregularities. Very few success stories move in a perfectly straight line or smooth path. Over time, if we are successful at buying great companies run by honest managers when they are attractively priced, there is a high probability strong returns will follow.

Risk and Concentration

At the end of the third quarter, the Saga Portfolio had a total of 12 positions with its top five holdings accounting for ~70% of the Portfolio. We manage the Portfolio in this way because great companies with honest and talented managements do not show up at attractive prices very often.

Conventional portfolio theory defines risk as volatility, therefore conventional money managers aim to lower risk by lowering volatility through increased diversification. Alternatively, we define risk as the possibility of permanent capital loss, or in other words uncertainty. Investing is a matter of forecasting an asset’s future cash flows which is anything but certain.

We have found that if a company meets our four simple filters; 1. a business we understand, 2. has a growing competitive advantage, 3. has high caliber management aligned with shareholders, and 4. selling for an attractive price, the degree of uncertainty, or risk of permanent capital loss over the long term, greatly diminishes. While these filters are not as precise or quantifiable as risk measured by betas or standard deviations, we believe they are more relevant despite their imprecision and more likely to lead to attractive investments.

Few companies meet filters 1, 2, and 3, but if they do it is rare the market has not already realized its strong prospects and placed a valuation on the company that lowers the potential for future excess returns. We approach the market as efficiently priced most of the time, believing Mr. Market knows more about a company’s prospects until we conclude we have some upper hand or variant perception. It is very difficult for a company to meet all four filters, therefore an investment strategy based on placing many bets with high frequency will likely find it difficult to beat the market in a meaningful or sustainable way. It seems fairly obvious to us that putting more money into your 20th best idea than in one of your highest conviction ideas will more likely hurt rather than help overall returns.

While investing in a concentrated way is no guarantee of success, a high level of diversification and turnover will likely provide average results at best. There is a much better chance of decreasing risk in a concentrated portfolio than in a diversified one if it means it increases the intensity with which we think about a business and its prospects before buying into it. A smaller number of investments and infrequent trading allows us to spend a significant amount of time studying a company before investing, or more importantly, not investing. In other words, we prefer to do a lot of thinking and not a lot of acting while most of Wall Street prefers to do a lot of acting and not a lot of thinking.

Of course, just because we have high conviction about a company’s future prospects and expected returns does not mean we have any idea what the share price will do over the next year. With greater concentration, we accept that near-term returns will be lumpier. Large declines in share prices, like earthquakes, are unavoidable every now and then. Like earthquakes, they are completely unpredictable. After a steep selloff in shares, one has to decide whether this is due to a mistake in analyzing a business’ intrinsic value, in which case the prudent move is to sell, or market madness, in which case the advisable course of action is to load up at the earliest opportunity. Share prices will provide no help in deciding which course of action is correct. Only having a solid grasp as to the company’s real value will help you take advantage of Mr. Market instead of the other way around.

Top five positions

We want to discuss any relevant updates to the Portfolio’s largest positions or any material new positions so you know what you own and why you own it. Since we are now able to invest in any company regardless of market capitalization, we started to build a position in a well-known large cap company which we plan to discuss further in the next letter.

Writing out an investment thesis is a productive part of the investment process that helps us organize our thoughts and analysis. Publicly stating positions could lead one to dig their heals into the ground despite finding out the original thesis may have had some cracks. While we explain the reasoning for why we may own a company and enter each investment with an expected holding period of forever, we reserve the right to change our minds if the facts change.

We prefer discussing a company’s fundamentals rather than writing about what stock prices did over the last quarter. At the end of the day it all comes down to a company growing its earning power over time, though it will not happen every single year. There will occasionally be down years, particularly with cyclical companies when customers push off larger purchases such as a home or a car, but the long-term trajectory should be positive. If we are correct in picking companies that can increase earning power over time, a rising share price will eventually be the outcome.

The Trade Desk (TTD):

We wrote about our investment thesis in The Trade Desk last quarter. It is a software platform company that enables customers to purchase and manage their digital ad campaigns. The Trade Desk is a great example of a platform business model that adds value by growing the network of connected buyers and sellers, increasing transparency, and enabling more accurate price discovery for buyers who want to make data driven decisions. This is a company that benefits from a self-reinforcing virtuous cycle which becomes more valuable the larger its network becomes. With The Trade Desk’s high barriers to entry, scalable business model that requires nominal capital to grow, and large total addressable market, we expect the Company to be worth a multiple of its current valuation.

Platform Specialty Products (PAH):

The Company announced 3Q18 results where sales and adjusted EBITDA for the Performance Solutions segment grew low single digits, reflecting some foreign exchange headwinds and softness in Asian markets. The $4.2 billion sale of the Arysta segment to UPL is expected to close on 12/31/18, at which time Platform Specialty Products will be renamed Element Solutions Incorporated. Management reaffirmed full-year adjusted EBITDA guidance excluding Arysta but expects to be near the low-end of the provided range.

Element Solutions provides specialty chemicals that focus on surface treatment and electronic assembly. The business is part of integral processes generally tailored to meet customer specific requirements. Its products typically represent a small proportion of total end material costs but play an essential role, providing sticky customer relations and higher margins.

Including $25 million of estimated cost savings from the reorganization, 2019 proforma EBITDA is expected to be $450M-$470M. Proceeds from the sale will go towards paying down debt resulting in a net debt of $1 billion. Valuation looks attractive with shares trading at 9x-10x proforma EV/EBITDA. Free cash flow is expected to be in the range of $275M-$300M, or only 11x-12x the current market value. There is a $750M share buyback program in place which management indicated would be one of the best uses of capital at current share prices as long as leverage remains less than 3.5x adjusted EBITDA.

Under Armour (UA):

The company reported 3Q18 results which reflect ongoing operational improvements focused on several supply chain initiatives. North American revenue trends started to show signs of improvement and international sales remain strong. Margin expansion is a positive sign there was better product mix and less promotion activity.

The investment thesis remains the same. Kevin Plank started the company in 1996 from his grandma’s basement and has grown the brand over the last 22 years. The Company has focused on creating a brand based on providing high quality performance apparel to athletes, growing with the sports apparel market and gaining share from Nike and Adidas. Since going public in 2006 through the end of 2016, sales grew greater than 20% a year. Starting in late 2016, sales and profitability slowed as North American sports apparel industry faced headwinds combined with several company specific setbacks.

Under Armour began restructuring efforts during 2017 to address the growing demand for athleisure apparel, improve supply chain and distribution, and increase focus on cost control. We believe the Under Armour brand remains strong and near-term operational issues have helped refocus the Company to thrive going forward.

Linamar Corporation (LIMAF):

Linamar is an auto-OEM headquartered near Toronto, Canada that we started to follow at the beginning of 2017. While auto manufacturers such as GM and Ford have provided lackluster returns to equity holders throughout their history, numerous auto-OEMs such as Linamar have performed much better.

Linamar benefits from its customers typically having higher switching costs, resulting from a 5-10 year production life cycles tied to contractual agreements, integrated processes, and long-term relationships. Several auto components are critical to the final product which creates a quality risk of switching to a new supplier. Linamar also operates on a global playing field providing some scale advantages.

Shares of companies touching the auto sector have reflected fears of peak cycle auto sales and uncertainty surrounding tariffs. While a preliminary NAFTA deal, renamed the United States-Mexico-Canada Agreement (USMCA), helps provide more clarity, tariffs or declining auto unit product are real risks and could potentially impact fundamentals.

Investing in a cyclical company at a potential peak could mean near-term fundamentals will deteriorate if auto unit production falls materially. Despite operating in a cyclical industry, Linamar has grown revenue and operating income at double digit rates over the last full auto-cycle benefitting from secular industry tailwinds from outsourcing of propulsion systems, growing market share, and making strategic acquisitions.

Further, Linamar’s auto industry exposure has declined following the $933M acquisition of Macdon Industries in February 2018. The industrial segment which manufactures harvesting equipment and aerial work platforms made up nearly 50% of operating income in the last quarter. Most recently, 1H18 sales and operating income grew by 18% and 19%, respectively.

The amount of fear and downside baked into share prices looks extreme in our opinion. Linamar is selling for an expected 2018 P/E and EV/EBIT of 6x and 6.5x, respectively. Even if auto demand falls and unit volumes tumble, we expect Linamar to grow at a steady rate over the next full cycle. We do not care if over the next four years, a company earns a lumpy $100, $0, $0, $100 or steady $50, $50, $50, $50, as long as we believe the current valuation provides an attractive return on expected cash flows.

Liberty Latin America Ltd. (LILAK):

As of 2Q results, Puerto Rico’s network is nearly 100% restored since Hurricane Maria hit in Fall 2017. LILAK recently announced they are acquiring the remaining 40% of the Puerto Rico operating segment they did not already own by issuing 9.5 million shares for the purchase value of $185 million at the time of the transaction. Despite issuing undervalued equity in our opinion, we think this transaction makes sense and is expected to be accretive on a free cash flow per share basis. In 2016 before the impact of Hurricane Maria, Puerto Rico had sales and operating income of $421 million and $212 million respectively, providing an attractive purchase price not including assumed debt of ~2x operating income for the 40% of Puerto Rico they didn’t already own.

Incumbent cable operators benefit from natural monopolies with recession resistant, utility-like characteristics. Once the large upfront investment in cable and wiring is built, maintenance costs are fairly nominal and the high costs of building an overlapping network keeps competitors away. The downside is having to build out the infrastructure, meaning the business is very capital intensive at the beginning. The expectation is that once the infrastructure is built and competition is negligible, free cash flow will jump.

In the U.S., cable systems are largely built out, therefore the only way to grow is through price inflation or acquisitions. Companies like Comcast and Charter Communications became as big as they are today by acquiring cable systems at relatively attractive valuations and then cutting corporate overhead costs. With the U.S. market largely saturated, less capital is required for growth so both companies are now experiencing higher levels of free cash flow.

LILAK is a dominant operator in the region and in a strong position to consolidate the fragmented region with many of its competitors burdened with heavier debt loads. The Company has faced several headwinds in recent years including operating/accounting issues following the 2016 Cable & Wireless acquisition and two consecutive years of bad hurricanes. A lot of cable system expansion and upgrades is still required to provide faster broadband service to households in Central and South America.

Overall growth has been pretty lackluster in recent years, but we expect LILAK to be able to grow operating income in the mid to high single digit range organically with the potential for further acquisitions, however most operating cash flow will be plowed back into the company to build out the infrastructure. The Company’s most recent results reflect slower growth rates but the question is if this reflects temporary headwinds due to hurricane impacts and management reorganization. Regardless, we think the lower valuation multiple limits the downside of slower growth and provides strong upside if LILAK can start building some momentum.

Is now a good time to invest?

Over any extended period, we would expect the S&P 500 to provide somewhere between 6%-9% compounded returns. Over the last 30 years the S&P 500 has returned ~10%, comprised of 6% corporate earnings growth, 2% average dividend yield, and the extra 2% coming from a higher valuation placed on equities, which is largely influenced by interest rates. Future returns will come from the same components.

We generally try to avoid making any hardline projections, but 6%-9% seems like a reasonable expectation, although returns could be outside this range over any shorter 10-year period. With net income margins and valuations at the high-end of historic averages and interest rates near historic lows, it is not unreasonable to expect returns near the low end or even below this range over the next 10-year period.

While out with friends or family, we often get asked about what is going on in the market, usually referring to why stocks may be up or down in any given week. Our typical answer is, “we don’t know.” We truly do not know where the market is heading any more than how much snow is going to fall this winter, we just know it will snow. Over long periods of time we have strong conviction that the market will continue to march upward in intermittent fits and spurts.

The question of whether to invest or not invest is more of a personal one. When an individual or institution owns assets, they have to make an active decision of how to allocate those assets. Should they hold cash or invest in something else in an effort to generate more wealth in the future? Our view is if anyone knows they will need cash within the next few years, investing in public equities is more of a speculative activity. We’ve probably hammered the point to death that anything can happen in the markets over the short term and you do not want to find yourself selling assets at fire sale prices.

Once you determine the amount of cash you may need to hold, the question is what to do with everything else. Cash is one of the worst performing asset classes over time. Holding excess cash is an active investment decision and strikes us as somewhat risky since it is certain to lose value. It does provide optionality if other assets can be bought at a cheaper price at some point in the future, however trying to time the market also seems risky to us and people that believe they have the foresight to do so are typically proved wrong. For years many market “experts” have claimed we were due for a crash, recommending investors should prepare for the imminent collapse in the market. Think about all the value that was lost by those that moved to cash in 2009, or 2013, or 2016.

When it comes to holding cash in the Saga Portfolio, we prefer to be fully invested as long as we can find enough attractive opportunities. We are investment managers so we try to invest rather than act more as a bank account by holding cash for you. That said, we will only invest in opportunities that offer attractive returns. Given our current size and fairly concentrated strategy, we hope to find enough attractive ideas to usually be fully invested.

Howard Marks, a great investor and writer, recently published a book called Mastering the Market Cycle, where he states:

“the greatest way to optimize the positioning of a portfolio at a given point in time is through deciding what balance it should strike between aggressiveness and defensiveness. And I believe the aggressiveness/defensiveness balance should be adjusted over time in response to changes in the state of the investment environment and where a number of elements stand in their cycles.”

Marks is saying there’s a time for investors to be aggressive and a time to be defensive depending on where we might be in the market cycle. While we couldn’t agree more that the spring of 2009 was the time to be aggressive and the time to be defensive was summer of 2007, however investing hindsight is always 20/20. We have less confidence in our ability to know when to be aggressive or defensive, therefore we always invest as though we are about to face an imminent economic blow.

Even at the market lows of March 2009 where one could throw a dart at a target of random stocks and likely pick one providing double digit returns for years to come, we would still pick companies we want to own if the economy was still on the brink of another collapse. There are always risks to investing and the best thing to do when you own a house in an earthquake zone is to build a very sturdy house, and then buy insurance. We will never know when an earthquake will hit and how bad it will be, but we want to be prepared for whenever it does.

A strong investor base is a true competitive advantage in the investment management business. The success of the Portfolio requires investors which are stable, long-term, and realistic in their expectations. So far, we could not be happier in this regard. While investors have the ability to withdraw funds at any time, last month when the stock market suffered its worst month since 2011, instead of withdrawing funds several investors added money to their accounts.

We would love to continue to grow with like-minded investors. If you know someone potentially interested in an alternative strategy like the Saga Portfolio, feel free to forward on our information. Thank you again for trusting us with your hard-earned capital.

We hope you found this update helpful in understanding your portfolio. If you have any questions or comments please reach out, we are always happy to hear from you!

Sincerely,

Saga Partners

Joe Frankenfield, CFA

Michael Nowacki

This article first appeared on ValueWalk Premium