RV Capital letter to investors for the year ended December 31, 2020, discussing the correct place to apply margin of safety.

Q3 2020 hedge fund letters, conferences and more

Dear Co-Investors,

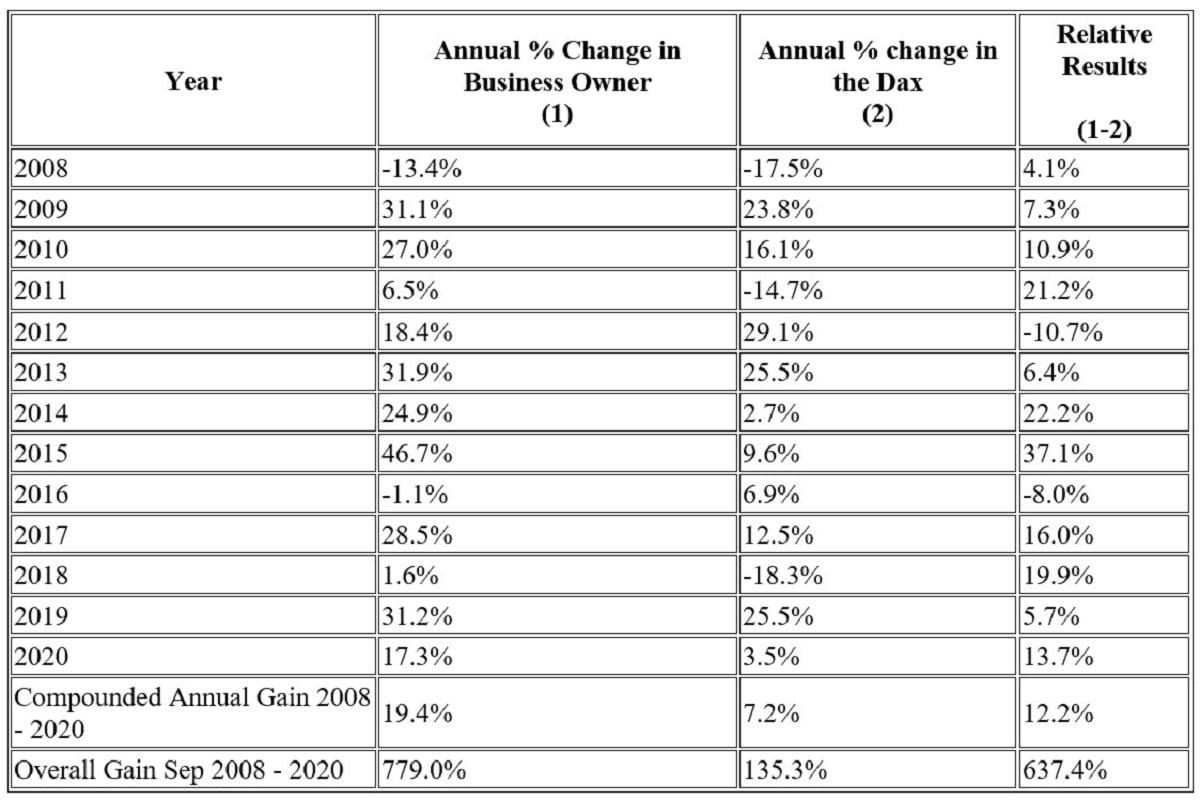

The NAV of Business Owner was €872.11 as of 30 December 2020. The NAV increased 17.3% since the start of the year and 779.0% since inception on 30 September 2008. The compound annual growth rate since inception is 19.4%.

The Development of our Companies

I described the development of our companies in my half-year letter with a particular focus on the impact of Covid-19, so I will keep my comments here short.

My conviction then was that our companies would emerge from the disruption caused by the Coronavirus stronger than before. This has largely played out as I hoped. The only caveat is that their competitors seem to have also fared reasonably well, thanks to massive economic stimulus. For the economy overall, this is no doubt the best outcome, but our companies’ relative competitive positioning is less improved than it might have been. The wait to see how our companies perform in a deep recession continues…

A Short Attack on Grenke

Grenke, the fund’s longest-standing holding, was subject to a short attack in the second half. A short seller published a report towards the end of September triggering a massive decline in the share price. Given the magnitude of the decline and the halting recovery since, the casual observer may infer that the short seller was on to something. Nothing, in my view, could be further from the truth.

The short seller made a wide range of allegations, but in essence claimed that Grenke is a fraud, i.e. its lease receivables are worthless, its dealer network fabricated and its cash non-existent. These allegations are, frankly, absurd.

I am sure that if you were to ask in confidence the armies of analysts, investors, auditors, and regulators, who are now scrutinizing Grenke, they would wholeheartedly concur with my assessment. However, instead of saying as much, they seem to prefer to discuss the intricacies of Grenke’s franchise system, the pros and cons of its governance structure, and other issues. They obviously feel on safer ground debating the minutiae of questions that are entirely incidental to the short seller’s principal allegations. Obviously, it is their prerogative to shift their focus to wherever they see fit, but they should first make their position clear on the main allegations.

I have views on Grenke’s family-orientated governance and the franchise system that powered its international growth. However, I will not be drawn into discussing my views here as now is neither the time nor the place for such a discussion. The company faces massive and false allegations about the reality of its business. In the context of the severity of the allegations levelled against it, criticism of any perceived missteps misses the point. It is the equivalent of accusing someone of murder and then interrogating them on a parking fine.

Grenke was, is and will continue to be a great company run by managers with talent and integrity. I am confident that it will emerge from these events stronger. My only regret is that the company’s directors and employees had to go through the unpleasant experience of having their integrity questioned.

If I am right, we will make a lot of money from the shares we were able to buy at the height of the panic. Let me be completely clear though: I take absolutely no pleasure in making money this way.

A New Investment in Slack

On a cheerier note, in the third quarter of 2020, we became co-owners in Slack, a channels-based communication service for businesses. In an unexpected twist, a few months later it was acquired by Salesforce.com at roughly a 50% premium to what we had paid.

In accordance with my usual practice, I was planning on writing about our investment in Slack. By laying out my investment hypothesis at the onset of an investment, I hope to enable investors to assess in hindsight whether it worked (or not) because of a plausible investment philosophy consistently applied. Given that Slack has effectively already played out as an investment, this rationale has gone. After all, anyone can make a successful investment decision look smart after the fact. Watch: "Having foreseen the likelihood of a pandemic in 2020, I decided in 2018 to buy AddLife given its strength in diagnostic tests and personal protective equipment…"

There is one element of my Slack investment thesis that I would like to lay out as it neatly illustrates an idea in my first-half letter and has not yet played out. I wrote then that I wanted to invest more in “early-stage, listed companies”. What I meant by this are companies whose moat is not yet fully developed, but not so undeveloped that it is difficult to say if they will ever have one. I described early-stage companies as possessing:

The kernel of an idea (however unformed), which - if you squint - you can imagine creating a new paradigm in decades to come.

Slack was the type of company I had in mind when I wrote this. Its moat in its core business of providing channels-based communication within companies is well developed. It benefits from a network effect (the more employees on Slack, the higher the value they derive from it), a broad developer ecosystem (thousands of integrations have been built for Slack) and switching costs (Slack becomes tightly interwoven into a company’s workflow through said integrations).

What really got me excited – the new paradigm – is “Slack Connect”. Connect is a feature that allows companies to extend Slack beyond their own organisation to external partners. Connect has not yet achieved viral growth – the moat is not yet developed. However, many of the world’s largest companies are already wall-to-wall with Slack, including Netflix and Amazon. If, as seems inevitable, they pull in their suppliers and they, in turn, pull in their suppliers, it will trigger a virtuous circle.

Far from being a moon-shot, Connect’s chances of success seem high, especially given the uptake by many of the world’s largest companies. Microsoft Teams is always mentioned as the biggest competitive threat, however there are worse situations than being in a two-horse race. Moreover, many companies may simply end up having both Teams and Slack to communicate with all their external partners.

Although we will most likely no longer be owners of Slack, it will nevertheless be interesting to see how Connect plays out over the coming years. Based on Slack’s existing business (growing at a not-too-shabby 49% in the July quarter, the most recent when we invested), the investment would have worked well, in my opinion, but not spectacularly so. Had Connect achieved escape velocity, I believe the investment would have been worth many times what we had paid for it.

Margin of Safety

Questioning key tenets of value investing has been a rich vein for me to mine in my letters over the years. I do not do this to discredit value investing. To the contrary, I am a fully paid-up value investor. I am convinced that the core idea of value investing – the intrinsic value of a company is the sum of all cash flows between now and eternity discounted at an appropriate rate – will be as close to a law of nature as we will ever get in what is ultimately a non-scientific discipline.

The reason I do it is because value investing has accumulated a considerable amount of baggage over the years, some of which has enriched it, but much of which has simply confused it. In the latter bucket, I would place the ideas that “tech (in the broad sense) is outside a value investor’s circle of competence,” “only a low multiple company is a cheap company,” or “tangible assets are more valuable than intangible assets”. These were topics in my 2016, 2018 and 2019 letters, respectively. I am not sure it is controversial to question these ideas now, but it may have been then.

It is in this spirit that I want to poke some holes in the idea of “Margin of Safety”.

Margin of safety can be understood as the difference between the intrinsic value of a security and what an investor pays for it. The greater the discount to intrinsic value, the higher the margin of safety. The idea was coined by Ben Graham. In “The Intelligent Investor”, he writes:

The margin of safety is always dependent on the price paid. It will be large at one price, small at some higher price, nonexistent at some still higher price.

Graham’s idea is a core tenet of value investing. Warren Buffet frequently refers to it. Investing legend Seth Klarman named his highly sought-after book “Margin of Safety” and wrote they are the “three most important words in investing”.

I do not disagree with Graham. Clearly, the lower the price of a security, the more attractive it is, or to stick with the parlance, the higher the margin of safety. My beef is with the way the concept is applied.

Consider the following quote by Graham:

The function of margin of safety is, in essence, that of rendering unnecessary an accurate estimate of the future.

At face value, this seems like sensible advice: “Just pay a low enough price, and the investment will take care of itself!”

The problem is that the conclusion many traditional value investors seem to have drawn is that it is a fool’s errand to spend too much time thinking about the future. Instead, they focus on things firmly anchored in the past and present such as a company’s assets, its historical earnings power, and its existing moat.

This philosophy is reflected in Bruce Greenwald’s book “Value Investing: From Graham to Buffett and Beyond”. Greenwald describes a hierarchy of valuation methodologies with an “asset-based valuation” at the pinnacle, followed by a current “earnings-power valuation”, with the “growth valuation” at the bottom as the least certain and, by implication, least important valuation methodology.

I strongly disagree with the idea that the future is of subordinate importance. To the contrary, I believe the single most important task for an investor is to form as accurate a view about the future as possible. If a company’s intrinsic value is the sum of its future discounted cash flows, how can you even know whether you have a margin of safety without forming a view on the future?

Many investors would perhaps agree on the importance of the future but take issue with the idea of striving for an accurate forecast. Given the inherent uncertainty of the future, they might argue that a broad brush, ideally conservative forecast is more desirable than an accurate forecast. Here too, I disagree.

The importance of striving for as accurate a view of the future as possible was brought home to me in a discussion with Wolfgang Grenke around how Grenke (and, I presume, most lending businesses) approach underwriting credit risk. Wolfgang told me that Grenke does not try to be conservative in forecasting default risk. It tries to be accurate. Only by pricing risk more accurately than its competitors can it earn economic profits from underwriting. There are no prizes for being inaccurate even if the inaccuracy always errs towards overestimating rather than underestimating credit risk. It is not just the lender that continually underestimates default risk that will go bust; the one that structurally overestimates default risk will too. It will miss out on attractively priced loans, thereby ceding a competitive advantage to competitors. It will also expose itself to negative selection as the more good loans it misses, the more bad ones are remaining in the pool.

This is not to say that Grenke (or other good lenders) do not aim to be conservative. It is just that conservatism is built into the business model in other parts of the stack, for example the amount of capital, the proportion of higher-risk loans, or the excess cash relative to funding needs.

If I look back at some of the best investment opportunities I have missed, it strikes me that when I thought I was being conservative, I was in fact being inaccurate. A good example of this is attaching little or no value to promising but early-stage investments at companies with a proven track record of delivering innovations. It is not conservative to view a promising new product or market entry as a “free option”. It is inaccurate.

Investors that consistently attach no value to free options commit the same sin as a lender that overestimates risk. They cede a competitive advantage to investors that do value them and expose themselves to negative selection by fishing in a pool drained of the best investment opportunities. My friend and fellow investor Dennis Hong of Shawspring Capital wrote an excellent letter on the importance of free options and how to spot them.

There are many more examples I could give where I have confused being conservative with being inaccurate – preferring established businesses to younger businesses, lower revenue growth to higher revenue growth, tangible assets to intangible assets, and so on. The point is that each of these situations needs to be thought through on merit. Companies whose intrinsic values are predicated on strong growth can have a margin of safety if bought at a sufficient discount to their intrinsic value, just as slower growing companies can too.

Where does this leave Margin of Safety?

In my view, the wrong place to apply margin of safety is in the assessment of a business, its competitive dynamics and ultimately its cash flows. All these elements need to be forecast as accurately as possible, not as conservatively as possible.

The correct place to apply margin of safety is in the price paid relative to an accurate assessment of a company’s intrinsic value. The higher the margin of safety – relative to comparable opportunities – the better. This is, of course, not the only place that margin of safety is appropriate. For example, diversification needs to be sufficiently high that a failure in one part of the portfolio does not lead to the whole edifice collapsing. It strikes me as the most important one though.

At the risk of being accused of trying to improve upon perfection, I would propose the following light edit to “The Intelligent Investor”:

The function of margin of safety is, in essence, that of not rendering unnecessary an accurate estimate of the future but minimising the damage of an inaccurate one.

Applying margin of safety is no substitute for developing as accurate a picture of the future as possible. To the extent margin of safety is used as an excuse not to think about the future, it increases the chances of losses – the precise opposite of what it is intended to do.

The Contrarian Gene

I happened to have been born with what might be called the contrarian gene. I genuinely enjoy thinking through the other side of any argument. The more “obvious” a hypothesis is, the more fun it is to pick a hole in it. It is not a trait that I tried to acquire or nurture in myself. It was though encouraged from an early age at school. In English class, we were invited to debate questions about which two fair-minded people might reasonably disagree, such as “This house believes in the death penalty”, “Spare the rod, spoil the child” or, “The woman’s place is in the home”. From today’s perspective, it is difficult to imagine reasonable people might disagree on these motions!

In some areas of life, a contrarian mindset has benefits, but in others it has clear disadvantages. For example, in social contexts, it is far easier to make friends if you enthusiastically endorse the other side’s point of view. We describe people we dislike as “disagreeable”.

One area where there is near complete consensus that being contrarian is a good thing is in investing. True to form, I am not convinced. Virtually everything in investing depends on the when and the where. How can it not when so many smart people are trying to figure out what works and then copy it? For example, investing in companies with a low price to book multiple worked well for a long time…until it did not.

I suspect something similar is at play with a contrarian mindset. A contrarian mindset is perfectly adapted to a world that is characterized by reversion to the mean. For example, in a world where capital flows relatively unimpaired from industries that are failing to meet their cost of capital into industries that are making extraordinary returns on capital, it pays to buy the out-of-favour company and sell everybody’s darling. Having invested through the telecoms bubble of the late 90s, this is precisely the argument made by Marathon Asset Management in “Capital Returns: Investing through the Capital Cycle”.

But what about a world where capital cannot easily flow into the most successful companies because they do not require capital? Or a world characterized by network effects and winner-takes-all economics where the most successful companies – everybody’s darlings – just go from strength to strength?

I believe the world I just described is like the one that we have been living in for the last ten years or so. I made considerable progress in adapting to this world by shifting the portfolio over time from companies anchored in the old world towards companies like Google, Wix and Slack that are firmly anchored in the new. However, a contrarian mindset needlessly slowed this transition down and, above all, greatly narrowed the universe of investable companies. Each of these three companies were out-of-favour when I invested in them. The prevailing wisdom was that Google could not negotiate the shift from desktop to mobile, content management systems such as Wix were commoditized, and Slack’s breakfast was being eaten by Microsoft Teams.

Google and Slack worked well as investments and Wix has done well so far. My point in writing this is not to engage in faux humility. The point is that there was a far wider universe of companies that had the wind firmly at their backs and were not lesser investment opportunities because of it. In fact, many were superior investments. The visceral need to be contrarian was more vice than virtue.

“Is this self-flagellation necessary in a year when the fund firmly beat most indices?” you may be asking. It is not self-flagellation. I am simply doing what I always do, which is to try and get better as an investor. The only way to do this is to look back at all investments – good or bad – and see what could have been done better. I cannot change my contrarian nature, but I do want to be more open to companies with the wind at their backs. Also, the more public my self-critique, the more likely I am to heed it.

I also want to call out the performance of my close peers – the folks you have heard me talk about in these letters as well as some I have not yet written about. Nearly all performed better than me in 2020, in some cases vastly better. Ouch! No, 12 months is not a sufficient length of time to measure a track record, but, on balance, I view their performance in 2020 as the culmination of better investment decisions over the period preceding it. I acknowledge their achievement, congratulate them, and firmly plan to catch up.

How I got Podcasting “Religion”

For those of you who prefer to listen to my investor letter rather than read it, I created an audio file. This is my first tentative step into the world of podcasting, so please excuse the lack of polish. Over the last year or so, I have increasingly found myself spending more time listening to podcasts than reading books and articles. The audio file is there for those of you who have developed a similar habit.

It is worth noting what a momentous change in my behaviour this is. Until recently, a fundamental way I viewed myself was as "someone who reads" in the same way that Roger Federer might view himself as "someone who plays tennis". If Roger suddenly downed the racquet and picked up a cricket bat, I would be mildly curious, to say the least, what triggered the change of heart (not that I am drawing a parallel between myself and Roger Federer – he is a terrible reader). In my case, three insights drove my behavioural change.

First, I generally find the ideas I stumble across in podcasts to be more thought-provoking, more up-to-date, and more concisely articulated than in books. Thought-provoking - as a podcast needs a big idea to rise above the mass of content out there. Up-to-date - as a podcast can be recorded and published the same day and a new one can be recorded the next day if the podcasters change their mind based on listener feedback. Concise - as a podcast is generally not longer than an hour whereas books tend to be at least three hundred pages irrespective of how much an author has to say.

Second, I find it easier to understand the nuance of ideas in podcasts than in books. I think this is because dialogue is the dominant form of the podcast whereas books tend to be monologues in the author's voice. My preference for dialogue over monologue is hardly surprising. The original form of formalised human learning was Socratic dialogue. Socratic dialogue was superseded by the written word after the invention of the printing press due to the written word’s advantage of near infinite replicability. Through the invention of podcasting, we have the benefit of replicability and dialogue. Even better, podcasts are mostly free, meaning they are accessible to anyone on the planet with a smartphone and an internet connection. It really is a good time to be alive without wishing to belittle the obvious challenges many people today face.

Third, I can listen to podcasts and go for a walk with my dog at the same time. I find this to be better for my back as reading generally involves sitting, which is not great for the spine. It also has the additional benefit that I burn a few extra calories. Our dog does not seem to be too displeased either - an all-around win-win if ever there was one!

To Zoom or not to Zoom

A few people have asked me whether I thought about doing the Annual Gathering by Zoom now that the physical meeting has been cancelled. I am a big fan of videoconferencing in general and Zoom in particular and am hugely grateful that so many things could continue to happen online despite the lockdown in no small part thanks to the engineers at Zoom.

In the case of the Annual Gathering though, I do not think it is appropriate to do it by Zoom. The content part of the Annual Gathering - that is to say the fireside chats with CEOs and fund managers, my annual Q&A, and the panels for emerging managers - is really just the hook. The niche nature of the content (I know this is difficult to believe but most of the world is not interested in barrique manufacturers and retirement village operators), as well as the time and the expense for most participants to travel to Engelberg, causes a unique group of investors from all over the world to self-select. They tend to be incredibly excited to be there and the atmosphere over the entire weekend is electric as I think anyone who has ever attended can attest to.

By now, you have probably guessed what the real purpose of the weekend is. It is to bring people together who have a similar passion for investing and enable them to form connections and deepen friendships. I take enormous pleasure from this for its own sake but lest anyone mistake me for Mother Theresa, I also derive considerable benefit from widening and deepening my network of investors, fellow stock pickers and company managers.

For all the wonders of Zoom, I do not see how all this can be replicated online. As such, we are going to skip 2021, but I hope this only serves to heighten anticipation for 2022. Stoicism recommends occasionally skipping a meal in order to enjoy the next one even more. Join me in the collective illusion that we chose not to meet this year, so that we appreciate next year so much more!

I cannot wait. Until then, as I was recently advised:

Stay positive, test negative!

Rob